Review of the Methods Applied to Estimate Direct Federal Tax Revenues

- Fiscal Policy

- Forecasts

- KOF Bulletin

How high is the quality of the direct federal tax estimates provided by the Federal Tax Administration (FTA) and the Federal Finance Administration (FFA)? Commissioned by the two administrations, KOF has carried out a detailed analysis of the respective revenue forecasts. The results of this analysis show that, although the forecasts are generally unbiased, parts of the forecasts could be improved.

In the context of an expert appraisal commissioned by the Federal Tax Administration (FTA) and the Federal Finance Administration (FFA), Florian Chatagny and Marko Köthenbürger have reviewed the method applied to estimate direct federal tax revenue in the period 1985 to 2015 and have formulated suggestions for possible adjustments. The forecast series consisted of a calendar year’s revenues in the fields of income tax and tax on earnings as well as the sum of the series plus lump-sum tax credits. The reference forecasts which were utilised for comparative purposes consisted of the published estimates of these series.

As a first step, the two economists applied econometric tests to review the quality of the forecasts. In general, the quality of the FTA forecasts was shown to be good. Statistical bias tests demonstrate that the FTA forecast estimates are generally unbiased and the forecast accuracy has hardly changed over time. This is not true for tax revenue in the field of natural persons where the forecast quality has tended to deteriorate over time. The statistical evidence of this trend is, however, rather weak.

The authors furthermore applied so-called rationality tests to assess whether the information underlying the forecast was utilised efficiently. According to the test results, the assumption of rationality cannot be rejected with regard to the FTA forecasts in the fields of total revenue and natural persons. However, in the field of legal entities, the rationality hypothesis is (slightly) distorted. The result indicates that the largest scope for improvement exists in the case of tax revenue forecasts for legal entities.

Table 1: Rationality test assessing the efficiency of the utilised information (2000–2015)

As a next step, the FTA forecasts were compared to real-time forecasts generated by a random walk model (RW) and other time series models (autoregressive [AR] and vector autoregressive [VAR] models). The database of the KOF macro model formed the (real time) basis for the explanatory variables and their forecasts. The forecast estimates were also compared to forecast combinations. Table 1 specifies the accuracy of the various forecast models for the period 2000 to 2015. Accuracy is measured as a percentage in the form of the mean absolute percentage error (MAPE).

The table shows that the accuracy of the forecast estimate (V) compares favourably to other models and forecast combinations. Especially in the field of legal entities, other models or forecast combinations cannot really compete with the forecast estimate. In the case of natural persons, however, a weighted combination of the forecast estimate and a VAR model of the forecast estimate is shown to be preferable. The weighting of both forecast is based on the moving average of the forecast errors of the respective forecasts as observed in the last five years. The mean absolute percentage error (MAPE) of the combined V+VAR forecast (w5) is 0.91 percentage points lower than the error of the forecast estimate. This corresponds to a total of approx. CHF 95 million in relation to the calculation result for the year 2015.

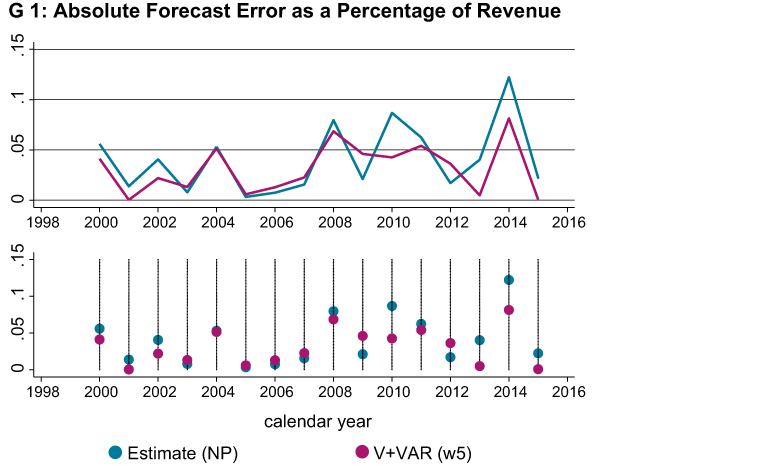

Graph 1 presents the absolute error produced by the two forecasts as a percentage of revenue. If the combination forecast is utilised, the forecast error over the relevant time period is lower in ten years and not much higher than the error produced by the forecast estimate in other years. As regards total revenue, it can ultimately be stated that the sum of the best separate forecasts in the fields of natural persons and legal entities (NJ in table 1) displays a lower forecast error than the forecast estimate. A disaggregated approach (i.e. separate estimates for natural persons and legal entities) is therefore preferable to an aggregated method.

Conclusion

KOF’s review of the method used to estimate direct federal tax revenue shows that the FTA forecasts are unbiased and mostly rational. According to the review, the forecast error also remains relatively stable over time. However, comparison with forecasts generated by other models indicates that the forecast of tax revenue in the field of natural persons could be improved via a weighted combination of the forecast estimate and a VAR model. The largest scope for improvement regarding the tax revenue forecast is found in the field of legal entities.

No database information available