trendEcon: Daily economic indicators based on Swiss Google search trends

- Swiss Economy

- KOF Bulletin

- Indicators

COVID-19 is causing the economy to change much faster than usual. To capture these rapid changes, a team of researchers has developed new economic indicators based on Google search trends. The indicator for the perceived economic situation has fallen more sharply in recent weeks than during the financial crisis. Some indicators of private consumption have already reached pre-crisis levels, while others have not yet recovered.

The economic situation is currently changing faster and more drastically than usual as a result of the COVID-19 pandemic. Common economic indicators are often only available with a delay of several months. They therefore provide little information on the effects that the drastic healthcare and economic policy measures are having on economic activity. It is against this background that the trendEcon project was created, which produces a series of economic indicators for Switzerland based on Google search trends. These indicators are updated daily and provide decision-makers in politics and business with up-to-date information on consumer behaviour and the public’s perception of the economic situation.

Searches on Google say a lot about the perceived economic situation and the demand for certain products and services. For example, when people become unemployed or are worried about their jobs, they search for words like ‘unemployed’. People who want to buy clothes are likely to type in the names of fashion stores like H&M or Zara. Thus, changes in relative search volumes tell us something about changes in unemployment and the demand for consumer goods.

The methodology behind the indicators

A team of KOF researchers and economists from other institutions have produced a total of seven indicators in their spare time. First, suitable search terms were collected for each indicator. Numerous search terms are possible for each topic. In some cases, however, the search volumes are too small or certain terms do not exist throughout the entire analysis period or are not equally popular. As the results for the French terms were similar to those for the German terms, but the French words suffered more from the problem of excessively small search volumes, only German words were used.

The appropriate search terms and their daily search volumes were downloaded from Google Trends. The data was seasonally adjusted, which includes, for example, correcting for the day of the week, as search behaviour on weekends is different from that on working days. The first main component of the data was then drawn to create the indicators, which means that the most meaningful linear combination of variables is used per indicator.

Perceived economic situation deteriorating significantly

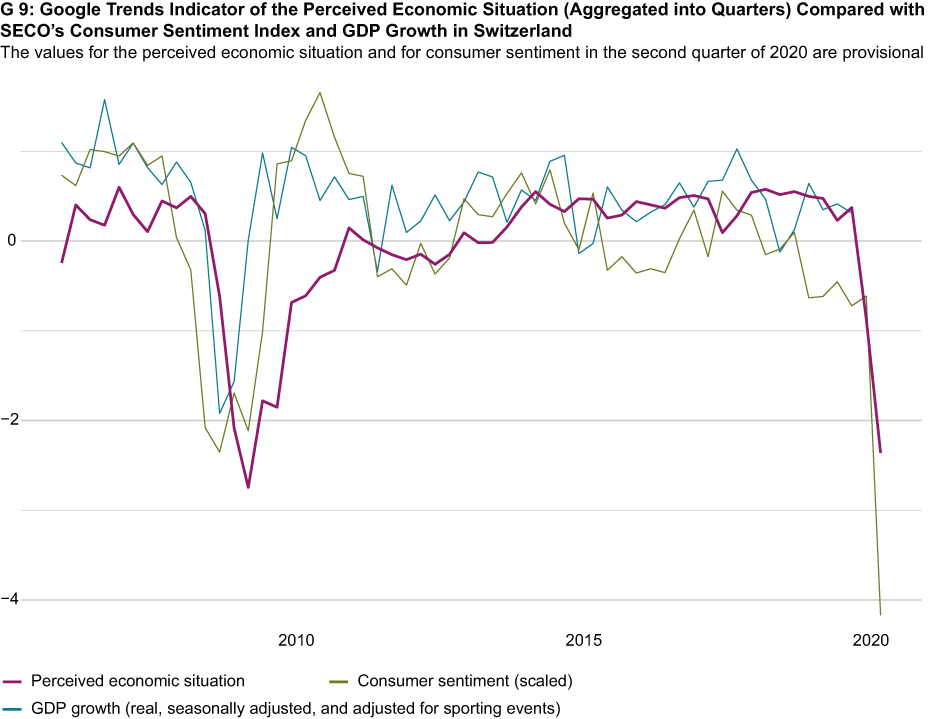

The main indicator, the perceived economic situation, contains search terms such as ‘economic crisis’ and ‘insolvency’. These reflect the public’s concerns about the economy and their personal situation. A comparison with quarterly economic growth (gross domestic product, or GDP) and the consumer sentiment index of the State Secretariat for Economic Affairs (SECO) in Chart 9 confirms that the indicator provides a good picture of macroeconomic trends. This can be seen, for example, in the slump caused by the financial crisis in 2008/09 and the subsequent recovery. According to the provisional data, the fall in the indicator in spring 2020 is more pronounced than during the financial crisis.

Private consumption: some indicators have already recovered

Another six indicators depict individual components of private consumption. Economic forecasters are interested in changes in the levels of consumer spending over time, since private spending in Switzerland accounts for more than half of GDP on the consumption side. Moreover, in this crisis, private consumption is particularly strong owing to the closure of restaurants, shops, cinemas, etc. and is unusually restricted on the supply side.

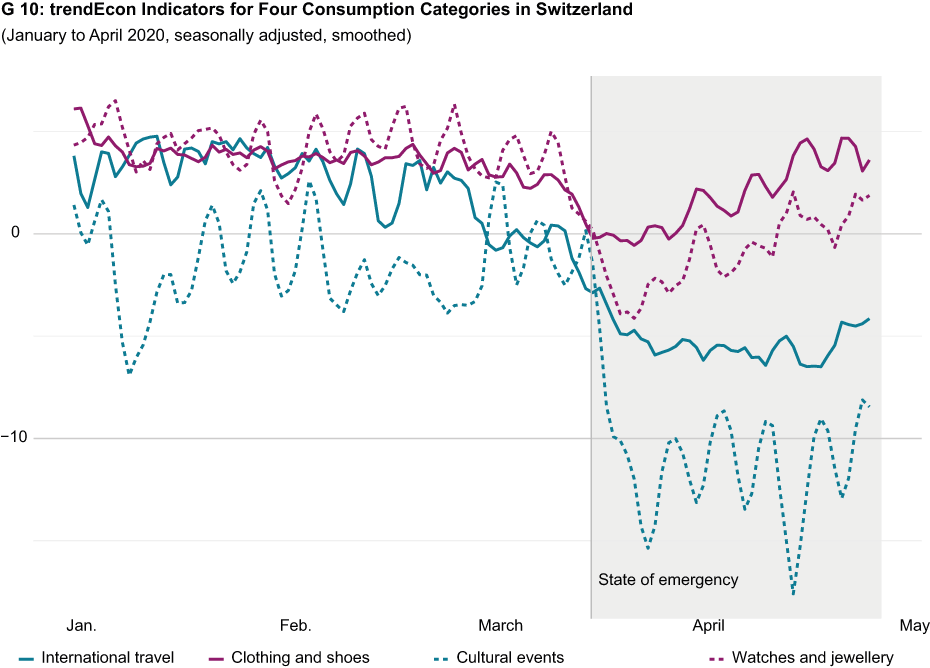

The four consumption indicators in Chart 10 show a sharp decline since a state of emergency was declared on 16 March 2020, with the indicator for international travel falling as early as the end of February. However, a recovery has been emerging for some time now. Although the indicator for clothing and shoes temporarily collapsed, it has since recovered to its pre-crisis level.

The sharp decline in the volume of searches for cultural events such as theatre or concerts is not surprising. Here it will be interesting to monitor future trends: will people immediately demand cultural events to the same extent as before the crisis once the restrictions have been eased or lifted, or will they wait for a certain time for fear of infection? Perhaps demand will also increase because the need for social consumption is considerable – or perhaps cultural consumption patterns will change permanently. Fluctuations in the watches and jewellery indicator over time also provide valuable information on consumer sentiment among the general public. Economic uncertainty generally reduces demand for expensive purchases and luxury consumer goods.

Further information on methodology, additional indicators, interactive charts and the data is available at external page www.trendecon.org. The indicators are the result of an unpaid collaboration between economists from the data consulting company external page cynkra, the KOF Swiss Institute for Business Cycle Research at the Swiss Federal Institute of Technology Zurich, the external page Economic Forecasts Department of the State Secretariat for Economic Affairs (SECO), the external page Swiss Federation of Trade Unions and the external page University of St Gallen. For a list of all participants please consult the external page team page.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland