COVID-19 fiscal measures: merely announcing them has an effect

Switzerland’s COVID-19 policy was federal in nature, with the cantons taking specific support measures to limit the economic slump caused by the various challenges. Recent unpublished analysis of these measures suggests that they managed to stabilise business expectations in terms of demand, production, employment and the general outlook as soon as they were announced.

The COVID-19 pandemic caused numerous industries to shut down temporarily. Companies were faced with a high level of uncertainty and had to cope with significant fluctuations in demand, their own output and supply chains. These slumps were largely caused by far-reaching economic restrictions imposed at home and abroad to protect the population. The effects of these restrictions were felt in various sectors, with some being more severely affected than others.

The Swiss government responded to these challenges by adopting a wide range of measures. In total, over 1,300 measures were implemented in Switzerland to support the economy. These included emergency loans, non-repayable grants and other forms of financial support. The initial measures taken at federal level were followed by individual initiatives adopted by the cantons. The cantonal measures designed to support the local economy varied both in terms of when they were implemented as well as their type and number.

What do we learn from business expectations?

Expectations play a decisive role in economic outcomes. During crises, companies must form expectations in order to be able to plan despite the fast-moving situation. The specific information that firms use for this purpose is the subject of extensive research. Recent studies have empirically shown that business expectations are also good indicators for determining future key performance indicators such as output and prices (Enders et al. 2022; Bachmann and Elstner, 2015). This analysis uses the example of COVID-19 to examine the role of government support measures in the formation of business expectations. The focus here is on demand, output, employment and price forecasts.

It is difficult to predict whether companies will adjust their expectations when the government offers potential financial support such as emergency loans or the deferral of outstanding repayments. While one might naturally assume that the prospect of support funding would boost positive expectations, the ongoing uncertainty resulting from the crisis may override this information. The measures adopted could be seen as too insignificant or too risky. Alternatively, firms may ignore or fail to notice these measures, potentially preventing any expectation effect.

Announcement of support measures stabilises business expectations

In order to analyse the effects that support measures have on business expectations, KOF economists Jan-Egbert Sturm, Vera Eichenauer, Andreas Dibiasi and Remo Gurtner have taken advantage of the fact that the cantons introduced these measures at different times. The business forecasts are taken from the monthly KOF Business Tendency Surveys, which collect qualitative data on firms’ expectations, among other things. The dataset from Eichenauer et al. (2024) is used to identify the exact dates on which the cantons’ support measures were introduced.

By identifying the exact timing of firms’ responses about their expectations, the influence of support measures on business expectations can be analysed using a quasi-experimental strategy (Difference-in-Differences). Companies are categorised according to the timing of their responses and the extent to which they are affected by specific measures. Finally, differences in the expectations of the firms affected by the announcement are compared with the expectations of firms in the same sector that are not affected by the measure. As representatives of both groups are monitored before and after the announcement, the difference in expectations between the groups is interpreted as an effect of the announcement. To further increase the comparability of these groups, the number of COVID-19 infections within the cantons and the stringency of health measures at a given time are also statistically controlled for (Pleninger et al., 2021).

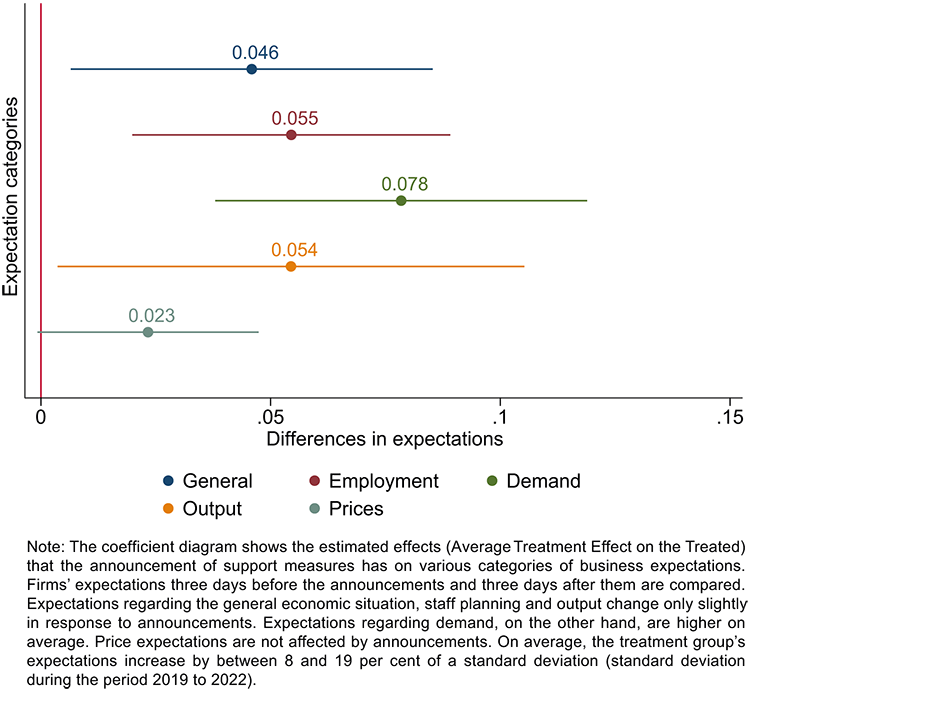

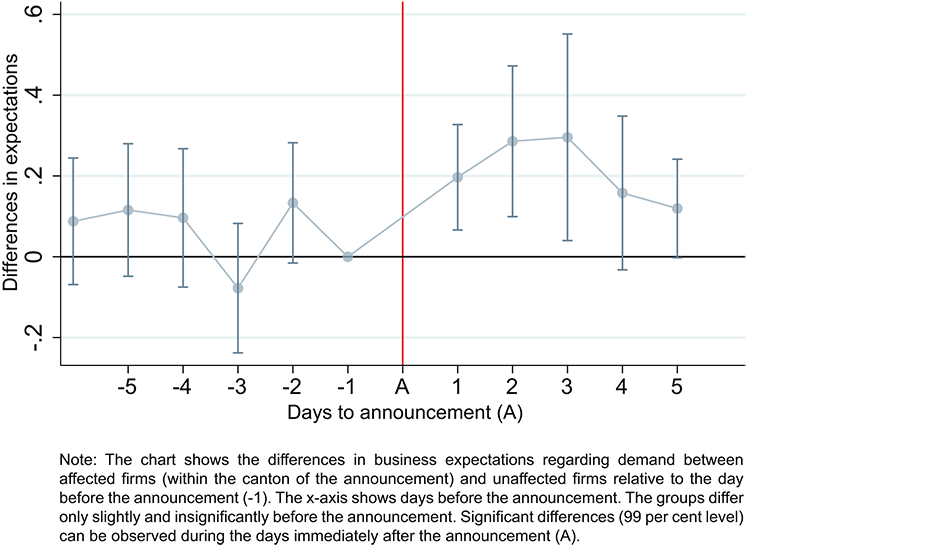

The results show (chart G 2) that companies potentially benefiting from cantonal support measures are more optimistic in terms of their output, demand and employment prospects during the days following the announcement. When the effects are analysed on a daily basis, it becomes clear that this increase in expectations is particularly noticeable immediately after the announcement (chart G 3). This can be explained by the fact that fast-moving developments relating to the pandemic can influence companies’ expectations within days.

Promises as a fiscal policy instrument

This monitoring indicates that promises made by the government can actually raise expectations throughout the economy. Companies appear to take information about cantonal measures seriously. This realisation should be taken into account by political decision-makers when it comes to the strategic timing of the introduction of support measures in times of crisis. Firms’ reaction to government announcements can be used as an indicator of the effectiveness of these measures. Previous research has shown that increases in expectations and the associated confidence can have a positive influence on the impact of government spending (Bachmann and Sims, 2012). The observed effects also suggest a high level of trust in the promises made by cantonal governments, as these are announcements rather than allocations of funds. More in-depth analysis of the present study aims to provide a fuller explanation of how firms form their expectations.

References

Bachmann, R., & Elstner, S. (2015). Firm optimism and pessimism. European Economic Review, 79, 297–325. external page https://doi.org/10.1016/j.euroecorev.2015.07.017

Bachmann, R., & Sims, E. R. (2012). Confidence and the transmission of government spending shocks. Journal of Monetary Economics, 59(3), 235–249. external page https://doi.org/10.1016/j.jmoneco.2012.02.005

Eichenauer, Z. V., Gurtner, R. & Oguz, F. (2024) Swiss Fiscal COVID-19 Policy Dataset for Federal and National Level: Timing, Spending and Political Responsibility. Mimeo.

Enders, Z., Hünnekes, F., & Müller, G. (2022). Firm Expectations and Economic Activity. Journal of the European Economic Association, 20(6), 2396–2439. external page https://doi.org/10.1093/jeea/jvac030

Pleninger, R., Streicher, S., & Sturm, J.-E. (2022). Do COVID-19 containment measures work? Evidence from Switzerland. Swiss Journal of Economics and Statistics, 158(1), 5. external page https://doi.org/10.1186/s41937-022-00083-7

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland