Swiss tourism remains on track

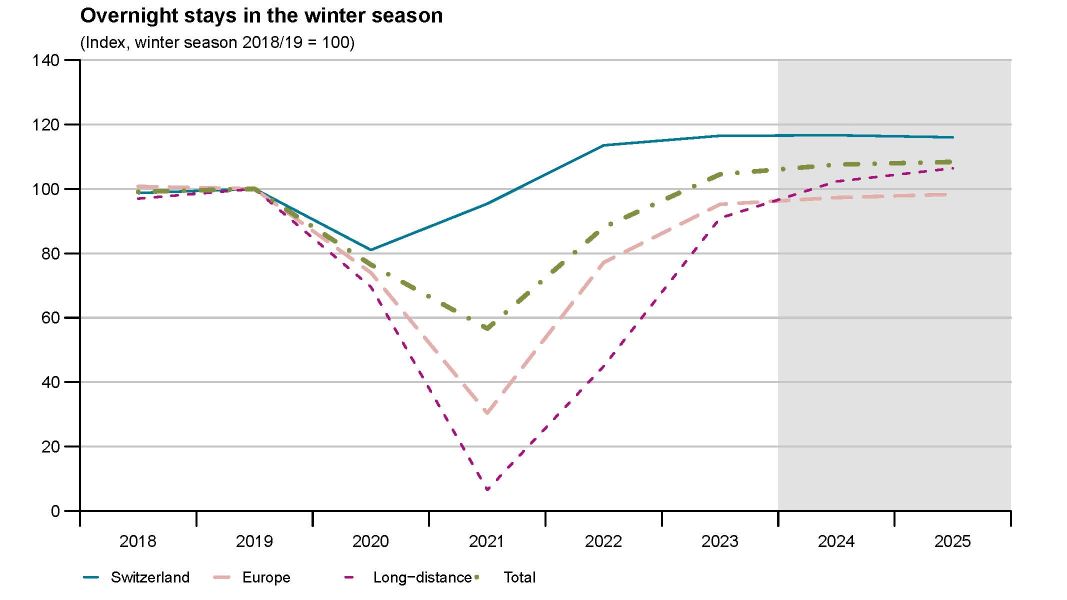

The Swiss tourism sector will continue to grow during the winter season. According to the KOF Tourism Forecast, Swiss guests and travellers from overseas markets such as the US will be the main drivers of the increase in overnight stays.

By posting growth of 408,00 overnight stays (up 1.7 per cent), the recent 2024 summer season achieved a record – mainly thanks to strong demand from the United States and stable numbers of guests from Switzerland. Neighbouring countries presented a mixed picture. The number of overnight stays by German guests stagnated owing to the country’s weak economy, while overnight stays by French guests rose again.

These trends are likely to continue during the winter. KOF is forecasting growth of 0.8 per cent in overnight stays for the 2024/2025 winter season. A seasonal comparison reveals that the strongest growth stimulus is coming from North American guests, while the number of overnight stays by European guests is better than recently expected.

Review of the 2024 summer season

Overnight stays by guests from Europe stagnated (down 0.5 per cent) – mainly owing to the persistently challenging economic conditions. Germany and Italy both reported a slight decline of 1 per cent as a result of inflationary pressures and weak demand. In contrast, tourism from France has recovered significantly since the pandemic and clearly exceeded pre-crisis levels. The number of overnight stays by French guests rose by 4 per cent last summer, with August standing out in particular: overnight stays then were over 30 per cent higher than before the pandemic.

Developments since the pandemic have been characterised by a shift in seasonal patterns. August saw an increase in tourism, particularly among European guests. At the same time, March has become less important, while February is becoming increasingly attractive owing to better snow conditions. These shifts can be partly explained by climate change, which is shortening the winter season and concentrating it on just a few weeks when snow is guaranteed.

Fewer guests from China and the Gulf States than before the pandemic

The number of overnight stays by guests from Asian countries continued to recover during the summer but remained below expectations overall. It rose by 5 per cent (50,000 overnight stays) compared with last summer.

The numbers of guests from China remain very low. In the summer of 2024 they were only half as high as they had been before the pandemic. As last year was even worse, however, this increase still made a positive contribution to the overall growth of 110,000 overnight stays.

The number of overnight stays by guests from the Gulf States fell. Although guests from this region were among the first to boost visitor numbers following the reopening immediately after the pandemic, it is now clear that pre-crisis levels are not being regained. Visitor numbers from the Gulf States between June and August were 25 per cent below their pre-pandemic levels. Efforts to build tourist resorts in this region may have lured some of these tourists away. The GCC Schengen visa, which is expected at the end of 2024 and will simplify visa requirements for the Gulf States, could start to boost growth from 2025. By way of comparison, the proportion of overnight stays from this region is roughly the same as that from Italy and India.

Travellers from the US are benefiting from the strong dollar

There was a further increase in overnight stays by travellers from North America this summer, which rose by almost 300,000 (up 14 per cent) following the sharp increase of 26 per cent in 2023. According to international air traffic statistics, US citizens took 20 per cent more international flights this year than they did last year. Of this figure, air travel to Europe increased by 16.2 per cent, which is likely due in part to the Olympic Games in Paris. Air travel by Americans to Switzerland increased by 28.5 per cent, while flights to Germany grew by only 6 per cent. In addition to Switzerland Tourism’s targeted marketing strategy, the considerable interest in travelling to Switzerland is likely to have been boosted by the strong dollar.

Swiss guests remain by far the most important country of origin. Their numbers are still significantly higher than they were before the pandemic and are above expectations. Overall, however, overnight stays fell by just under 200,000 (down 1.8 per cent) compared with last summer. However, it was to be expected that the pandemic-related overhang would gradually be reduced.

Germany is the economic laggard

Macroeconomic outlook: The global economy has been showing mixed signs of recovery over the course of 2024. The US economy has exceeded forecasts, driven by strong consumption and high levels of investment. Despite a slight slowdown in the labour market there, the strong US dollar continues to benefit Swiss tourism, as travel to Europe remains attractive for Americans. In contrast, the eurozone is struggling with weaker growth, particularly in Germany, where investment and private consumption have declined. However, the weaker euro could make Switzerland more expensive for European tourists and thus influence their travel decisions.

While China continues to face economic challenges, particularly in the property sector, political considerations also play a role here. Since the pandemic, the Chinese authorities have been less inclined to actively promote travel to Western countries owing to geopolitical tensions and domestic political priorities. A strong recovery in Asian tourism has not yet materialised either, even though a gradual improvement is visible in markets such as Japan and South Korea.

On the whole, inflationary pressures are easing in both the eurozone and the US but remain high in the service sector. This could also influence consumer behaviour in 2025 and have an impact on international travel. While global markets are slowly recovering, uncertainty remains – particularly in Asia, which has not yet fully stabilised.

Winter 2024/25 forecast

KOF continues to expect an encouraging winter for tourism. The forecast for the coming 2024/2025 winter season has been adjusted only slightly downwards, with an increase of 0.8 per cent in overnight stays now expected (summer forecast: rise of 1 per cent). Following a brief dip in the summer, the latest KOF surveys of business expectations show that they are at a similar level to last winter and above forecasts for the winters before the pandemic.

Staycations remain popular in Switzerland

Swiss guests remain the most important visitor group, particularly in winter. A further slight decline in favour of long-distance travel is expected (down 0.5 per cent). KOF’s surveys of the accommodation sector also show a stable flat trend in domestic forecasts. The number of overnight stays by Swiss guests is likely to remain high.

Overnight stays by European guests are expected to grow by 2 per cent during the coming winter season. While the number of overnight stays by German guests is likely to stagnate owing to the country’s economic challenges, stable growth is forecast for French guests, which should continue over the winter – albeit at a slower pace – following the successful summer.

The boom in overseas visitors from North America is likely to continue during the winter season, albeit at a slightly slower pace than in the summer. KOF expects to see strong growth of almost 10 per cent in overnight stays from North America.

The number of overnight stays by guests from Asia will slowly increase over the coming winter (up 1 per cent) and is therefore already above its pre-pandemic level, which can also be attributed to the seasonal shift towards more winter tourism and less summer tourism. The number of Russian guests, who were particularly prominent during the winter months, remains constant at only 30 per cent of its level before the start of the war in Ukraine.

KOF is forecasting modest growth for 2025

KOF expects the 2025 summer season to stagnate at this year’s level, showing a slight increase of 0.2 per cent. Overnight stays by European guests are likely to remain flat thanks to stable energy prices and declining inflationary pressures. By contrast, the Chinese market remains uncertain; despite slow growth, only 60 per cent of its pre-crisis level is expected to be reached. The downward trend in the Gulf States continues, and it remains to be seen whether the planned visa facilitation measures can fuel a recovery. There is the potential for a decline in domestic guests: if they increasingly favour long-haul travel, the number of their overnight stays may not grow during next summer.

Moderate growth of 1.1 per cent is forecast for the 2025/2026 winter season, supported by the recovery in tourism from China. Although the economic situation in China remains uncertain and pre-crisis levels are not expected to be fully attained in the next few years, the numbers of guests from China (including Hong Kong) should reach around two-thirds of their pre-pandemic levels by winter 2025/26. An encouraging, albeit slower, trend is also forecast for North America, where the relevant numbers are already more than 40 per cent above their pre-pandemic levels.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland