Companies revise investment plans significantly during lockdown

- Swiss Economy

- KOF Bulletin

The KOF Investment Survey estimates the causal effect of the COVID-19 pandemic on the investment activity of Swiss companies. According to this survey, Swiss companies have scaled back their plans to invest in equipment during the current year by 7.3 percentage points and have reduced their plans to invest in research and development by 14.9 percentage points. This has far-reaching consequences for the further course of the recession and the dynamics of the subsequent economic recovery.

This year's spring survey, which was conducted from 25 February to 15 May 2020 and in which 3,104 companies participated, has been significantly influenced by the COVID-19 pandemic. The survey period includes the first Swiss person to test positive for SARS-CoV-2, the first Swiss death, the spread of the virus throughout Switzerland and the measures taken by the federal government to combat the pandemic.

These events have inevitably influenced companies’ investment plans, which is clearly reflected in the responses of the survey participants. Companies' investment plans have tended to be more modest since the Federal Council declared a state of emergency on 16 March.

The six-monthly implementation and repetition of the same questions over the different survey waves of the KOF Investment Survey make it possible to examine in greater detail the extent to which companies have changed their investment plans as a result of the pandemic.

Difference-of-differences analysis using the state of emergency as the cut-off date

In autumn 2019 the companies were asked about their investment plans for the coming year. In spring 2020 they were again asked what amount they intended to spend on investment in the current year. Using this data and a so-called difference-of-differences approach, it is possible to investigate in more detail whether and how companies changed their investment plans in spring 2020 compared with those they had stated in the survey of autumn 2019 – depending on whether they completed the investment survey in spring 2020 before or during the COVID-19 pandemic.

Revisions of investment plans are therefore calculated separately for two groups of companies. Companies that completed the spring survey before the pandemic broke out belong to the first group; those that responded during the pandemic belong to the second group. The cut-off date for group classification is 16 March 2020, the date on which the Federal Council declared a state of emergency and took far-reaching measures to protect the population and combat the pandemic.

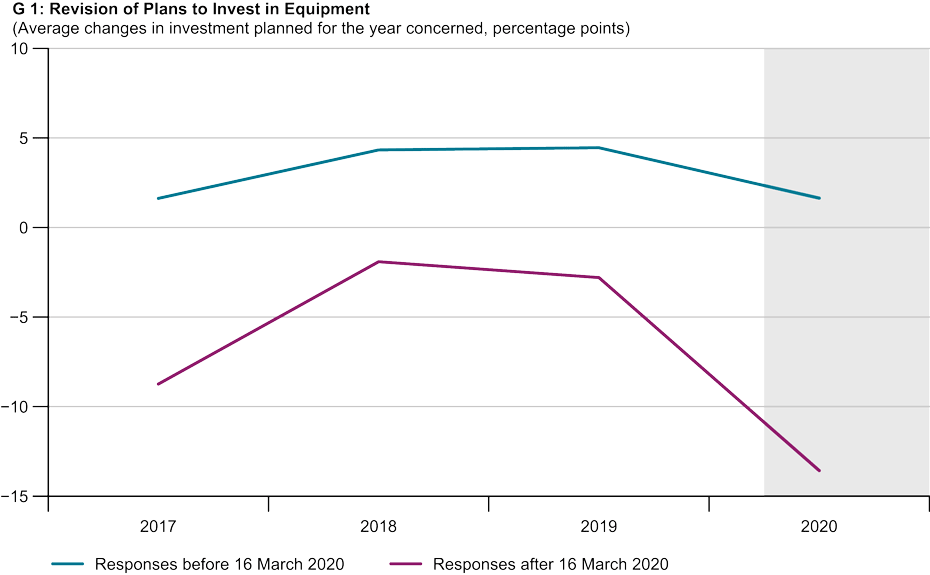

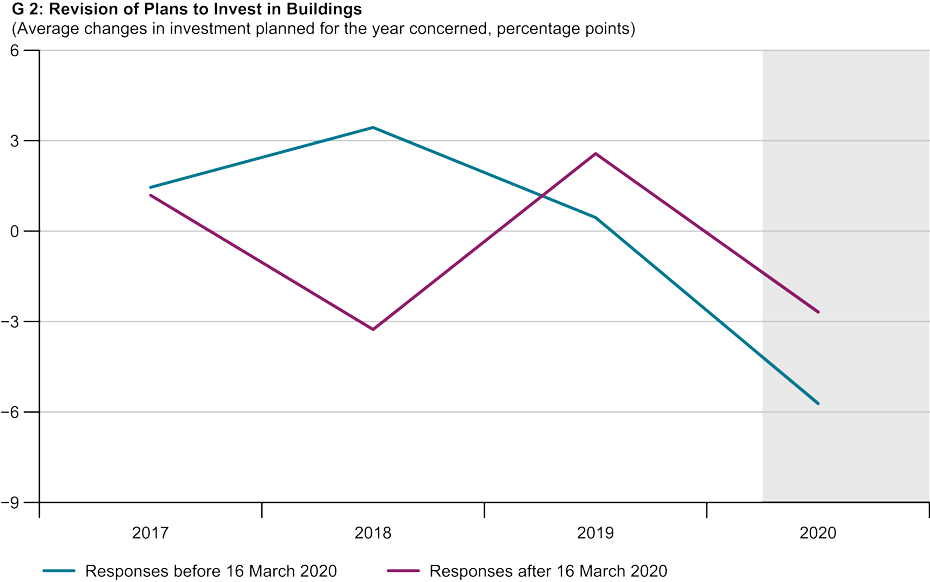

Chart G 1 shows the resulting average changes in planned equipment investment per group for the most recent survey pair (autumn 2019 – spring 2020) and for three previous survey pairs (autumn 2016 – spring 2017; autumn 2017 – spring 2018; and autumn 2018 – spring 2019). Most of the values are around the zero line, which means that companies do not usually make massive changes to their investment plans between the two survey waves. At the end of the year, the budgets for the next year are approved and companies usually have little reason to make fundamental revisions between autumn and spring.

Things are different this year. The companies in the second group in particular have recently revised their plans significantly downwards. For further analysis it is now particularly important that the two lines run in parallel before the selected cut-off date. The idea of the difference-of-differences method is to use this common trend in the response behaviour of the two groups before the pandemic to argue that without COVID-19 the red line would have run parallel to the blue line even in spring 2020. Under this assumption, the pandemic’s impact on companies' investment plans is obtained by subtracting the planned revision of those who responded before 16 March 2020 from the revision of those who responded after 16 March. It is therefore calculated as the difference between the differences.

Things are different this year. The companies in the second group in particular have recently revised their plans significantly downwards. For further analysis it is now particularly important that the two lines run in parallel before the selected cut-off date. The idea of the difference-of-differences method is to use this common trend in the response behaviour of the two groups before the pandemic to argue that without COVID-19 the red line would have run parallel to the blue line even in spring 2020. Under this assumption, the pandemic’s impact on companies' investment plans is obtained by subtracting the planned revision of those who responded before 16 March 2020 from the revision of those who responded after 16 March. It is therefore calculated as the difference between the differences.

Effects vary widely from sector to sector

In the case under consideration, the difference is negative. On average, companies have revised their planned equipment investments for this year downwards by 7.3 percentage points as a result of the pandemic. Using a regression model, it can be estimated that this change and the pandemic’s negative effect on investment plans illustrated in the chart are statistically reliable with a certain probability of error.

Furthermore, the analysis can be further deepened using such regression models. For example, it can be seen that industry (-11.1 pp) is much more severely affected in the aggregate than the services sector (-1.1 pp). In contrast, the effect on the construction sector is not statistically significant.

There is considerable heterogeneity within sectors, and the pandemic’s impact on individual sectors varies greatly. Among the service providers, transport and tourism (-52.5 pp), hospitality (-48.1 pp) and the retail sector (-16.2 pp) are particularly affected by the crisis. Conversely, it has had a positive impact on equipment investment in post and telecommunications (+74.5 pp), financial services (+63.1 pp) and information technology (+26.7 pp).

In manufacturing industry, investment in equipment is to be reduced as a result of the pandemic, especially in the production of electrical appliances and equipment (-26.4 pp) and in mechanical engineering and vehicle production (-4.6 pp). In contrast, investment plans in the food and beverage sector (+13.0 pp) have been increased significantly.

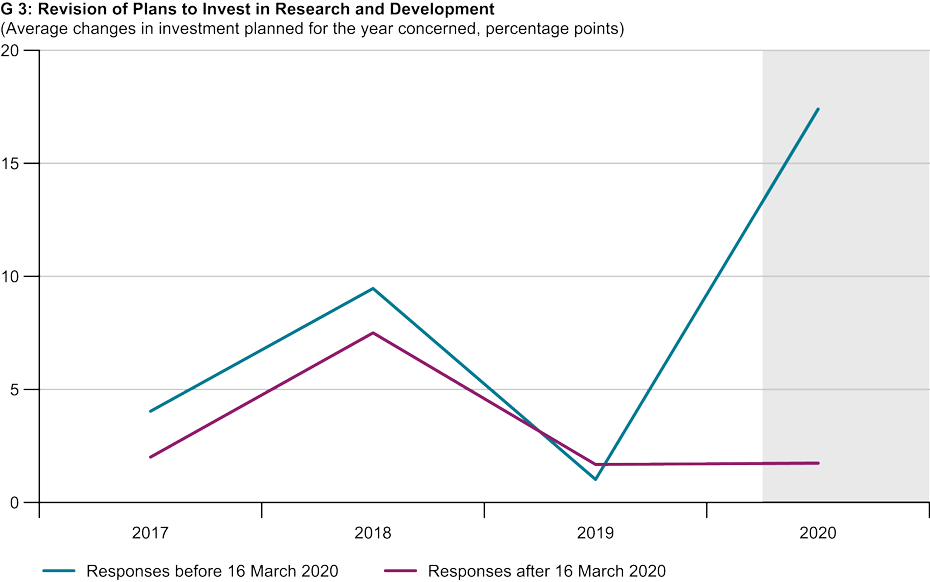

Chart G 3 shows the average changes to planned investment in research and development. The average treatment effect is more negative for this type of investment than for equipment investment. Compared with the survey responses before the start of the pandemic, companies have reduced their investment plans for R&D by 14.9 percentage points this year. This difference is statistically significant.

Prospects of a ‘V-shaped’ recession are fading

Overall, the survey data analysed in this way show that the pandemic has had a severely negative impact on companies' investment plans. This finding is worrying for at least two reasons.

Firstly, it kills off any prospects of a painful but brief ‘V-shaped’ recession. Corporate investment activity has a decisive influence on economic growth. If investment fails to materialise, economic recovery starts later and is much slower. This would result in what some economists have called a ‘swoosh-shaped’ recession, i.e. the shape of the economic recovery would then look like the logo of the sporting goods manufacturer Nike.

And, secondly, these findings could be further accentuated in the medium term by companies’ rising levels of debt. Liquidity assistance and bridging loans (‘COVID-19 loans’) are a key pillar in the Swiss government's package of measures to cushion the economic impact of the pandemic. Although government guarantees do help to compensate for loss of income in the short term, the increased debt burden does not remain without consequences. Research has shown that companies with high levels of debt reduce their capital spending even more sharply after a crisis. If the debt burden rises as a result of the pandemic, this could have a negative impact on companies' willingness to invest and thus on the strength of the economic recovery as such.

Further information on the KOF Investment Survey can be found here.

1) The exact time of answering is known to those participants who fill in the questionnaire electronically. The following analysis is therefore based exclusively on the responses of those companies that participate in the survey electronically.

2) As of 20 May 2020, the case numbers for SARS-CoV-2 come from official sources (cantons and the Principality of Liechtenstein) and are made available in machine-readable form on the Swiss Open Government Data (OGD) portal by the Statistical Office of the Canton of Zurich (external page https://github.com/openZH/covid_19).

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland