Company bankruptcies returning to pre-crisis levels

KOF Bulletin

Government support measures have meant that far fewer companies have had to file for bankruptcy since the start of the coronavirus crisis than in normal times. Recently, however, corporate bankruptcies have risen sharply, returning to pre-crisis levels. This trend is broadly based both sectorally and regionally.

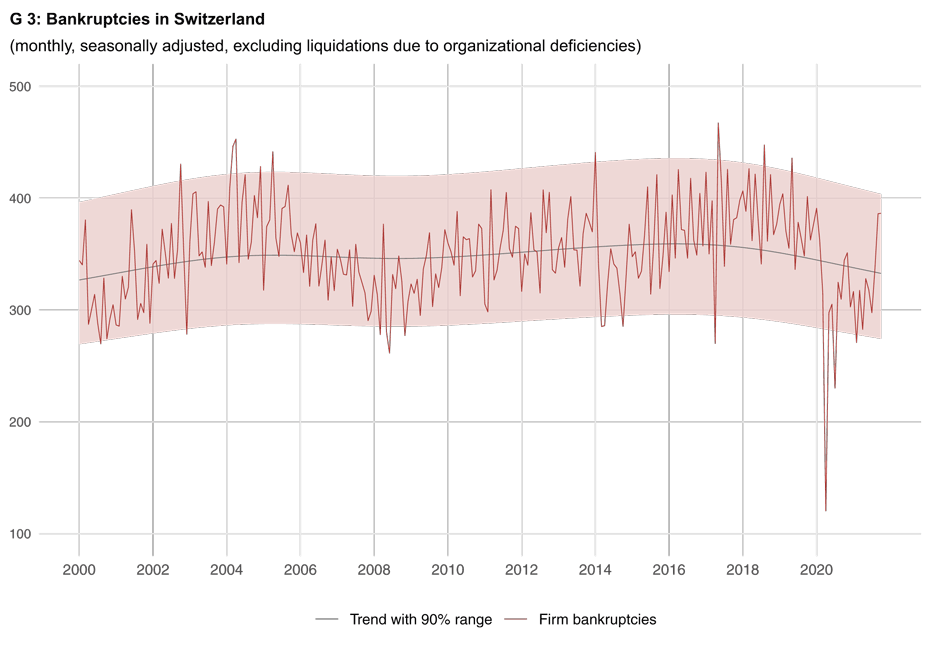

KOF examines company bankruptcy trends based on commercial register figures collected and processed by Dun & Bradstreet Schweiz AG. The current paper by Florian Eckert and Heiner Mikosch provides a detailed evaluation. The data show that the number of monthly company bankruptcies plummeted at the beginning of the COVID-19 crisis. Corporate bankruptcies in 2020 were on average about 19 per cent lower than in 2019, and they are expected to remain more than 10 per cent below pre-crisis levels in the current year. One reason for this is the economic and legal support measures provided by the government – such as easier access to short-time working, the COVID-19 loan scheme and hardship assistance.1 These bridging measures have enabled much of the economy to withstand any pandemic-related cyclical disruption. As the economy bounces back, corporate bankruptcies have returned to pre-crisis levels (see G 3).

Economic policy measures affecting the numbers of bankruptcies

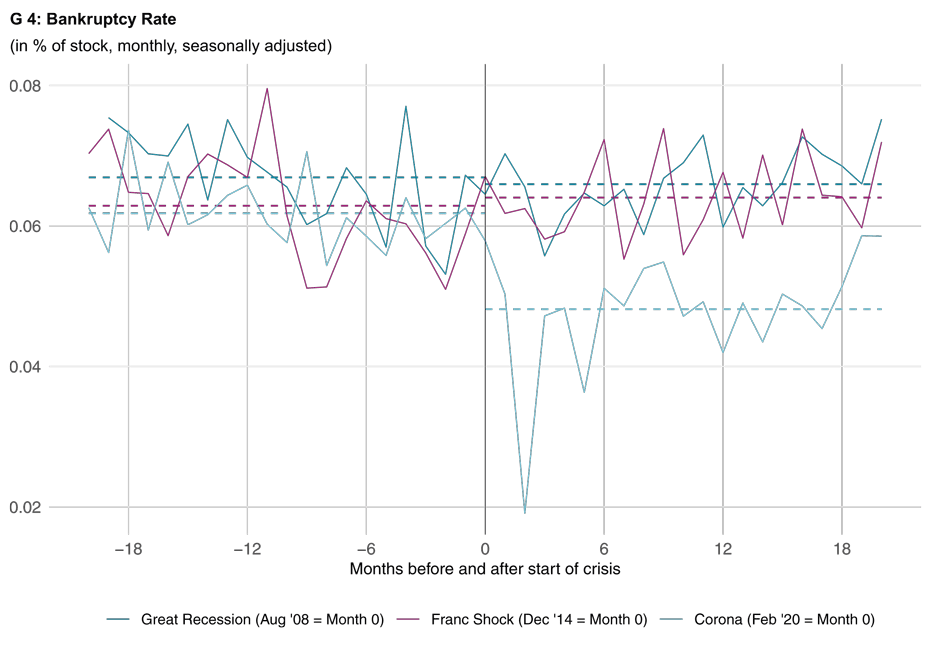

A comparison with previous crises reveals the exceptional nature of the coronavirus crisis. Whereas the Great Recession of 2008 and the Swiss franc shock of 2015 were not immediately followed by fluctuations in the bankruptcy rate, a different trend has been observed during the COVID-19 crisis. The official support measures provided meant that the bankruptcy rate fell from over 0.06 per cent before the crisis to 0.02 per cent in April 2020. It gradually picked up again until the autumn of 2020 but then fell back to 0.05 per cent, probably partly thanks to the cantonal hardship assistance offered to particularly hard-hit companies. In the late summer of 2021, however, the bankruptcy rate continued to return to normal, rising sharply, and is now almost back at its pre-crisis levels (see G 4).

Volatile trends in the sectors

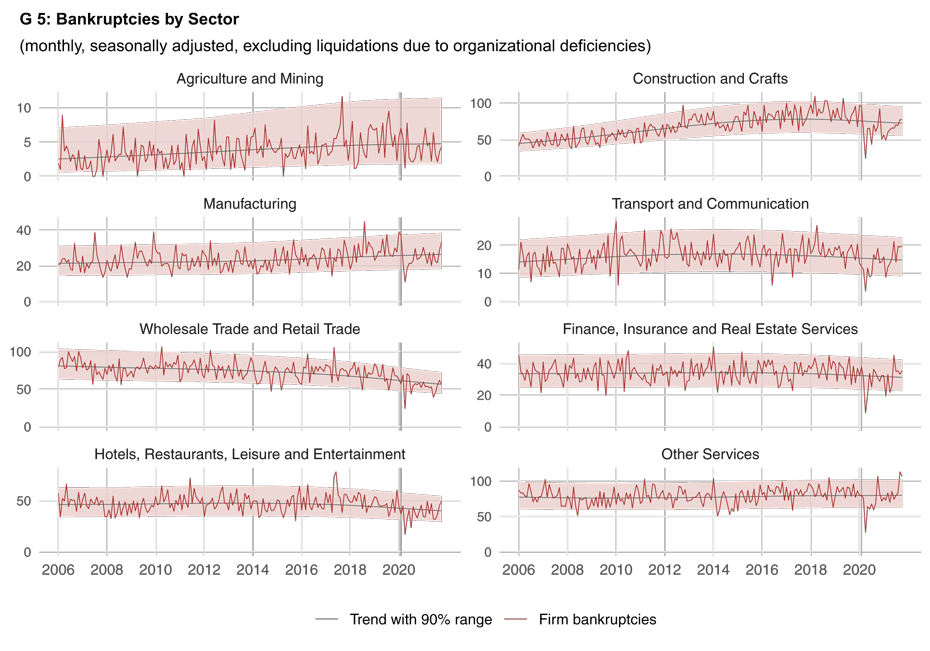

Sectoral analysis is hampered by the volatile nature of the disaggregated data. However, the trend for Switzerland as a whole is also evident – to a greater or lesser extent – in most sectors. The latest increase is mainly due to bankruptcies in other services such as business and tax consultancy, IT services, personal services and other business services (see G 5). A temporary surge in bankruptcy numbers in individual sectors occurs sporadically – most recently, for example, last summer in financial, insurance and real-estate services. However, these fluctuations are often of a temporary nature and should not be interpreted as the start of a wave of bankruptcies. Bankruptcy figures in the hospitality and entertainment sector and in the transport and communications sector, which were hit particularly hard by the pandemic, have recently moved back above their long-term trends but remain within the 90 per cent volatility range. Regional analysis shows that the most recent increase was particularly pronounced in the major regions of Central Switzerland and Espace Mittelland.

The wave of start-ups is gradually subsiding

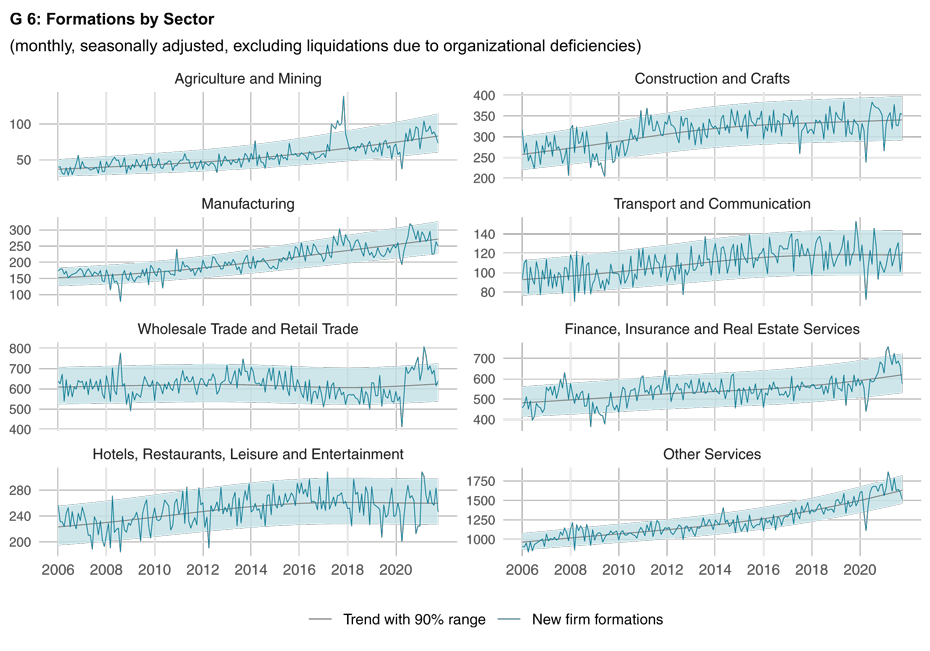

The pandemic has triggered or at least accelerated structural change in many sectors. Swifter digitalisation has fuelled a real start-up boom in the wholesale and retail sector and in the financial services, insurance and real-estate sector in particular. The numbers of start-ups in these industries have been extremely high since the summer of 2020 and have been undiminished by the impact of the second wave of coronavirus and the associated restrictions such as the closure of non-essential retail outlets. However, this trend has also returned to normal recently (see G 6).

Risk of a wave of bankruptcies remains low

Corporate bankruptcies are likely to continue to rise gradually owing to catch-up effects in particularly strongly supported sectors as well as higher levels of corporate debt. In addition, changes in consumer preferences have triggered structural change in some sectors, which is also likely to increase the bankruptcy rate – for example in the hospitality and retail sectors. However, these structural adjustments are likely to emerge only gradually as the epidemiological and economic situations return to normal. Nonetheless, the swift economic recovery and the targeted support provided to sectors affected during the pandemic are likely to ensure that the risk of a large wave of bankruptcies remains low.

----------------------------------------

1) The immediate reasons for the sharp fall in bankruptcies in spring 2020 were the legal standstill ordered by the Federal Council (19 March to 4 April 2020), the subsequent debt collection holidays (until 19 April) and the suspended obligation to report over-indebtedness (until the end of October 2020). The federal government’s COVID-19 loan scheme, under which companies were able to obtain state-guaranteed bridging loans on favourable terms and without much red tape until July 2020, is likely to be a major reason why there have not been significant catch-up effects to date. The expansion and simplification of short-time working have also enabled the companies affected to cover their staff costs. Particularly hard-hit firms receive additional contributions in the form of the cantonal hardship assistance available since 2021.

References

Mikosch, Heiner and Eckert, Florian (2021): Firm Bankruptcies and Start-Up Activity in Switzerland During the Corona Crisis, KOF Working Papers, No. 499.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland