Business situation virtually unchanged

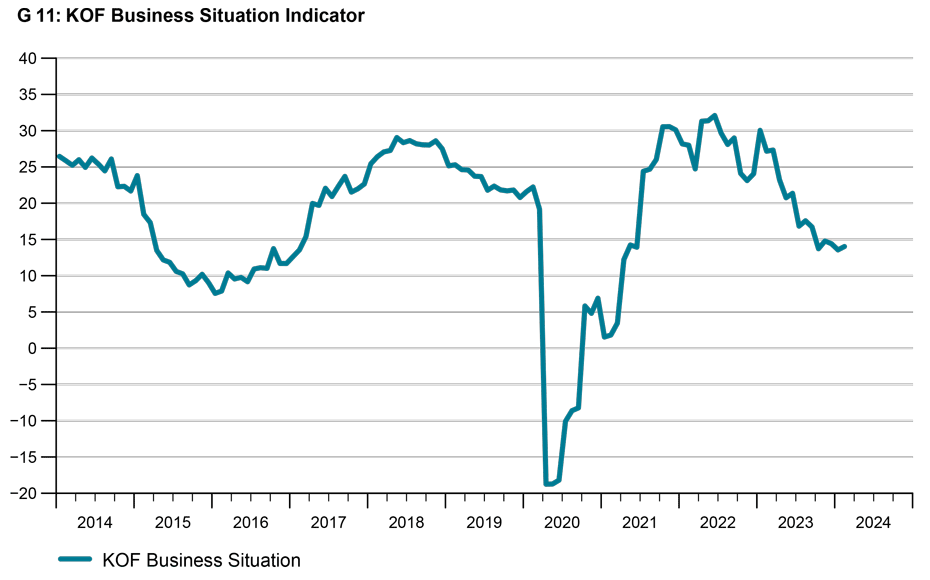

The KOF Business Situation Indicator for the Swiss private sector rose slightly in February (see chart G11), following two consecutive months of modest declines. Overall, business activity at Swiss companies has not changed significantly since October 2023. The sharp downward trend of the first three quarters of 2023 has been broken for the time being. Although the Swiss economy has recovered, there is a lack of momentum.

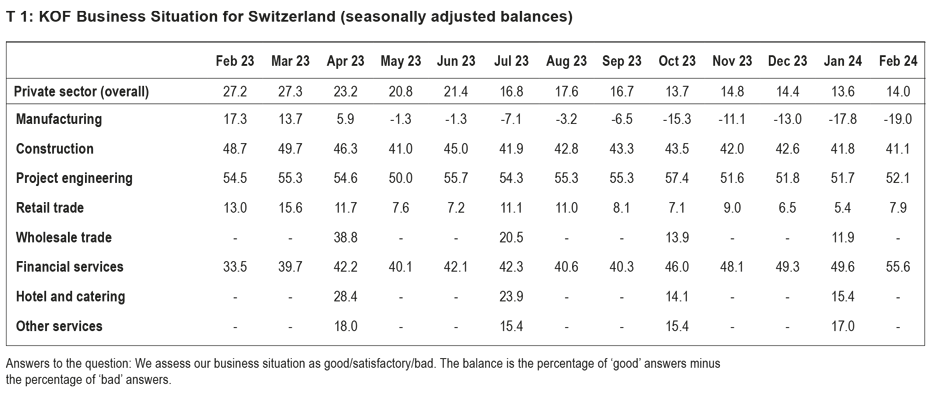

A breakdown by sector reveals a mixed picture. While the downward trend in the Business Situation Indicator for manufacturing industry continues unabated, business activity in project engineering and construction has hardly changed. The situation in the retail trade and in the finance and insurance sectors is brightening considerably.

Output in the manufacturing sector has recently been curbed, and stocks of finished goods have been reduced somewhat. Companies’ expectations regarding the future level of overall demand and export prospects are more cautious than before, albeit positive.

The business situation in the Swiss construction industry is currently slightly under pressure. The Business Situation Indicator has been fluctuating within a relatively narrow band since May 2023. According to the KOF Business Tendency Surveys from February, output has increased in the last three months but firms are slightly more sceptical about future demand than before.

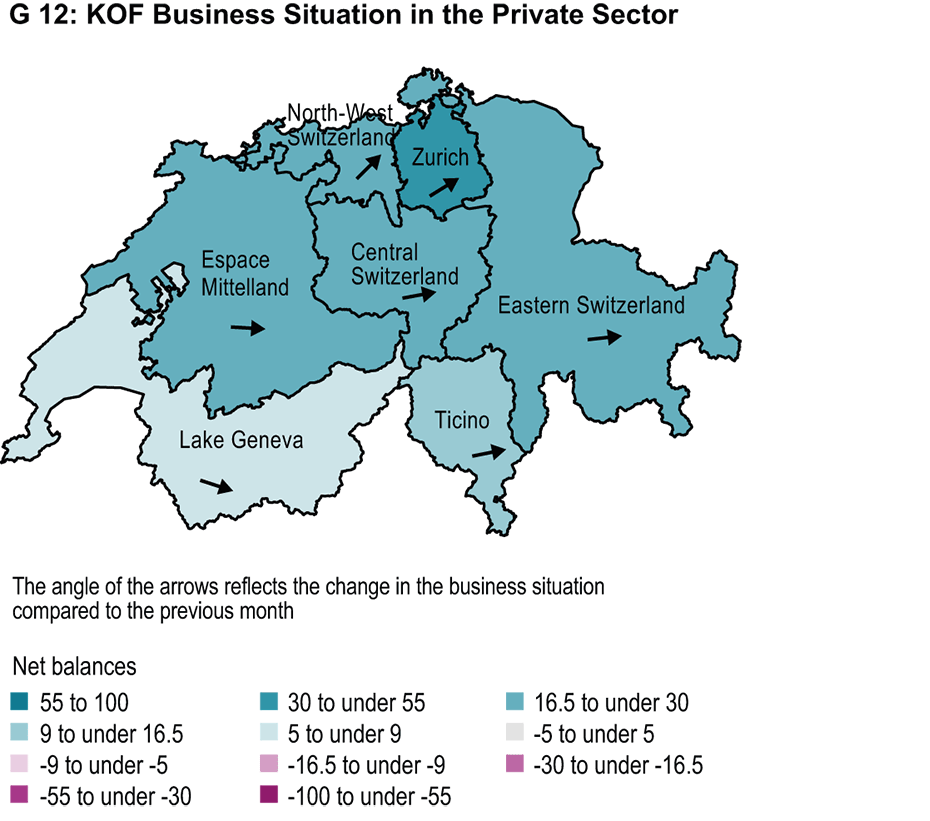

The Business Situation Indicator for the retail trade rose in February, which is mainly due to the responses received from large firms. By contrast, medium-sized retailers are more sceptical about their situation than before. However, medium-sized enterprises are increasingly expecting to see sales growth in the near future (see table T1).

From a regional perspective, the business situation is improving in most parts of the country. This is particularly evident in Northwestern Switzerland and the Zurich region, but only slightly so in Central Switzerland, Ticino and Eastern Switzerland. The business outlook in Espace Mittelland is a little gloomier, while in the Lake Geneva region it is much gloomier (see chart G12).

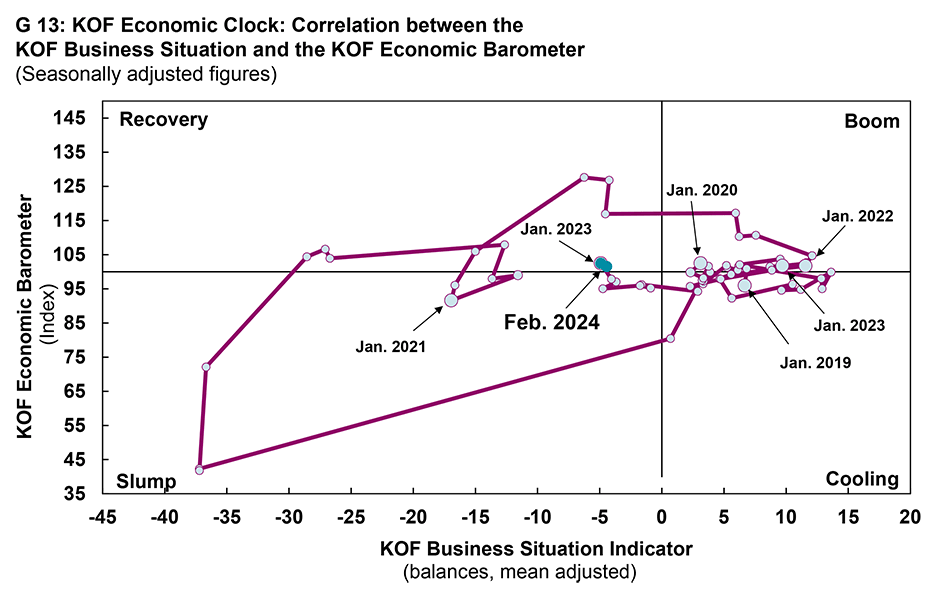

The KOF Business Situation Indicator illustrates companies’ current business situation. The KOF Economic Barometer, on the other hand, is an indicator of the economic outlook. The Economic Barometer shows that economic conditions were challenging in 2023, although there are tentative signs of improvement in the first few months of 2024 (see chart G13).

Explanation:

Chart G11 shows the KOF Business Situation Indicator across all sectors included in the survey. The business situation of sectors that are only surveyed quarterly is kept constant in the interim months.

Chart G12 shows the business situation in the main regions defined by the Swiss Federal Statistical Office. The regions are coloured differently to reflect their business situation. The arrows within the regions indicate the change in the situation compared with the previous month. An upward-pointing arrow indicates that the situation has improved compared with the previous month.

The Business Situation Indicator in the KOF Business Cycle Clock (chart G13) is plotted against the KOF Economic Barometer. The indicator reflects the current business situation, while the barometer is a leading indicator of changes in activity. The clock can be divided into quadrants. During the recovery phase the business situation is below average but growth prospects are above average. At the peak of the economic cycle the situation and prospects are both above average. During the slowdown phase the situation is above average and prospects are below average. At the bottom of the economic cycle the situation and outlook are both below average. Ideally the chart runs through the quadrants in a clockwise direction.

The KOF Business Situation Indicator is based on more than 4,500 reports from firms in Switzerland. Companies in the manufacturing, retail, construction, project engineering, and financial services and insurance industries are surveyed monthly. Businesses in the hospitality, wholesale and other services sectors are surveyed during the first month of each quarter. These firms are asked, among other things, to assess their current business situation. They can rate their situation as either ‘good’, ‘satisfactory’ or ‘poor’. The net balance of their current business situation is the difference between the percentages of ‘good’ and ‘poor’ responses.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland