Eurozone Growth at Moderate Pace

- Eurozone Economic Outlook

- KOF Bulletin

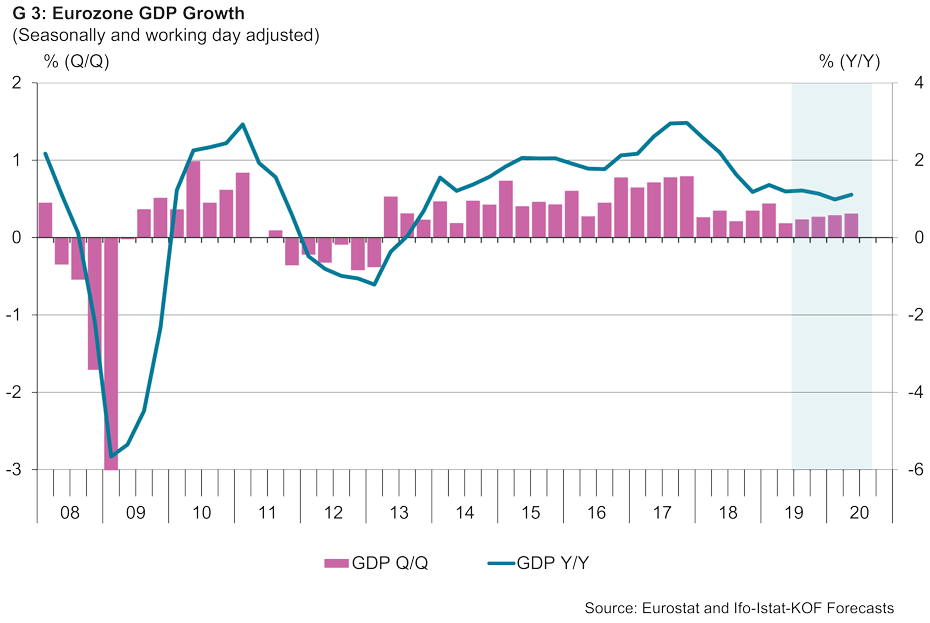

The euro area economy will pick up some momentum, according to three research institutes: ifo in Munich, KOF in Zurich, and Istat in Rome. Economic growth will rise from its low rate of 0.2% in the third quarter of 2019 to 0.3% in the fourth quarter of 2019. The institutes expect the euro area economy to continue to grow by 0.3% quarter on quarter in each of the first two quarters of 2020.

The expansion of GDP in the euro area continued to be sluggish in Q3 (+0.2%, as in Q2). The main driver was private consumption. Reflecting weak external demand, the contribution of net exports was slightly negative. Industrial production kept falling and is now on a downward trend since Q1 2018.

The slow-down in China and the weakness in the automotive sector weighed especially on capital and intermediate goods producers. This is particularly relevant for the German economy, which only recovered slightly in Q3 (+0.1%) from negative growth in Q2 (-0.2%). France and Spain, which have a higher share of services and consumer goods production, performed better, while the Italian economy remained weak.

Private consumption remains main driver of GDP growth

According to leading indicators, the outlook stabilized in the recent months. The consumer sentiment indicator by the European Commission signals little change, but the sentiment indicator related to manufacturing seems to have bottomed out - after a deterioration since the beginning of 2018. Markit’s purchasing manager’s index confirms this broad picture. Its manufacturing sub-index stabilized during Q4 2019.

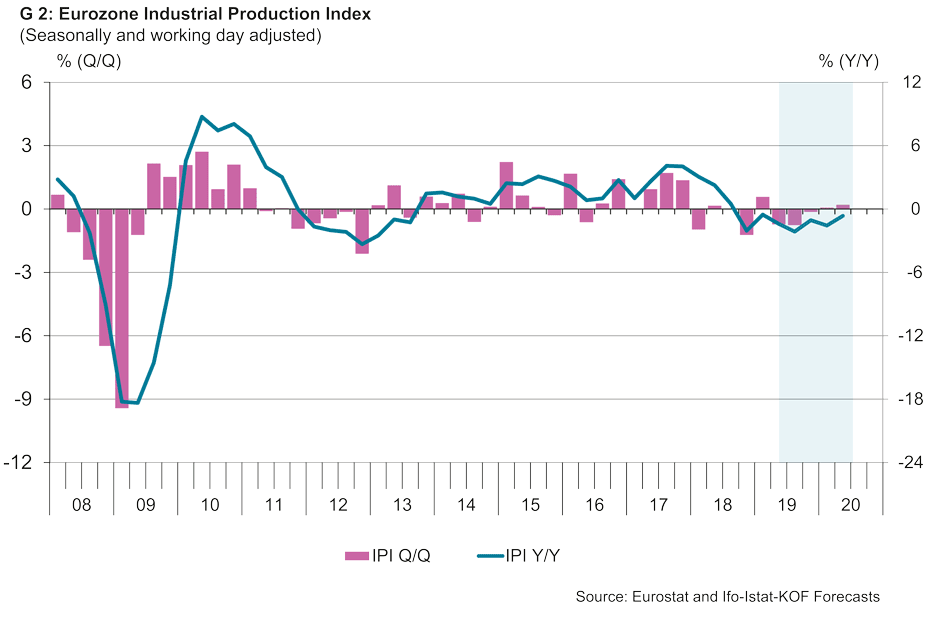

However, industrial production still declined in September and October, with monthly changes of -0.1% and -0.5%. After a quarter-on-quarter change of -0.8% in Q3, industrial production is likely to fall again slightly in Q4 (-0.2%), before it is expected to rally moderately with +0.1% and +0.2% in Q1 and Q2 2020 (see Graph G 2).

GDP growth in the euro area is forecast to increase slightly faster than in Q3. In Q4 2019 and the first two quarters of 2020 it is expected to be +0.3%. For the year 2019, this results in a GDP increase of 1.2% compared to the year 2018 (see Graph G 3).

Private consumption is likely to continue to be the main driver of GDP growth, as labor markets remain resilient to the downturn in industrial production. Private consumption is expected to expand with steady quarterly rates of 0.3% over the forecast horizon. Government consumption will also add to growth, as fiscal policy in the euro area is projected to become more expansionary in 2020. After high levels, capacity utilization has decreased in the manufacturing sector, but it is still slightly above the long-term average over the last 20 years. First signs of an ease of tension in the trade war between the US and China as well as increased certainty about Brexit may stimulate external demand.

In a similar way as industrial production, gross fixed capital investment is projected to slightly decline in Q4 (-0.1%), before it will expand by +0.3% and +0.4% in Q1 and Q2 2020.

Inflation remains moderate

Due to the reduction of energy prices, headline inflation, measured as annual changes in the Harmonized Index of Consumer Prices (HICP), came down to relatively low levels since the beginning of 2019. It stood at a modest rate of +1.0% in November. Core inflation, which excludes the effects of energy and unprocessed food prices, increased in November to +1.5%, due to increasing price pressures for services. These are most likely due to past changes in the accounting of package holidays in Germany.

Headline inflation is expected to be steady at +1.0% in Q4 2019, which results in an inflation rate of +1.2% for the year 2019. In 2020, inflation is projected to accelerate to +1.3% in Q1, before it will somewhat slow down to +1.2% in Q2, due to basis effects of past energy price fluctuations. The inflation forecast is based on the technical assumption that the Brent oil price remains stable at USD 65 per barrel and that the dollar/euro exchange rate stays at 1.12 over the forecast horizon.

Risk landscape is changing

While some older factors of uncertainty seem to have eased somewhat, new risks are emerging. There is now more clarity about Brexit. With the re-election of Boris Johnson as prime minister in the UK in December, Brexit is very likely to be executed on January 31st. This reduces uncertainty. From 2021 onwards, new modalities in the relationship between the remaining members of the EU and the UK need to be negotiated, with a still uncertain outcome. Moreover, there are first signs of an ease in trade tensions between the US and China; but there remains the risk of a further escalation.

Within the euro area, a new risk has emerged in France. Strikes – above all in public transportation – since December 2019 may lead to a weaker growth performance. Lastly, the escalating tensions between the US and Iran bear the potential for further conflict, economic repercussions, and fluctuations in energy prices.

Eurozone Economic Outlook

This quarterly publication is prepared jointly by the German external page ifo Institute, the KOF Swiss Economic Institute, and the Italian external page Istat Institute. The forecast results are based on consensus estimates building on common macroeconomic forecast methods by the three institutes. Details and graphs can be found in the right column.

Contact

No database information available