KOF Business Tendency Surveys: challenges facing the Swiss economy are diminishing

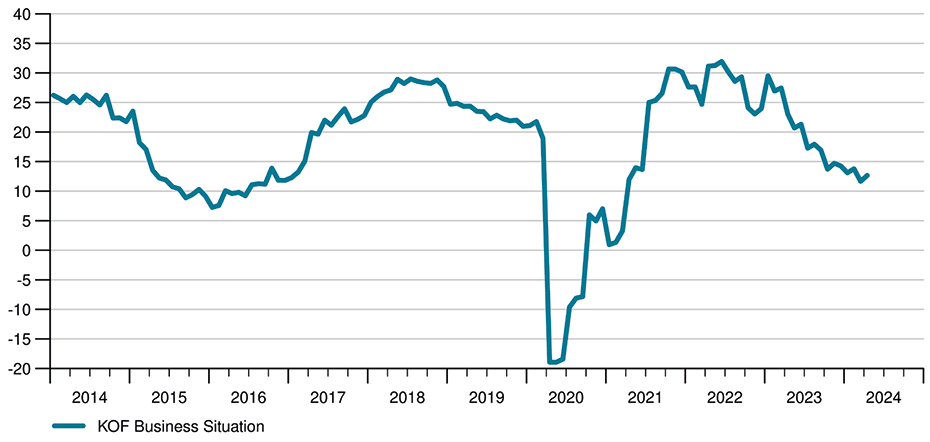

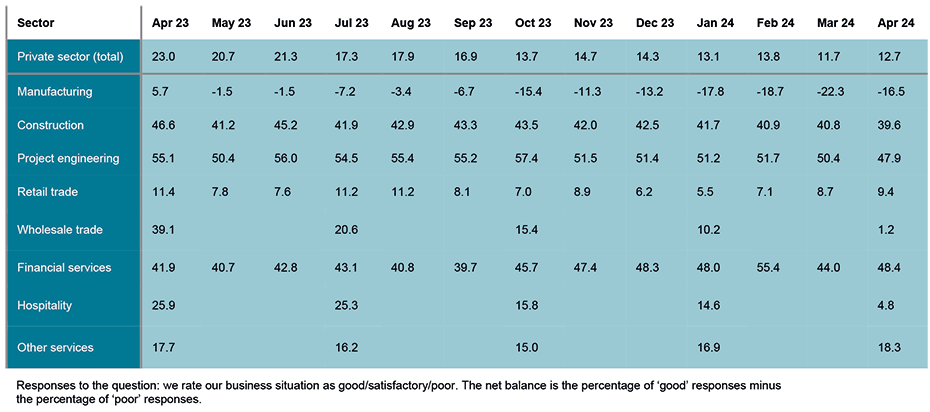

The KOF Business Situation Indicator for the Swiss private sector, which is calculated on the basis of the KOF Business Tendency Surveys, rose modestly in April (see chart G 7). The situation in the manufacturing sector eased, while it deteriorated slightly in the construction industry. Companies’ inflation forecasts are falling and private consumption could provide stimulus to the Swiss economy.

The persistently tough business situation – particularly in manufacturing industry – eased in April. Business also improved in financial and insurance services and in the retail trade. This was already the third slight increase in the Business Situation Indicator for the retail trade in a row. Firms engaged in other services are also reporting a gradual improvement (see table T 1).

In contrast, business in the project engineering and construction sectors – both of which are associated with building activity – deteriorated slightly, while the situation in the hospitality and wholesale sectors worsened significantly. The improvement in the retail and manufacturing sectors – particularly in consumer goods production – as well as the weaker but still fairly encouraging business situation in the hospitality industry together indicate that private consumption could provide stimulus to the Swiss economy.

Companies’ inflation concerns easing

Firms expect to see moderate levels of general consumer price inflation in Switzerland going forward. As far as trends over the next twelve months are concerned, company reports indicate an average inflation forecast of 1.6 per cent. Expected inflation over this time horizon fell below 2 per cent for the first time to 1.9 per cent in January. Inflation of 2.6 per cent had been forecast for the next twelve months in April 2023. Over an extended time horizon – i.e. the inflation rate in five years’ time – firms’ forecasts fell to an average of 1.9 per cent and thus below 2 per cent for the first time in April.

As far as companies’ policies with regard to their own sales prices are concerned, the upward pressure on prices, which picked up at the beginning of the year, is now subsiding again. The pressure on firms’ earnings situation has eased. Companies expect their average gross wages to rise by 1.6 per cent over the next twelve months. This means that expected wages are lower than they were in January (1.8 per cent) and are on a par with firms’ average inflation forecasts.

Competitive situation in manufacturing improving

Business in the manufacturing sector is no longer quite as challenging as it was in March. The situation is improving for export-led companies in particular. While consumer goods manufacturers are breathing a sigh of relief, capital goods producers remain on a downward spiral. The pressure on their competitive position is easing both domestically and in international markets. Accordingly, their earnings situation is now encouraging. Companies are expecting demand for their products to pick up both domestically and internationally in the near future.

The building-related sectors of the economy are slowing

Business in project engineering and construction – the areas associated with building activity – has been on the decline for several months. Demand in both sectors is growing more slowly than before. Earnings continue to improve, however, and a weaker – albeit not negative – trend is expected in the near future. Capacity utilisation in the construction industry has fallen but remains just above average. Although no increase in construction output is expected in the near future, the outlook is no longer as gloomy as it was. Complaints about a lack of demand are growing. Project engineering firms are expecting to expand their services more slowly in the coming months than they did previously. The time period for which existing order books will be sufficient has recently increased again. However, the sums involved in newly signed construction contracts are no longer rising.

The situation in the retail trade has eased during the spring

Business in the retail sector improved in April for the third month in a row. Supermarkets and department stores in particular, as well as the retail trade in data-processing equipment and software, are currently experiencing an upturn. In contrast, the mail-order business and parts of the retail sector that operate without sales outlets are slowing sharply. Overall sales of goods in the retail trade are no longer performing as poorly as they were. The pressure on earnings is easing considerably. Companies are still only planning to raise their prices in isolated cases. Survey respondents are confident about their future sales, although they are not quite as optimistic as they were in the previous month and in April of last year.

Wholesale business activity continues to deteriorate. Although the Business Situation Indicator is falling in both the wholesaling of consumer goods and the wholesale trade in producer goods, the situation in the latter case is particularly challenging. The Business Situation Indicator for the wholesaling of machinery and equipment, for example, has fallen sharply.

Business activity in the hospitality industry is weakening across the board

The Business Situation Indicator for hospitality is falling again. Business is now as buoyant as it was before the pandemic but no longer as exuberant as it was between the second half of 2022 and large parts of 2023. This downturn is affecting both the accommodation and food-service sectors. All tourism areas are being affected: mountain regions, lake regions, and major towns and cities. Revenue has barely increased compared with last year. Earnings are no longer improving on balance. The number of overnight stays by domestic guests has not been rising for some time, while the number of overnight stays by foreign tourists is now increasing less frequently. A lack of demand is becoming more important as a constraining factor in the food-service industry, whereas staff shortages are losing relevance.

The situation for financial and insurance service providers is improving

Business in the financial and insurance services sector is improving slightly following a downturn in the previous month. Survey respondents are also more confident than before in their expectations regarding the performance of their business over the next six months. However, earnings growth – particularly among banks – has recently slowed. For insurance companies, on the other hand, it has been more buoyant than before. According to the banks, the creditworthiness of their private customers is improving while that of their corporate clients is deteriorating only marginally. Nevertheless, they expect new lending – particularly to corporate customers – to be sluggish.

Other service providers’ business is recovering slightly

Business activity in other services improved slightly in April. However, companies’ business forecasts for the next six months are slightly more cautious than they were before. Although demand has picked up recently, capacity utilisation remains virtually unchanged. Staffing levels are no longer considered too low by survey respondents as frequently as they were previously. There are currently no plans to increase the numbers of individuals working in personal services on balance. However, companies’ earnings have been performing well over the past three months. Business-related services in particular have reported an encouraging trend.

The results of the KOF Business Tendency Surveys from April 2024 include responses from around 4,500 firms from manufacturing, construction and the major service sectors. This equates to a response rate of around 61 per cent.

The detailed results of the KOF Economic Surveys (including tables and charts) can be found on our website:

https://kof.ethz.ch/en/news-and-events/media/press-releases.html

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland