KOF Monetary Policy Communicator

The KOF Monetary Policy Communicator for the Euro Area provides a quantitative measure of ECB communication.

An Indicator for Measuring ECB Communication

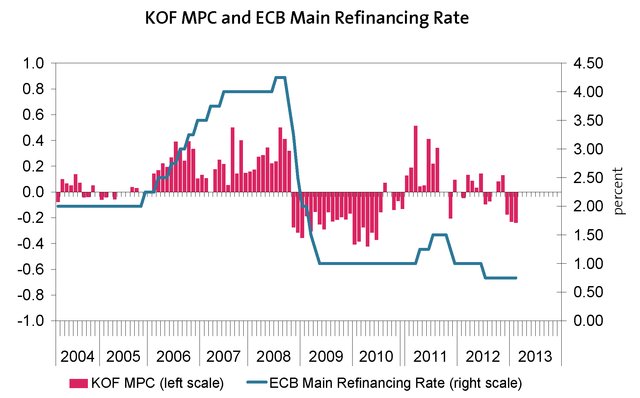

It translates the ECB president’s statements concerning risks to price stability as made during the monthly press conference into an index.

By aggregating forward-looking statements concerning price stability, the KOF MPC contains information about the future path of ECB monetary policy. It anticipates changes in the main refinancing rate by two to three months.

The KOF Monetary Policy Indicator is published on the day of the monthly Governing Council meeting at 17.30 CET.

News

KOF Monetary Policy Communicator for the Euro Area, July 2025

The KOF MPC figure for 24 July 2025 is 0. At today’s meeting, the ECB’s Governing Council decided to keep the three key ECB interest rates unchanged.

Papers using the KOF MPC:

Christian Conrad and Michael J. Lamla (2010): The High-Frequency Response of the EUR-US Dollar Exchange Rate to ECB Monetary Policy Announcements, Journal of Money, Credit and Banking, 42 (7)1391–1417.

Matthias Neuenkirch (2013): Monetary Policy Transmission in Vector Autoregressions: A New Approach Using Central Bank Communication, Journal of Banking and Finance, forthcoming.

Michael J. Lamla und Jan-Egbert Sturm (2013): Interest Rate Expectations in the Media and Central Bank Communication, Chapter in CESifo/MIT book - Central Bank Communication, Decision-Making And Governance, edited by Pierre L. Siklos and Jan-Egbert Sturm

Bulíř, A., Čihák, M. and Šmídková, K. (2013), Writing Clearly: The ECB's Monetary Policy Communication. German Economic Review, 14: 50–72.

Jan-Egbert Sturm and Jakob Haan (2011): Does central bank communication really lead to better forecasts of policy decisions? New evidence based on a Taylor rule model for the ECB, Review of World Economics (Weltwirtschaftliches Archiv), 147(1), 41-58.

Jakob de Haan (2008): The effect of ECB communication on interest rates: An assessment, The Review of International Organizations, 3(4), 375-398.

Newsletter

If you want to subscribe to our mailing list, please write an email to with subject "subscribe".

Contact

KOF FB Data Science und Makroök.

Leonhardstrasse 21

8092

Zürich

Switzerland