Second pandemic wave slowing global economic recovery

- KOF Bulletin

- KOF Economic Forecasts

The epidemiological situation has deteriorated further in many countries, including across Europe, which is important for Swiss exporters. Although vaccination campaigns are now under way, restrictions are likely to remain in place in many areas. It will therefore be some time before the global economy recovers from the coronavirus crisis, the aftermath of which is likely to be felt for quite a while.

The measures taken to contain the COVID-19 pandemic resulted in an unprecedented economic slump. However, they proved largely effective in containing the pandemic, allowing many countries to return to some degree of normality in the summer. Consequently, value added also recovered, which in the euro area in the third quarter, for example, had still been 4 per cent below its pre-crisis level of the fourth quarter of 2019. Many countries reported extremely high growth rates as part of this normalisation process.

However, both epidemiological and economic developments varied widely from country to country. China, for example, was able to quickly bring the epidemic under control and almost completely relaunch its economy after just a few months. The United Kingdom, on the other hand, was late in introducing its containment measures, which is why its gross domestic product (GDP) in the third quarter was still almost 10 per cent below its pre-crisis level. Another factor here was probably the long-lasting uncertainty about future relations with the European Union (EU).

The aftermath of the shock is likely to be felt for some time to come

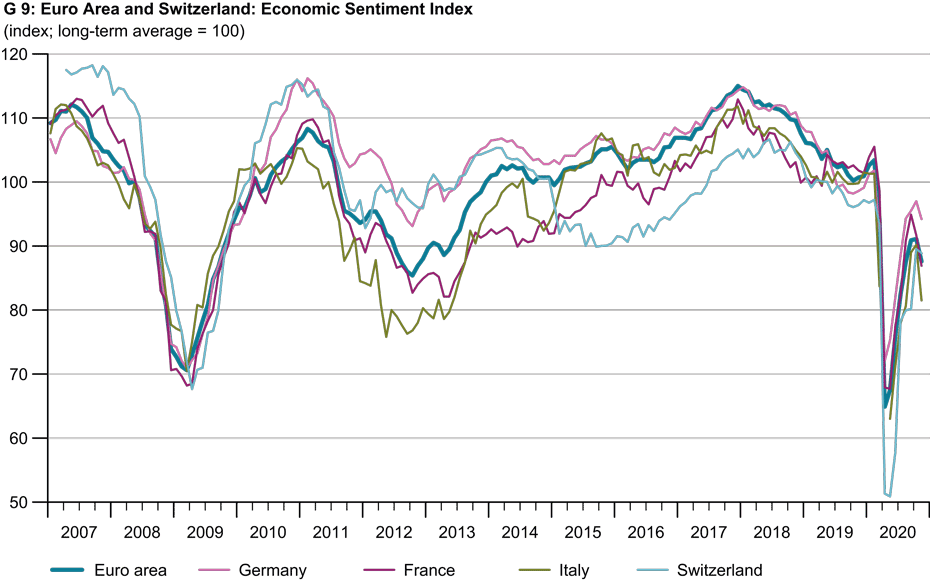

The economic situation has recently deteriorated significantly, especially in Europe, which is important for Swiss exporters. Infection rates in many countries rose sharply in October. This further deterioration was captured in the European Commission's Economic Sentiment Indicator, which in November fell by another 4 points to 86.6 and thus remains well below its long-term average of 100 (see G 9). The purchasing managers' indices for the service sector also show a sharp deterioration in the business situation.

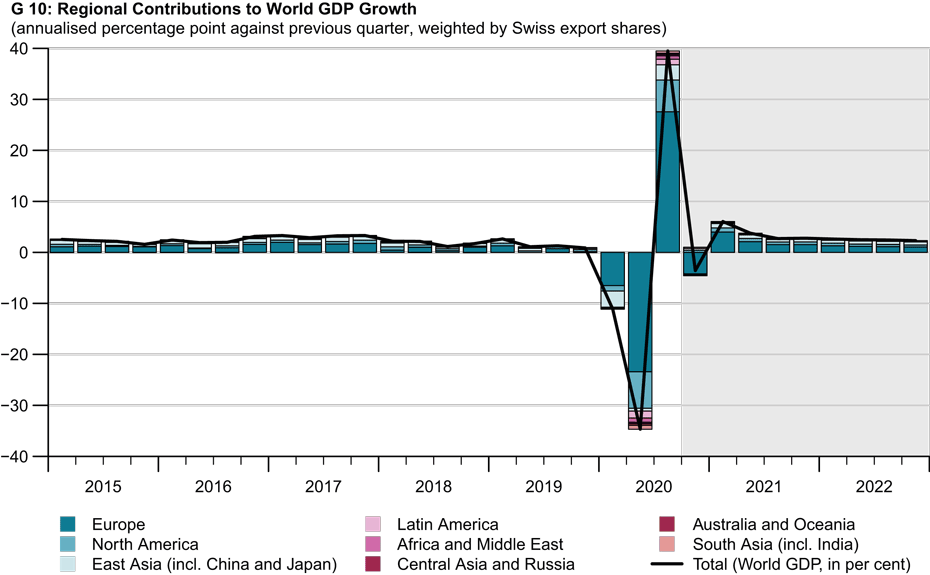

Overall, the global economy was likely to contract slightly in the fourth quarter of 2020 from a Swiss perspective (see G 10). No rapid improvement is expected over the coming months either. The current restrictions will probably have to remain in place longer than previously expected over the winter months in order to keep the reproduction number (‘R number’) below 1. The warmer weather from spring onwards will allow these restrictions to be relaxed. The widespread availability of vaccines should reduce the reproduction number further.

However, the production and distribution of these vaccines could take a considerable period of time, and there is no guarantee that the public will be sufficiently willing to take the vaccines. Consequently, public health measures and restrictions are likely to remain in place in many areas, which will have a negative effect on capacity utilisation and productivity. In addition, the aftermath of this economic shock is likely to be felt for some time. Higher unemployment and lower labour force participation could be accompanied by a lower propensity to consume and invest in many countries. Reducing the high levels of debt accumulated by households and the public finances will put pressure on spending over the medium term.

Expansionary fiscal and monetary policy will continue to support the economy in 2021

Back in spring 2020, many local, national and supranational authorities decided to introduce extensive rescue packages, loan guarantees and support measures to mitigate the effects of the coronavirus crisis. Short-time working proved to be particularly effective at stabilising the economy. In the euro area, where many member states use this instrument, the unemployment rate rose by only 1.3 percentage points from the beginning of the year to 8.7 per cent in July before falling back slightly over the following months. In the United States, where this instrument was hardly used, unemployment rose by more than 11 percentage points to 14.7 per cent in April, but then fell back to 6.7 per cent in November.

Fiscal policy is expected to remain highly expansionary in 2021. The EU, for example, is planning to disburse the first tranche of funding as part of its €750 billion ‘Next Generation EU’ stimulus package. A further stimulus package of a similar scale was recently agreed in the United States. Given the low levels of capacity utilisation in many economies and the sharp drop in energy prices in March, it is not surprising that inflation rates are currently very low. Central banks around the world have eased monetary policy to stabilise the economy and keep prices up. Even though commodity prices have recently risen sharply, they are unlikely to surge in the near future. Consequently, monetary policy is likely to remain expansionary. The euro area loosened it even further in December by increasing and extending its emergency pandemic purchase programme.

Forecasting risks still mostly on the downside

The economy will continue to be significantly affected by how the pandemic evolves. Forecasting risks arise primarily from the assumption underlying the baseline scenario that the pandemic can be brought under control by means of restrictions and regional lockdowns that are not economically harmful. It is quite possible, however, that the number of cases will rise sharply again after the Christmas holidays, which would trigger renewed restrictions. These could then only be partially lifted once more favourable weather conditions arrive in the spring or after large sections of the public have been vaccinated. One upside risk is that an early and successful vaccination campaign will have largely eradicated the pandemic by the summer.

The full economic forecast for 2021/2022 – including tables and charts – can be found here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland