Around 60 per cent of Swiss companies suffering from weak demand

- Business Tendency Surveys

- Swiss Economy

- KOF Bulletin

The coronavirus-specific questions asked in the October Business Tendency Surveys revealed that around 10 per cent of the firms surveyed said that they considered their survival to be at risk. In the hospitality industry this figure is as high as one in three companies, which is also where the pandemic will have the greatest impact on annual sales. In general, smaller firms are more afraid of bankruptcy than larger ones, and there are also regional differences.

Since May 2020 the regularly conducted KOF Business Tendency Surveys have been supplemented by specific questions on the current coronavirus crisis. Around 3,000 companies from the six sectors of manufacturing, construction, retail1, project engineering, financial and insurance services, and other services answer these specific questions every month. In addition, firms in the hospitality and wholesale sectors are surveyed on a quarterly basis.

The outlook for companies was even bleaker in May

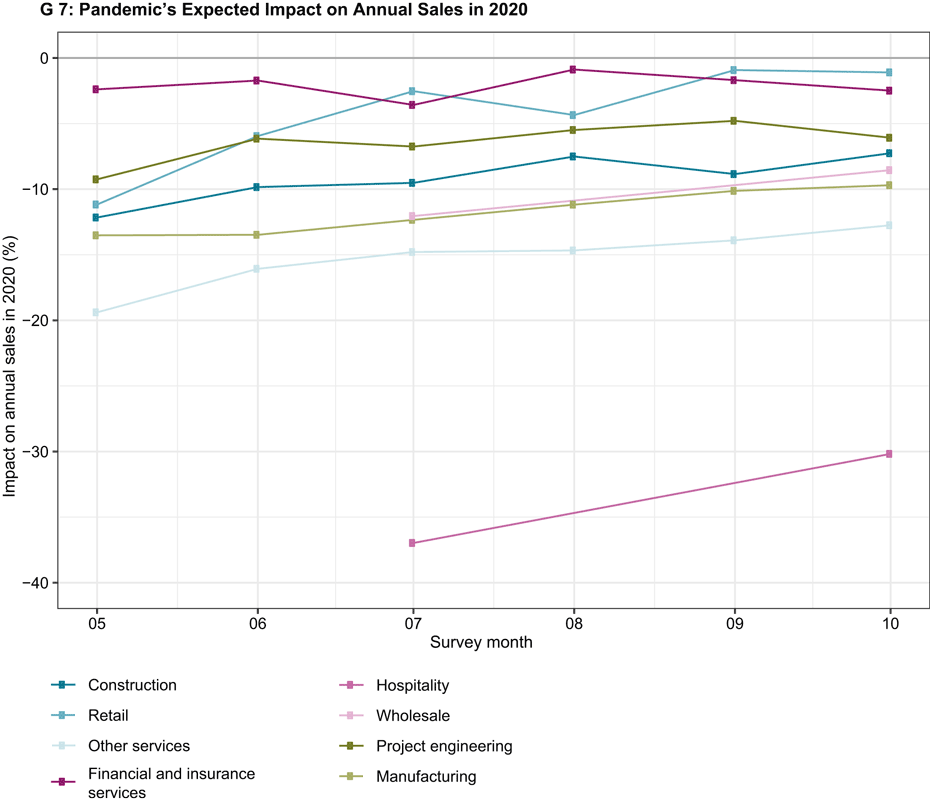

One of the recurring questions asks survey respondents about the pandemic’s impact on annual sales in 2020. This repeated questioning reveals how the expected declines in sales differ between the various sectors of the economy and whether these expectations will be revised over time.

Chart G 7 shows the pandemic’s anticipated impact on total sales in 2020 by survey month and sector, with firms’ responses weighted by company size. In all sectors for which monthly responses are available, companies were more confident in October than they had been in May 2020. One exception is financial and insurance services, which expected to see a slightly more negative impact on revenue in October, although financial institutions had been forecasting a comparatively small impact from the beginning of the pandemic. The difference between the May and September responses is greatest among retailers, where forecasts have improved from minus 11 per cent to minus 1 per cent. For the year as a whole, therefore, hardly any further losses are expected here.

Hospitality, for which only quarterly data are available, is by far the most adversely affected sector overall. Businesses in this industry expected revenues to decrease by around 30 per cent in October, while they had forecast a drop of 37 per cent in July. Other service providers and the manufacturing sector are also relatively severely affected, with revenues falling by 13 per cent and 10 per cent respectively (as at October 2020). Although the outlook for companies was even bleaker in May, the pandemic is likely to leave deep scars in many sectors of the economy.

The extent to which a company’s revenue is adversely affected by the current crisis also depends on the firm’s size. After controlling for attributes such as region and sector, medium-sized firms expect their sales to fall by 1.9 percentage points less than large companies, while small firms anticipate a 3 percentage-point drop and very small businesses forecast a 4.3 percentage-point decrease.

The negative impact of the second wave of infection is still just about visible in October’s responses. However, the majority of these responses were received in the first half of the month, i.e. before the restrictions were tightened on 18 and 28 October. If the rising infection rates and more stringent measures have an impact that is not consistent with the expectations from previous months, this will probably become apparent next month.

Small businesses more likely to be at risk of failing

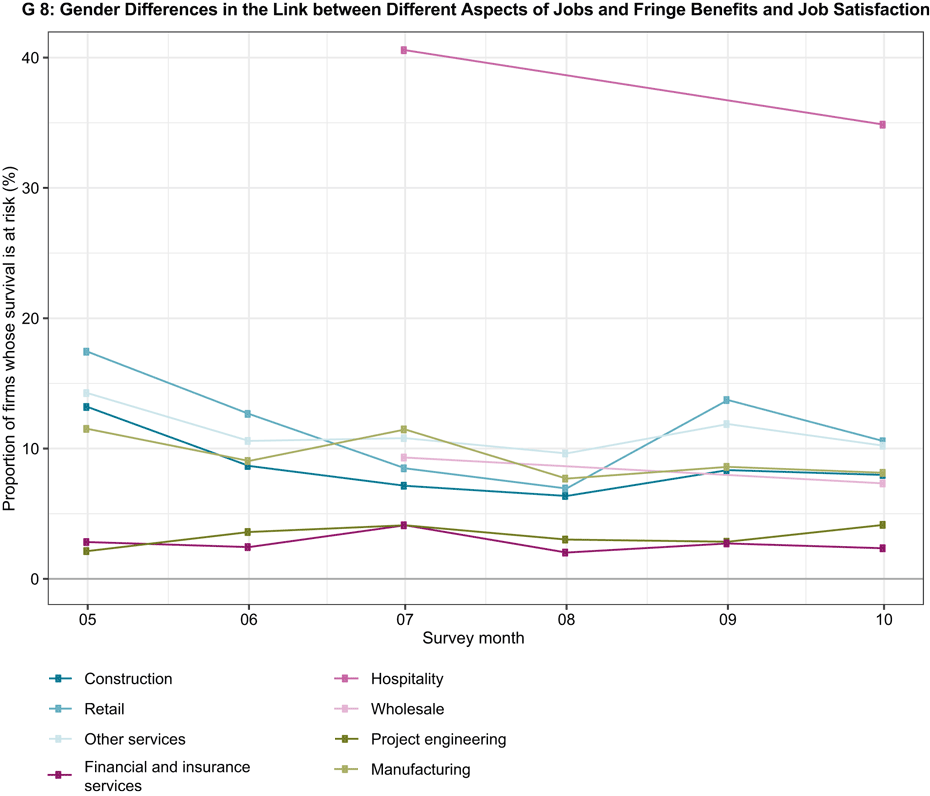

Another specific question asks companies to indicate how much the pandemic poses a risk to their survival. The proportion of firms that consider their survival to be at either high or very high risk has also fallen from an overall average of 11 per cent in May to 7 per cent in August.2 In September and October, however, the threat to their survival increased again slightly (see chart G 8). By far the most vulnerable businesses are those in the hospitality sector, followed by retailers and other service providers. Findings based on logistic regressions show that smaller firms are more likely to be at risk. Moreover, the survival of companies based in Ticino or the Lake Geneva region is less certain.

Falling demand affecting about 60 per cent of companies

Companies were also asked what factors are most affected by the COVID-19 pandemic. The proportion of firms that are not affected increased from 10 per cent in May to 18 per cent in October. Falling demand continues to be the biggest constraint on companies, with 61 per cent of respondents citing this factor in October.3 The second most important constraint (21 per cent) is customers’ insolvency or deferral of payment. Compared with May, slightly more companies reported in October that their own margins were too low or even negative.

-------------------------------------------------------------------

1) Only a small sample of companies in the retail sector is surveyed by KOF. These results are therefore of limited significance for the sector as a whole.

2) As the wholesale and hospitality sectors are only surveyed on a quarterly basis, the monthly figures do not include these two industries in order to allow monthly comparisons.

3) Monthly figures excluding the wholesale and hospitality sectors.

The detailed findings of the KOF Business Tendency Surveys (including tables and charts) are available on our website.

The findings of the latest KOF Business Tendency Surveys from October 2020 include the responses of more than 4,500 private-sector firms from industry, construction and the major service sectors. This equates to a response rate of around 59 per cent.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland