Global economy bounces back after slump

- KOF Bulletin

- World Economy

While the economies of China and the United States have already rebounded significantly from the coronavirus pandemic, the recovery in Europe has been sluggish. From the second quarter onwards, however, KOF expects this recovery to progress in Europe as well thanks to the vaccination campaigns and a slight easing of restrictions.

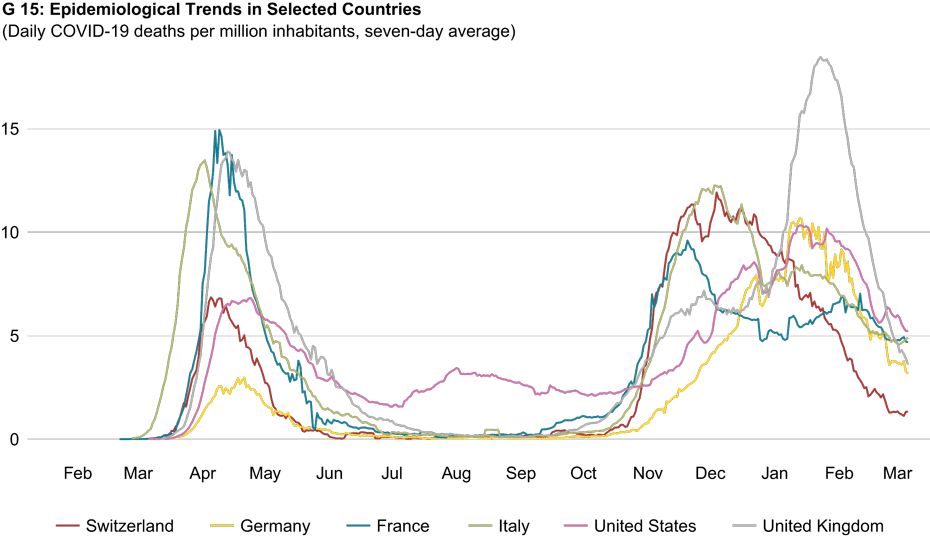

After the first wave of the COVID-19 pandemic had passed by the end of summer 2020, restrictions were relaxed in many places. By adopting a strict test, trace and isolate policy, infection rates were kept low in various East Asian countries and the crisis was quickly overcome. In Europe, however, a resurgence of infections in the autumn led to a second wave (see G 15). Whereas only local restrictions were imposed in the United States, many European countries decided to reintroduce stricter measures at national level in late autumn and winter. The measures taken proved to be much less restrictive – at least on economic activity – than during the first wave. The more targeted measures mainly consisted of the closure of personal-contact services and the introduction of curfews, international travel restrictions and stricter ‘social distancing’ requirements, which particularly affected private consumption. The transport, hospitality, retail, arts, entertainment and leisure sectors continue to be hit hard. Restrictions were not imposed on much of manufacturing industry and the construction sector.

Asymmetric recovery across sectors

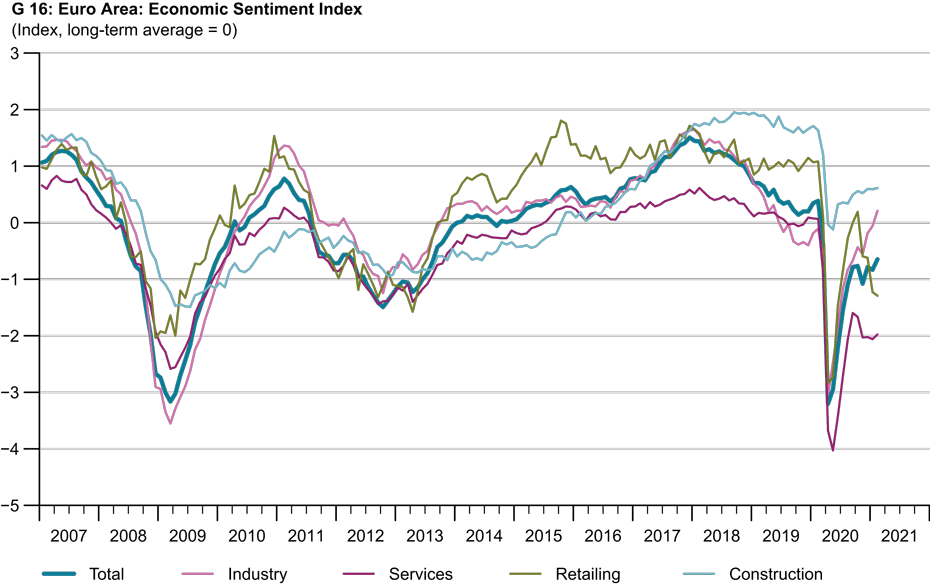

The approval of various vaccines since the end of last year and the launch of international vaccination campaigns to combat the virus have fuelled hopes of a rapid end to the pandemic. However, the emergence of new, highly contagious virus variants from the United Kingdom, South Africa and Brazil as well as the sluggish progress of the vaccination campaigns in many countries have clouded the future outlook. Continued high infection rates in many places have led to restrictions being extended further and the movement of people across borders being limited. This trend is also reflected in the overall purchasing managers' index for the euro area, which continues to show weak momentum and most recently rose to 48.8 in February. This increase was mainly due to manufacturing industry, while the services sector continued to slide in February. The Economic Sentiment Index also rose in February but remained below its long-term average, suggesting weak momentum in the first quarter of 2021. However, there is a sharp divergence between sectors here. Sentiment in construction and manufacturing is already optimistic again and the indicator is on an expansionary path. Services and the retail sector, on the other hand, continue to suffer from the restrictions and point to a renewed decline in value added in the first quarter (see G 16). In the United States, by contrast, both industrial output and the retail sector grew in January. The US Purchasing Managers' Index (ISM) continued to rise well above its expansion threshold, not least because of the economic stimulus packages that have been passed.

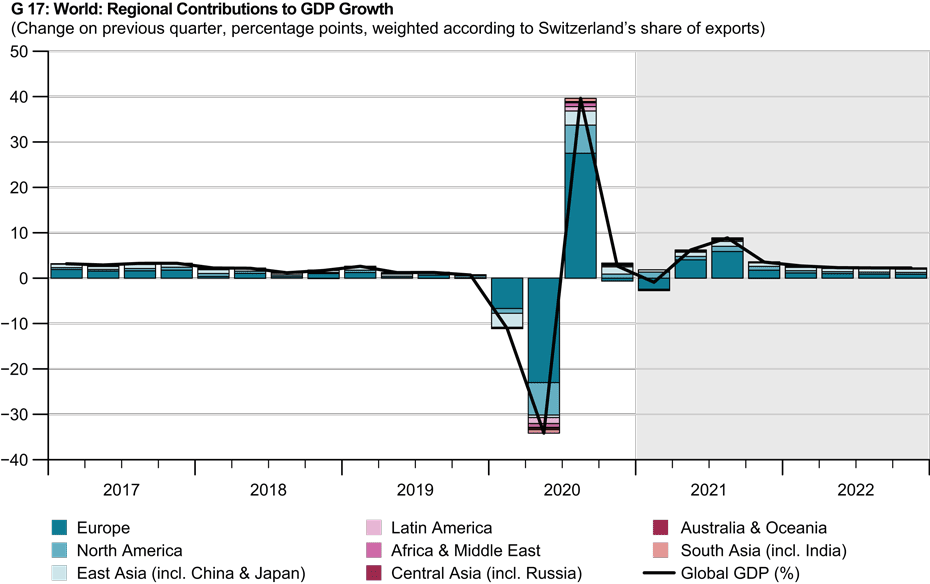

From a Swiss perspective the global economy is likely to deteriorate slightly in the first quarter of 2021 following positive growth in the fourth quarter of 2020 on the back of strong stimulus from East Asia and the United States (see G 17). During the first quarter the Chinese economy is likely to return further towards normality and the US will continue along its path of economic recovery. In contrast, the euro area remains in the midst of the crisis as a result of the second wave of the pandemic. After GDP declined by 2.6 per cent on an annualised basis last year, output is expected to fall again in the first quarter of 2021. However, this slump will be much more moderate than during the first wave. The industrial sector is currently benefiting from robust domestic and external demand, and business-related services have proved more resilient than during the first wave. Personal services, hospitality, and the arts and culture have suffered to a similar extent as in the first lockdown. This is also reflected in private consumption, which remains severely constrained by the restrictions. GDP in the United Kingdom is also expected to decline sharply in the first quarter of 2021, falling by 16.3 per cent on an annualised basis. Coming on top of a renewed strict national lockdown, the end of the country’s membership of the EU’s single market and customs union in December 2020 and its resultant supply chain problems will also play a role here.

KOF expects a global recovery to begin in the second quarter. As vaccination campaigns progress, restrictions should be eased worldwide and lead to encouraging growth rates. From Switzerland's perspective the global economy will pick up speed in the third quarter thanks to catch-up effects from private consumption and stronger investment momentum. Fiscal measures such as the ‘Next Generation EU’ package, the economic stimulus programmes in the Unites States and the continuation of expansionary monetary policy will further support the recovery of the global economy. Various restrictions such as ‘social distancing’ measures in public places and increased controls on international travel will remain in place for some time but will have a limited impact on value creation. In the medium term, however, higher unemployment rates and low labour force participation rates, as well as high levels of private and public debt, are likely to weigh on spending and economic activity.

The latest economic forecast for Switzerland can be found in the external page KOF Economic Forecast of the end of March.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland