Research, development and innovation: the current state of Switzerland's major regions

- Digitization

- Innovation

- KOF Bulletin

The seven major Swiss regions differ significantly in some cases with regard to production factors but not in terms of the results of the innovation process. The differences in input factors appear to be primarily due to structural factors. It is small firms in the construction and service sectors that cause these differences. At the same time, these types of firms make a smaller contribution to the results of the innovation process, which reduces the regional differences in innovation success.

The federal structure of the Swiss political system means that regional aspects of economic life deserve special attention. Evaluations were therefore carried out for the first time at the level of Switzerland's seven major regions (NUTS-2 level) as part of the KOF Innovation Survey 2019. The seven major regions include the Lake Geneva region, Espace Mittelland, Northwestern Switzerland, the Zurich region, Eastern Switzerland, Central Switzerland and Ticino. This article is divided into three parts. In the first step we look at the input factors of the innovation process. We measure how intensive the efforts of firms in the individual major regions are to generate innovation. For this purpose we analyse the companies’ activities with regard to research and development (R&D). In the second step we look at the output factors of the innovation process. That is, what results these innovation efforts have ultimately yielded. We measure this in terms of the propensity to innovate and the commercial success of innovative products and services. In the third step we compare how the R&D activities of the seven major regions differ across sectors and size categories. This breakdown shows the drivers behind the different levels of R&D activity in the major regions.

In major regions with less R&D-activities, companies research more intensively

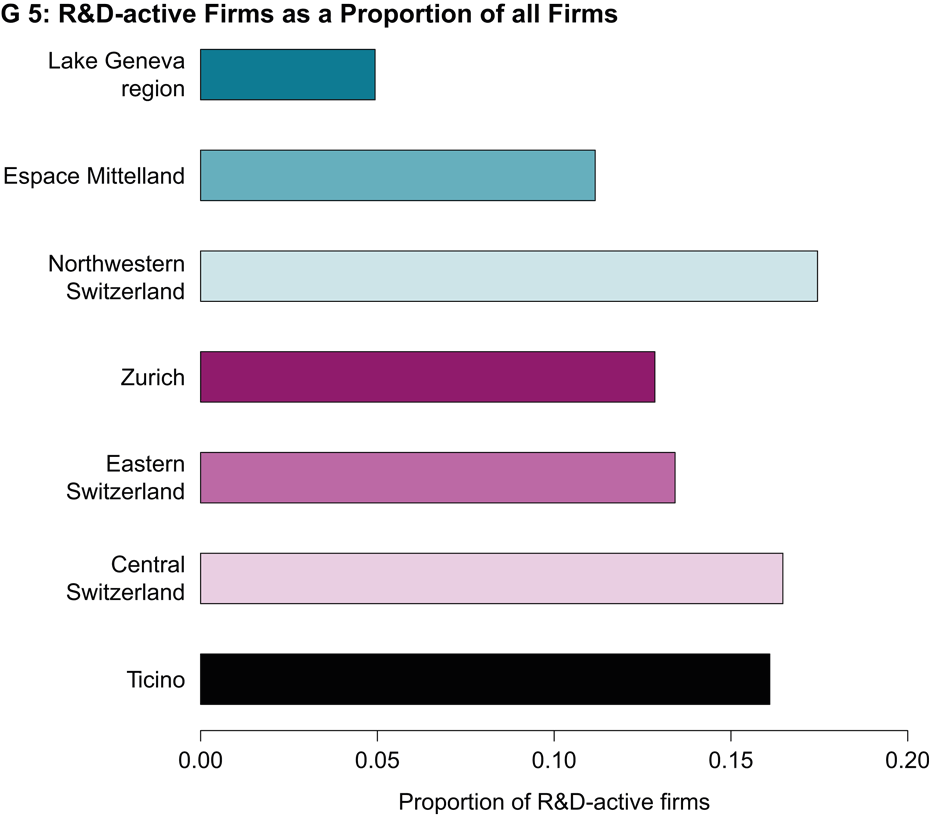

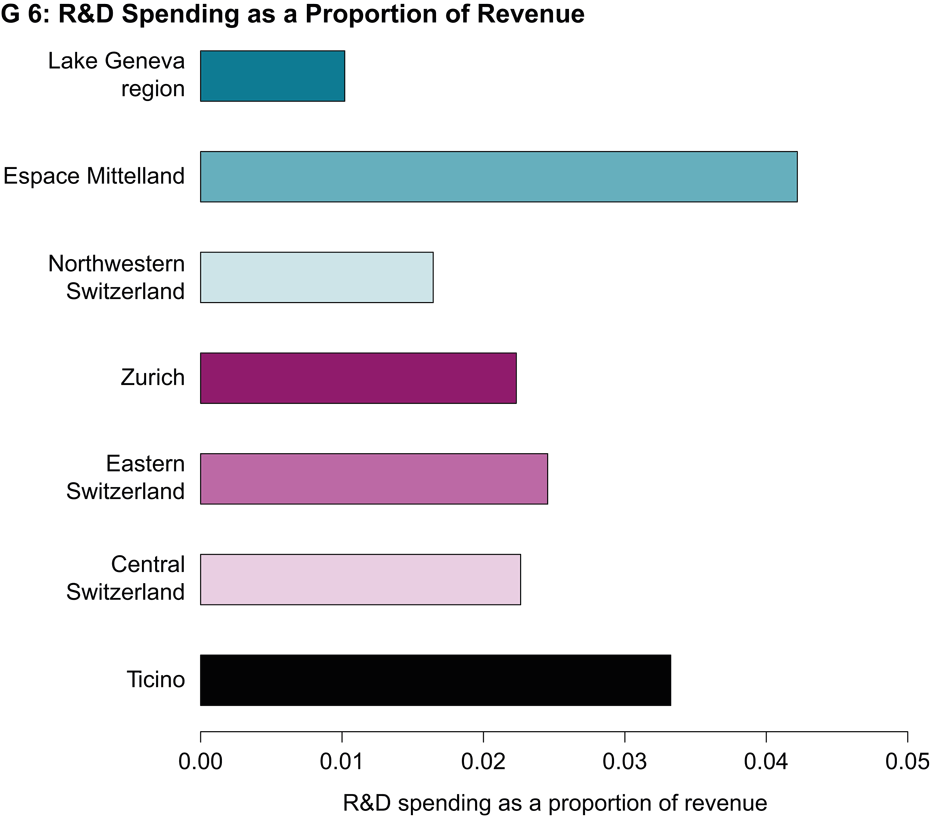

There are some clear differences in the numbers of R&D-active companies (G 5). While R&D-active firms in Northwestern Switzerland, Central Switzerland and Ticino account for over 15 per cent of all companies there, these proportions are significantly lower in Eastern Switzerland, Zurich and Espace Mittelland but are still over 10 per cent with the exception of the Lake Geneva region. In contrast, the picture is the opposite for R&D expenditure as a share of revenue (G 6). The major regions that are leaders in terms of their proportions of R&D-active firms are further behind in terms of R&D spending as a share of revenue, while the major regions that lag behind in terms of their proportions of R&D-active companies have comparatively higher average values for their shares of R&D expenditure. The concentration of R&D activities among firms thus differs between the major regions. However, Ticino and the Lake Geneva region do not conform to this pattern. Ticino is above average for both indicators, while the Lake Geneva region has below-average values for both. In general, however, it can be said that major regions in which companies conduct less R&D pursue R&D more intensively.

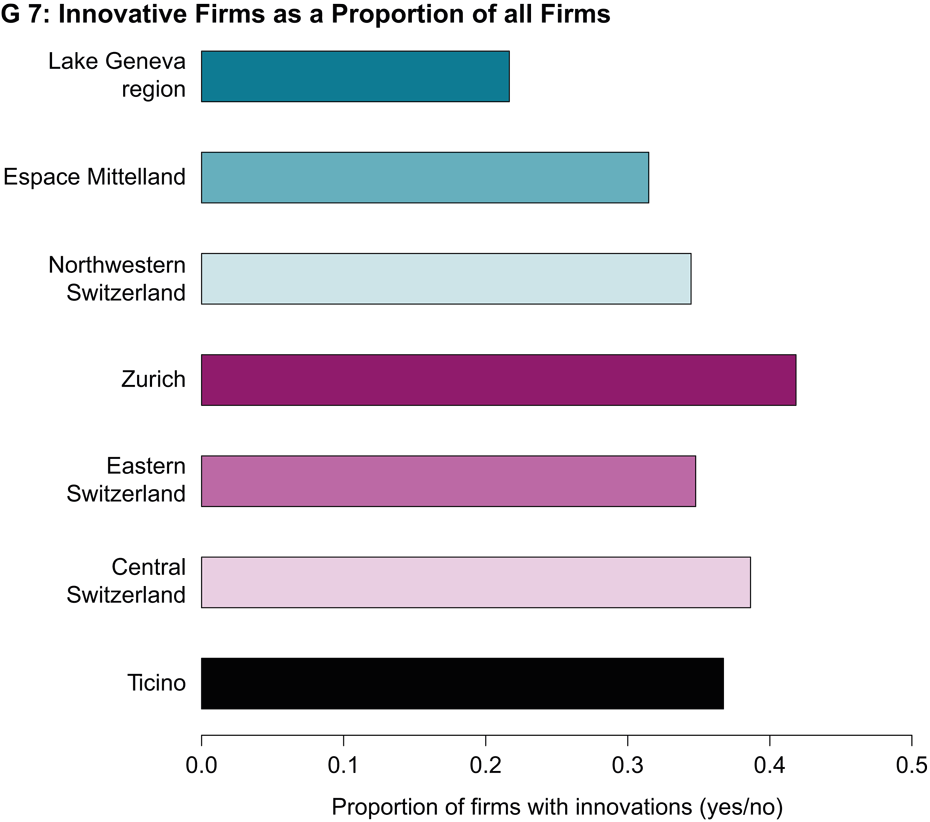

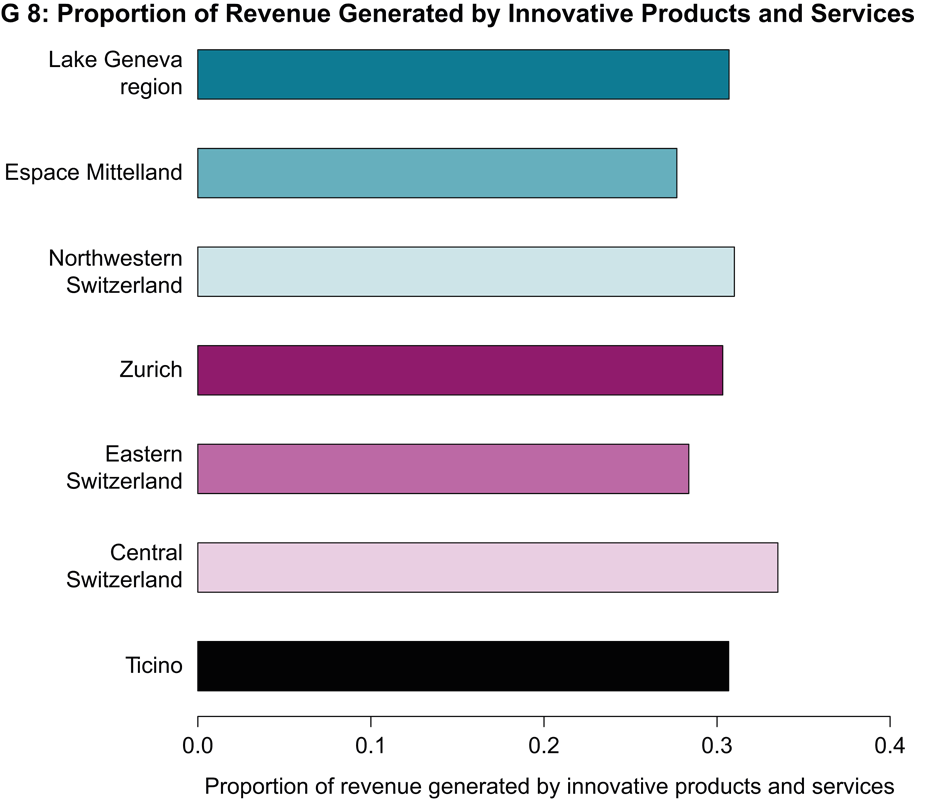

In terms of the proportions of companies with innovative products and processes, the seven major regions are much closer together than they are for the indicators of R&D activity (input factors) (G 7). Only Zurich stands out from the other major regions. Overall, however, the differences between the major regions are significantly smaller. The differences between the major regions are even smaller in terms of the proportion of revenue generated by innovative products and services (G 8). Here, all of the major regions have a similar share of around 30 per cent of revenue.

If we look at Charts 5 to 8 as a whole, we see that, notwithstanding the differences in input factors, the output factors of the innovation process do not reveal substantial differences between the major regions. Specifically, the Lake Geneva region and Zurich appear to achieve innovation results similar to the other major regions despite their lower innovation efforts. It can be concluded from this that these two major regions produce higher proportions of non-R&D-driven innovations that are relatively successful in the market. In contrast, companies in Espace Mittelland and Ticino base their innovative products and services on R&D activities to a greater extent than is the case in other regions.

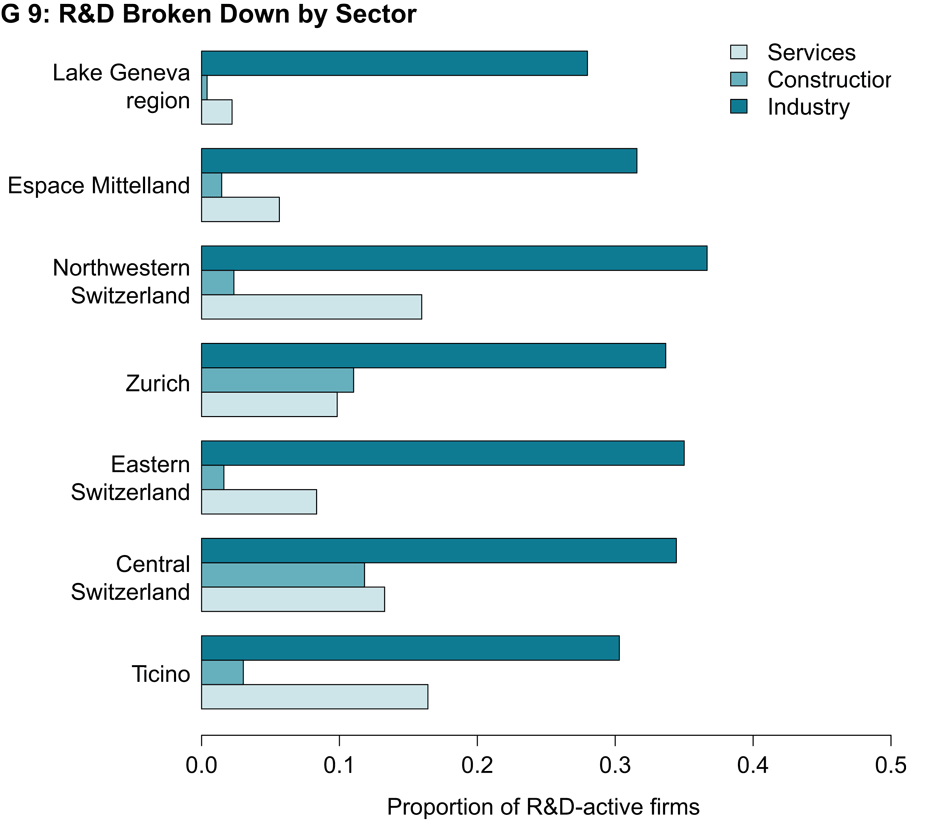

If the proportions of R&D-active companies are broken down by the three sectors of industry, construction and services, a different picture emerges than for the overall economy (G 9). In industry, the shares of R&D-active companies are relatively similar in all major regions. The discrepancies we have seen in Chart 5 are therefore primarily driven by differences in construction and services. The Lake Geneva region and Espace Mittelland show very low values in these two sectors, while Ticino and Northwestern Switzerland reveal much higher values. So whereas industry is similarly invested in R&D-driven innovation in the various major regions, we see large discrepancies in services. In particular, Northwestern Switzerland, Ticino and Central Switzerland show more R&D-intensive service sectors.

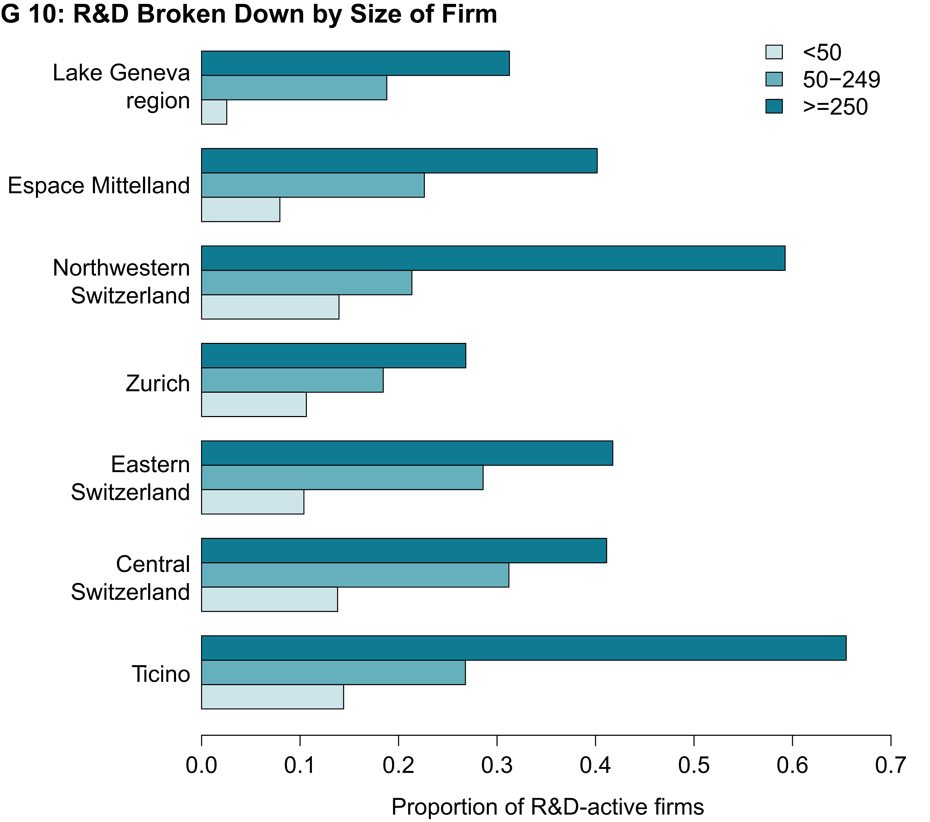

Large companies do more research

Broken down by company size (<50, 50-249 and >=250 employees), the shares of R&D-active firms again reveal a different picture (G 10). We see the same rankings across all seven major regions: large companies conduct R&D much more frequently than small and medium-sized firms. The rankings for large companies across the major regions are similar to those in Chart 5 for the overall economy but are less pronounced. The Lake Geneva region and Espace Mittelland reveal very low values, especially among small firms. Together with Chart 9, this also explains the substantial differences between the major regions in Chart 5. The Lake Geneva region and Espace Mittelland account for small proportions of R&D-active companies in the economy as a whole, driven by the segment of small firms in the construction and services sectors. This is also the reason why the output factors of the innovation process in Charts 7 and 8 do not differ greatly between the major regions. Large and medium-sized enterprises in industry are more important for the innovation output of a major region than small businesses engaged in construction and services.

Spescha, A., Wörter M. (2020): Innovation in the Swiss Private Sector – Results of the Innovation Survey 2018. Study commissioned by SERI. Online external page here.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland