How Swiss tourism compares internationally

- KOF Tourism Forecast

- KOF Bulletin

The number of international tourist arrivals in the first eight months of this year was 70 per cent lower than it had been before the coronavirus crisis. Although demand in Europe partially recovered during the summer months, rising infection rates are slowing down this recovery. However, Switzerland is not in a bad position when compared internationally: thanks to the strength of its domestic tourism, it has lost fewer overnight stays than other countries.

Hardly any other industry is being hit as hard by the current crisis as tourism. In the first half of the year, the food service sector and cultural and entertainment businesses were severely restricted or temporarily closed in many countries. In order to stop the spread of coronavirus, travel restrictions were imposed worldwide, which brought international travel virtually to a standstill. The number of international tourist arrivals in the first eight months of this year fell by 70 per cent compared with last year – a loss of 700 million arrivals. The current resurgence in infection rates and the tightening of restrictions are likely to act as a further drag on tourism in many countries. Tourism demand will remain subdued in the coming months owing to the uncertainty about how the pandemic will evolve going forward.

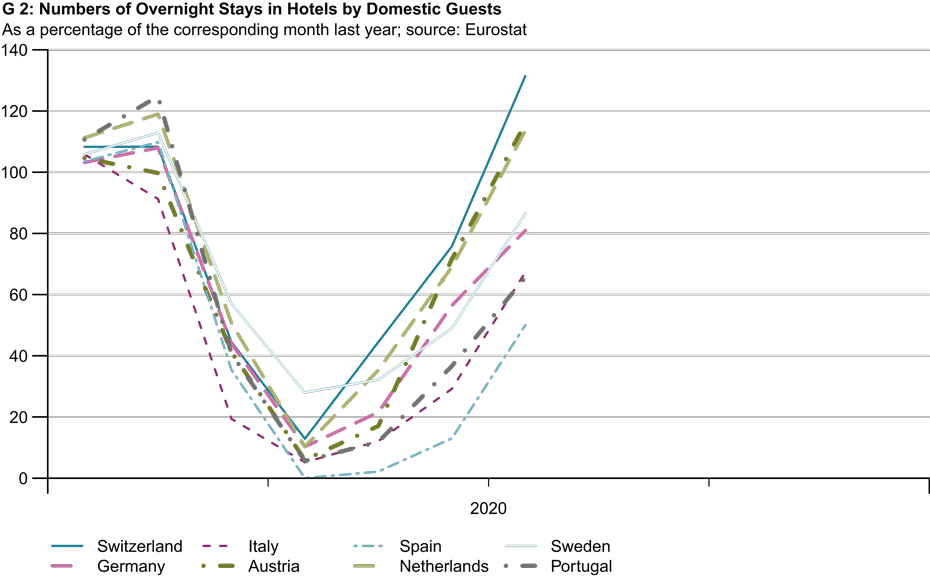

Tourist demand in Europe recovered to some extent during the summer months after many restrictions were lifted and intra-European borders were reopened from mid-June onwards. The numbers of overnight stays in hotels had returned to their pre-crisis levels of between 40 per cent and 90 per cent in all European countries by July (see G 1). Overnight stays in Switzerland were at 70 per cent of their pre-crisis levels by July, while the corresponding figures for Germany and Austria were 70 per cent and 77 per cent respectively. Domestic guests in particular spent more of their holidays in Switzerland during the summer. In contrast, foreign visitors were largely absent with the exception of some European tourists from neighbouring and Benelux countries. By comparison, overnight stays in July in Italy, which was far more seriously affected by the pandemic, were at just under half of their pre-crisis levels.

Countries with a high proportion of domestic tourists are benefiting

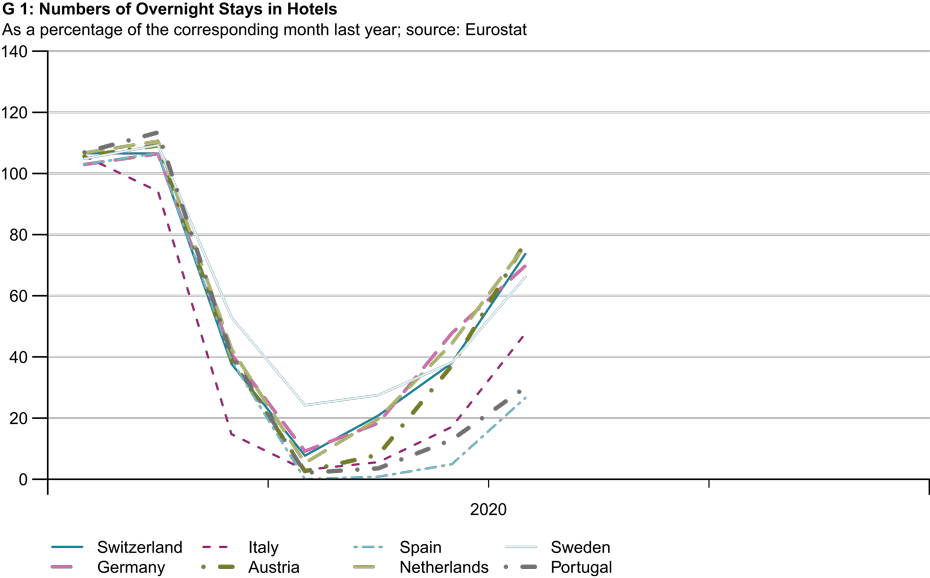

Domestic demand was the main driver of the tourism recovery in the summer. In view of the travel restrictions and the generally high level of uncertainty associated with travelling abroad, many tourists opted for holidays in their own countries. Domestic demand in many countries during the summer months rose significantly above its pre-crisis levels. Hotel overnight stays by domestic guests in Switzerland in July were 30 per cent above their pre-crisis levels, which particularly benefited alpine and rural areas. Overnight stays by domestic guests in Austria rose by 15 per cent, while domestic demand also increased significantly in Denmark, Norway and the Netherlands. In contrast, overnight stays by domestic visitors in July were one-fifth lower than before the crisis in Germany and one-third lower in Italy (see G 2).

While countries and regions that focus on domestic tourists have so far been relatively better able to cope with the crisis, countries with a high proportion of international guests are suffering most. These include countries with large tourism sectors such as Croatia, Greece and Spain, which lost over 40 per cent of their overnight stays in the first seven months of this year compared with last year. Portugal, Italy and Bulgaria lost around 35 per cent of all of their overnight stays. By comparison, the cumulative loss of hotel overnight stays in Switzerland and Germany is around 25 per cent each and amounts to 22 per cent in Austria. On the whole, the loss of hotel overnight stays is higher in countries which had more COVID-19 infections per 100,000 inhabitants and which imposed tighter restrictions to fight the pandemic.

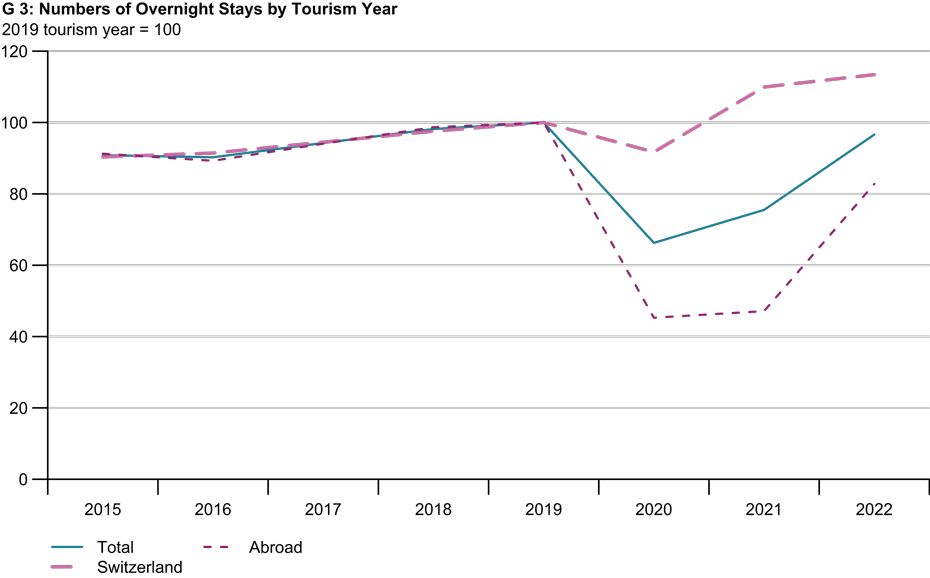

30 per cent fewer overnight stays in the coming winter

As the number of infections rises, restrictions are currently being tightened again in many countries. These include travel restrictions in the form of quarantine rules. This is slowing the recovery in tourism during the winter months. This situation is not expected to gradually improve until spring, once a potential vaccine has been developed and people's habits change during the warmer season. This would revive international tourism demand. European demand, especially between neighbouring countries, should recover relatively quickly. On the other hand, the recovery in intercontinental travel will be sluggish. Although restrictions on non-European tourists entering the Schengen area could be lifted next spring, the lead times for intercontinental travel are long. Buoyant domestic demand should support the tourism industry in many countries but can only partially compensate for the absence of foreign visitors (see G 3).

In Switzerland, overnight stays by domestic guests in the coming winter season are expected to be around 8 per cent above their pre-crisis levels and will mainly benefit winter sports destinations. On the other hand, overnight stays by European guests are likely to be about one-third lower than last year and about half of their pre-crisis levels. Guests from overseas markets will largely stay away owing to travel restrictions. Overall, these overnight stays are forecast to fall by 30 per cent this winter. However, if the pandemic returns for longer and in a more severe form than currently assumed, this decrease could be as much as 50 per cent.

Overall, the pandemic will cause an estimated loss of 13.3 million overnight stays during the 2020 tourism year. As expected, prices in the hotel business have also fallen this year and are not expected to return to their pre-crisis levels until 2022. This means that the hotel sector will have lost CHF 1.6 billion in revenue. For the tourism industry as a whole the loss of revenue during the 2020 tourism year will exceed CHF 10 billion. Next year the loss of demand compared with the 2019 tourism year is likely to be CHF 6.2 billion. Overall, the number of overnight stays by foreign guests is likely to be just under 80 per cent of its pre-crisis level at the end of 2021 and then 90 per cent of this level at the end of 2022. The pre-crisis level will not be fully reached until the end of 2023.

The full tourism forecast from October 2020 can be found here.

Contact

No database information available