Negative Interest Rates I: Companies’ Assessment of Monetary Policy

- Monetary Policy

- Swiss Economy

- KOF Bulletin

- Surveys

Five years after the suspension of the minimum exchange rate of the Swiss franc, the manufacturing industry is still complaining about lower competitiveness on the eurozone markets and the excessive strength of the Swiss franc compared to the euro. For the majority of companies, the advantages and disadvantages of the negative interest rate policy balance each other out. However, as a special KOF survey shows, financial institutions have a very different view on the matter.

January marked the fifth anniversary of the suspension of the minimum exchange rate. KOF has taken this occasion to add special questions to a section of its regular Business Tendency Surveys, focussing predominantly on the subjects of competitiveness, the negative interest rate policy and the exchange rate. These questions were only presented to the participants of the online survey. Although the results are not universal, they indicate certain trends in the assessments of the Swiss companies. More than 3,900 companies were invited to take part in the online survey, of which 2,048 submitted responses to the special questions. This corresponds to a response rate of 52%.

What is your competitive position today compared to the situation before the suspension of the minimum exchange rate of the Swiss franc in early 2015? This is what KOF wanted to find out. The competitive position can be affected by a number of factors, especially if one looks at a period of several years. While the exchange rate is an important factor, it is certainly not the only one. The economic policy framework, technological developments and other structural factors, for instance, may also play a crucial role. Nevertheless, this question is relevant to our analysis of the current situation.

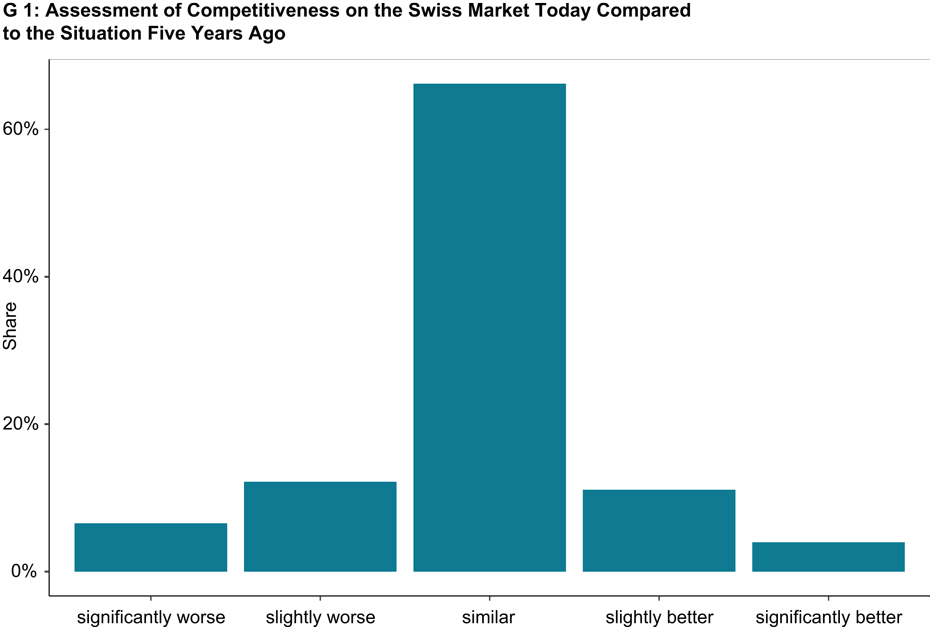

Competitiveness: individual sectors are still affected

The first sub-question relates to competitiveness on the domestic market, i.e. Switzerland. At around 66%, the majority of the companies rate their current competitiveness on the domestic market as similar to five years ago (see Graph G1). Critical voices can be heard more frequently in the retail trade. However, the results should be interpreted as a rough tendency and taken with a pinch of salt. Few assessments were provided by the retail trade, since the survey was carried out in cooperation with the Swiss Federal Statistical Office and the special questions could be submitted to a few companies only. Nevertheless, the scepticism voiced by a number of retail companies appears plausible since purchases abroad have become more attractive thanks to the stronger Swiss franc. Moreover, sections of the traditional retail trade have come under pressure from growing online trade.

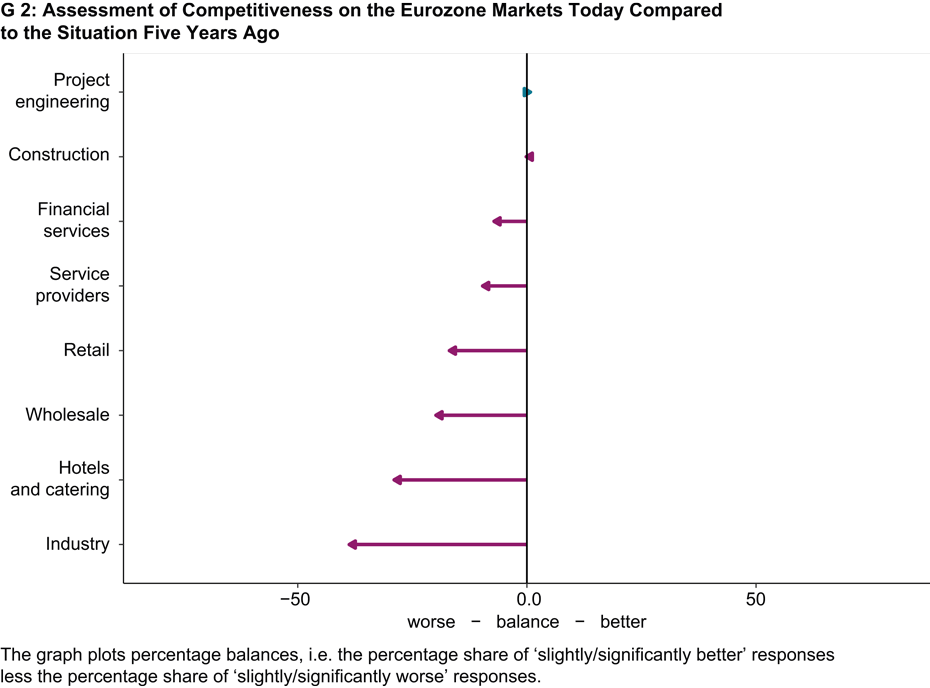

In respect of the eurozone markets, approximately half of the respondents which are active on these markets state that their competitive position is now similar to five years ago (51%), and around 13% describe it as slightly or significantly better. By contrast, 36% of the companies rate their competitiveness as slightly or significantly worse. Hotels and catering companies express an above-average level of dissatisfaction with their competitiveness on the eurozone markets (in relation to the number of eurozone guests), as does the manufacturing industry (see Graph G2). Among the manufacturing companies which serve this market, a clear majority (58%) rate their competitiveness as slightly or significantly worse than five years ago.

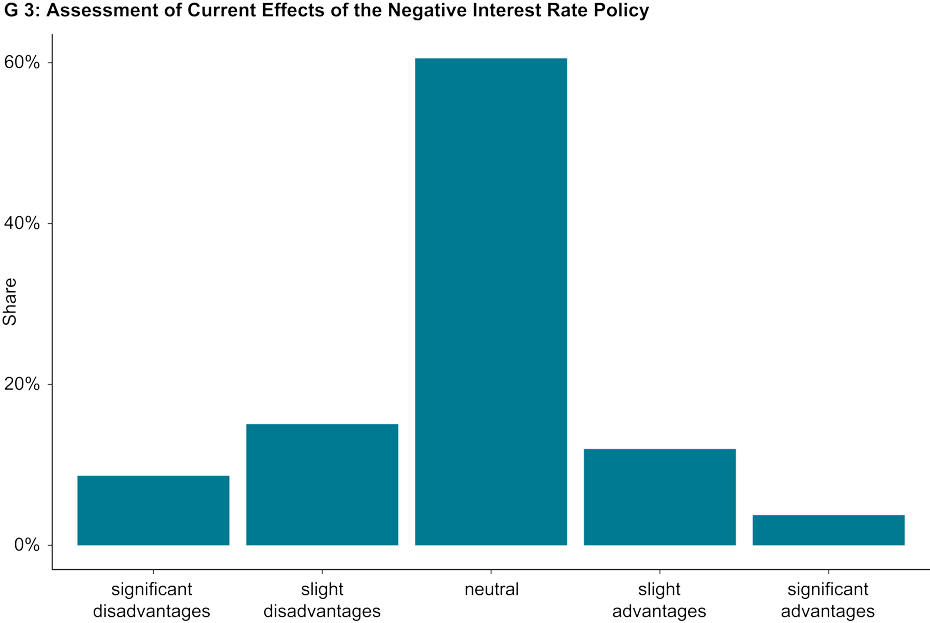

Negative interest rates: financial institutions and construction sector break the mould

60% of the companies assess the current effect of the negative interest rate policy as neutral with pros and cons balancing each other out (see Graph G3). 16% perceive slight or significant advantages, while an even higher percentage (24%) see slight or significant disadvantages.

By contrast, the financial and insurance services providers show a clear trend, with 65% stating that the cons outweigh the pros (25% slightly, 40% significantly). No other sector expresses such clear disapproval of the negative interest rate policy. By contrast, the construction industry generally rates the negative interest rate policy as slightly positive. The financial and insurance services providers draw a gloomy picture of the negative interest rates, most likely due to the impact of this policy. 48% of the financial institutions state that they are slightly affected and 36% that they are significantly affected by the negative interest rates. These are the highest percentages of all sectors.

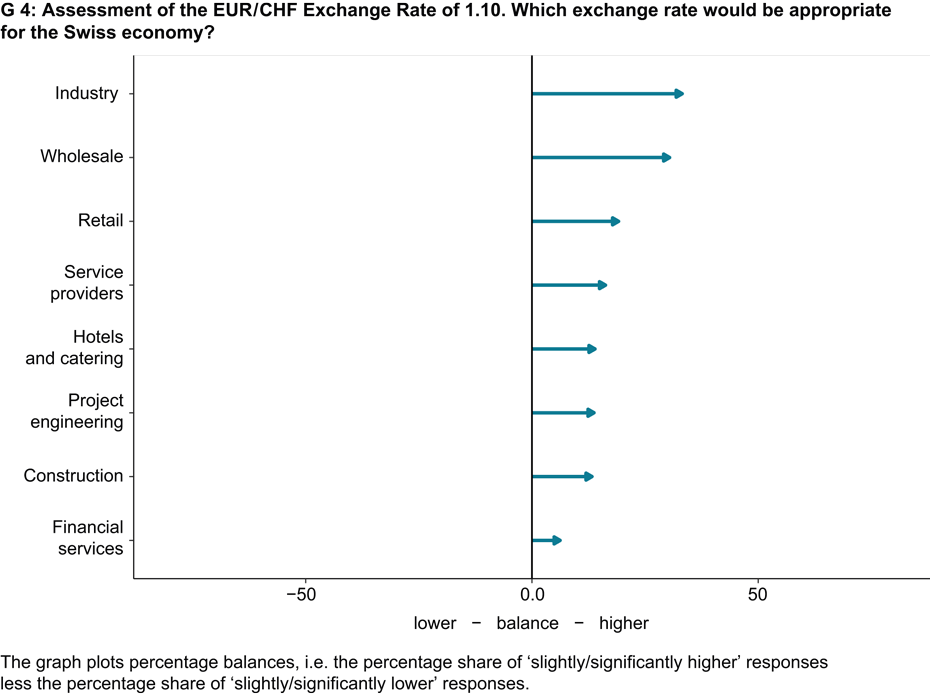

Swiss franc exchange rate: sectors diverge

Furthermore, the companies were asked about their view on the euro/franc exchange rate. Is a euro/franc exchange rate of around 1.10 currently appropriate for the Swiss economy, or should it be higher or lower? If the Swiss franc is overvalued, the exchange rate should be higher. 27% of the companies think that the exchange rate should be slightly higher and 11% that it should be significantly higher. Close to 53% consider the rate to be appropriate, while just under 10% state that it should be slightly or significantly lower - which means that the Swiss franc is undervalued. However, it should be remembered that the Swiss franc has gone up slightly since the survey was conducted.

All in all, we can conclude that close to 38% of the companies believe that the Swiss franc is overvalued, while over 62% do not specifically share this opinion. However, the assessments vary according to sector (see Graph G4). In the manufacturing industry as many as 52% of the companies state that the Swiss franc is too strong. Hence, as well as tending to believe that the Swiss franc is overvalued, manufacturing businesses in particular also tend to complain about lower competitiveness on the eurozone markets.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland