KOF Tourism Forecast: overseas markets giving summer season a boost

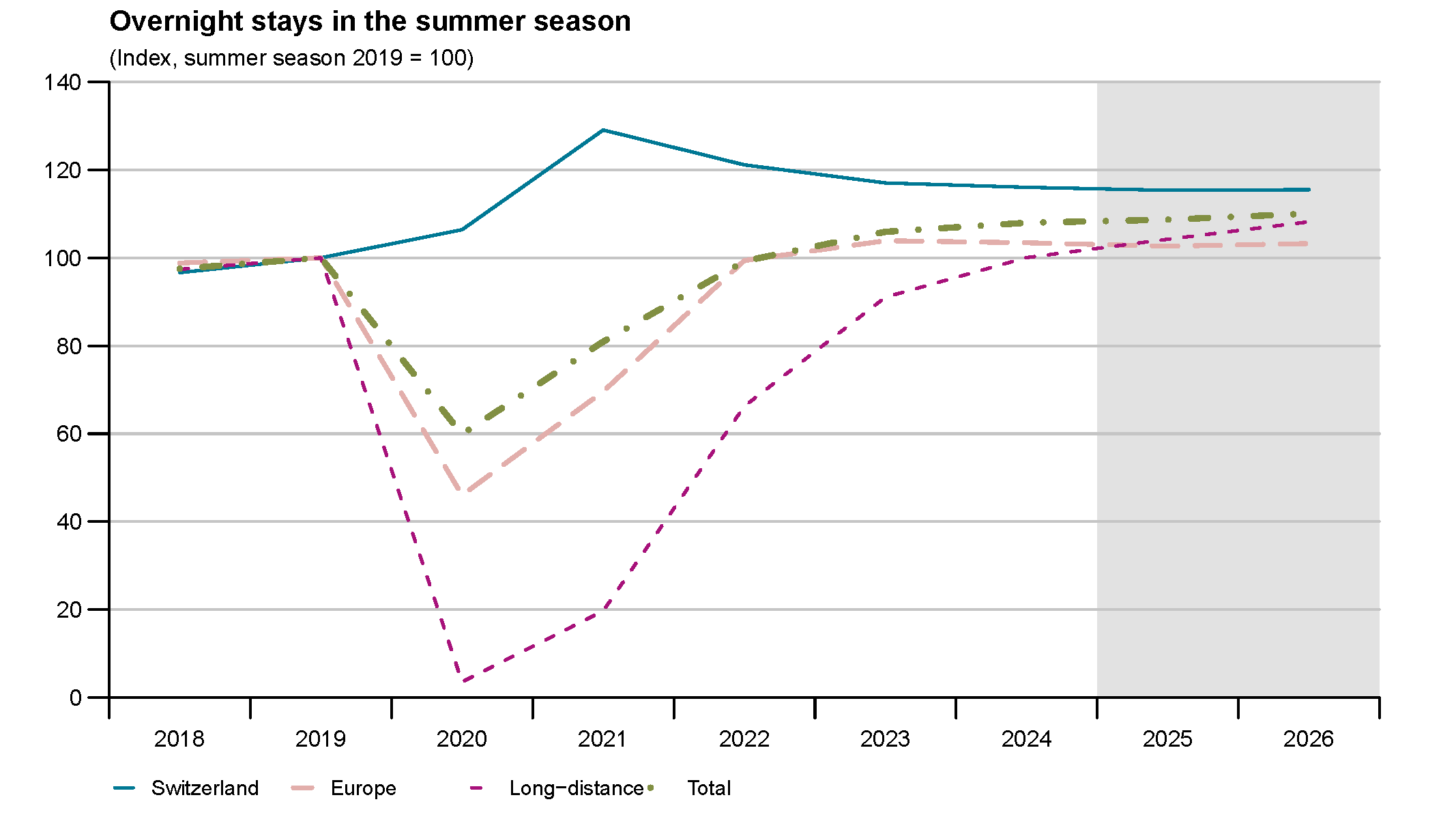

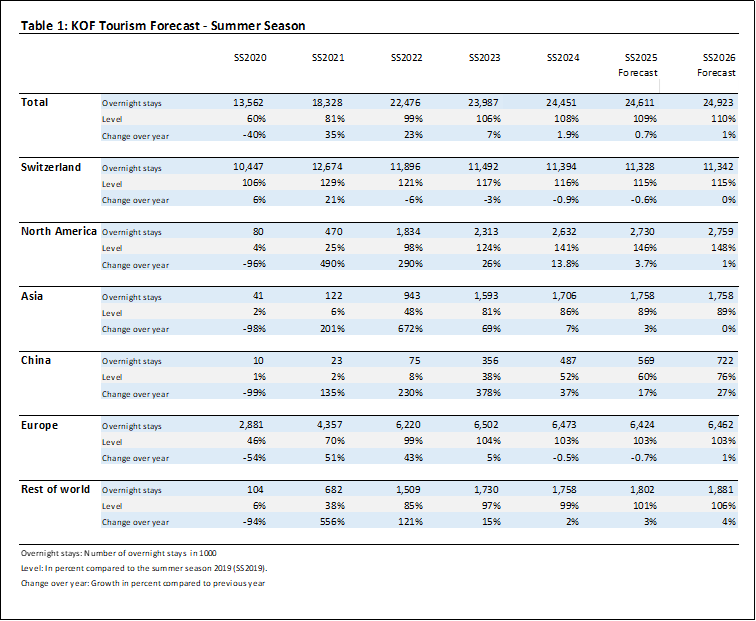

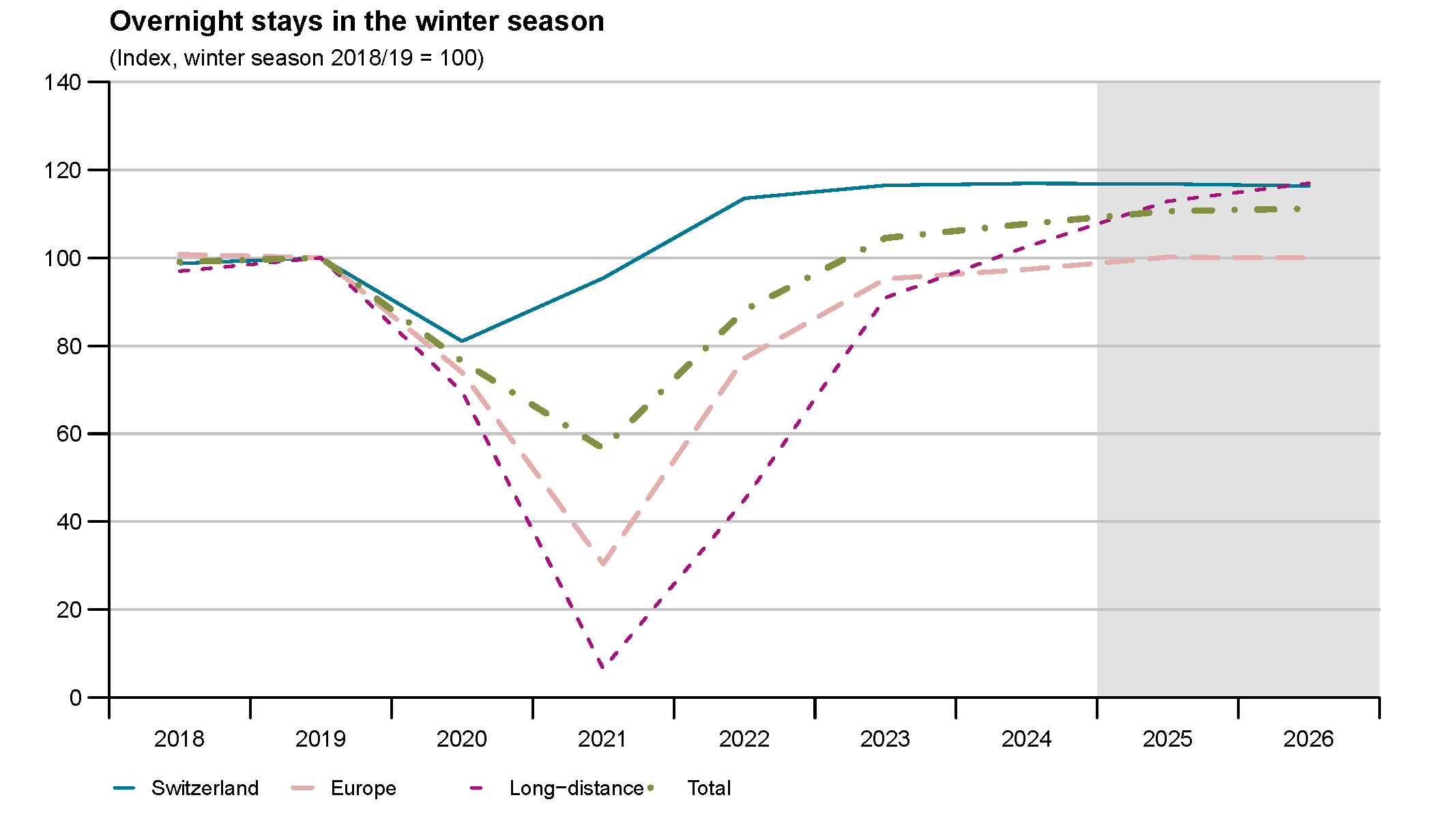

After the 2024/25 winter season recorded an all-time high, summer is also likely to see a slight increase. KOF’s latest forecast for Swiss tourism expects the number of overnight stays to rise by 0.7 per cent to a total of 21 million. Guests from overseas markets in particular will contribute to this trend. The high level of overnight stays is likely to be maintained and even increase slightly (up 0.5 per cent) during the coming winter season.

Brief overview: Swiss tourism is starting the 2025 summer season with strong tailwinds. Following the recent winter record of 18.5 million overnight stays (up 2.6 per cent year on year), KOF’s forecast from autumn 2024 remains almost unchanged and is being raised only slightly. The main reason for this is long-distance travellers, whose overnight stays continue to increase, while domestic guests are sustaining their historically high levels.

Despite the strong Swiss franc, subdued global economic growth and geopolitical tensions, experience shows that these factors will only dampen demand for costly Switzerland to a limited extent. One possible downside risk is an eventual slowdown in US tourists in the second half of 2025, although the overall trend is positive. KOF therefore anticipates a significant increase in guests in summer 2025 and another high number of overnight stays in winter 2025/26.

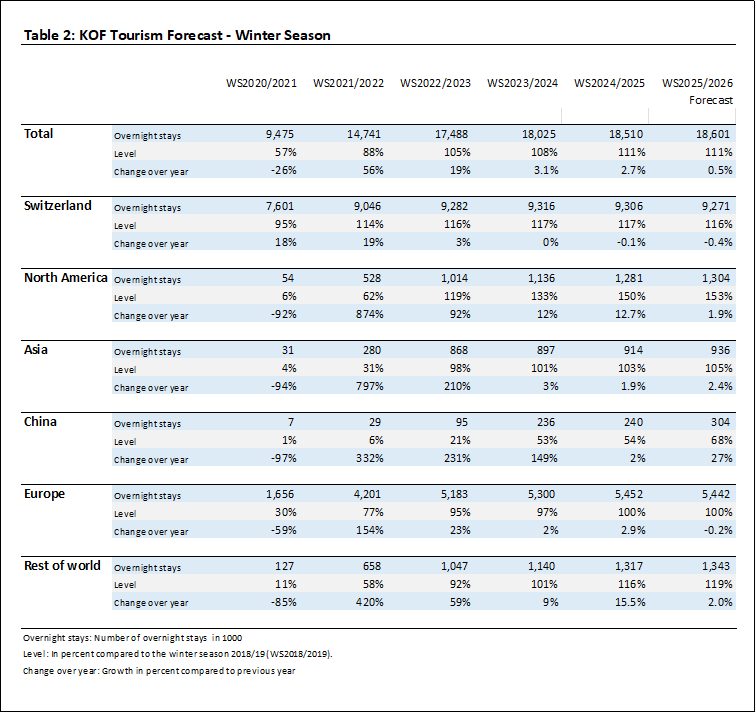

Review of the 2024/25 winter season: The 2024/25 winter season achieved an all-time high of 18.5 million overnight stays. The concentration on the core months is striking: February is now the strongest month, while March fell back slightly. This trend has been consistently apparent since 2021.

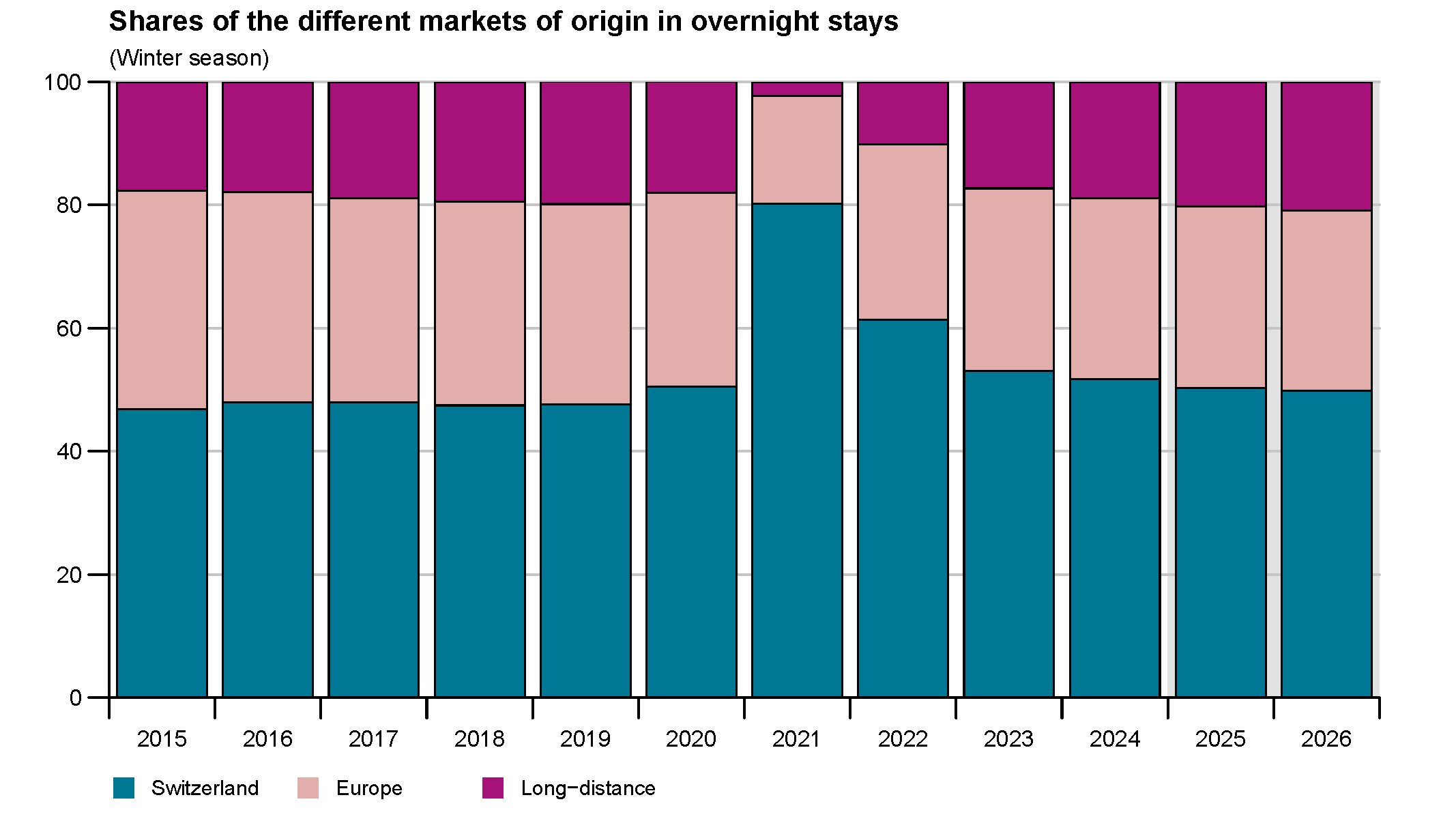

Domestic guests: Although overnight stays by the Swiss are stagnating, their volume remains well above its pre-Covid average. They therefore continue to form a reliable base. The proportion of overnight stays by domestic guests is just under 50 per cent of total overnight stays.

Guests from Europe: This was a mixed but generally encouraging picture. Tourists from France stayed overnight just over 15 per cent more often in November than in the previous year, overnight stays by guests from the UK grew slightly, while those by tourists from Germany fell slightly, following the long-term trend. Overall, there was an increase of around 2 per cent compared with the previous winter.

Long-haul travellers: This was a strong growth driver. Tourists from the United States boosted their overnight stays by almost 14 per cent in March and are now at 150 per cent of their 2019 level. The numbers of overnight stays by guests from Brazil, India and Australia grew at double-digit rates. Overnight stays by Chinese tourists increased slightly (up 2 per cent), as expected, but remain well below their pre-crisis levels.

Macroeconomic outlook: The global economic environment in 2025 is likely to be weaker than recently expected. Trade disputes, higher financing costs and a low propensity to invest are slowing global growth. At the same time, the latest UN Tourism Barometer signals a consistently strong desire to travel. This continues the decoupling of the tourism sector from other consumer industries that has been observed since the pandemic.

This resilience varies from region to region. The US – strong in consumption and price-tolerant – is supporting premium tourism. China is recovering only slowly owing to structural problems. Europe continues to stagnate. The high exchange rate is discouraging brief trips from border regions but is hardly affecting long-haul travellers. Overseas markets in particular are therefore likely to remain stable in 2025.

Forecast for the 2025 summer season: KOF is slightly revising upwards its forecast for overnight stays in the summer. Firstly, the outlook for tourism consumption in the long-haul markets has improved and, secondly, bookings from North America and Asia particularly have risen sharply. KOF is now forecasting an increase of 0.7 per cent to around 21 million overnight stays.

Domestic guests: Although the number of overnight stays by domestic guests remains high – comparable to summer 2024 – it shows a slight decline of around 0.6 per cent. This decrease should not be interpreted negatively, as the extremely high figure of 12.6 million overnight stays in 2021 has since levelled off at a normal but still high level. The number of overnight stays is expected to stabilise at this high level – supported by population growth – during the following summer.

Guests from Europe: KOF expects the numbers of European tourists to more or less stagnate in summer 2025 (down 0.7 per cent). This means that the slow negative trend will continue. Visitors from France are likely to maintain their record levels, those from Germany will fall slightly, while the trend among tourists from the United Kingdom and Northern Europe will be neutral to slightly positive. Despite reporting a slight decline, Germany remains the most important travel market.

German guests are more sensitive to rising prices than French visitors. This is because the composition of the respective groups differs. In Germany there are significantly more people from highly varied income groups. French visitors to Switzerland, on the other hand, are usually a more homogeneous and wealthier segment. This is why German holidaymakers on lower incomes react more strongly to higher costs.

Overseas travellers: Overnight guests from North America are likely to continue to rise significantly. The number of overnight visitors from other long-haul destinations such as India, Brazil and the Gulf States is also showing positive trends. Guests from China are contributing a slight increase but remain well below their pre-crisis levels. Overall, the overseas markets are compensating for Europe’s flatlining and are making the main contribution to growth in the summer season.

Winter forecast 2025/26: KOF expects to see around 18.6 million overnight stays during the 2025/26 winter season, which represents an increase of just under 0.5 per cent year on year. This level thus remains historically high.

Domestic guests: Their number of overnight stays remains stable at just under 9 million. High incomes, short journey times and more flexibility thanks to working from home are supporting demand.

Guests from Europe: KOF expects to see virtual stagnation here (down 0.2 per cent). The strength of the Swiss franc and weather-related risks are having a particularly negative impact on the behaviour of German tourists; the number of overnight stays by guests from France and the UK remains encouraging.

Overseas travellers: Overnight stays by guests from North America remain at a record high. Chinese tourists are making a small contribution. One potential downside risk would be a slowdown in US spending, which is not currently assumed in the baseline forecast.

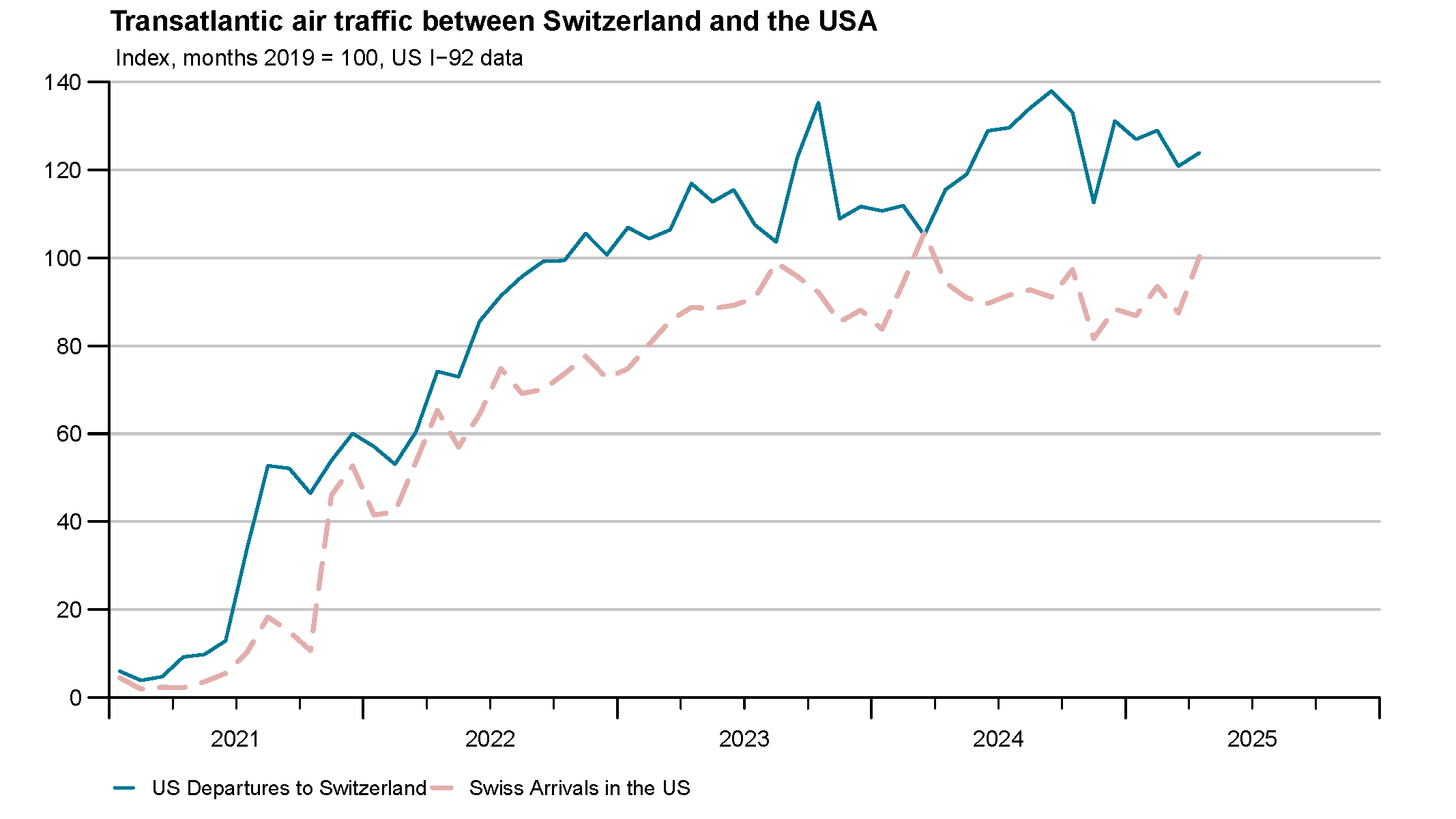

Focal topic: US tourism in Switzerland

The number of overnight stays by North American guests in Switzerland reached a record high of 3.8 million in 2024. At the same time, visits to the United States by Swiss nationals are still well below pre-crisis levels. This asymmetrical trend is notable – especially in light of the current economic situation in the US. Despite trade tensions, inflation-related loss of purchasing power and cautious economic forecasts, the US population’s desire to travel to Switzerland remains intact. In contrast, America is proving less popular as a travel destination for the Swiss themselves. The continuing weakness of the US dollar coupled with higher travel costs should actually make the United States more attractive as a travel destination for the Swiss.

This contrasting trend is illustrated in the figure above, which compares arrivals of Swiss nationals in the US with departures of Americans to Switzerland. The data has been standardised to 2019 as the baseline year (100 per cent). There have been clear differences since the beginning of 2022: while Swiss guests in the United States remain below pre-crisis levels, US tourists in Switzerland are reaching record numbers. Flight capacity was 40 per cent higher before the pandemic than it is today. Accounting for over 20 per cent of all foreign overnight stays, the US market is now more important than ever and is becoming increasingly strategically significant for Swiss tourism.

Why do so many US tourists continue to travel to Switzerland despite the unfavourable exchange rate? The main reasons are structural:

- Robust purchasing power: Real consumer spending in the US rose again by 0.7 per cent in March this year. The U.S. Travel Association expects travel spending to increase by just under 4 per cent for the year as a whole. This encouraging trend is fuelling continued interest in Switzerland as a premium destination.

- Exchange-rate risk is being mitigated: The US dollar was already trading at just CHF 0.83 in the autumn of 2024 and briefly fell to CHF 0.86 in April this year. Nevertheless, Switzerland reported record overnight stays by US tourists in 2024 and is starting 2025 with double-digit growth. Many Switzerland packages are priced in dollars, with airlines and tour operators absorbing any exchange-rate losses through their margins. The additional cost for guests is therefore lower than a simple exchange-rate comparison would suggest.

- Increasing seat capacity: According to the Official Airline Guide, capacity on transatlantic routes will continue to grow until later this year. Some direct flights between Zurich and New York can be booked for as little as CHF 500 in summer, making them only slightly more expensive than European flights.

- Attractive winter sports prices: In the Alps, hundreds of mountain railway companies are competing for customers, meaning that day passes often remain below the psychologically important 100-franc mark – even in prominent destinations. In the US, on the other hand, top resorts charge significantly more on public holidays. Ski resorts there are located large distances from each other and therefore have a stronger monopoly when it comes to pricing.

Risks remain manageable but present

The Consumer Confidence Index in the US fell to 86 points in April (its lowest level since 2011) and could lead to a dip in bookings towards autumn. Any renewed slide in the dollar below CHF 0.80 could noticeably exacerbate price perceptions. However, neither of these factors has been assumed in the baseline forecast. As long as incomes and capacity continue to grow, the US market will remain the most important driver of growth on long-haul routes.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland