Negative Interest Rates II: Economists Not Expecting them to Stop Any Time Soon

- Monetary Policy

- KOF Bulletin

- Economists Surveys

Since 2015 the Swiss National Bank’s base rate has been in negative territory. Do the benefits of negative interest rates outweigh the drawbacks, or vice versa? How is the base rate expected to change over the next few years? And how are the current policies of the SNB, the ECB and the Fed to be assessed? A survey of Swiss economists carried out in December 2019 attempted to cast light on these issues.

On 15 January 2015, the Swiss National Bank (SNB) removed the exchange rate floor of 1.20 francs to the euro. At the same time, it reduced the base rate, which had moved into negative territory a short time before, to -0.75%. Five years later there is still no end in sight to negative interest rates, whilst debates into the issue are becoming increasingly heated.

For instance, in a study released last October, the Swiss Bankers Association expressed harsh criticism. Negative interest rates are no longer fulfilling their economic purpose: the Swiss franc is not overvalued, prices are stable and the economy has adjusted to the current conditions. At the same time, negative interest rates are stated to have a number of negative consequences for the economy – for instance, savers are punished and incentives to run up debts are increased, pension funds encounter difficulties in achieving projected returns and the real estate market risks overheating.

What do economists from Switzerland think about the issue? In partnership with the “Neue Zürcher Zeitung”, KOF surveyed Swiss academic economists concerning negative interest rates at the end of 2019. 126 economists from 19 institutions took part in the survey.

Only one in five is expecting positive interest rates in the near future

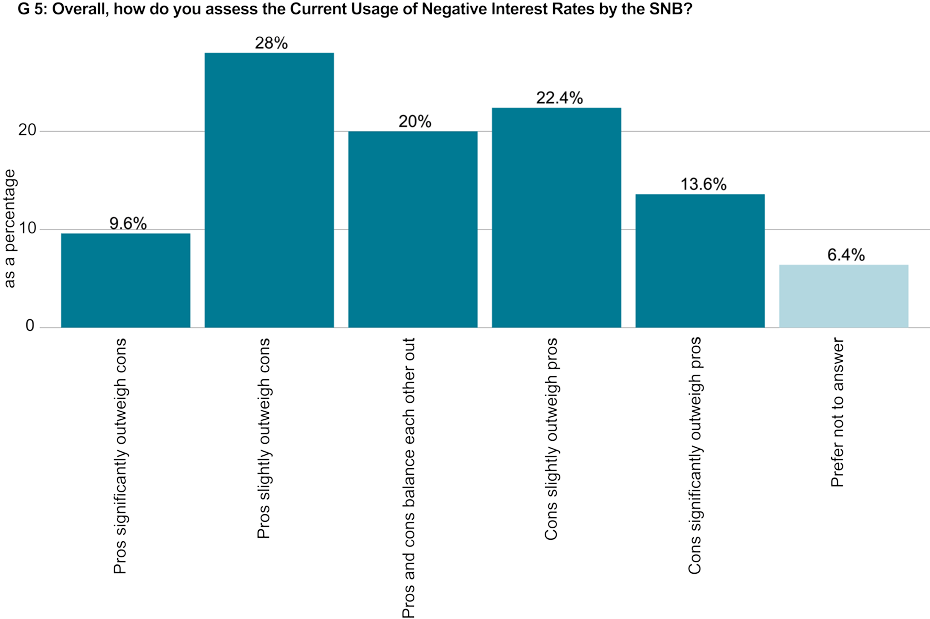

The survey results show that Swiss researchers do not speak with one voice as regards the policy of negative interest rates: for 38% of those questioned the benefits outweigh the drawbacks, whilst 36% take the opposite view (see graph G5).

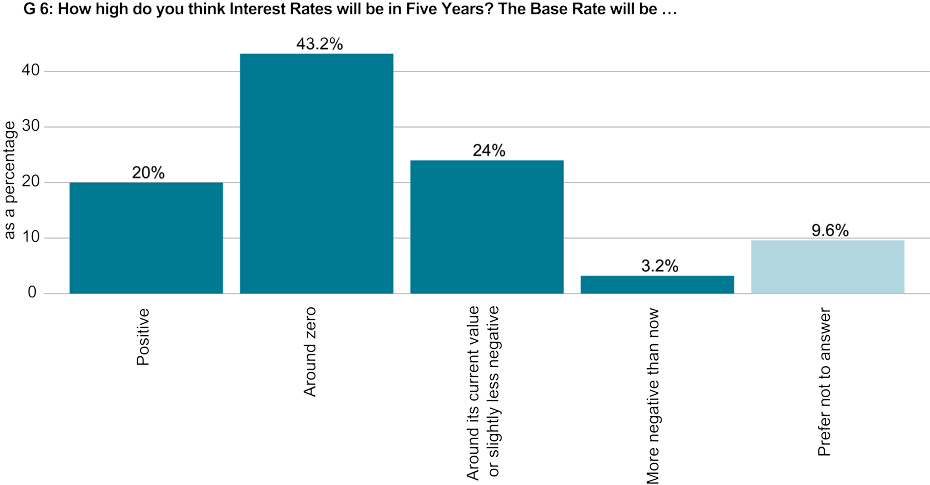

However, a return to positive interest rates could take some time yet. A majority of the Swiss economists surveyed believe that the base rate will be either negative or zero in five years’ time: around two-thirds are anticipating interest rates between the current level and around 0%, with only 20% expecting a clearly positive rate (see graph G6). This is remarkable given that, five years ago, negative interest rates were still regarded as an unconventional, short-term fix.

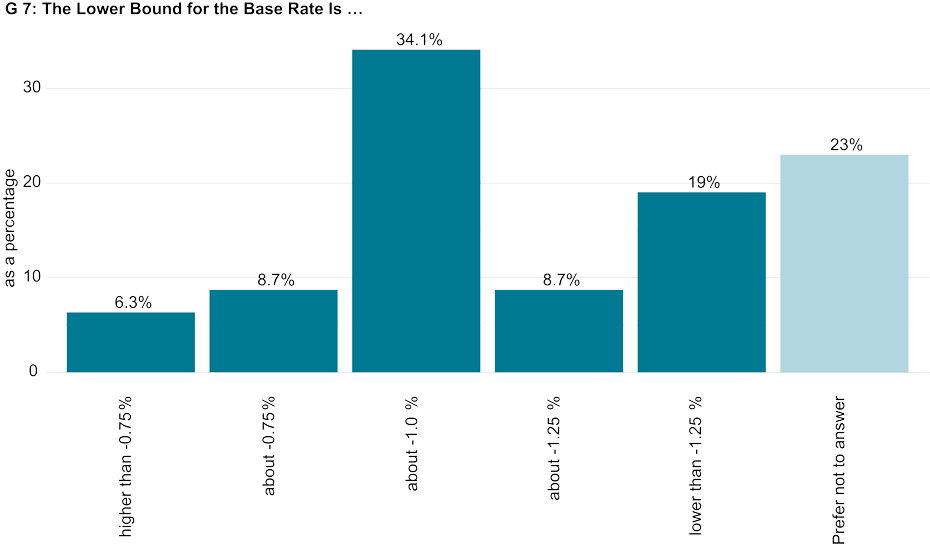

A further drawback of the negative interest rate policy is that it limits scope for action by the SNB. The so-called “lower bound” of the base rate describes the point below which interest rates cannot be lowered any further without economic operators withdrawing their deposits en masse from banks and storing them as cash. Theoretically, this lower boundary could be at 0%. In practical terms, however, it is lower, although precisely where is uncertain.

A majority of the economists surveyed believes that the SNB could lower the base rate to -1%, or even further (see graph G7). That just under a quarter of survey participants did not answer this question shows how complex the issue of the “lower bound” is.

A majority consider the franc to be appropriately valued or undervalued

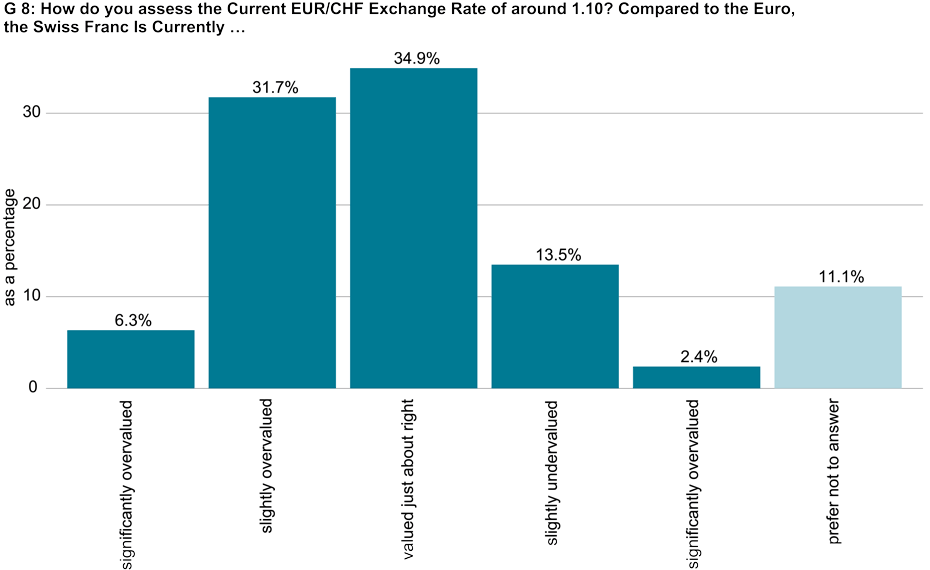

Movements in the exchange rate for the Swiss franc play a major role in justifying negative interest rates. In the most recent assessment of the monetary policy situation in December 2019, the SNB considered the franc to be “still overvalued”, which is why it is maintaining the negative interest rate.

In the survey the economists were asked about their assessment of the exchange rate with the euro, the most important exchange rate in trade-weighted terms. Here too, opinions differ: 38% consider the Swiss franc to be overvalued, 35% regard it as being valued just about right, whilst 16% see it as undervalued (see graph G8). However, it should be noted that the franc has appreciated in value slightly since the survey was carried out – the euro exchange rate is currently 1.07.

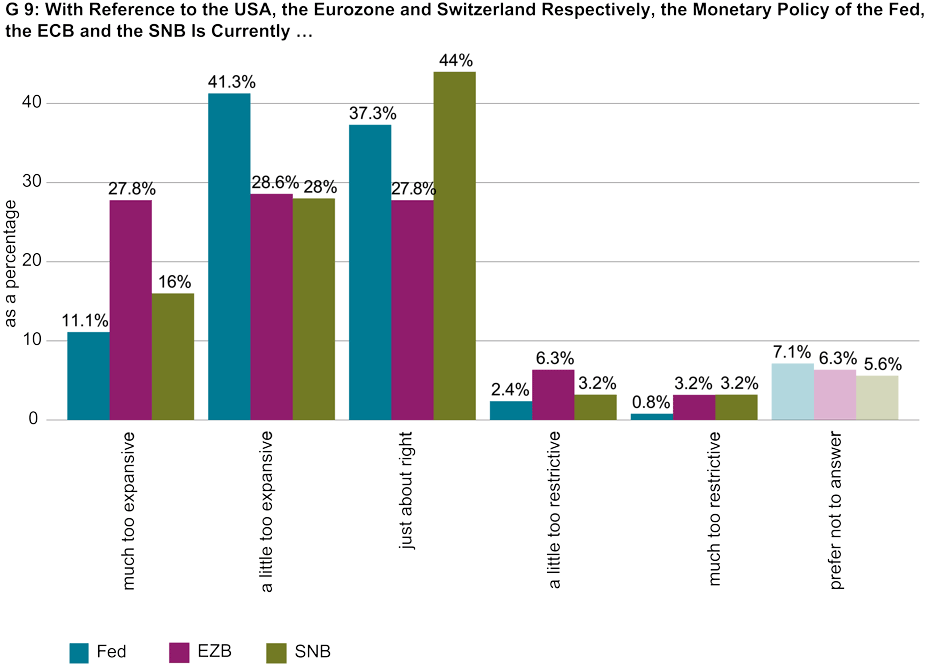

The Fed and the ECB: monetary policy considered to be overly expansive

Finally, the survey also considered the monetary policy of the US central bank, the Federal Reserve, the European Central Bank (ECB) and the SNB (see graph G9). The monetary policy pursued by the Fed and the ECB is considered to be a little too expansive or too expansive by a majority of the economists surveyed. According to 44% of the researchers surveyed, the monetary policy of the SNB is a little too expansive or too expansive. On the other hand, 44% of those surveyed consider it to be just about right.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland