What the Swiss economy can expect in the new year

- KOF Bulletin

- KOF Economic Forecasts

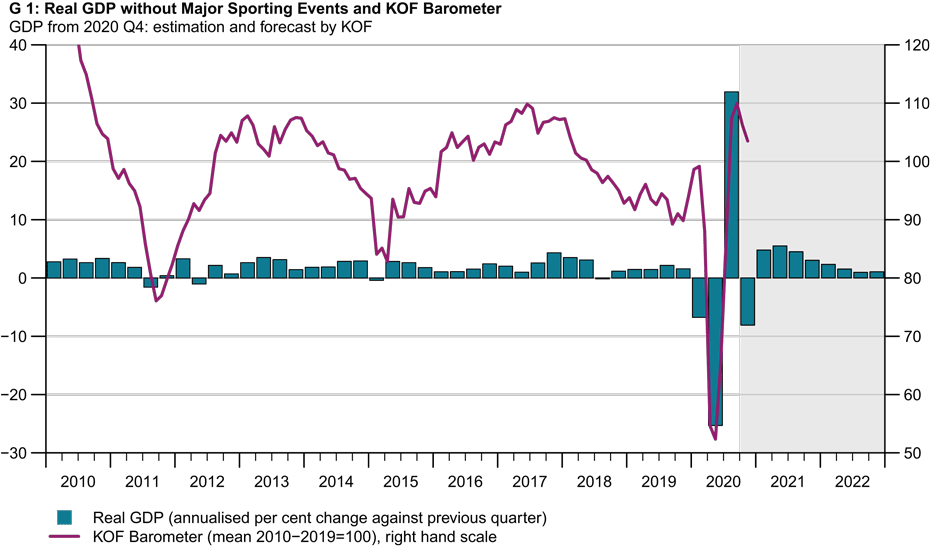

KOF expects GDP to grow by 3.2 per cent in 2021. However, this forecast assumes that the pandemic situation does not deteriorate any further. The negative scenario predicts growth of only 0.6 per cent. Moreover, the differences between the individual sectors of the economy are considerable. Some have already returned to their pre-crisis levels, while for others this will probably not be the case until after 2021.

Although Switzerland's gross domestic product (GDP) contracted sharply last year owing to the coronavirus crisis, it should pick up again in 2021 (see chart G 1). The strength of this recovery, however, depends on how the pandemic progresses. KOF’s baseline scenario assumes that the pandemic will subside in the first few months of the new year. In this case it expects to see annual GDP growth of 3.2 per cent. The economy should return to its pre-crisis levels by the end of 2021. If, however, the pandemic has gained further momentum by then and more drastic restrictions have become necessary, growth will be significantly lower in 2021. This negative scenario predicts growth of only 0.6 per cent. The economy will then only return to its pre-crisis levels one year later at the turn of 2022/2023.

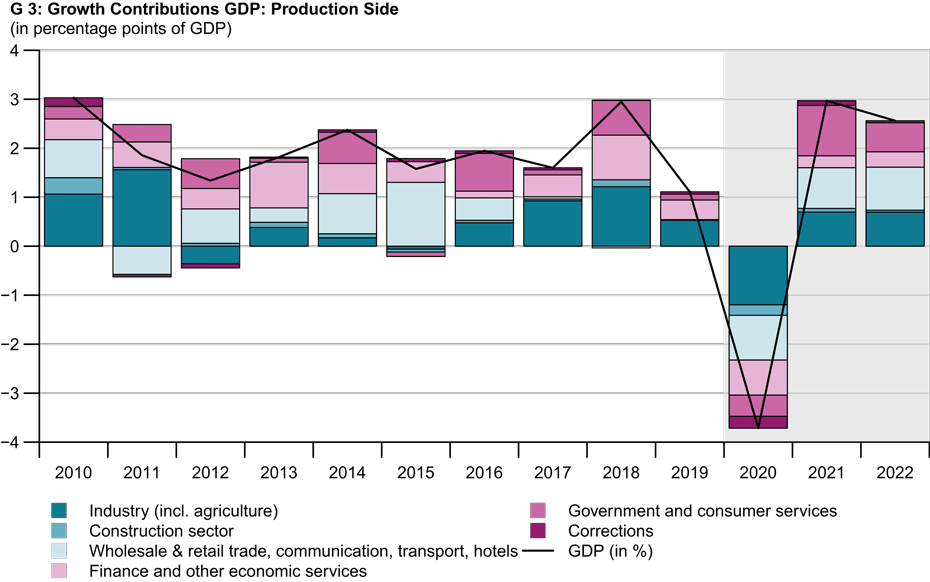

KOF’s latest economic forecast provides an overview of how the individual sectors of the economy are likely to perform in the new year (see also chart G 3).

Private consumption: slow recovery

Household spending last year was affected by various factors such as the coronavirus restrictions, the rise in unemployment, and the uncertainty surrounding future household incomes. Private consumption expenditure is expected to increase by 4 per cent in 2021, with growth in the first quarter still being noticeably slowed by epidemiological developments. Aggregate private consumption will probably not return to its pre-crisis levels until the fourth quarter of 2021, while per-capita consumer spending will not reach these levels again until the third quarter of 2022.

Inflation is likely to have averaged -0.7 per cent in 2020. However, if tourism goods and oil products are excluded from the consumer price index, the prices of the remaining goods remained more or less at the previous year's level. KOF expects inflation to average 0.1 per cent in 2021.

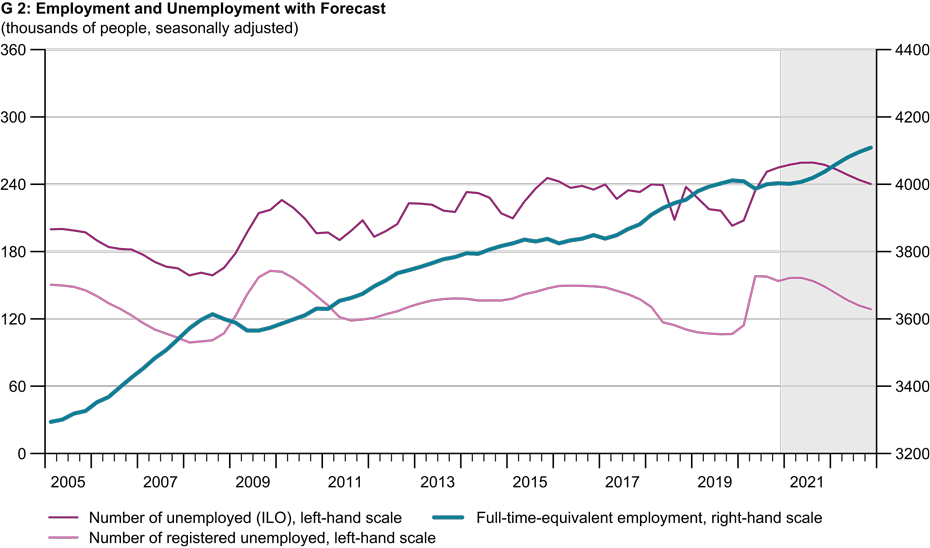

Labour market: employment set to recover from the second quarter onwards

The effects of the second wave of the pandemic on the labour market will become apparent over the coming months. Employment is expected to stagnate in the winter half-year 2020/2021 (see chart G 2). Of key importance will be the extent to which companies retain those jobs that are currently subject to short-time working. The prospect of an early start to the vaccination campaign should have a positive effect on the labour market. The decreasing level of uncertainty could persuade many companies to wait until at least spring 2021 before implementing redundancies. Sectors that are severely affected by the crisis, however, are likely to see a further decline in employment. The number of those in work should recover from the second quarter of 2021. Overall, KOF expects full-time-equivalent employment to grow by 0.4 per cent in 2021.

The impact of the pandemic is likely to weigh on wage growth over the longer term. This is partly due to past trends: according to initial estimates by the Swiss Federal Statistical Office (FSO), the nominal wage growth of 1 per cent in 2020 was the highest recorded by the Swiss Wage Index (SLI) for almost ten years. However, this means that wage increases do not reflect the poor performance of many companies’ profit margins and the decline in overall economic productivity growth. As was the case in the wake of the Swiss franc shock in 2015, it is expected to take some time for this overshooting of wages to be compensated for during this crisis. KOF is therefore forecasting historically low wage increases – as recorded by the SLI – of 0.3 per cent for 2021.

Investment: recovery expected, but uncertainty remains high

Although investment is likely to have declined by 5.4 per cent in 2020, we can be cautiously optimistic about the trend expected in the new year. Capacity utilisation in industry has recovered slightly. And, with the exception of hospitality and other service providers, the earnings situation in all sectors improved significantly at the end of 2020. KOF therefore expects equipment investment to rebound in 2021. However, uncertainty remains well above pre-crisis levels. Equipment investment has been reacting particularly sensitively to the progress of the pandemic. If the second wave lasts longer than predicted under the baseline scenario, this will dampen investment activity.

Foreign trade: gaining momentum from spring 2021 onwards

The deterioration in the epidemiological situation over the winter months is slowing the recovery in tourism. Accordingly, exports and imports of services probably declined in the fourth quarter of 2020 and are only expected to gradually increase again in spring 2021. The recovery in the trade in goods was slowed in the final quarter by the deteriorating economic situation. Here, too, stronger stimulus for foreign trade is not expected to come until spring. Total exports will grow by 5.7 per cent in 2021. Imports will increase at the slightly higher rate of 6.9 per cent.

Public consumption and fiscal policy: substantial deficits over the coming years

Revenues from income taxes and profit taxes will temporarily fall sharply over the coming years as a large number of companies are expected to report losses for 2020. The tightening of restrictions in response to the second wave will exacerbate these effects and also have a negative impact on income and profits in 2021. Next year we can expect to see significantly lower short-time working compensation but higher unemployment benefits than in 2020.

The funds needed to cover the additional expenditure and to compensate for the revenue shortfall at the federal level will be raised in the capital markets. Government spending in 2020 and 2021 will significantly exceed the limit defined by the debt brake. However, any reduction of these accumulated deficits over the six years prescribed by the debt brake would be virtually impossible and economically undesirable. The predominantly negative interest rates paid on Swiss government bonds mean that any repayment extension would even reduce the state’s financial expenditures.

Monetary policy: still expansionary

International central banks continue to try to mitigate the economic effects of the pandemic by pursuing expansionary monetary policies. Given that forecasts for short-term interest rates remain unchanged at around zero, no interest-rate hikes are expected until at least 2022. In order to ensure that long-term interest rates remain low as well, central banks’ balance sheets – which have grown massively in recent months – are likely to increase further. The balance sheet of the Swiss National Bank (SNB) also continues to trend upwards as the Swiss franc is considered a safe haven and is in particularly strong demand in times of crisis. Consequently, the SNB will probably continue to intervene to reduce any upward pressure on the franc.

The full economic forecast for 2021/2022 – including tables and charts – can be found here.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland