KOF Bulletin

How are Swiss companies doing? What is the situation on the labour market? How is the international economy developing? And what is the latest news from KOF research? The monthly KOF Bulletin answered these questions and more until October 2024, when it was replaced by the ‘KOF Insights’ magazine in 2025.

Latest articles

Older articles

KOF Business Situation Indicator rises again

The KOF Business Situation brightened for the second time in a row in August (see chart G 2). The improvement is becoming more widespread this month. Firms are also more confident about future business activity than before. The Swiss economy staged a modest recovery in the summer.

Can STEM events attract more pupils to technical degree programmes?

A study by KOF at ETH Zurich shows that participation in STEM events increases the likelihood that pupils will later study such a subject. In particular, events at which a larger proportion of female experts present have a strong impact on the choice of subject. However, the positive effect of additional female speakers is not limited to schoolgirls. Pupils are also more likely to choose STEM subjects after attending events featuring a higher proportion of female experts.

When is state intervention needed?

Automatic stabilisers are normally sufficient to dampen fluctuations in the economic cycle. If the economy slides into a severe recession, however, state intervention is necessary.

“Switzerland has the potential to develop into a global AI hub”

Hans Gersbach, KOF’s co-director, talks about the potential and risks posed by artificial intelligence and how Switzerland can position itself as a technology hub through smart regulation.

Many firms plan to invest more; environmental projects are being scaled back

The semi-annual KOF Investment Survey reveals major sectoral variations in the investment expectations of Swiss firms. Investment planned for the current year is increasing only in the service sector but is stagnating in industry and even decreasing in construction. This decline is being accompanied by lower-risk investment projects and a reduced focus on environmental protection measures.

“Monetary policy in the eurozone will remain restrictive for the time being”

KOF economists Alexander Rathke and Alexis Perakis analyse the interest-rate decisions taken in the eurozone, the United States and Switzerland. They also comment on the political risks posed by the snap elections called in France.

Wealth tax: a minimum tax on the rich

Despite having very high incomes, the rich and super-rich often pay much lower income tax in percentage terms than middle-income households. In Switzerland, too, the income-tax burden on billionaires is often significantly lower than that on the rest of taxpayers thanks to the privileges enjoyed by business owners. However, wealth tax makes a significant difference here by stepping into the breach when income tax is no longer effective.

Why do households perceive inflation differently than firms and forecasting organisations?

Swiss households have been asked about their numerical inflation expectations as part of the SECO consumer sentiment surveys conducted since the beginning of 2023. Initial results show that households’ inflation expectations are higher than those of forecasting organisations and firms as well as the official inflation rates. Despite these distortions, the survey data provides valuable information on factors such as the anchoring of inflation expectations.

KOF Business Situation Indicator suffers a setback

The KOF Business Situation Indicator for the Swiss private sector fell in June after showing an improvement in the previous month (see chart G 6). Firms are slightly less confident about developments over the next six months. A radical economic turnaround has not yet been achieved.

Why the Olympics and the European Football Championships will increase Swiss GDP

KOF is forecasting that the Swiss economy will grow by 1.6 per cent this year. A quarter of this increase will be due to the European Football Championships being held in Germany and the Olympic Games in Paris. KOF economist Alexander Rathke explains the background to this effect.

"Our goal is a symbiosis of economic research and data science"

KOF economist Samad Sarferaz talks about the methodological refinement of KOF’s economic forecasts and their underlying models. He also gives an up-to-date assessment of the Swiss economy, inflation and monetary policy.

KOF Business Situation Indicator continues to rise

The KOF Business Situation Indicator for the Swiss private sector rose very slightly in May. It did not fall again in the previous month and remained stable (see chart G 4). In May, firms were more confident than before about business activity over the next six months. There are increasing signs that the Swiss economy may have bottomed out.

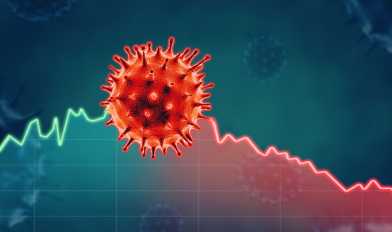

COVID-19 fiscal measures: merely announcing them has an effect

Switzerland’s COVID-19 policy was federal in nature, with the cantons taking specific support measures to limit the economic slump caused by the various challenges. Recent unpublished analysis of these measures suggests that they managed to stabilise business expectations in terms of demand, production, employment and the general outlook as soon as they were announced.

“Switzerland is under pressure to act”

KOF Director Jan-Egbert Sturm talks about Switzerland’s relationship with the European Union and analyses the opportunities and risks posed by the new negotiations for the bilateral agreements.

KOF Business Tendency Surveys: challenges facing the Swiss economy are diminishing

The KOF Business Situation Indicator for the Swiss private sector, which is calculated on the basis of the KOF Business Tendency Surveys, rose modestly in April (see chart G 7). The situation in the manufacturing sector eased, while it deteriorated slightly in the construction industry. Companies’ inflation forecasts are falling and private consumption could provide stimulus to the Swiss economy.

Elections cause fiscal waste in weak and strong democracies alike

Once politicians enter office, they strongly prefer to stay there. Politicians in democracies may therefore be tempted to engage in wasteful spending during elections to convince voters of their economic merits. Such fiscal manipulation is traditionally linked to uninformed voter bases in less developed democracies. A recent study by KOF researchers, however, reveals that fiscal manipulation is more widespread and complex.

The EU in crisis: taking stock of the economy

There is currently a lack of economic growth in the European Union. In addition, demographic change and unresolved structural problems are slowing economic activity. Once the European elections have been held in June, the new EU government will face major challenges. KOF’s international economic experts have analysed the situation in the three largest EU member states Germany, France and Italy.

KOF Business Situation Indicator on the decline again

The KOF Business Situation Indicator for the Swiss private sector fell again in March after initially not continuing its downward trend in the previous month (see chart G 8). Firms’ expectations about their business activities over the next six months are slightly more confident than they were in the previous month. Conditions in the Swiss economy remain challenging.

How to Regulate Stablecoins

Cryptocurrency markets are rallying to new highs. Simultaneously, another type of cryptoasset is gaining relevance: stablecoins. Unlike Bitcoin & Co, stablecoins aim to maintain a steady value against a national currency. They facilitate trade on cryptoexchanges, underpin the DeFi ecosystem and promise to be a stable store of value. Unregulated, however, they come with significant risks. KOF economists Hugo van Buggenum, Hans Gersbach and Sebastian Zelzner discuss regulatory measures.

How relevant are energy prices really for firms?

The sharp rise in energy prices since 2022 has led to much debate. But how important are energy prices really for companies? And through which channels are companies exposed to energy prices? To answer this question, researchers from KOF, EPFL and the University of Lausanne conducted a company survey funded by the Enterprise for Society (E4S) Foundation and the MTEC Foundation.

Global economic growth remains weak for the time being

According to the KOF Economic Forecast, the global economy will not pick up speed again until the second half of the year. The loss of household purchasing power caused by the high inflation rates of the past two years will dampen private consumption in the short term. In addition, the more challenging funding conditions and the high level of political uncertainty are weighing on investment momentum in many countries.

“The welfare state is not an outdated model”

Michael Graff, Co-Head of the Research Division Macroeconomic Forecasting and Data Science, explains his views on the successful initiative for a 13th monthly AHV pension payment and the future of the welfare state in an age of demographic change. He also reveals what plans he has for his retirement.

Investment on the rise, but not in all sectors

The results of the semi-annual KOF Investment Survey point to a nominal increase in investment of 8.2 per cent in 2024, driven by technological progress and supported by the service sector. By contrast, industry and construction are reporting a slowdown or even a decline in their investment plans owing to funding shortages and a downturn in demand.

Artificial intelligence: how networks are controlling firms’ AI expertise

The latest KOF research shows that AI technology is being introduced in relatively closed groups, similar to exclusive clubs. This could lead to a concentration of relevant AI know-how, making it more difficult for this key technology to spread and increasing dependence on a small number of technology providers. This in turn can make the economic performance of different regions less equal. Policymakers should push to overcome excessive cluster effects.

The power of central bank communication

A recent study by KOF analyses the impact that central bank communication has on financial markets, which are a key transmission channel for monetary policy. The findings show that monetary policy speeches are an important source of information for the formation of expectations in financial markets. The findings also suggest that volatility in financial markets increases when a central bank communicates too complexly.

Business situation virtually unchanged

The KOF Business Situation Indicator for the Swiss private sector rose slightly in February (see chart G11), following two consecutive months of modest declines. Overall, business activity at Swiss companies has not changed significantly since October 2023. The sharp downward trend of the first three quarters of 2023 has been broken for the time being. Although the Swiss economy has recovered, there is a lack of momentum.

Between market power and labour rights: the impact of the seasonal worker statute on immigrants’ wages

Switzerland’s seasonal worker statute, which was abolished in 2002, tied residence permits to employers. According to the monopsony theory, such regulation gives employers greater bargaining power in wage-setting and could depress wages. This article analyses this hypothesis and suggests that immigrants’ social and economic rights – strengthened by the free movement of people – may have helped to reduce wage differentials.

How can gender-specific differences in higher education be overcome?

Women are still under-represented in managerial positions in the academic sector. A programme for female professors in Germany aims to change this. An ongoing study involving KOF is investigating the success of this support programme.

The free movement of people has had no impact on the number of apprenticeships

Has the free movement of people had a negative impact on Swiss firms’ willingness to train apprentices? A new study shows that the number of apprenticeships did not fall during the first few years following the opening of the country’s border. However, the reasons why firms train apprentices has changed because it has become easier and cheaper for them to recruit suitable workers externally.

The weakness of the global economy persists

Restrictive monetary policy, falling but still high inflation and multiple uncertainties will continue to slow the global economy this year. According to the KOF Economic Forecast, worldwide business activity will not pick up again until 2025.

Business situation virtually stable at the end of the year

The KOF Business Situation Indicator hardly changed in December (see chart G13). Its rapid decline, which lasted from the beginning of 2023 into October, has slowed for the time being. The Swiss economy is currently sluggish.

Falling wealth taxes contributing to rising wealth concentration

As in many other countries, wealth concentration in Switzerland has increased in recent decades and remains high. At the same time, taxes have regularly been reduced over the last 50 years. Wealth tax cuts explain around a quarter of the observed growth in wealth concentration. This means that there are other key drivers of wealth inequality besides taxes.

The mental health of the Swiss population during the pandemic

How did the Swiss fare during the first two waves of the COVID-19 pandemic? Using data from Dargebotene Hand and Swisscom, analysis conducted by Marc Anderes and Stefan Pichler shows that calls to the Dargebotene Hand helpline increased significantly just after the outbreak of the pandemic.

“The battle against inflation has not yet been won”

Alexis Perakis, monetary policy expert at KOF, talks in this interview about his predictions for inflation, interest rates and the Swiss franc exchange rate this year. He considers the current debate about interest-rate cuts to be premature.

Supported democracy: reinventing direct democracy, AI and voting twice

There are many concerns about how artificial intelligence (AI) might impact communication and democratic processes adversely, as opportunities to the production of fake news are becoming more and more sophisticated. Yet AI also offers new ways to organise democracy. It could even enable direct democracy to be reinvented. Hans Gersbach (KOF) and César Martinelli (George Mason University) have been exploring these possibilities and they present one of its core ideas in this article.

“ChatGPT may not be the greatest poet and thinker of our time, but it is an increasingly important source of inspiration”

Johannes Dahlke, Assistant Professor of Digital Innovation and Entrepreneurship at the University of Twente, KOF Research Fellow and former member of the Innovation Economics Section, talks in this interview about the potential of artificial intelligence and explains how technological change will affect the labour market and individual professions.

KOF Business Situation Indicator continues to fall

The KOF Business Situation Indicator for the Swiss private sector continued to deteriorate in November (see graphic G 3). This was the third monthly decline in a row. The business outlook for the next six months remains virtually unchanged at a subdued level. Economic activity in Switzerland remains sluggish.

International digital technology cycles and local economic performance

The development of new digital technologies is increasingly dependent on international knowledge. In the recent past this trend has led to political concerns about dependence on foreign knowledge suppliers. A study by KOF, which uses a global patent dataset from 1980 to 2015, emphasises the importance of international knowledge networks for technological progress.

KOF’s Business Tendency Surveys: Swiss economy lacking stimulus

The KOF Business Situation Indicator for the Swiss private sector, which is calculated from KOF’s Business Tendency Surveys, fell in October for the second month in a row (see chart G5). Following a modest decline in the previous month, business activity cooled significantly in October. By contrast, companies’ business expectations for the coming six months are almost unchanged and more or less average on a medium-term comparison.

Demographic change: what are the implications for inflation?

Switzerland’s population is ageing. This article attempts to qualitatively assess the impact that this trend has on inflation. Its immediate effects are likely to be moderate. At the same time, there are risks: inflation could turn out to be higher but, surprisingly, it could also be lower.

Media formats and their role in the perception of monetary policy

In today’s ever-changing global economy, clear and effective communication by central banks is crucial to build trust in their policies and manage public expectations. A new study by researchers at KOF and ETH uses an experiment to investigate how central banks influence inflation expectations through different media formats and which communication formats are most effective.

How monetary policy can be deciphered using language analysis

Central banks shape global financial markets through their carefully crafted speeches. Words often trigger immediate market reactions and provide a more timely signal than many regularly updated economic indicators. When compiling its analysis, KOF uses natural language processing to decode indicators from central bank transcripts that make it possible to replicate and predict market movements in a timely manner.

Gloomy outlook for the global economy

The international economy has slowed. Above all, the effects of China’s weakness and of restrictive monetary policy are weighing on the global economy.

Exports proving robust

Swiss foreign trade is holding up well despite global turbulence and the current weakness of major trading partners such as China and Germany.

KOF Business Situation Indicator slightly lower

The KOF Business Situation Indicator for the Swiss private sector retreated very slightly in September after flatlining in the previous month (see chart G 8). Its decline was modest, however, and in return companies are slightly more confident about their future business than they were before. The Swiss economy is not showing any fundamental signs of change at the moment.

“China is facing major challenges that go beyond its real-estate crisis”

KOF economists Vera Eichenauer and Heiner Mikosch talk in an interview about the Chinese economy’s weaknesses and their impact on the Swiss economy.

KOF Business Situation unchanged

The KOF Business Situation Indicator for the Swiss private sector pauses in August (see Chart G 5). After a sharp decline in the previous month, it does not fall further. Expectations for further business development remain rather subdued. The Swiss economy is developing sluggishly.

Long-term experience of immigration weakens nationalist parties

In many countries, support for xenophobic views varies considerably from region to region. It is often strongest in areas without a large proportion of foreigners. A new study shows that a lack of local experience with immigration is partly responsible for this. Regions that have had more experience with immigration and integration in the past exhibit a much weaker nationalist backlash against new waves of immigration.

Labour market restrictions on refugees

Restricting employment opportunities for refugees reduces their likelihood of working and earning in the long term. This imposes high costs on refugees and host societies.

“There are winners and losers of immigration”

KOF economist Andreas Beerli explains in an interview why immigration is desirable from an economic point of view and in which areas Switzerland still needs to improve.

Global economic outlook remains weak

Although the much-feared energy crisis has failed to materialise, persistently high inflation, rising interest rates and geopolitical conflicts are weighing on the global economy.

New incentives for antibiotics research and development

An estimated 33,000 people die in the European Union every year as a result of being infected with antibiotic-resistant germs. The number of deaths associated with antimicrobial resistance worldwide is estimated to be more than 5 million per year. New antibiotics urgently need to be developed, but this is often not profitable for companies. This article discusses a dynamic funding model that would make it more attractive for firms to develop new antibiotics.

Significant increase in company bankruptcies

A significant increase in company bankruptcies has been evident in Switzerland since autumn 2022, while business start-ups have been declining sharply for several months. The following article examines this trend in detail and gives possible reasons for this increase.

Climate risks and investment: how Swiss companies are dealing with climate change

Although many Swiss firms see their business activities as being exposed to physical climate risks, they nevertheless view ecological change predominantly as an opportunity rather than a risk. Investment aimed at combatting climate change is accelerating and, in comparison with the EU, Switzerland is one of its pioneers. Having added a new block of questions to its investment survey, KOF can shed light on the economic impact of climate change from the perspective of Swiss companies.

KOF Business Situation Indicator edges up

The KOF Business Situation Indicator for the Swiss private sector rose slightly in June, averting a third consecutive decline (see chart G 16). However, this modest improvement does not yet indicate that the Swiss economy has received a significant boost. Business expectations about developments in the near future emphasised this view; they hardly changed compared with the previous month and were average overall.

Business situation deteriorating

The KOF Business Situation Indicator fell across the board in May. This means that the business situation is worsening for the second month in a row, and it is significantly less encouraging than it was in May last year (see chart G 10). Economic activity in Switzerland is currently sluggish.

How dependent is Swiss industry on China?

One-fifth of Swiss industrial companies are moderately to heavily reliant on critical inputs from China. Their greatest dependence is in the electronics sector, followed by the pharmaceuticals and chemicals sectors. Just under one-fifth of firms are unable to assess their own reliance. The measures already taken or those that are planned reveal that production and procurement are being redirected towards Europe and Switzerland. These are among the findings of a KOF company survey.

“The pension system is one of the great achievements of the welfare state”

Michael Graff, head of the Macroeconomic Forecasting research division at KOF, explains the advantages and disadvantages of the Swiss pension system and why pension reforms are so difficult to implement.

“Artificial intelligence has the potential to revolutionise economic research”: ten questions for ChatGPT

This article is a collaboration between man and machine. We conducted an interview with the ChatGPT voice software on economics, business cycle research and politics. KOF innovation researcher Mathias Beck and KOF co-director Hans Gersbach rank the quality of ChatGPT’s responses and its potential below.

KOF Business Tendency Surveys: Swiss economy faltering

The KOF Business Situation Indicator for the Swiss private sector, which is calculated from the KOF Business Tendency Surveys, fell in April after barely moving in the previous month (see G 3). Business is thus still performing better than it did in the autumn of last year but is no longer as buoyant as it was in January.

2021

Digital divide? An analysis of the usage data from the Job-Room online job platform

In a study conducted for Switzerland’s State Secretariat for Economic Affairs (SECO), KOF has examined the use of the Job-Room.ch online job platform within the context of the introduction of mandatory job notification. It shows that people without IT skills, with little knowledge of the local language or with low levels of education are at a disadvantage.

"Globalisation is far from over"

KOF Director Jan-Egbert Sturm talks in an interview about the future of international trade, the lessons to be learned from the coronavirus crisis, and Switzerland’s competitiveness.

KOF business situation remains encouraging

Swiss companies’ business situation in November remained virtually stable compared with the previous month (see chart G 10). The Business Situation Indicator is thus sustaining its high level. Companies remain confident about developments going forward. The economic recovery is currently robust.

Seven facts about the circular economy

A recent study by the KOF Swiss Economic Institute and the Bern University of Applied Sciences on the circular economy shows that Switzerland is only at the beginning of a transformation process. Basically, the study estimates Switzerland's potential to efficiently implement circular measures and thus generate competitive advantages as high.

Company bankruptcies returning to pre-crisis levels

Government support measures have meant that far fewer companies have had to file for bankruptcy since the start of the coronavirus crisis than in normal times. Recently, however, corporate bankruptcies have risen sharply, returning to pre-crisis levels. This trend is broadly based both sectorally and regionally.

A view from space: satellite data to measure inequality

Economic inequality across much of the world has increased in recent decades, which is linked to social and economic trends. However, any study of the causes and effects of this phenomenon is hampered by the limited availability of consistent inequality data. A KOF study constructs a measure of inequality based on satellite data. The basic idea is that light intensity reflects economic activity in a geographical unit.

Rising inflation: why is it only temporary, and what does the pandemic have to do with it?

Prices have risen recently in both the United States and Europe. But much of this price increase can be explained by the COVID-19 pandemic and is therefore likely to be only temporary.

"A model is only as good as the model engineer"

In this interview, KOF economist Heiner Mikosch explains the data and algorithms behind the new KOF Nowcasting Lab and how it differs from a classic economic forecast.

KOF Business Tendency Surveys for October: companies emerging from the worst of the pandemic

Swiss companies’ business situation continued to improve in October and is now almost as encouraging as it was in spring 2018 (see Chart G 7). The worst of the COVID-19 crisis has been overcome. Companies’ expectations about future developments remain optimistic and uncertainty continues to decrease.

How does inflation come about?

Recently there have been increasing warnings of a resurgence of inflation. This paper presents the results of an empirical study of the main factors that have affected inflation over the past two decades.

Comparing the coronavirus crisis and the financial crisis: eight differences and similarities

With the financial crisis and the COVID-19 crisis the world has experienced two severe economic crises within just over a decade. An analysis of the causes, evolution and consequences of these two economic crashes shows that the two crises could hardly be more different.

KOF Business Situation Indicator: business situation slightly improved

The KOF Business Situation Indicator rose in September after barely moving in the previous month (see chart G 16). Swiss companies’ business is currently predominantly encouraging; the last time it was better than at present was back in 2018. Firms are looking ahead confidently to growing their business over the coming six months. The Swiss economy is still on an upward trajectory.

KOF-NZZ Economists’ Survey: majority of economists fear higher inequality as a result of coronavirus crisis

In August, KOF and Switzerland’s Neue Zürcher Zeitung (NZZ) newspaper surveyed economists at Swiss universities on the subject of income and wealth inequalities and the associated ‘99 per cent Initiative’. 70 per cent of the 142 survey respondents were of the view that inequality of disposable incomes in Switzerland has increased as a result of the coronavirus crisis. More than half of them fear that income inequality will become worse in the long term.

When national wealth grows faster than national income: a warning sign for the Swiss real-estate market?

In this paper we show that the development of wealth as a percentage of income in Switzerland has followed a J-shaped pattern over the last 120 years: a very stable trend in the 20th century followed by a sharp increase since 2010.

Men seeking part-time jobs are disadvantaged

Gainful and inactive work is still unequally distributed between the sexes. One reason is that few men work part-time. This is partly due to the fact that men looking for part-time jobs are discriminated against by recruiters.

COVID-19 in Switzerland: have the containment measures worked?

In the fight against the pandemic, countries are relying on non-pharmaceutical containment measures. In Switzerland, these have led to a decline in new infections. In addition, the population is helping by making voluntary adjustments to their behaviour.

Macroeconomic uncertainty and the role of employment protection

The impact of uncertainty on the economy was most recently illustrated in the context of the pandemic. But the uncertainty was also a decisive factor in previous crises. A new KOF study examines the impact of uncertainty on economic development.

KOF Business Situation Indicator: business situation virtually unchanged

Swiss companies’ business remained fairly stable in August. July’s sharp rise in the KOF Business Situation Indicator was almost, but not quite, maintained. The business situation therefore remains favourable.

China: a competitor to the EU, a partner to Switzerland?

China’s growing economic and political influence around the world and the impact that this has on Switzerland were the topics of the KOF Economic Forum held on 11 June this year. In Switzerland's China strategy, China is primarily portrayed as a partner whereas, in the EU and the US, China is mainly perceived as a competitor or rival. How does China respond to the West’s approach? And what does this mean for the Swiss economy?

Light at the end of the tunnel: companies are investing in expanding their capacity

The coronavirus crisis caused investment activity in the first year of the pandemic to fall less sharply than firms had originally feared. This is shown by the results of the semi-annual investment survey conducted in spring 2021. Investment is now expected to grow by a nominal 7 per cent in the current year. The increased proportion of companies that plan to pursue expansion investment is a sign of positive demand stimulus, especially in industry and among service providers.

The recovery of the global economy is in full swing

Now that the pandemic is largely under control in most advanced economies, economic momentum is also picking up again worldwide. The United States in particular is living up to its reputation as the locomotive of the global economy thanks to massive government stimulus. However, there is a growing danger that the US economy will overheat in the medium term.

Improvements in Swiss life expectancy and length-of-life inequality since the 1870s

Over the past 140 years, female Swiss life expectancy has increased from 58.4 years in 1876 to 85.6 years in 2016. Male life expectancy has increased from 56.3 years in 1876 to 81.9 years in 2016. Most of these gains are due to a larger share of the Swiss population reaching old age, while a small remainder of the gains is due to an increase in old age itself.

KOF Business Situation Indicator: business situation virtually unchanged but shortage of intermediate products worsens

The strength of Swiss companies’ business activity in June was similar to the previous month (see G 15). Following five recent rises in the KOF Business Situation Indicator, some of which were quite significant, the recovery was therefore weaker in June. The economy's recent turbulent catch-up process is slowing down.

KOF Business Situation Indicator: Business situation improving; availability of intermediate products problematic

Swiss companies’ business continued to improve in May. The Business Situation Indicator has thus been rising steadily since the beginning of the year (see G 6). Although the indicator has not yet returned to its pre-crisis level, this landmark is within sight. The Swiss economy is increasingly picking up speed. One growing problem, however, is the availability of intermediate products.

Lessons from Brexit

A webinar entitled ‘KOF Beyond the Borders’ saw representatives from academia and the media discuss Brexit and the question of what lessons can be learned from the UK’s experience that could be applied to Switzerland.

How major sporting events distort Swiss GDP

Two major sporting events are on the agenda this year: the European Football Championships and the Olympic Games in Tokyo. The sporting organisations behind them, UEFA and the IOC, both have their headquarters in Switzerland. Consequently, these competitions also have an indirect economic impact on Switzerland's gross domestic product.

Have financial markets decoupled from the real economy?

Reality for much of the year so far during the coronavirus crisis has consisted of lockdowns, working from home and living a dreary everyday existence while stock markets have kept hitting new highs. However, there are academic explanations for this apparent contradiction.

"Switzerland thrives on having open borders"

KOF Director Jan-Egbert Sturm explains in an interview why, from an economic perspective, the conclusion of a framework agreement between Switzerland and the EU would have been desirable and what economic risks now loom after the failure of the agreement.

President Joe Biden is facing major challenges in what is the most severe economic crisis in post-war history.

US President Joe Biden has started his term in office with plenty of momentum. But the 78-year-old is facing major challenges in what is the most severe economic crisis in post-war history – and his political and fiscal leeway is limited. The following is an interim assessment of the first 100 days of the Biden administration.

KOF-NZZ Economists’ Survey: large majority of Swiss economists against rapid debt reduction

In April of this year, KOF and Switzerland’s Neue Zürcher Zeitung (NZZ) newspaper surveyed economists on the subjects of state aid during the coronavirus crisis and the future of public finances. There are hardly any economists who think that the debt brake should be applied very rigorously. There is also agreement among the 167 survey respondents that cuts in education, research and social security should be avoided. The level of government support is generally not considered to be too high.

Do deflation and rigid wages harm the economy? The importance of wage rigidity for monetary policy

At the beginning of 2015 the Swiss National Bank abandoned the franc-euro minimum exchange rate, triggering a deflationary shock. How did incomes and unemployment of workers with and without rigid wages react to this?

KOF Business Tendency Surveys: recovery progressing in leaps and bounds

The Swiss economy reported a significantly better business situation in April than in the previous month (see G 14). The upward trend in the Business Situation Indicator, which has been ongoing since the beginning of the year, is thus continuing at an accelerated pace. Firms are also much more confident about developments over the coming months than they were in the previous month and at the beginning of this year.

Coronavirus crisis: more and more sectors report shortage of goods and intermediate products

While the decline in demand is constraining fewer and fewer companies, the availability of goods, inputs and supplies is now one of the most important restrictions. Among wholesalers, for example, about half of all businesses are affected.

KOF Business Situation Indicator: broad-based improvement

The business situation of Swiss companies continued to ease in March. After hitting a low in January, the Business Situation Indicator rose this month for the second time in a row (see G 18). This improvement is visible across all sectors surveyed. The recovery of the Swiss economy is strengthening.

Global economy bounces back after slump

While the economies of China and the United States have already rebounded significantly from the coronavirus pandemic, the recovery in Europe has been sluggish. From the second quarter onwards, however, KOF expects this recovery to progress in Europe as well thanks to the vaccination campaigns and a slight easing of restrictions.

Wave of bankruptcies: postponed or cancelled?

Far fewer companies went bankrupt last year than would have been expected in normal times. This is due to the legal and economic support measures introduced. A sudden wave of bankruptcies is still not expected.

Research, development and innovation: the current state of Switzerland's major regions

The seven major Swiss regions differ significantly in some cases with regard to production factors but not in terms of the results of the innovation process. The differences in input factors appear to be primarily due to structural factors. It is small firms in the construction and service sectors that cause these differences. At the same time, these types of firms make a smaller contribution to the results of the innovation process, which reduces the regional differences in innovation success.

The situation in the labour market remains challenging

On paper, employment in Switzerland has hardly fallen despite the coronavirus crisis. But a brief look behind the scenes shows that the pandemic and its economic impact have also affected the labour market. Many companies will remain reluctant to create new jobs on a large scale until the current uncertainty has subsided.

KOF Business Situation Indicator: Business currently slightly more buoyant; many companies are sceptical about the year as a whole

The business situation of Swiss firms recovered slightly in February after being under pressure at the beginning of the year. Nevertheless, the situation is currently less encouraging than it was in the autumn. The Swiss economy is still waiting for further tailwinds.

The KOF Weekly GDP Indicator for Switzerland

Most traditional macroeconomic indicators were not suitable for capturing the drastic economic slump of spring 2020 in a precise and timely manner. This brought into focus the need for high-frequency economic monitoring using alternative data such as credit card transactions. These alternative data sources offer valuable insights but are also fraught with problems.

Digital investment pays off – but only if companies change their organisational structures

Although more and more firms are recognising the benefits of digitalisation and are therefore investing in the corresponding technologies, this approach does not necessarily yield productivity gains. A new study by KOF shows how companies can improve their competitiveness by modifying their organisational structures and investing in information technology (IT).

Coronavirus crisis: many firms short of money for investment

Investment activity by Swiss companies slumped in 2020 as a result of the economic crisis caused by the coronavirus pandemic. The findings of the semi-annual KOF Investment Survey show that companies plan to catch up on some of their postponed investment projects in the second year of the pandemic. However, one in five firms lacks the financial resources to do so, which is slowing down their investment drives.

The COVID-19 pandemic is widening the gap between rich and poor

The coronavirus crisis has exacerbated existing inequalities in Switzerland. Low-income households are being hit particularly hard by the pandemic – not just financially but also in terms of mental health. This is because most high-income earners have been able to switch to working from home and have suffered only a minor loss of income, whereas many low-income earners have been affected by short-time working and unemployment. And that, in turn, has had a serious impact on their mood.

Hospitality sector: half of businesses fear for their survival

About 60 per cent of the businesses surveyed in January claimed that the pandemic had reduced their revenue last year. The hospitality industry has been hit particularly hard: annual revenues here are likely to have fallen by about 37 per cent in 2020, with almost one in three businesses seeing a drop of more than 50 per cent. Fear of bankruptcy increased again in all sectors in January.

KOF Business Tendency Surveys: companies feeling stronger headwinds again at the start of the year

The KOF Business Situation Indicator fell in January after having risen slightly at the end of 2020 (see G 3). While the business situation in the goods-producing sectors is stable to positive, some service industries in particular are struggling. The pandemic is thus driving a wedge between the trends in different sectors of the economy.

Faster, more flexible, more challenging: how COVID-19 has changed research at KOF

Cancelled events, Zoom conferences and looking after children while working from home: the coronavirus pandemic has drastically changed the world of work – including at KOF. In addition, researchers have had to readjust their methodologies and working practices in order to take account of the many facets and fast-moving pace of the coronavirus crisis. Eight KOF economists tell us how COVID-19 has affected their research and what they have learned for their work from the pandemic.

"There is more discrimination before lunch and after work"

Using a new method, researchers from KOF and ETH have for the first time studied how discrimination occurs on online job boards. They are able to show that discrimination based on origin is widespread – and that the time of day plays a key role. So do online platforms increase discrimination in job searches or, on the contrary, can they be used to create more fairness? Co-author Daniel Kopp discusses the most important findings.

KOF Business Situation Indicator: business activity bounces back

The KOF Business Situation Indicator rose in December after suffering a setback in November (see G 11). Despite the second wave of the pandemic in Switzerland and neighbouring countries, companies started December on a fairly positive note. The situation is nowhere near as tough as in the spring. However, the latest tightening of restrictions and the news about a new coronavirus variant are not included in these survey results.

What the Swiss economy can expect in the new year

KOF expects GDP to grow by 3.2 per cent in 2021. However, this forecast assumes that the pandemic situation does not deteriorate any further. The negative scenario predicts growth of only 0.6 per cent. Moreover, the differences between the individual sectors of the economy are considerable. Some have already returned to their pre-crisis levels, while for others this will probably not be the case until after 2021.

Second pandemic wave slowing global economic recovery

The epidemiological situation has deteriorated further in many countries, including across Europe, which is important for Swiss exporters. Although vaccination campaigns are now under way, restrictions are likely to remain in place in many areas. It will therefore be some time before the global economy recovers from the coronavirus crisis, the aftermath of which is likely to be felt for quite a while.

Digital investment alone is not enough: innovation is also needed

Companies usually hope that investing in digital technology will increase their competitiveness. However, there is no evidence of any direct correlation here. As a KOF study shows, innovation is needed in order to actually raise productivity through IT investment.

What does a higher national debt mean for Switzerland?

The coronavirus crisis is causing Switzerland’s national debt to rise. There is already vigorous debate about how to respond to this increase. However, Swiss public finances are still in good shape even in the wake of the crisis. Calculations show that the country’s debt ratio should fall relatively quickly even without fiscal austerity.

December 2020

Switzerland remains the most globalised country in the world

Globalisation increased only slightly in 2018. Although economic globalisation has recently grown, the emerging international trade conflicts have revealed their first negative effects. The coronavirus crisis is likely to further slow economic and social globalisation as a result of the worldwide recession and restricted mobility. The most globalised countries are Switzerland, the Netherlands and Belgium.

KOF Business Situation Indicator: companies’ business situation slightly less encouraging

The KOF Business Situation Indicator reported a minor setback in November. After rising in October, it has recently fallen slightly (see G 17). Although coronavirus restrictions have been tightened in recent weeks, companies are currently in a better situation than they were during the summer months.

Webinar: Federalism during Times of Coronavirus – Curse or Blessing?

Federalism in a crisis: the theme of the next ‘KOF Beyond Borders’ event is hidden in the pun. How are various federalist states doing in combating the pandemic and its consequences? Does this crisis also reveal a crisis of federalism?

How has COVID inflation performed since the summer?

Following a sharp rise in the number of infections in the autumn, the Swiss government and the cantons have taken further measures to combat the pandemic. Both factors are likely to have contributed to the fact that Swiss people have again adjusted their consumption. This also affects the measurement of inflation, albeit not as much as during the lockdown in spring. This is illustrated by an updated comparison of the national consumer price index (LIK) with an alternative COVID price index.

How is the retail sector faring as it enters the Christmas period?

The Christmas trade is of great importance for the retail sector. November and, even more so, December are usually the months that generate the highest sales of the year. KOF has therefore taken the pulse of the retail sector. Following a swift recovery in Switzerland and neighbouring countries after the slump in spring, confidence in November fell only slightly in Switzerland but plummeted in Austria.

The rise of the separatists: the impact of regional resources

Brexit has put the issue of independence back on the political agenda in Scotland. This publication examines what economic factors reinforce separatist tendencies. Regional resource wealth plays a central role in this context. In particular, the analysis shows that oil discoveries have a causal effect on the electoral success of Scottish separatists.

The mobility of the Swiss population during the second coronavirus wave

Social distancing is key to the containment of the coronavirus pandemic. The mobility of the population provides important indications of whether the relevant measures and recommendations are being followed. Analysis of mobility data in Switzerland shows clear differences between the first and second waves. In addition, there are indications that mobility and infection rates influence each other.

November 2020

How Swiss tourism compares internationally

The number of international tourist arrivals in the first eight months of this year was 70 per cent lower than it had been before the coronavirus crisis. Although demand in Europe partially recovered during the summer months, rising infection rates are slowing down this recovery. However, Switzerland is not in a bad position when compared internationally: thanks to the strength of its domestic tourism, it has lost fewer overnight stays than other countries.

KOF forecasting conference: "Major crises set things in motion"

Is the coronavirus crisis overshadowing the climate debate or is it playing into its hands? KOF’s forecasting conference on 22 October saw representatives from the worlds of business, politics and science discuss in a webinar how lost profits can affect green investment and what significance Swiss climate policy has internationally.

How much would a no-deal Brexit cost the UK?

The clock is ticking. If the EU and the UK fail to sign an agreement by the end of December, a no-deal Brexit will become a reality – with drastic consequences for the British. It is estimated that, by 2030, UK GDP would be 2.5 per cent lower than if the withdrawal followed an orderly process and 5.3 per cent lower than without Brexit altogether. Long-term adjustments would not take place for 15 years.

KOF Business Tendency Surveys for October 2020: business situation improving; effect of new measures uncertain

Companies’ business has recently improved noticeably. While the situation in the retail sector is now more encouraging than it has been since 2014, it has not yet returned to pre-crisis levels in many other areas. When asked about their plans for the future, however, companies in some sectors of the economy became more cautious over the course of October.

Around 60 per cent of Swiss companies suffering from weak demand

The coronavirus-specific questions asked in the October Business Tendency Surveys revealed that around 10 per cent of the firms surveyed said that they considered their survival to be at risk. In the hospitality industry this figure is as high as one in three companies, which is also where the pandemic will have the greatest impact on annual sales. In general, smaller firms are more afraid of bankruptcy than larger ones, and there are also regional differences.

Coronavirus crisis is slowing wage growth

After the labour market had deteriorated sharply in the spring, it recovered over the summer - thanks in particular to short-time working. However, the outlook for the winter suggests that a second wave of unemployment is to be expected. The increase in nominal wages next year is likely to be the lowest in 80 years.

October 2020

KOF Business Situation Indicator: business virtually unchanged

The KOF Business Situation Indicator has remained almost stagnant. Whereas it rose sharply in July and August, the indicator hardly increased at all in September (see G 8). After the economy noticeably improved in midsummer, this positive trend is now faltering. The economy is in a precarious position.

Prognosetagung: climate crisis, coronavirus crisis – does the economy now have to adapt?

Climate change used to dominate the debate – until COVID-19 began to spread. Does the coronavirus crisis eclipse the climate crisis? Or is it indirectly creating a greener economy? This is what we will be discussing at the next KOF Prognosetagung on 22 October, with Swiss Airlines CEO Thomas Klühr, Microsoft Switzerland Director Marianne Janik, Swiss Re expert Nora Ernst, environmental scientist and Green National Councillor Bastien Girod and KOF Director Jan-Egbert Sturm.

European integration: has it affected economic sectors differently?

More competition, better allocation of resources, higher productivity – that is what European integration should ensure. A recent study of the longer-term effects of integration shows that, while it has led to reforms in product markets, it has had little impact on financial and labour markets. If reforms are brought about nonetheless, this is due not only to the euro but also to the single market.

Proportion of women in STEM subjects: major differences between cantons

In Switzerland the proportion of women studying technical subjects is lower than in most other OECD countries. Despite many support programmes, this situation has hardly changed in the last ten years. A study based on new educational data reveals major cantonal differences: in the cantons of Zurich and Zug, for example, twice as many female Matura students embark on STEM courses as in Geneva and Uri.

Do women earn less because other job aspects are important to them?

In Switzerland there is still a significant unexplained pay gap between women and men. It is conceivable that women accept lower salaries because they attach more importance to other factors such as pleasant working conditions. However, the latest findings from a survey of ETH Zurich alumni do not support this theory.

September 2020

KOF Business Situation Indicator: further improvement in the business situation

The KOF Business Situation Indicator rose in August for the second month in a row. However, this increase was significantly lower than the one in the previous month. Swiss companies’ business is improving only very gradually.

IT security raises productivity

Swiss companies are increasingly being confronted with IT security problems. There are significant differences between the various corporate sectors in the area of cyber defence and, in some cases, there is a great deal of catching up to do. Effective IT security is a prerequisite for using digital technologies to increase productivity.

Retail sector: is everything back to how it was before coronavirus?

Business in the retail sector improved considerably in July. The results of the KOF Business Tendency Surveys show that the situation is now as satisfactory as it was before the pandemic. Were the events of this spring just a brief aberration for the retail sector?

What explains the increase in public social expenditure in OECD countries?

Almost all industrialised countries now have higher public social spending than they did a few decades ago. How did this increase come about? A recent KOF study shows that globalisation, economic crises, rising unemployment and an ageing population are the main factors affecting social spending. The COVID-19 pandemic is also likely to influence future trends.

How the pandemic affects inflation measurement

The coronavirus crisis substantially changed consumer behaviour during the lockdown. This can lead to a situation where the prices of consumed goods over time differ significantly from those in Switzerland’s national consumer price index (LIK). In order to estimate these differences, KOF has linked the official LIK data with card transaction data and constructed an alternative COVID price index. This suggests that inflation has been underestimated since the beginning of the coronavirus crisis.

Considerable reluctance to take out COVID-19 loans?

In order to mitigate the consequences of the coronavirus crisis for the self-employed and businesses, Switzerland has relied on three instruments: short-time working, income support for the self-employed, and so-called ‘COVID-19 loans’. Researchers have investigated which firms have made the most use of these instruments. One of their findings is that companies that were already in debt before the crisis have made particularly frequent use of COVID-19 loans.

July/August 2020

KOF Business Situation Indicator: retail sector with a new lease of life, otherwise hardly any change in companies’ fortunes

The KOF Business Tendency Surveys have revealed that Swiss companies’ fortunes hardly changed in June. KOF’s Business Situation Indicator thus confirms the stabilisation trends prevailing in the Swiss economy. The virus-induced economic freefall had already ended in the previous month. The retail sector in particular showed signs of life again in June. The Swiss economy is likely to have bottomed out for the time being.

Is dual vocational training worthwhile for companies in Nepal?

Apprentices’ wages, additional benefits for apprentices, and the costs for firms offering apprenticeships: the authors of a new KOF Working Paper have investigated whether these dual vocational training costs are offset by the value produced by apprentices during their training. The findings of a pilot project in Nepal show that companies achieve a modest net benefit when they offer apprenticeships.

The Global Economic Barometers: current and leading world indicators

KOF has been publishing coincident and leading composite indicators for the global economy every month since January. The two Global Economic Barometers provide timely and highly frequent information. The algorithm used to construct the two barometers is run from the beginning each time. This guarantees the flexibility of the barometer system. At the current edge, the barometers have been quick to identify the economic slump that has accompanied the spread of the coronavirus.

Coronavirus crisis: how does the Swiss labour market compare internationally?

Unemployment in Switzerland surged in the first half of the year as a result of the coronavirus crisis. Nevertheless, Switzerland has so far got off relatively lightly by international standards. Unemployment in Switzerland has risen less sharply than in the UK or Canada, for example, but slightly more than in Sweden or Germany. The example of Sweden shows that the crisis has hit the labour market hard even in cases where the authorities have not ordered a lockdown.

June 2020

KOF Business Situation Indicator: economy no longer in freefall

The KOF Business Situation Indicator regained some ground in May after having crashed in the previous month: the indicator is rising very modestly (Graph G 10). Nevertheless, Swiss companies reckon that their current situation is significantly worse than it was during the 2009 financial crisis. Although the Swiss economy is still in recession, it is no longer in freefall.

Business start-ups in Switzerland: the story so far

How high is the ‘start-up rate’ in Switzerland compared with other countries? What is the main motive for setting up businesses in Switzerland? What competences are particularly relevant for start-ups and what factors encourage innovation performance? This article provides an overview of the most important findings of KOF’s research on business start-ups in Switzerland.

The Swiss construction sector during COVID-19

The business situation in the Swiss construction sector deteriorated sharply in April. Construction site closures in parts of Switzerland and hygiene regulations are delaying ongoing construction projects. KOF expects construction investment to decline by 2.0 per cent in real terms in 2020.

How the impact of COVID-19 on Swiss companies is measured

The COVID-19 pandemic and the measures being taken by the government to mitigate its health consequences are affecting many companies in Switzerland. In order to obtain a timely and comprehensive overview of this impact, Swiss companies’ websites are regularly checked for the use of relevant terms, and these findings are then broken down by company size, sector and location.

Companies revise investment plans significantly during lockdown

The KOF Investment Survey estimates the causal effect of the COVID-19 pandemic on the investment activity of Swiss companies. According to this survey, Swiss companies have scaled back their plans to invest in equipment during the current year by 7.3 percentage points and have reduced their plans to invest in research and development by 14.9 percentage points. This has far-reaching consequences for the further course of the recession and the dynamics of the subsequent economic recovery.

May 2020

How does digitalisation affect everyday working life?

Greater labour productivity, more interesting work, easier interaction with colleagues and line managers, more time pressure: KOF researchers asked graduates of higher technical colleges about the extent to which digitalisation is changing their work. The results show that the impact is significant. However, it differs according to gender and age.

trendEcon: Daily economic indicators based on Swiss Google search trends

COVID-19 is causing the economy to change much faster than usual. To capture these rapid changes, a team of researchers has developed new economic indicators based on Google search trends. The indicator for the perceived economic situation has fallen more sharply in recent weeks than during the financial crisis. Some indicators of private consumption have already reached pre-crisis levels, while others have not yet recovered.

First hard figures from the United States

The fight against the COVID-19 pandemic is causing severe distortions in goods, labour and capital markets. However, it takes several weeks or even months for the reality to reach official statistics and econometric models. In the US, important basic statistics are published earlier and in more detail than in many other countries. The first available indicators for March confirm scenario calculations that predicted a sharp recession.

A mobility indicator for Switzerland

The measures taken to slow the spread of the COVID-19 pandemic also aim to reduce social interaction. What influence do these measures have on the mobility behaviour of the Swiss? KOF researchers have developed an indicator that constantly shows this. According to the indicator, mobility has continued to increase in recent days, having reached its lowest level at the end of March. However, it is still far from its normal state.

April 2020

Most sectors are facing a difficult year ahead

Although large sections of the Swiss economy have got off to a good start in 2020, the coronavirus pandemic is stifling any optimism. The manufacturing, hospitality and retail sectors have come under particularly intense pressure.

The economy in the clutches of coronavirus

Instead of presenting a forecast, this spring KOF has published three scenarios that show how the economy might potentially perform going forward. The baseline scenario assumes a recession in the first half of the year, while the negative scenario predicts a longer-lasting slump. The mild scenario is becoming increasingly unlikely.

The ECB's communication as a monetary policy instrument

The European Central Bank’s main communication channel is the press conferences it holds following its Council meetings. In addition to its decisions on monetary policy measures, the Council also outlines its view of the economic situation in the euro area. Although the subtle differences between the introductory remarks made are often barely perceptible to laypersons, investors and economists react to them and revise their expectations accordingly.

KOF Business Situation Indicator: storm clouds are gathering

The KOF Business Situation Indicator fell significantly in March, plunging to its lowest level since spring 2017. Companies are particularly concerned about developments in the near future: demand forecasts are being cut sharply in all of the sectors surveyed. The coronavirus pandemic is casting its shadow over the Swiss economy.

March 2020

KOF Business Situation Indicator: Swiss economy currently robust

The KOF Business Situation improved further in February, albeit only marginally. As a result, the easing of tensions that was already apparent in January has been confirmed. The Coronavirus epidemic has not yet, for the time being, had much of an impact on the Swiss economy. However, recent developments - in particular in Italy and Ticino - are not covered by the survey results. Aside from this, the basic economic trend is fairly positive at the moment.

New education law in Serbia improves position of students

In Serbia, a new law on dual vocational education and training has been launched which provides better protection and more rights for students in the workplace. A survey shows that this law has a major impact on the everyday school and work life of young people.

Swiss foreign trade suffers from uncertainty

The weak global economic climate coupled with the low propensity to invest abroad held back the Swiss export economy last year. Following also the rapid outbreak of the Coronavirus at the start of the year, this caused major uncertainty for exporters.

Looking back on a difficult year for Switzerland’s most important trading partners

Global economic dynamism was relatively weak also last year. Economic policy uncertainties, dwindling world trade and weak demand for investment goods left a major mark in particular on Europe and East Asia. This article looks back over 2019 and examines Switzerland’s economic environment.

Globalisation and Its Impact on the Middle Class

A new study shows that globalisation has diminished the income share of the middle class. Even the poorer parts of the population saw their income shares decline, while the shares of high incomes has risen. This effect is driven by developments in transition and developing countries.

Companies Plan to Invest More in Environmental Protection

According to the results of the semi-annual KOF Investment Survey, investment activities in Switzerland are set to slow down further this year. The uncertain international environment has put a brake on expenditure growth. Nevertheless, investment in environmental protection and compliance with commercial law requirements has clearly acquired greater importance.

February 2020

KOF Business Tendency Surveys of January 2020: Swiss Companies Start the Year With a Deep Breath

The business situation of Swiss companies improved slightly in January. At the moment it is much less challenging than it was in January of last year. Following a very weak first half of 2019, the situation has been stable since the autumn. The Swiss economy has been able to pull out of its downward spiral.

New Technologies and Productivity: What Role Does the Educational Level Play?

There are frequent reports in the news suggesting that information and communication technologies lead to higher productivity especially for highly educated workers. However, most of the studies consider only the complementary effect of new technologies and tertiary educated workers. A new study investigates the effect these technologies have on workers with different levels of education.

Investments in Process Innovations Raise Productivity of Swiss Companies

Companies investing in product and production process innovations can achieve a significant increase in productivity, as shown by a study jointly conducted by KOF researchers and the German ZEW Institute. The correlation is particularly strong for companies that are subject to very high levels of international competition. Thus these investments evidently play an important role in securing competitive advantages.

Negative Interest Rates II: Economists Not Expecting them to Stop Any Time Soon

Since 2015 the Swiss National Bank’s base rate has been in negative territory. Do the benefits of negative interest rates outweigh the drawbacks, or vice versa? How is the base rate expected to change over the next few years? And how are the current policies of the SNB, the ECB and the Fed to be assessed? A survey of Swiss economists carried out in December 2019 attempted to cast light on these issues.

Negative Interest Rates I: Companies’ Assessment of Monetary Policy

Five years after the suspension of the minimum exchange rate of the Swiss franc, the manufacturing industry is still complaining about lower competitiveness on the eurozone markets and the excessive strength of the Swiss franc compared to the euro. For the majority of companies, the advantages and disadvantages of the negative interest rate policy balance each other out. However, as a special KOF survey shows, financial institutions have a very different view on the matter.

January 2020

KOF Business Situation Indicator: Swiss Companies Report Downturn at the End of the Year

Towards the end of 2019, the business situation of Swiss companies slowed down again (cf. G 4). The Swiss economy is held back by the sluggish trend in the manufacturing industry. By contrast, the construction industry and numerous service sectors reported a stabilisation of the business trend. Overall, the difficult international environment continues to place a strain on the Swiss economy.

Eurozone Growth at Moderate Pace

The euro area economy will pick up some momentum, according to three research institutes: ifo in Munich, KOF in Zurich, and Istat in Rome. Economic growth will rise from its low rate of 0.2% in the third quarter of 2019 to 0.3% in the fourth quarter of 2019. The institutes expect the euro area economy to continue to grow by 0.3% quarter on quarter in each of the first two quarters of 2020.

Swiss Internal Tax Competition and Inequality

Recently, there has been lively debate about Switzerland’s role in international tax competition. The author of this article investigates the phenomenon of ‘socio-spatial segregation’, one of the effects of inter-cantonal tax competition. ‘Socio-spatial segregation’ refers to the geographical concentration of households which are similar in terms of criteria such as income, wealth, age or ethnicity.

The Amended Job Registration Requirement and Its Consequences

Since July 2018, companies have been required to register any vacancies in professions with unemployment levels of more than 8% with the regional employment offices (RAV). As of 1 January, this threshold was lowered to 5% and the classifications of reportable professions were narrowed down. Despite the lower threshold, the effective scope of the job registration requirement has declined. On top of this, the bigger weight of the building sector will affect implementation.

Earlier Articles

KOF Business Situation Indicator: Swiss Economy Picks Up Slightly – Manufacturing Remains Under Pressure

In November, Swiss companies reported no further slowdown of their business situation. Following a decline in September and October, the KOF Business Situation Indicator went up slightly in November (See Graph 6). Although the Swiss economy picked up to some extent in autumn, the economic environment remained difficult.

The Swiss Franc’s Equilibrium Exchange Rate: a Tentative Assessment

The turbulent history of the Swiss franc since the outbreak of the financial crisis has increasingly raised the question as to where the point of equilibrium is for the Swiss franc exchange rate. Although there cannot be any absolute point of equilibrium, attempts have nonetheless been made to assess the mispricing of the Swiss franc using the Behavioural Equilibrium Exchange Rate (BEER) model.

Do Internships Really Pay Off?

Increasing numbers of university students do internships during their time at university to prepare themselves for the labour market. However, there is little evidence whether or not such an investment actually pays off. A new study investigates this question.

KOF Youth Labour Market Index: Switzerland Back at the Top

The situation of young people on the labour market has clearly improved between 2016 and 2017. According to the latest KOF Youth Labour Market Index, Switzerland reaches the highest index score across Europe. Denmark drops to the second rank, but still shows a highly satisfactory situation on the youth labour market. With respect to the previous year, large improvements stem from the Eastern European countries, especially Slovenia and the Czech Republic.