The Swiss construction sector during COVID-19

- Construction Industry

- KOF Bulletin

The business situation in the Swiss construction sector deteriorated sharply in April. Construction site closures in parts of Switzerland and hygiene regulations are delaying ongoing construction projects. KOF expects construction investment to decline by 2.0 per cent in real terms in 2020.

Construction sites in some regions of Switzerland were closed at the beginning of the lockdown. Ticino closed them from 21 March to 4 May. Geneva and Vaud closed construction sites for only a couple of days, but they are often inspected to check whether the hygiene regulations are being followed. These measures caused a high degree of uncertainty in the construction sector at the beginning of the lockdown. It was unclear at times whether construction sites would be closed nationwide and how strictly and regularly they would be inspected.

Large proportion of short-time working in the construction sector

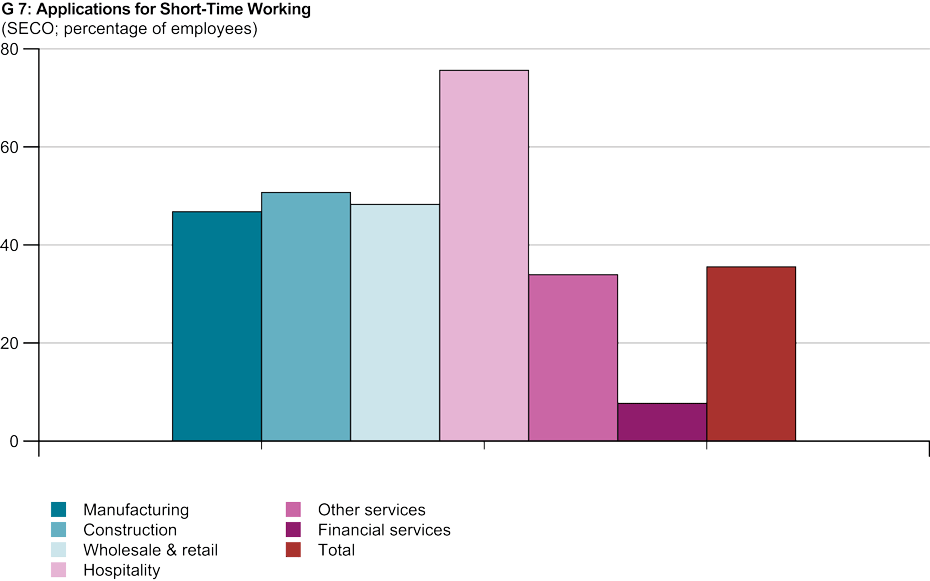

The number of short-time working applications across the economy as a whole rose to 1.8 million in April. By way of comparison, 92,000 individuals were on short-time working during the financial crisis. In the construction sector there had been short-time working applications for 51 per cent of employees by April (Graph G 7). Only the hospitality industry had an even higher proportion (76 per cent). The Swiss average was 36 per cent. In the past, 80 per cent of short-time working applications have actually been utilised. The large proportion of applications in the construction industry may be related to the high degree of uncertainty about construction site closures.

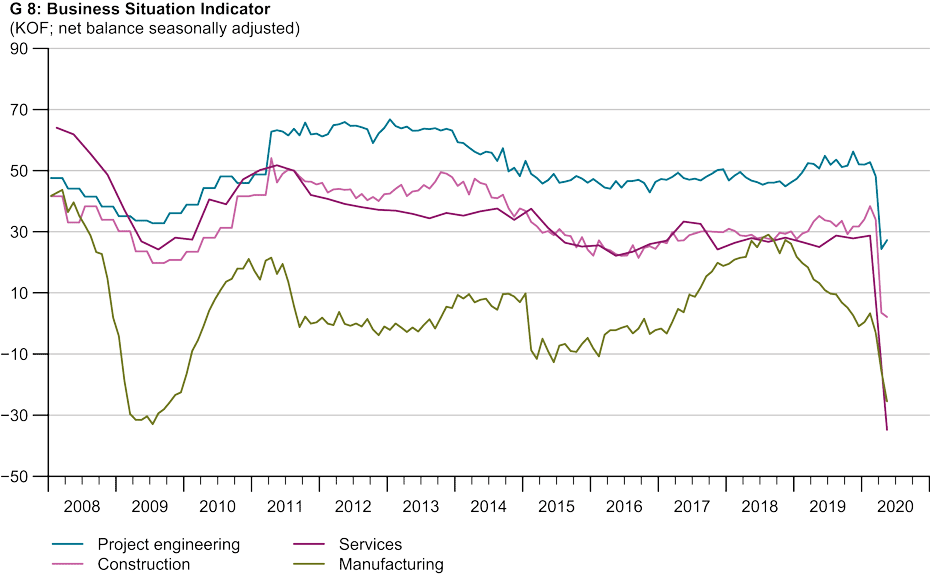

Business activity in all sectors of the Swiss economy slowed significantly in April (Graph G 8). The KOF Economic Barometer suffered the strongest monthly decline since the indicator had started to be calculated. The service sector and the hospitality industry recorded the sharpest drop in the Business Situation Indicator. Construction companies also became more pessimistic about the economic situation. The Business Situation Indicator for the construction sector fell from 34 points in March to four points in April (on a seasonally adjusted basis). The business situation of civil-engineering companies deteriorated the most.

Uncertainty may have abated slightly

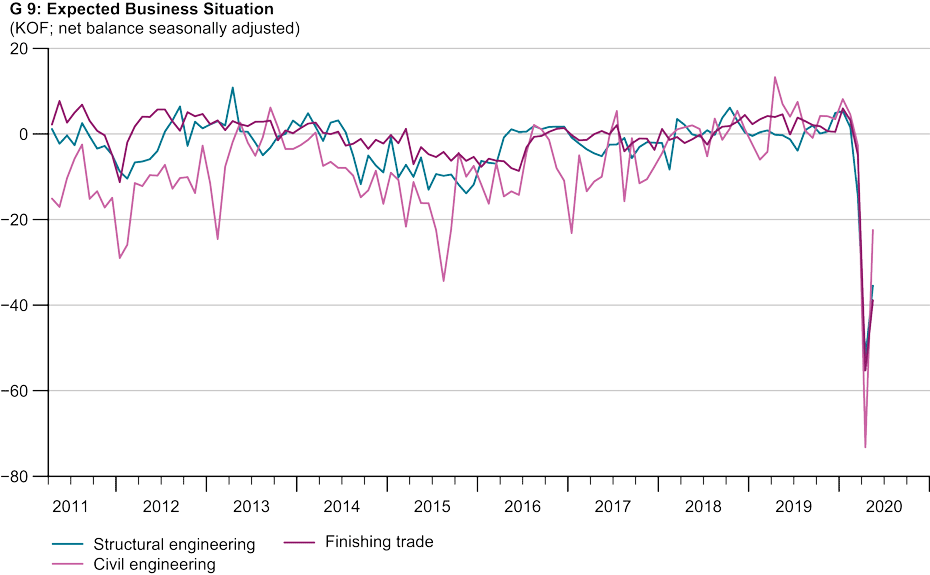

However, preliminary results for May suggest that the Business Situation Indicator remained flat in the construction sector while it continued to decline in manufacturing. Furthermore, construction companies’ expectations about their business situation over the next six months improved compared with April (Graph G 9). This could be a sign that the uncertainty existing at the beginning of the lockdown may have already abated to some degree.

However, the decline in the construction sector is less pronounced than in other industries of the Swiss economy. Furthermore, the construction sector has performed very well in the last few years with the result that, despite declining, the current Business Situation Indicator is still in positive territory. Although major projects are being delayed because of hygiene restrictions, they will – according to the latest information available – nevertheless be completed, and construction companies’ order books are well stocked.

Economic outlook

The economic forecast for the construction sector has been revised downwards substantially. KOF currently expects real-terms construction investment to fall by 2.0 per cent in 2020 and by 1.4 per cent in 2021. Although the recession in the construction sector is less pronounced than in the economy as a whole, the recovery is likely to take longer.

Industrial and commercial construction in particular as well as residential construction will probably suffer. The civil-engineering sector is expected to be more robust thanks to two infrastructure funds that will secure the financing of Swiss infrastructure in the long term. The aim of these two funds is to decouple infrastructure investment from cyclical influences on the federal budget. Switzerland’s high fiscal spending is therefore expected to have only a minor impact on its capacity to finance future infrastructure projects.

Contact

No database information available