Monetary policy: rising inflation puts central banks under pressure to act

- KOF

- Monetary Policy

- Inflation

- KOF Bulletin

The continuing rise in prices is forcing the central banks in the United States and Europe to reconsider their highly expansionary monetary policies. The Swiss National Bank will probably only reverse its policy stance once central bankers in the euro area have implemented their first interest-rate hike.

Monetary policy in the United States, the euro area and Switzerland remains expansionary. However, international monetary policy is likely to become less expansionary this year as a result of economic and price trends. The rise in consumer prices that began last year is continuing in the largest currency areas. This price surge is being driven by disruption to international supply chains and massive increases in the prices of energy and raw materials. International producer prices were rising even before the outbreak of the war in Ukraine, with the resulting trade disruption and economic sanctions further fuelling price hikes. This supply-side shock – in addition to the above-mentioned shortages – is having a global impact owing to the international interconnectedness of intermediate goods and Russia’s importance as a commodity and energy exporter. Accordingly, this affects inflation in all major currency areas and, consequently, the policies adopted by central banks.

A monetary policy dilemma

The evolution and duration of the war could pose a monetary policy dilemma. In the event of prolonged uncertainty, investors – and, to some extent, consumers – might curb their spending, which would cause economic activity to flatline and, in extreme cases, could trigger a recession. In this scenario, central banks could still combat high inflation by tightening monetary policy, thereby increasing the risk of a sharper economic downturn. So, in contrast to past crises, when price rises were often subdued, in this case there would be a trade-off between high inflation and economic activity.

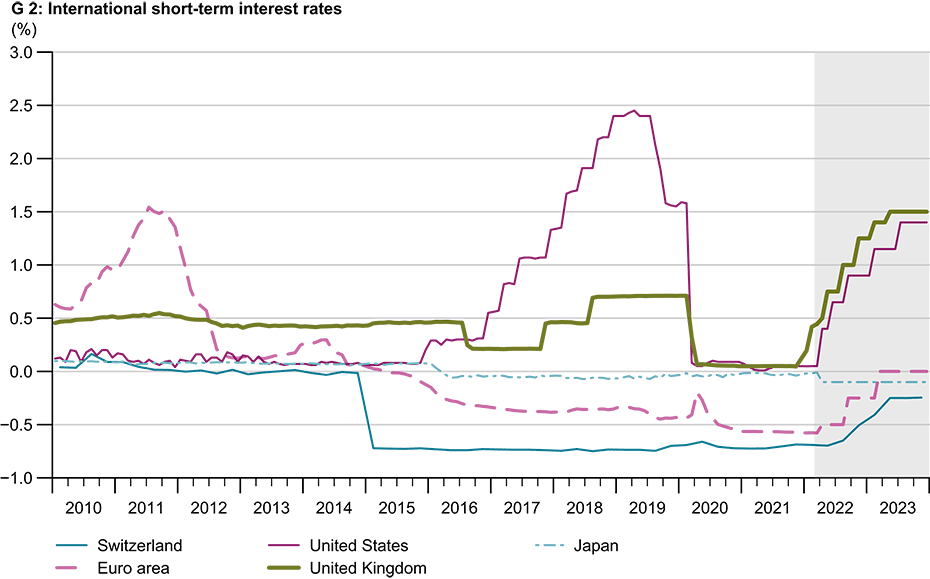

US Federal Reserve less expansionary despite war in Ukraine

Year-on-year inflation in the US reached almost 8 per cent in February of this year, which represents a clear departure from normal levels after almost a decade of stable prices. According to KOF, however, this sharp upturn is, in part, only temporary in nature. At 2.5 per cent, the year-on-year increase forecast for the coming year is already re-approaching the long-term target of 2 per cent. As the war in Ukraine is only slightly depressing the short-term economic outlook for the United States, positive growth and a strong labour market can still be expected. Sharply rising prices and quasi-pandemic unemployment rates prompted the US Federal Reserve (Fed) – as announced in December – to raise interest rates by 25 basis points in March. KOF expects to see at least two further rate hikes in each of 2022 and 2023. Bearing this in mind, we can expect to see short-term interest rates of 1.5 per cent by the end of next year (see Chart G 2). The Fed will end its bond purchases to coincide with its first rate hike. However, its balance sheet – which has more than doubled in size since the beginning of the pandemic – is likely to shrink only slowly, as the Fed tends not to reinvest maturing bonds rather than actively selling them.

First interest-rate moves by the ECB as well

Compared to the United States, the European market is being more directly affected by the war in Ukraine. European countries tend to be more heavily reliant on Russian energy and commodity supplies, which significantly increases the risk of a recession, with prices rising simultaneously. The downside risks are commensurately greater, which was largely taken into account by the European Central Bank (ECB) at its March meeting. For the time being, however, it reckons that inflation is anchored back at the ECB’s inflation target of 2 per cent in the medium term. This is a positive signal after long-term inflation expectations were previously below the ECB’s target. Specifically, it is making net bond purchases from the third quarter of 2022 directly dependent on the economic data available at the time. If expected medium-term inflation remains in line with the 2 per cent target, its asset purchase programme (APP) is predicted to end in the third quarter. According to the ECB, this is also a prerequisite for raising its key interest rates. In the favourable baseline scenario of its latest economic forecast, KOF expects to see solid economic growth in the second half of 2022 as well as medium-term inflation rates slightly below target. Consequently, an initial increase of 25 basis points in key interest rates is expected in the autumn of this year and will be repeated next year. In addition, the Pandemic Emergency Purchase Programme (PEPP) expired at the end of March, so no new net purchases will be made in future – at least under this scheme. In the event of a prolonged escalation of the war in Ukraine and the imposition of more far-reaching related sanctions, the ECB’s interest-rate move will be postponed in the negative scenario, although the rate of this increase will be higher than in the baseline scenario owing to rising inflation.

SNB keeps interest-rate differential with euro area constant

After having been in negative territory for long periods over the last ten years, inflation in Switzerland rose to 2.2 per cent in February. One major factor here is the rise in import prices, which make foreign products in the Swiss basket of goods more expensive. As in other countries, the factors responsible for this increase will moderate over time. In addition, the appreciation of the Swiss franc, which has been tolerated by the Swiss National Bank (SNB) so far, is slowing inflation. Inflation rates of between 0.5 per cent and 1 per cent are expected in 2023, which is within the SNB’s target range. The franc/euro exchange rate therefore remains highly relevant to the SNB’s monetary policy. As has been shown in the past, the franc is a safe haven for investors in times of crisis. In order to prevent the risk of further upward pressures on top of the impact of the war, the SNB will not raise interest rates before the ECB does so. However, the SNB is likely to follow suit as soon as the euro area’s central bankers dare to take the first step, which would move interest rates towards zero for the first time since 2015.

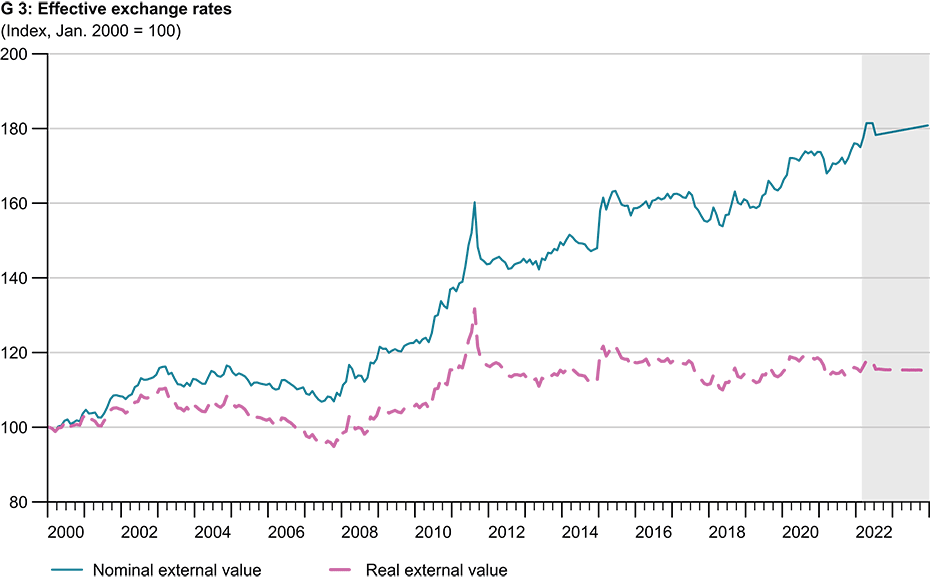

The franc appreciates in nominal terms while its real exchange rate remains constant

The long-term nominal appreciation of the Swiss franc would continue even without the war in Ukraine. Depending on how the war progresses, however, the SNB might intervene by buying foreign securities in order to stabilise the exchange rate. However, the Swiss monetary authorities are allowing this nominal appreciation because of the inflation differential with other countries. This differential is unusually large at the moment. More relevant to the economy is the real exchange rate, which is forecast to remain relatively constant this year and next (see Chart G 3). The domestic population’s purchasing power abroad will therefore hardly change.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland