Digital technology: are small firms being left behind?

Big data, ChatGPT, virtual reality – artificial intelligence (AI) is omnipresent. But not all firms are benefiting to the same extent. While large companies upgraded digitally during the period between 2020 and 2022, many SMEs are lagging behind. There was also untapped potential in the combination of AI and big data – which could harm competitiveness in the long term. Here are the key findings from our recent study on the innovation landscape in Switzerland.

Executive summary

The gap is widening: big data is being used by 20 per cent of small firms and 60 per cent of large companies. AI is being used by just over 8 per cent of small firms but by more than one in three large companies.

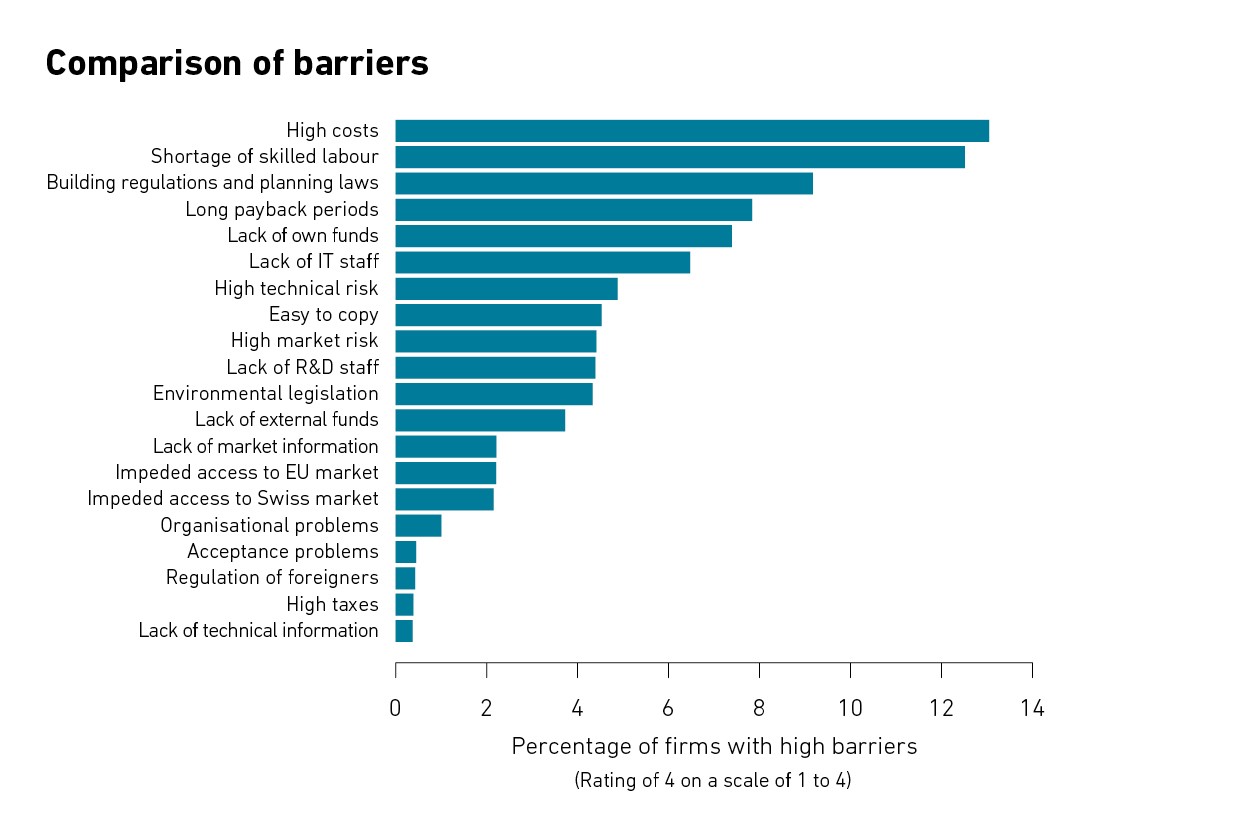

Irrespective of digital technology, high costs were still cited as the main obstacle to innovation. Skilled labour shortages, building regulations and planning laws are further recent factors.

A clear shift is emerging among large companies. The proportion of revenue spent on R&D is falling, while the percentage of innovating firms remains constant. This indicates a lower ‘depth’ of innovation. In fact, the market success of innovative products and services – measured in terms of the share of revenue generated by innovations – has been declining since 2016. This downward trend is particularly pronounced among new-to-the-market products.

The boom in digital technology during the pandemic was primarily driven by greater employee expertise rather than by higher investment in hardware and software. This is suggested by the figures from the latest KOF Innovation Survey. Firms continued to spend around 17 per cent of their total investment on information and communication technologies (ICT) between 2020 and 2022. However, more skilled workers underwent training and professional development in these areas.

Large companies one step ahead

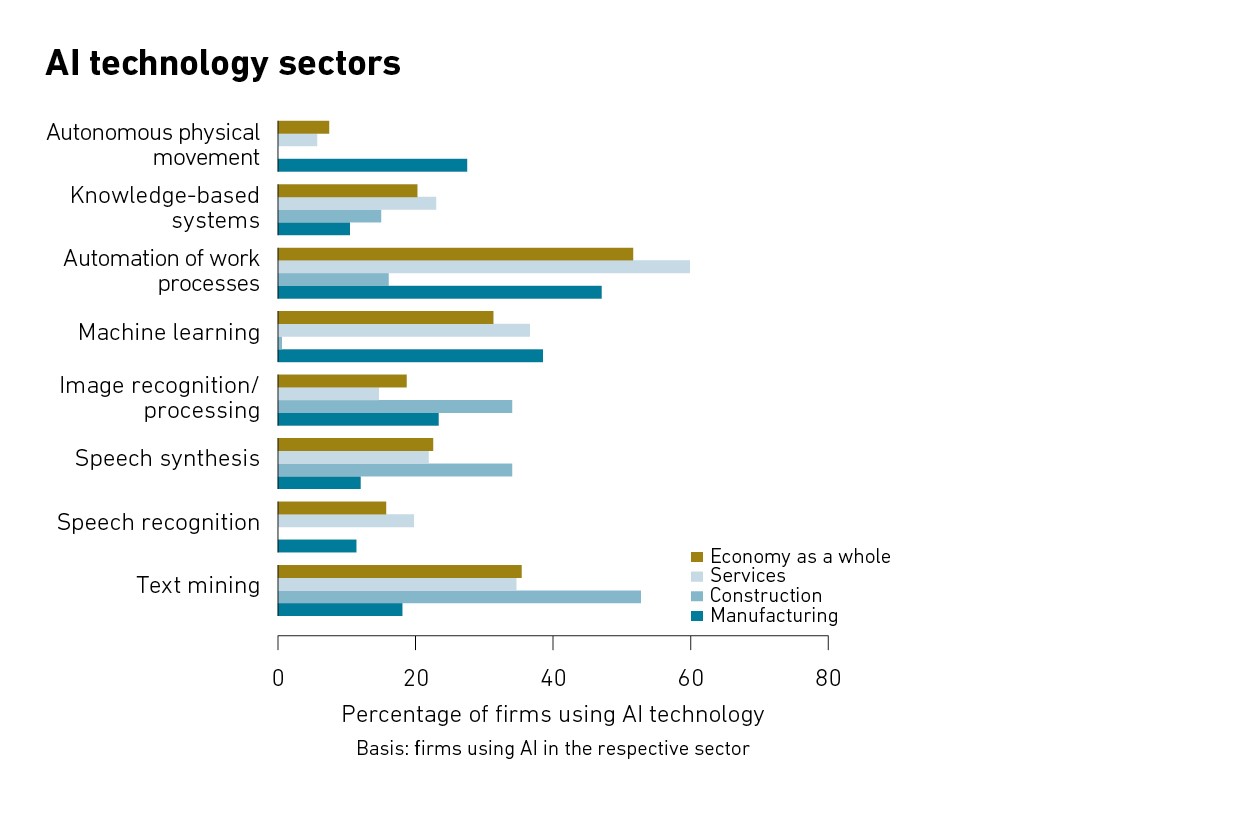

The survey also reveals that the use of big data and AI has increased significantly overall (see chart G 1). They are primarily being used to automate workflows and processes. However, there is a huge divide in the extent to which they are being applied by small firms and large companies. Big data is being used by 20 per cent of small firms and 60 per cent of large companies. The situation is similar for AI, with just over 8 per cent of small firms using it, while for large companies this figure is already more than one in three. It remains to be seen whether ChatGPT and the changes rapidly implemented since its publication a good two years ago can close this gap.

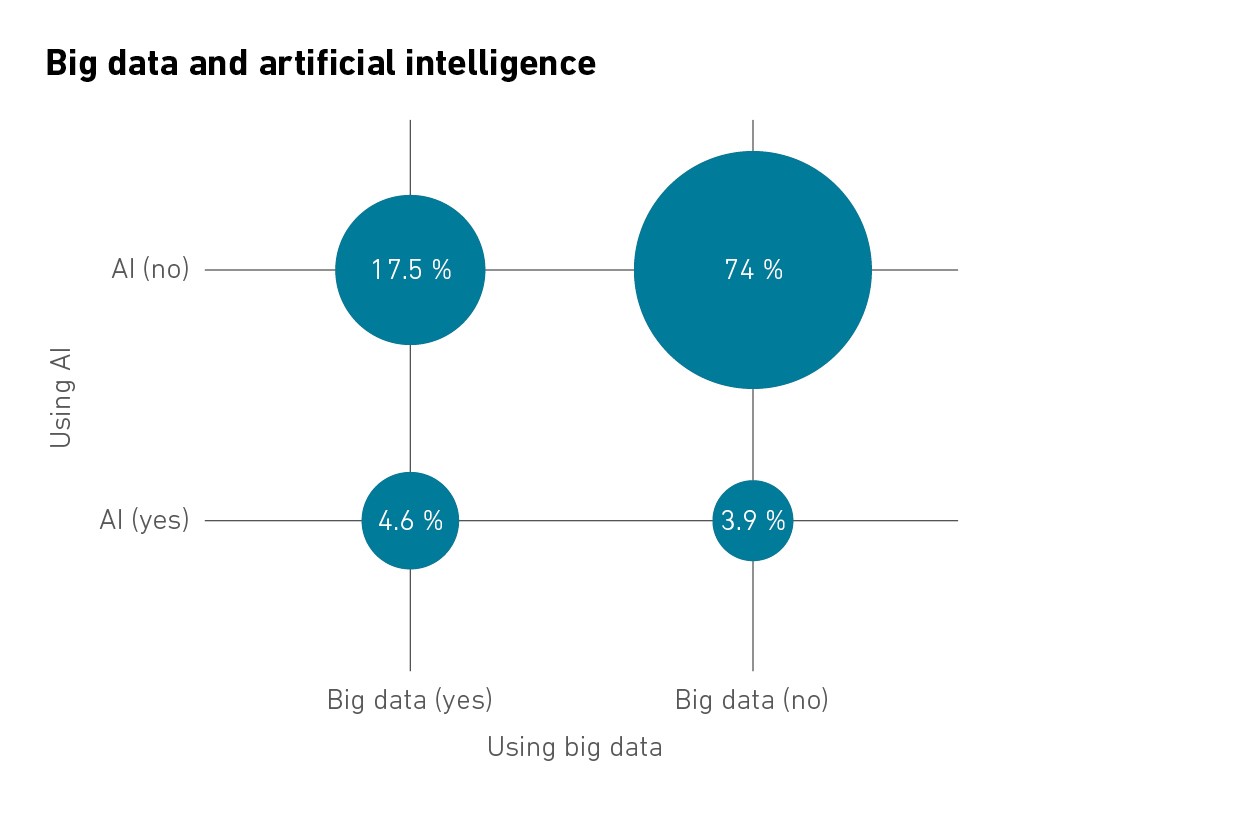

One key to achieving competitive advantage is the combination of big data and AI. So far, however, less than 5 per cent of firms use AI to evaluate and analyse large volumes of data (see chart G 2). This could be due to a lack of expertise, infrastructure or poor data quality. If companies use AI, around a third adapt it to their specific needs. A quarter use AI software that has been developed or modified either by their own staff or by external providers. The study also shows that AI is particularly prevalent in industries with higher added value. This indicates a positive correlation with a firm’s competitiveness.

Swiss innovation landscape still strong and resilient

A cursory glance not only at digital technology but also at how innovative the Swiss economy is reveals a stable but varied innovation landscape. Despite fiercer international competition and the challenges of the pandemic years, firms maintained the success of their innovative products and services at the same level as in previous years. However, the proportion of companies actively conducting research and development (R&D) fell slightly between 2020 and 2022. The percentage of revenue spent on R&D also grew less than before. This means that the historically high level of R&D concentration in the Swiss economy has become entrenched, which is primarily due to the trend among businesses with fewer than 50 employees. By contrast, firms with between 50 and 100 workers were more willing to engage in risky R&D and invest more.

The high-tech sector plays an important role in Switzerland’s innovative prowess. However, it is precisely in this industry that the innovation landscape appears to be changing. The proportion of innovative and R&D-active companies is highest in this sector. R&D spending is also the highest here in relative terms. However, the market success of innovative products is lower than that of cutting-edge services. This is a sign of stiff international competition which, on the one hand, requires greater innovation efforts but, on the other, hinders the market success of innovative products.

Cost pressures on small SMEs

Process innovations to reduce production costs have increased among small SMEs for the first time since the 2014 to 2016 survey period. The cost pressures on many firms have grown. However, the proportion of businesses with cost-cutting process innovations continues to fall among larger SMEs with between 100 and 250 employees and large companies with more than 250 employees. The level of production cost savings achieved by large companies has even been declining for several periods. Either cost pressures have eased here or it has become much more difficult to realise further production cost savings.

High costs were the most frequently cited obstacle to innovation in the survey (see chart G 3). This had already been the case in previous years. Skilled labour shortages and, above all, building regulations and planning laws are additional recent factors. These are the second and third most important obstacles.

Fewer and fewer radical innovations

There is a clear shift in large companies’ innovation activities. The proportion of revenue spent on R&D has been falling significantly while the percentage of innovating firms has remained constant for several periods. This indicates a lower ‘depth’ of innovation. And, indeed, the market success of innovative products and services has been declining since 2016 when measured in terms of the share of revenue generated by innovations. This downward trend is particularly evident in the proportion of revenue generated by new-to-the-market products (radical innovations), i.e. products and services with a high level of innovation depth, which generally provide at least short-term competitive advantages.

New innovation funding instruments

Following a steep rise in the proportion of innovative companies that have received innovation funding, this proportion has stabilised at a high level. This sharp increase is primarily due to cantonal funding. The tax deductibility of R&D expenses and the patent box have provided additional funding instruments since 2020. It is also striking that around a quarter of innovative firms see the changes in Switzerland’s association status with Horizon Europe as either negative or very negative.

The study

As part of the innovation survey, which has been conducted every two years since the 1990s, KOF researchers were commissioned by the State Secretariat for Education, Research and Innovation (SERI) to investigate the status of digital technology and its use by firms in Switzerland.

The latest study in full: external page www.innovationserhebung.ch

Commentary “Room for improvement”

Comment by Prof. Dr. Martin Wörter, Head of the Innovation Economics research division

“The innovative prowess of the private sector is a mainstay of our country’s competitiveness and prosperity. Economic policymakers would be well-advised to optimise the regulatory framework for research and development (R&D) and for innovation activities in all areas of society. There is further room for improvement here. A cursory glance at the existing obstacles shows that – in addition to the high costs of innovation – skilled labour shortages and, above all, building regulations and planning laws have become significantly more important as barriers to innovation.

But that’s not all. International competition has intensified – particularly in the high-tech sector, which is important for Switzerland. This is also reflected in the fact that R&D spending as a percentage of revenue has increased while the market success of innovative products has decreased. Higher expenditure for lower returns means less competitive advantage from R&D or longer payback periods for innovative products. In the longer term this could jeopardise the financial viability of inhouse R&D and increase the risk of innovation, particularly for small SMEs. This could encourage R&D activities to be concentrated at larger companies. This in turn reduces the ‘absorptive capacity’ of the Swiss private sector as a whole, especially as inhouse R&D activities are often a prerequisite for recognising and exploiting the potential of new developments and trends in the competitive environment and at universities. Funding innovation can help to maintain the private sector’s absorptive capacity at a high level.

And it really does, as the latest evaluation study on Innosuisse’s project funding shows. It significantly increases the workforce and innovative revenue at the subsidised firms.

“The current regulatory framework, which remains uncertain, is definitely not helpful here in terms of building and using this expertise at firms as quickly as possible.”Martin Wörter, Head of the Innovation Economics research division, KOF

Innovation parks and, more recently, the greater tax deductibility of R&D expenditure (at cantonal level) also have the potential to boost innovation. However, policymakers also need to act in other areas. The market potential of innovation and the prospect of corporate growth are key motivations for investing in R&D and innovation. Frictionless access to the world’s major markets (EU, US and Asia) is therefore essential to Switzerland’s appeal as a centre of innovation.

Digital technology – especially the latest developments in the use of artificial intelligence to analyse big data – is another key driver of innovation. The potential here is enormous and will affect many areas of the economy. Both the availability of large amounts of data and the technical ability to develop artificial intelligence on a company-specific basis will be crucial to using these technologies to achieve a competitive advantage. This goes way beyond ‘large language models’ such as ChatGPT. The current regulatory framework, which remains uncertain, is definitely not helpful here in terms of building and using this expertise at firms as quickly as possible.”

Literature on this commentary:

Hulfeld, F., Spescha, A., Woerter M. (2024). Funding R&D Cooperation Between Firms and Universities - The Effectiveness of the Innosuisse Model. KOF Working Paper No. 522 12/2024, KOF Swiss Economic Institute, Zürich. external page https://doi.org/10.3929/ethz-b-000708831

IN THE FIELD – what companies say

Do you use AI in your company?

Since 2024, we have been using AI primarily on an individual basis. GenAI and ChatGPT support us with translations, summaries, creating reports or as a programming aid. Copilot Pro helps with smaller everyday tasks such as processing emails. We are currently working on a company chatbot. We are also looking into the use of AI in individual projects, such as image recognition in consulting.

What specific benefits do you get from AI in your company?

So far, the benefits have been limited. The main focus is on familiarising all employees with AI in order to identify future potential.

What are your goals in terms of AI?

We are currently setting up a cross-company innovation management system. This includes a digitalisation strategy and a technology radar designed to identify meaningful fields of application for AI at Andermatt Biocontrol Suisse.

Do you combine big data with AI?

No. The main obstacles are a lack of internal know-how, the investment volume, but also the existing data structure and quality.

Enquiries to: Heiri Wandeler, Head of Production, R&D, Technology, Andermatt Biocontrol

Do you use AI in your company?

AI is a very important tool for us. Internally, we use AI primarily to increase efficiency. In software development, our main business, all our engineers have AI tools at their disposal that make them between 10-30 per cent more efficient. This means that we can develop better and more cost-effective software solutions for our customers. All employees also have access to our CudosGPT – a tool similar to ChatGPT, but secure and with access to our internal data. Another very cool feature is our AI assistant, which we use for project controlling. It has access to our time tracking data and accounting; it can check invoices and evaluate projects. This saves us hours of time every month. AI has also become a business area in its own right for us. We are authorised to pass on to other companies the solutions we have developed for ourselves.

Your vision?

The rapid development will continue. The areas in which AI can be meaningfully deployed are growing almost daily. We see ourselves in the future as AI experts and enablers, helping companies in Switzerland to become better, faster and cheaper thanks to AI. AI is turbocharging digitalisation: because digitalisation is becoming cheaper, companies are suddenly tackling many issues that should have been digitalised long ago.

Do you combine big data with AI?

Yes. We develop our own algorithms, which we train and test using the data. And we use AI as a search tool for big data.

Enquiries to: Reto Bättig, CEO Cudos AG, 60 employees

“AI and big data will be very important in Switzerland, as they will be indispensable in the important service sector. Manufacturing companies such as Andermatt Biocontrol Suisse will also make use of them. These are justified fields of application, but with somewhat less speed and scope.”Heiri Wandeler

“Get on with it! Don't start huge projects, but set up small teams that generate benefits quickly and cost-effectively. We have to start learning how to use AI now and have the infrastructure, interfaces and good data ready for the future. Waiting is not an option.”Reto Bättig

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland