Macroeconomic uncertainty and the role of employment protection

- Labour Market

- KOF Bulletin

The impact of uncertainty on the economy was most recently illustrated in the context of the pandemic. But the uncertainty was also a decisive factor in previous crises. A new KOF study examines the impact of uncertainty on economic development.

Phases of high uncertainty predominantly coincide with periods of economic weakness. According to economic theory, this is partly due to the wait-and-see behaviour of companies and consumers. At times of heightened uncertainty both are reluctant to spend and make new purchases and therefore they postpone decisions. This reduces aggregate demand in an economy and weakens economic development in general.

The impact of uncertainty on economic activity

Economic uncertainty can affect the performance of an economy through a variety of channels. The best-known channel is the wait-and-see mechanism described above, the so-called ‘real options’ theory. According to this theory, the decision-making process followed by companies (as well as consumers) can be represented as a series of options. The more uncertain a company’s future demand becomes, for example, the more likely it is to choose the option of waiting until the uncertainty dissipates and not hiring any new employees. This is because additional hiring incurs costs and the company is afraid of being stuck with these costs if it does not subsequently need the new employee. Hiring costs include search costs, registration costs and training costs. In addition, the costs that would be incurred as a result of possible layoffs are already taken into account in hiring decisions. Once the uncertainty around demand has dissipated, companies will move to respond to the increased level of demand and make up for their postponed decisions. What is interesting here is that, for the same level of uncertainty, higher adjustment costs lead to more waiting.

How is macroeconomic uncertainty measured?

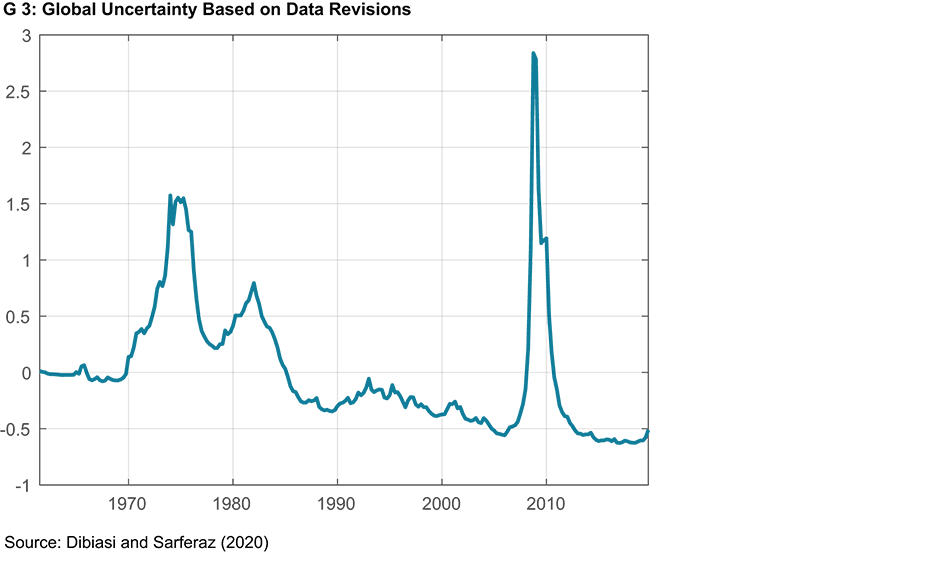

Precise measures of uncertainty are indispensable in order to empirically verify these theoretical relationships. In research there are various approaches to measuring uncertainty. These range from simple text analysis methods to highly complex statistical procedures. A new study by KOF shows how uncertainty can be estimated based on revisions of macroeconomic statistics, such as revised GDP. Revisions of GDP occur because the official statistical offices do not have all the necessary information available at the time of compilation. In order to compile GDP the statistical offices rely on estimates of sub-components. The quality of these forecasts is closely linked to the changing levels of macroeconomic uncertainty. The data revision method exploits precisely this relationship. The use of machine learning techniques enables uncertainty indicators to be constructed from data revisions. This new method can estimate the exact timing of macroeconomic uncertainty more accurately than many other indicators. Moreover, it is very close to the economic concept of uncertainty. More importantly, this method enables us to construct consistent uncertainty indicators for 39 countries (chart G 3 represents the aggregate global indicator). This situation permits a cross-country analysis of the relationship between uncertainty and economic development and allows for a more informed examination of the impact of uncertainty on economic development.

The role of employment protection in mitigating uncertainty effects

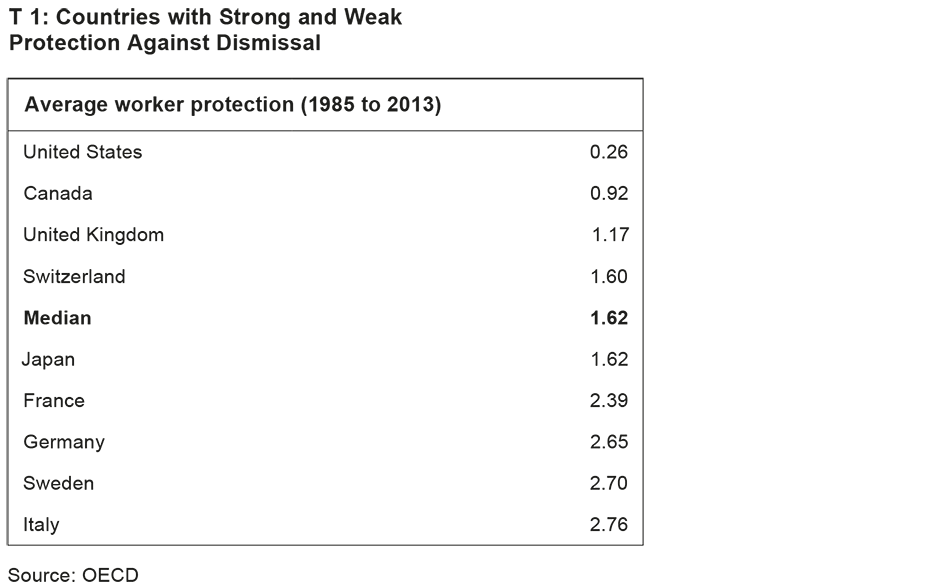

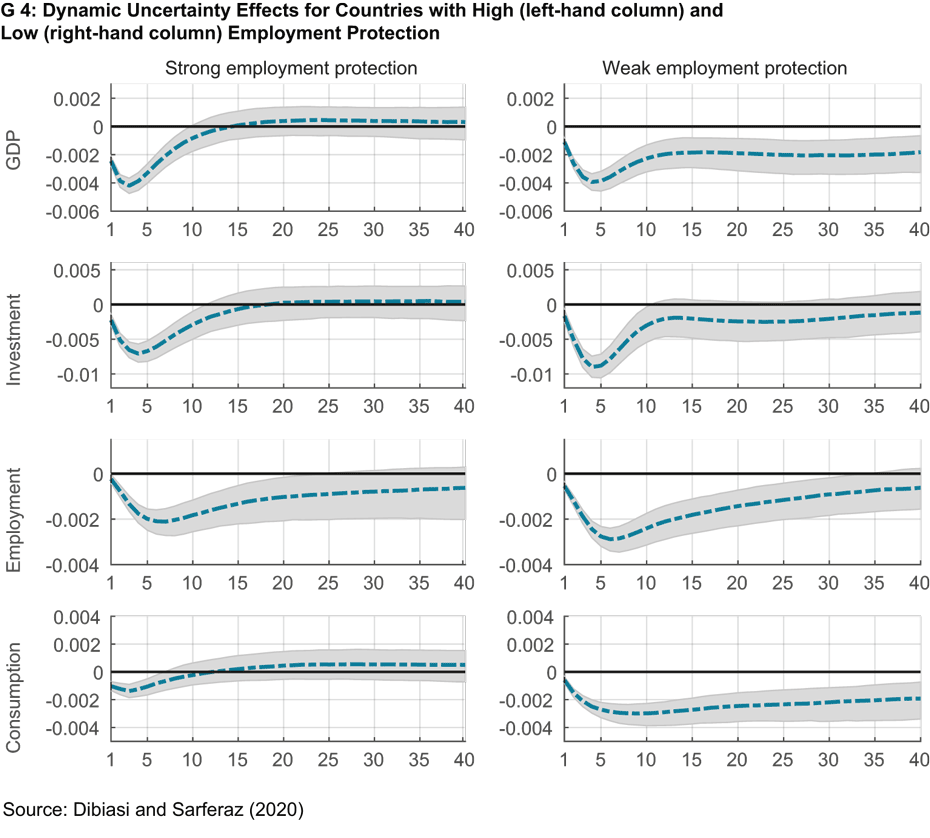

The KOF study uses the new measures of uncertainty to examine in more detail the role that redundancy costs play in the impact of uncertainty on economic development. The countries being analysed in the study were divided into two groups: one with high worker protection and one with low worker protection. The countries with high worker protection include Sweden and Germany, whereas the Anglo-Saxon countries tend to have low worker protection (see table T 1). Switzerland is more or less in the middle of the pack in this respect. This applies both to the laws on individual and mass redundancies and to restrictions on the use of temporary employment contracts. The findings of this analysis suggest that the degree of labour protection plays a decisive role in uncertainty effects. The dynamic effects of insecurity on GDP, investment, employment and consumption are more negative and longer lasting in countries with low employment protection than in countries with high worker protection (see chart G 4). These findings can be explained by the fact that it is more expensive for firms to make workers redundant in countries with stricter employment protection legislation. Consequently, employment levels may change less in the face of increased uncertainty. Once the economy recovers, firms that have been more reluctant to reduce their staffing levels can fall back on their remaining employees and thus more easily expand their production capacity in an upswing. Because employment is less responsive, firms are also less likely to cut back on investment, so output shrinks less. Strong employment protection translates into higher job security for workers. Consequently, heightened uncertainty makes workers less worried about their future level of income than if they had weak employment protection. Households therefore do not increase their precautionary saving as much and reduce their consumption less.

References

Dibiasi A. and S. Sarferaz (2020): Measuring macroeconomic uncertainty: a cross-country analysis. KOF Working Papers No. 479, 1–44, external page https://doi.org/10.3929/ethz-b-000420180

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland