KOF-NZZ Economists’ Survey: large majority of Swiss economists against rapid debt reduction

- Public Finances

- Economists Surveys

- Swiss Economy

- KOF Bulletin

In April of this year, KOF and Switzerland’s Neue Zürcher Zeitung (NZZ) newspaper surveyed economists on the subjects of state aid during the coronavirus crisis and the future of public finances. There are hardly any economists who think that the debt brake should be applied very rigorously. There is also agreement among the 167 survey respondents that cuts in education, research and social security should be avoided. The level of government support is generally not considered to be too high.

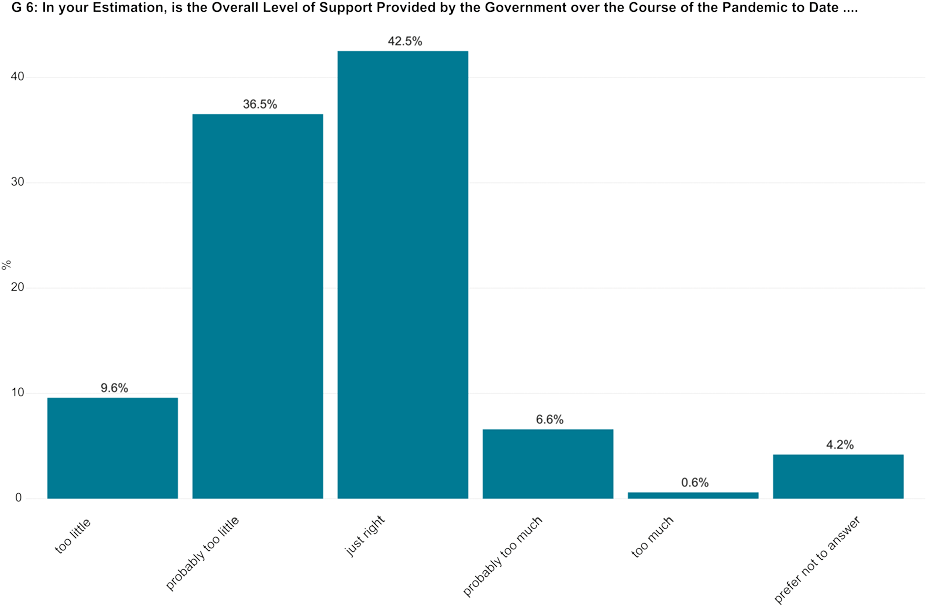

The Swiss government has adopted various support measures to boost the economy during the pandemic. For example, guarantees have been given for bridging loans, support for short-time working has been expanded, a job replacement scheme for the self-employed has been introduced, and financial support has been provided for companies that have been hit particularly hard. Since the beginning of the pandemic the public has been debating whether the total amount of these support measures is adequate. 43 per cent of the economists surveyed consider the amount to be appropriate over the course of the pandemic to date (see G 6). However, 46 per cent believe that this amount is too little. Only 7 per cent reckon that these measures are too extensive.

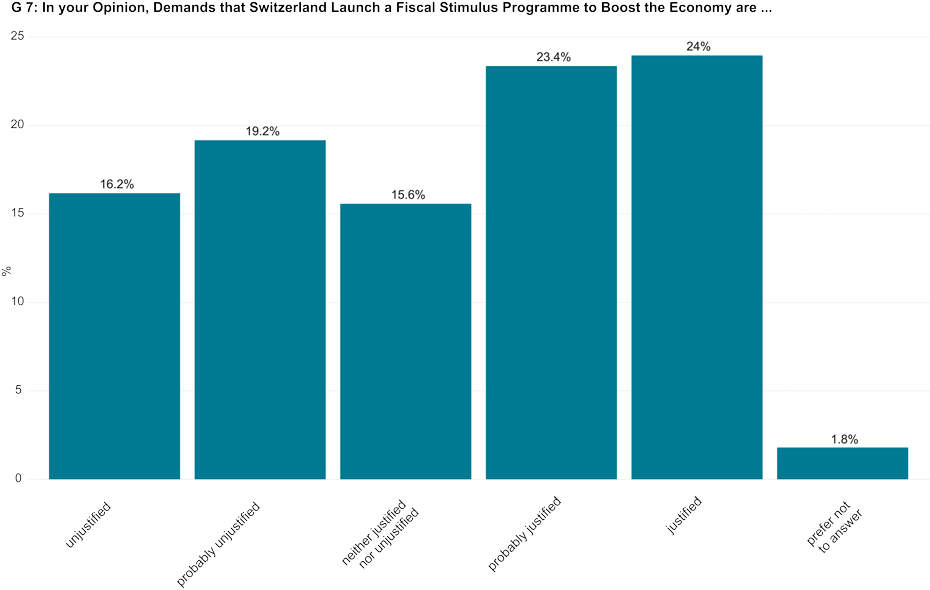

Some countries have launched fiscal stimulus programmes in order to accelerate economic recovery from the coronavirus crisis. In the United States, for example, an extensive support package has been put together that includes investment in infrastructure projects. The EU's reconstruction fund, on the other hand, relies to a large extent on investment in digitalisation projects and measures to combat climate change. In Switzerland, this type of fiscal stimulus package is currently not on the agenda. Whether such a programme might make sense depends on how the recession evolves, how the economy recovers, whether additional government spending is justifiable and whether the stimulus programme could cause inflationary pressures. The opinions of the economists surveyed differ: 47 per cent of survey respondents (tend to) support such stimulus for Switzerland, while 35 per cent (tend to) reject it (see G 7).

One in four wants to suspend debt brake during coronavirus crisis

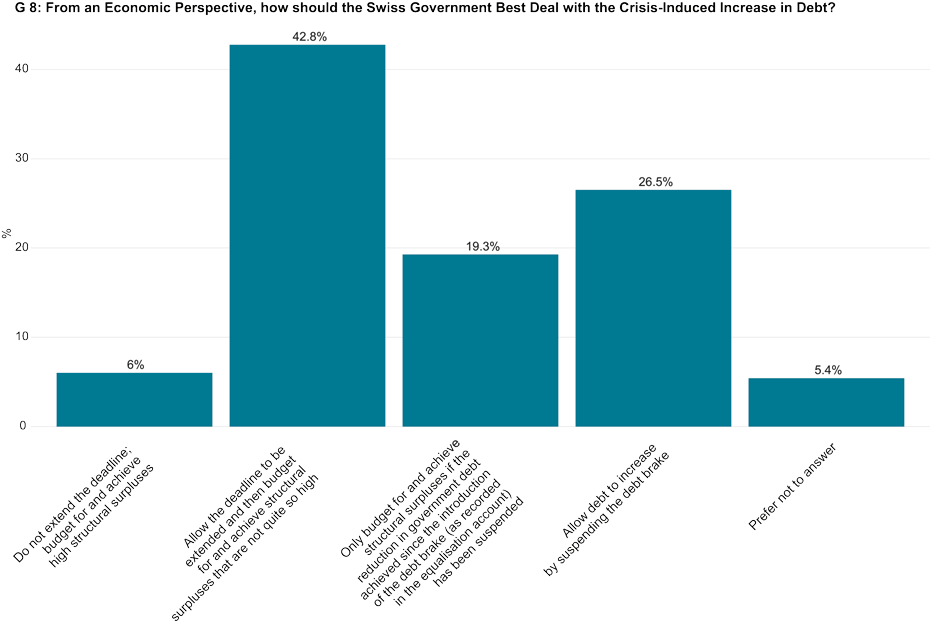

The debt brake, which came into force in 2003, obliges Switzerland’s federal government to stabilise nominal federal debt over the economic cycle. This is to ensure that the government’s room for manoeuvre is always guaranteed and should not be exploited at the expense of future generations. The rules applicable to the debt brake state that the extraordinary expenditures for coronavirus-related measures, which are charged to the amortisation account, must be paid off within six years through structural surpluses in the ordinary budget. These extraordinary expenditures amounted to around CHF 15 billion in 2020; after offsetting them against the balance of the amortisation account at the end of 2019, there was a deficit of just under CHF 10 billion on the amortisation account at the end of 2020.1 For 2021 the Federal Department of Finance (FDF) expects Switzerland to incur additional extraordinary expenditures amounting to CHF 21 billion.2 Economists were asked how the Swiss government should best deal with this increase in debt from an economic perspective. One option is to reduce the debt within six years, which would require large structural surpluses. However, it is questionable whether such high surpluses would be feasible at all and, secondly, the pressure to save could slow the economic recovery. Consequently, only 6 per cent of economists recommend this option (see G 8).

Alternatively, Switzerland’s Federal Assembly can extend the deadline for debt reduction in special cases under the Federal Budget Act, which would mean that structural surpluses would not need to be quite so high but would be spread over a longer period of time.3 This is the most frequently chosen option, accounting for 43 per cent of responses. A third option is to offset the deficit against the equalisation account.4 The shortfalls in the ordinary budget since the introduction of the debt brake are recorded in the equalisation account. In order to avoid supplementary credits, the administrative units always budget cautiously, which results in credit reserves. At the end of 2019 the positive balance on the (notional) equalisation account was CHF 28 billion.5 So if this balance (or part thereof) is transferred to the amortisation account, only some of the coronavirus-related debt would have to be reduced. Such offsetting against the equalisation account is advocated by 19 per cent of survey respondents. Another option is to suspend the debt brake and, accordingly, not to require structural surpluses in subsequent years. 27 per cent of economists chose this option. Proponents argue that federal government debt should decline as a result of future budget shortfalls even without structural surpluses. Moreover, the government debt ratio – i.e. the ratio of government debt to gross domestic product (GDP) – decreases in a growing economy even without debt reduction.

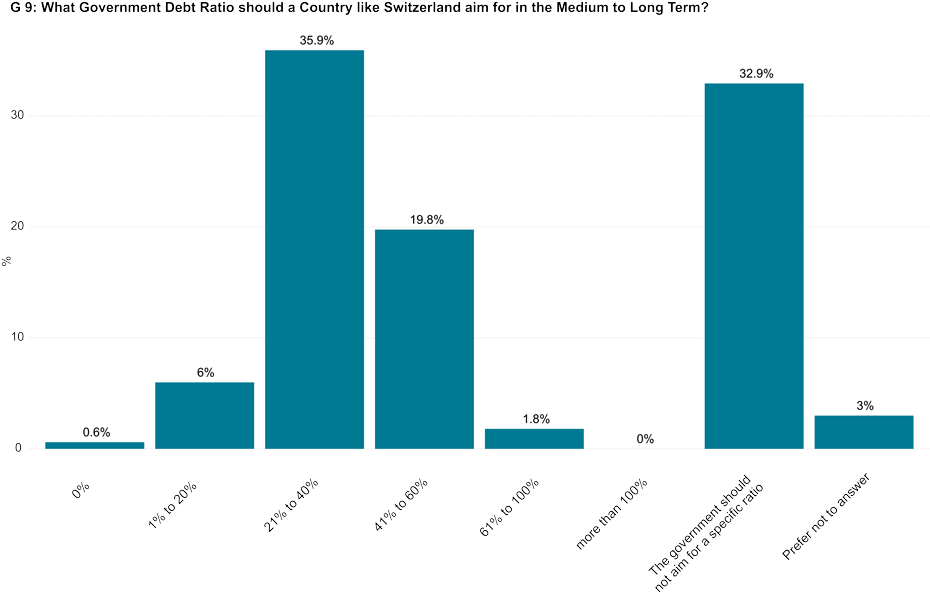

In 2019 – prior to the pandemic – Switzerland had a public debt ratio of around 26 per cent according to the Maastricht definition.6 This ratio was thus relatively low for Switzerland compared with other countries; the corresponding ratio in Germany, for example, was 60 per cent.7 Given the exceptional measures taken, the ratio in Switzerland is likely to rise to over 30 per cent by the end of the year.8 The economists were asked what government debt ratio a country like Switzerland should aim for in the medium to long term. A range of 21 per cent to 40 per cent was chosen most often, accounting for 36 per cent of responses (see G 9). 20 per cent of survey respondents stated that a ratio of between 41 per cent and 60 per cent should be aimed for, although such a ratio would probably require a long-term suspension of the debt brake. According to almost one-third of respondents, on the other hand, the government should not aim for a specific ratio. The reason for this response is probably that the debt ratio should not be considered in isolation: the sustainability of debt depends primarily on the nominal interest rate, future GDP growth, the currency of the debt, and the debt levels of other countries.

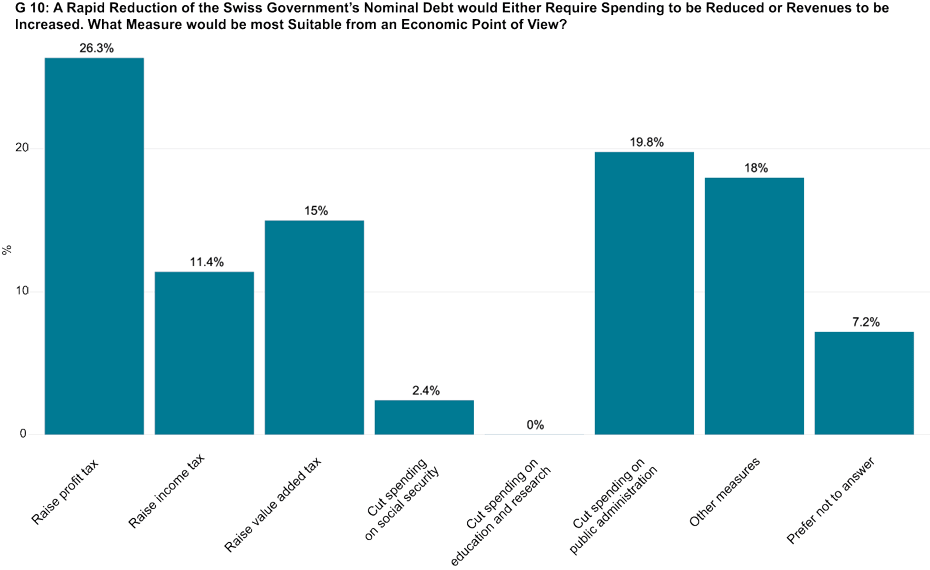

Another question asks what one specific measure the Swiss government should ideally take to reduce its debt. While 22 per cent of economists prefer spending cuts, 53 per cent are in favour of increasing revenues (see G 10). Raising profit tax is seen as the most suitable option, accounting for 26 per cent of responses. Other potential measures would be to reduce spending on public administration (20 per cent), raise value added tax (15 per cent), increase income tax (11 per cent), cut spending on social security (2 per cent) or reduce spending on education and research (0 per cent). Other measures are seen as most appropriate by 18 per cent.

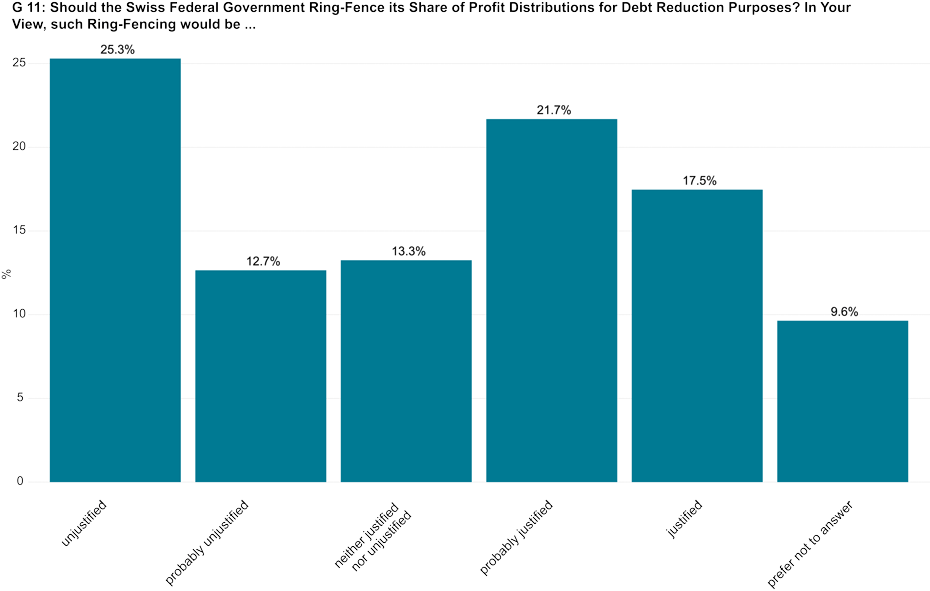

Opinions are divided on ring-fencing the SNB’s distributed profit

In order to enable the level of debt to be reduced rapidly, politicians are debating whether to ring-fence the profit distributed by the Swiss National Bank (SNB).9 The Finance Committee of the Council of States has suggested ring-fencing the SNB’s annual profit distributions of up to CHF 2 billion so that they can be used to reduce the Swiss government’s crisis-related debt.10 This way, the money would not be allocated to the budget, where other claims might be made on it. On the other hand, this would put political pressure on the SNB and thus compromise its independence. The economists who took part in the survey are divided on this point as well: 39 per cent are either wholly or partly in favour of ring-fencing these funds, while 38 per cent are either wholly or partly against it (see G 11).

----------------------------------

1) external page https://www.efv.admin.ch/dam/efv/de/dokumente/Finanzberichte/finanzberichte/rechnung/2020/rg1-2020.pdf.download.pdf/RG1_d.pdf (S. 24-26)

2) external page https://www.newsd.admin.ch/newsd/message/attachments/65609.pdf

3) external page https://www.fedlex.admin.ch/eli/cc/2006/227/de#art_17_b

4) external page https://www.nzz.ch/meinung/corona-ausgaben-zurueckzahlen-aber-nicht-alle-ld.1560133

5) external page https://www.efv.admin.ch/dam/efv/de/dokumente/Finanzberichte/finanzberichte/rechnung/2020/rg1-2020.pdf.download.pdf/RG1_d.pdf

6) external page https://www.efv.admin.ch/dam/efv/de/dokumente/Finanzberichte/finanzberichte/rechnung/2020/rg1-2020.pdf.download.pdf/RG1_d.pdf

7) external page https://www.efv.admin.ch/dam/efv/de/dokumente/Finanzberichte/finanzberichte/rechnung/2019/rg1-2019.pdf.download.pdf/RG1-d.pdf

8) external page https://www.bfs.admin.ch/bfs/de/home/statistiken/oeffentliche-verwaltung-finanzen/ausgaben-schulden.assetdetail.14960370.html

9) external page https://www.parlament.ch/press-releases/Pages/mm-fk-s-2021-03-23.aspx

10) external page https://www.snb.ch/de/iabout/snb/annacc/id/snb_annac_profit

The KOF-NZZ Economists’ Survey covers topics relevant to economic policy in Switzerland and provides a means of making the views of research economists visible to the public. KOF’s media partner in the preparation and interpretation of the Economists’ Survey is Switzerland’s Neue Zürcher Zeitung (NZZ) newspaper. Further information on the Economists’ Survey is available here.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland