Looking back on a difficult year for Switzerland’s most important trading partners

- KOF Bulletin

- World Economy

Global economic dynamism was relatively weak also last year. Economic policy uncertainties, dwindling world trade and weak demand for investment goods left a major mark in particular on Europe and East Asia. This article looks back over 2019 and examines Switzerland’s economic environment.

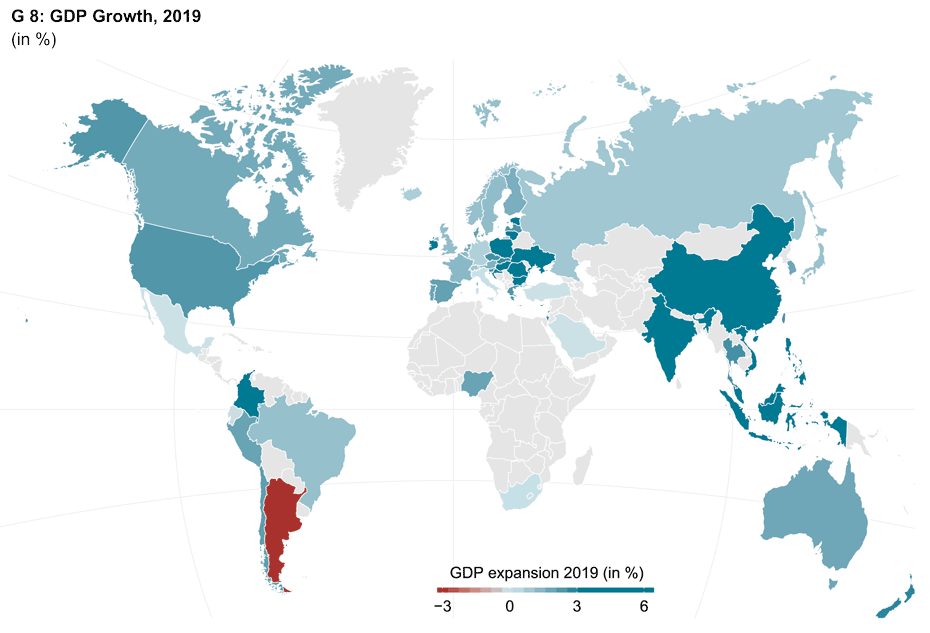

Economic weakness was particularly apparent in Western Europe, and thus for Switzerland’s most important trading partners (see Chart G 8). Increases in overall economic output in Germany and Italy were below average over 2019, whilst the strikes that broke out in December in France put an abrupt end to the previously robust economic performance. Slowdowns were even apparent in Spain, Portugal and the Netherlands, which had previously been posting solid economic figures. On the other hand, North America and in particular the USA experienced a favourable economic dynamic, with overall economic output growing at an above-average rate also this year, following the slashing of taxes in 2018. This was fuelled, amongst other things, also by positive developments on the labour market and significant rises in real incomes, which thus ensured buoyant consumer sentiment.

The situation is somewhat different in Latin America, where the economy has been stalled for several years now. In Brazil a robust recovery from the protracted recession in 2015 and 2016 is still not in sight, whilst investments in Mexico are being held back due to fears of further trade disputes. The Argentinian economy fell into a deep recession, caused by a loss of confidence in fiscal discipline as well as the structural reforms introduced by the government. A slowdown was even registered last year in East and South-East Asia, the world’s economic engine room. As a result of the trade dispute with the USA as well as its own domestic problems, China in particular experienced a sharp slowdown which could only be offset in part through fiscal and monetary countermeasures.

Turbulent times for the manufacturing industry

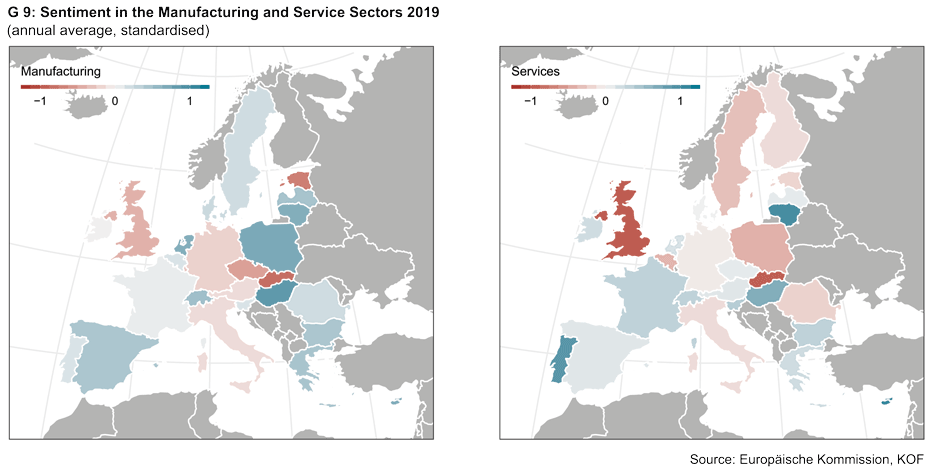

One reason for the economic slowdown was the cyclical fall back from the peak reached in 2017. However, economic policy uncertainty surrounding Brexit, trade disputes involving the USA as well as a structural shift in the automobile industry towards electric vehicles were more important factors. These were also accompanied by an adjustment in global value creation chains, a significant fall in world trade as well as reticence on the part of investors. As a result, the subdued economic dynamism was felt mainly in the manufacturing sector, and in particular by manufacturers of capital goods. These companies are more reliant on exports and more heavily incorporated into global value creation chains than service providers and the manufacturers of consumer goods. Countries such as Germany, where the production of capital goods accounts for a larger share of value creation within the manufacturing sector, were thus more markedly affected by the economic downturn (see Chart G 9; a positive figure indicates more optimistic sentiment compared to the long-term average).

Central banks put their foot back on the accelerator

Monetary policy in the major currency zones was loosened in response to the real economic downturn. In 2019 the Federal Reserve lowered the target federal funds range in three steps to 1.5% to 1.75% and resumed bond purchases in order to remove liquidity bottlenecks on the money markets. The European Central Bank (ECB) also cut its deposit facility rate to -0.5% and likewise resumed its bond purchasing programme. Central banks in the United Kingdom and Japan also signalled at least their willingness to pursue a more expansive approach.

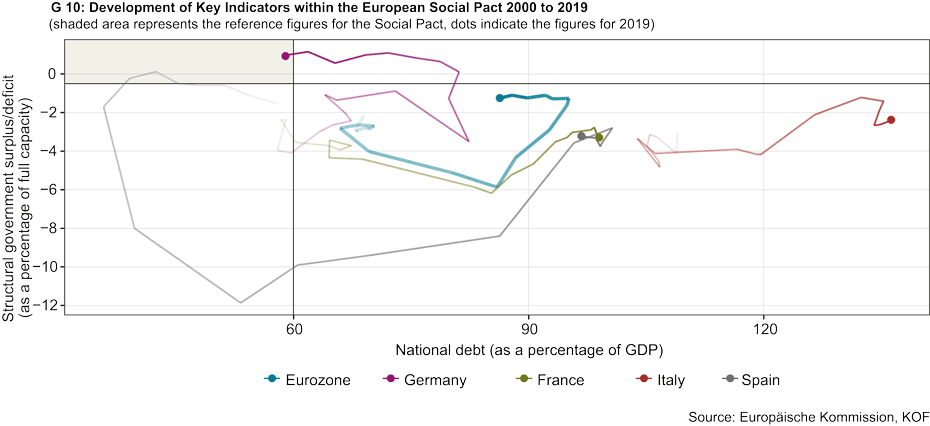

Due to the prevailing economic climate, continuing expansive financial policies appear to have had an impact on many countries. In 2018, the United States posted the largest budget deficit (as a percentage of GDP) throughout the entire Organisation for Economic Co-operation and Development (OECD), whilst the 2019 deficit is set to be similar. Eurozone financial policy this year was even more expansive than it was in 2018. However, there is not too much scope for any further expansive measures (see the figures for the last 20 years in Chart G 10); debt levels are high and the structural deficit in some countries is higher than the 0.5% target laid down in the European Fiscal Compact.

Factors of uncertainty take the upper hand at the start of the year

Last year’s economic performance was characterised by persistent economic policy uncertainties, which have recently abated. For instance, the withdrawal of the United Kingdom from the EU has been completed whilst China and the USA have concluded a “Phase 1” trade agreement, which has resolved at least some disputed issues. However, structural questions concerning Chinese industrial policy as well as the subsidising of state-owned companies are still unresolved.

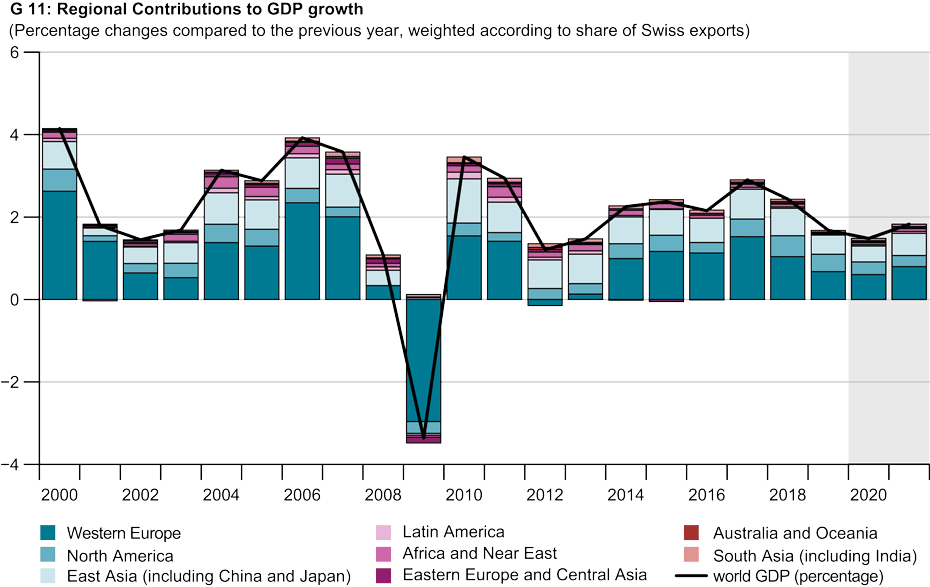

The flare-up of conflicts in the Near East and the outbreak of the new strain of Coronavirus in the central Chinese province of Hubei have caused a difficult start to 2020. Further imponderables are being generated by the trade talks between the EU and the UK as well as the upcoming elections in the USA, which are set to be highly divisive and hotly disputed. In the meantime, various provisional indicators point towards a stabilisation in the economic situation. However, it is likely that it will take several quarters for a noticeable recovery in the world economy to kick in (see Chart G 11).

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland