No wave of bankruptcies in Switzerland for the time being; support measures appear to have had an effect

Between March and July of this year, 21 per cent fewer companies in Switzerland went bankrupt than in the same period of last year. The support measures taken during the coronavirus crisis are likely to play an important role in this regard. It is still too early to sound the all-clear, however, as some bankruptcies have probably only been postponed. Bankruptcies have tended to increase gradually after previous economic crises as well.

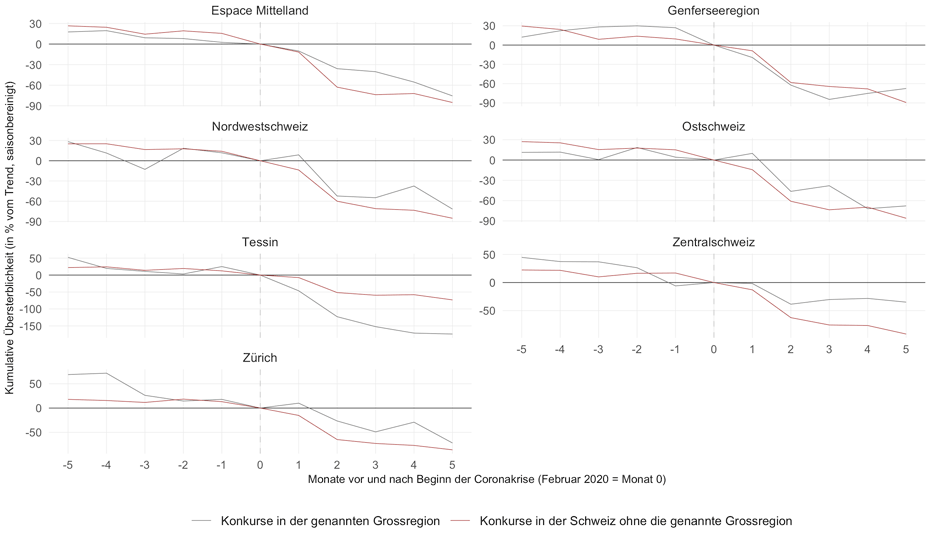

There is great concern that the coronavirus crisis will trigger a wave of corporate bankruptcies in Switzerland. Analysis conducted by the KOF Swiss Economic Institute in collaboration with Bisnode D&B now shows that there are as yet no signs of such a wave of bankruptcies. In recent months the number of bankruptcies has not been significantly higher than expected in any major region or sector of the economy. On the contrary: between March and July of this year there were 21 per cent fewer bankruptcies than in the same period of last year. In the construction industry and the artisan trades there were as much as 32 per cent fewer bankruptcies on average. The economic slump was evident across all major regions, albeit to varying degrees. Whereas there were almost 50 per cent fewer bankruptcies in Ticino, there were only 10 per cent fewer in Central Switzerland.

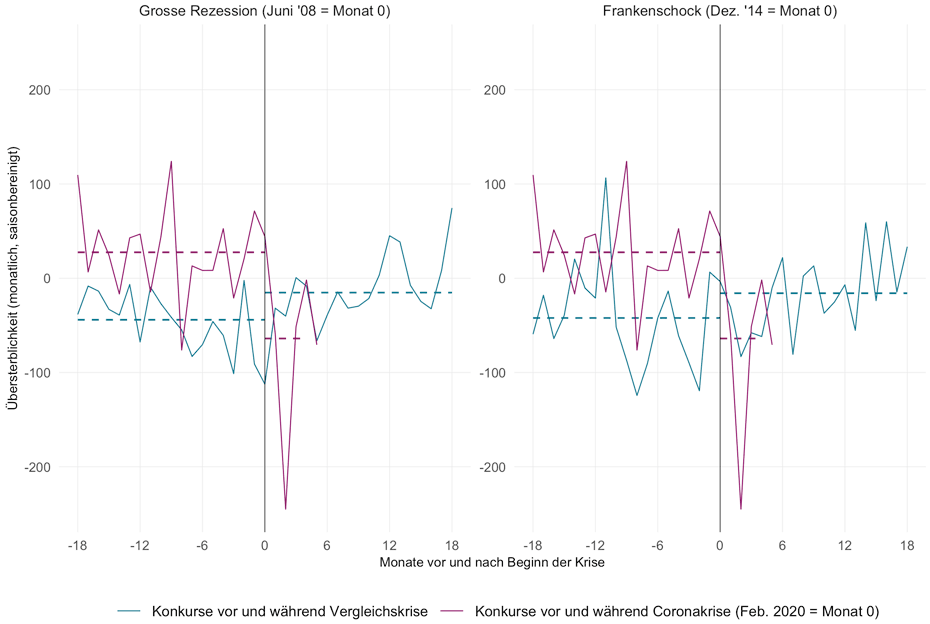

One reason for the generally low level of bankruptcies could be the support measures taken in connection with the coronavirus crisis – such as easier access to short-time working, the COVID-19 lending programme and the ban on debt collection which remained in force until the beginning of April. It is still too early to sound the all-clear, however, as some bankruptcies are merely likely to have been postponed by these measures. Even after past economic crises, moreover, the incidence of bankruptcies has increased gradually rather than abruptly.

Surprisingly few bankruptcies in the hospitality sector and in the leisure/entertainment industry

Only the canton of Valais recorded an above-average number of bankruptcies in June and July, although there was no significant excess mortality here. In addition, the coronavirus crisis appears to be causing a higher incidence of bankruptcies in the wholesale and retail sectors than in the rest of the Swiss economy. The hospitality sector and the leisure/entertainment industry, on the other hand, have so far been affected very little. This is surprising, as these sectors have suffered and continue to suffer severely under the coronavirus-related restrictions. At the same time, however, firms in these sectors have made particularly frequent use of the COVID-19 lending programme.

Bankruptcy figures in Switzerland are generally highly volatile and can be subject to sharp fluctuations from month to month. The researchers therefore use the concept of excess mortality to analyse the incidence of company bankruptcies over time. The bankruptcy monitoring system is updated regularly.

A lengthy article on this topic can be found in the external page Ökonomenstimme blog.

You can find the Press Release Download here (PDF, 122 KB).

You can find the full Insolvency Report (in English) Download here (PDF, 512 KB).

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland