European integration: has it affected economic sectors differently?

- KOF Bulletin

- World Economy

More competition, better allocation of resources, higher productivity – that is what European integration should ensure. A recent study of the longer-term effects of integration shows that, while it has led to reforms in product markets, it has had little impact on financial and labour markets. If reforms are brought about nonetheless, this is due not only to the euro but also to the single market.

European integration has produced winners and losers – that is beyond dispute. However, it has so far been unclear what impact integration has had on individual economic sectors. For example, integration may have brought disproportionate benefits to the financial sector while causing disproportionate damage to the manufacturing sector.

Why is it so difficult to identify the economic consequences of European integration? It is conceivable that the very different effects in different countries and different sectors are responsible for this. Researchers from KOF and University College London have examined two questions in more detail in this context:

- Does European integration encourage or slow down policy decisions on structural reforms in labour, financial and product markets?

- Do the growth effects of these structural reforms differ more between sectors than between countries?

Product markets in particular are being deregulated

The textbooks teach us how important reforms are for growth. Greater interdependence between countries should have both direct and indirect effects on value creation: directly through increased competition and indirectly through structural reforms. For example, greater flexibility in product markets, financial market regulation and labour markets can be expected ultimately to raise productivity by removing distortions, improving allocation of resources, and increasing competition.

This analysis is based on data from 36 countries since the early 1970s, thus comprising more years and countries than a number of earlier studies. The longer timeframe allows recent events such as the global financial crisis and the European sovereign debt crisis to be included in the analysis. In addition, both short- and long-term effects can be estimated and compared.

Researchers have shown that a common internal market and a single currency have, above all, led to deregulation in product markets, for example through lower barriers to entry and the abolition of price controls. Regulation of labour markets and the financial sector seems to be unaffected by European integration. Neither employment law nor credit market controls show any signs of reforms that could be attributed to European integration.

Euro or internal market – which is the driving force?

According to the main study conducted to date, the euro has been the driving force behind reforms. But researchers have now used regression analysis to show that the single market is at least as important here. The difference between these findings and previous ones is due to the larger sample of countries and the extended timeframe.

Previous estimates should therefore be interpreted as short-term effects, whereas those in this study should be seen as longer-term ones. The latest findings reveal that the internal market for labour and products may have been even more supportive of reform than the euro. In the financial sector, however, neither the euro nor the internal market can be identified as a key driving force.

The longer time series also shows that reforms have up to ten times more impact on productivity in the long term than in the short term. However, they do not lead to higher growth in all areas to the same extent: the researchers show that reforms – once triggered – generate stronger productivity gains in the financial sector than in labour and product markets. However, European integration leads to hardly any reforms in this sector specifically.

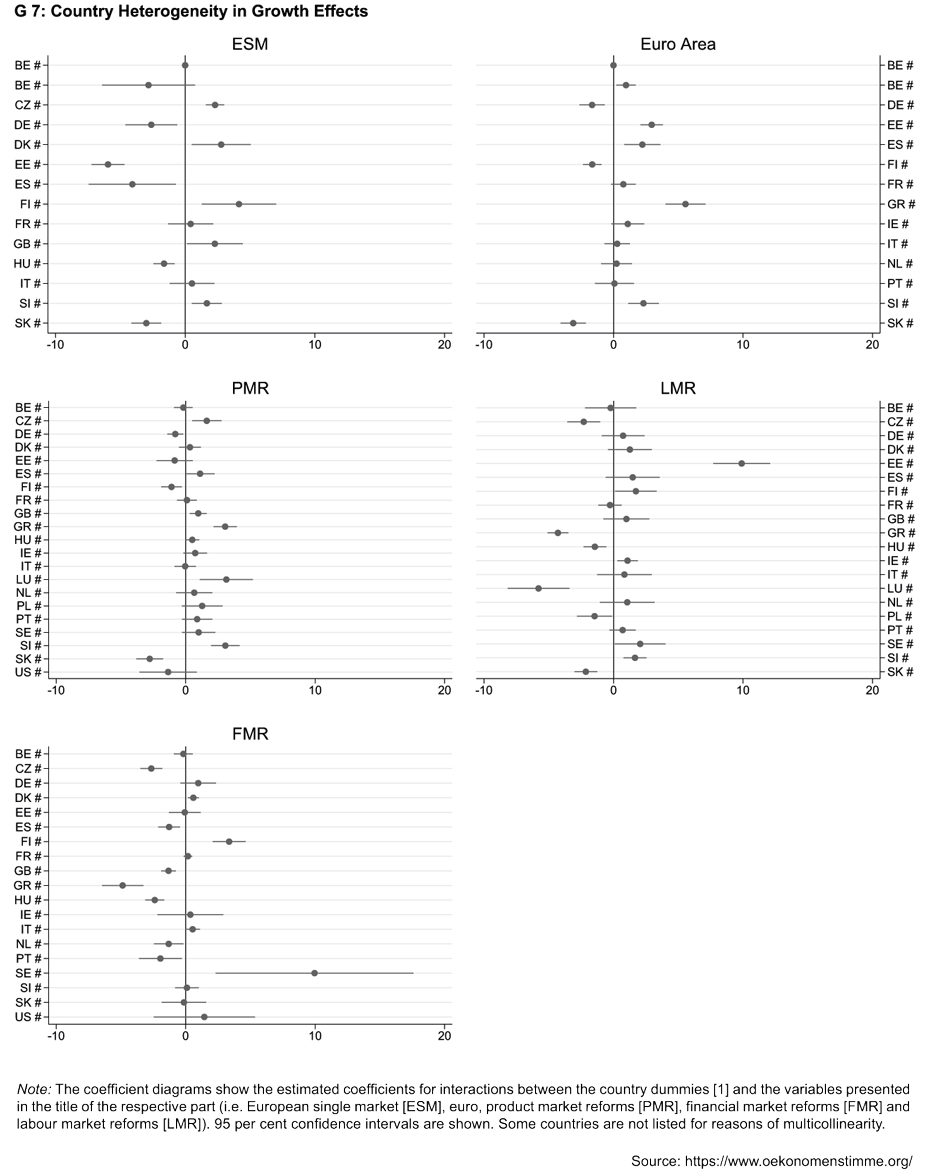

The growth effects of reform decisions can vary not only between sectors but also between countries (see G 7). For example, there is still no universal answer to the question of how European economic integration ultimately affects value creation. However, this study shows that differences between countries are more important than sectoral heterogeneity. It is therefore heterogeneous countries – rather than individual sectors – that make it so difficult to measure the impact of reforms.

The full version of this analysis can be found on external pageÖkonomenstimmecall_made.

Contacts

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland

Director of KOF Swiss Economic Institute

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland