Light at the end of the tunnel: companies are investing in expanding their capacity

KOF Bulletin

The coronavirus crisis caused investment activity in the first year of the pandemic to fall less sharply than firms had originally feared. This is shown by the results of the semi-annual investment survey conducted in spring 2021. Investment is now expected to grow by a nominal 7 per cent in the current year. The increased proportion of companies that plan to pursue expansion investment is a sign of positive demand stimulus, especially in industry and among service providers.

Swiss firms’ investment activity suffered greatly during the coronavirus crisis. According to the results of the semi-annual investment survey carried out in spring 2021, investment in fixed assets decreased by 6 per cent in nominal terms in 2020. However, this means that investment during the first year of the pandemic fell less dramatically than companies had originally feared. The most recent survey, conducted in autumn 2020, reveals that they were expecting a nominal decline of over 9 per cent.

Businesses expect to see investment growth of 7 per cent in nominal terms

The outlook for investment growth in the current year, on the other hand, remains unchanged. Companies expect to report nominal growth of 7 per cent for 2021. This growth is fairly evenly spread across industry (up 5 per cent), construction (up 6 per cent) and the services sector (up 7 per cent). However, there are large variations between individual sectors. Wholesalers and retailers expect to see a strong surge in investment (up 12 per cent and 21 per cent respectively). The hospitality industry, on the other hand, which has been hit particularly hard by the crisis, continues to suffer from lack of investment during the second year of the pandemic. Having already cut its investment activity by 19 per cent in 2020, the hospitality sector expects to report a further decline of 30 per cent for the current year.

Investment growth is driven by capital spending on equipment and machinery. 27 per cent of survey respondents plan to increase their investment in capital equipment this year (compared with 24 per cent in the previous survey conducted in autumn 2020). The sharpest rise since the last survey has been in plans to invest in buildings. 19 per cent of companies intend to increase their construction investment during the current year (compared with 15 per cent in autumn 2020). This is particularly true of the services sector, where the largest construction projects are in the provision of professional, scientific and technical services (up 42 per cent) and in the wholesale and retail sectors (up 25 per cent and 29 per cent respectively). The scale of these projects indicates that the pandemic has created pent-up demand for investment that is now set to be realised.

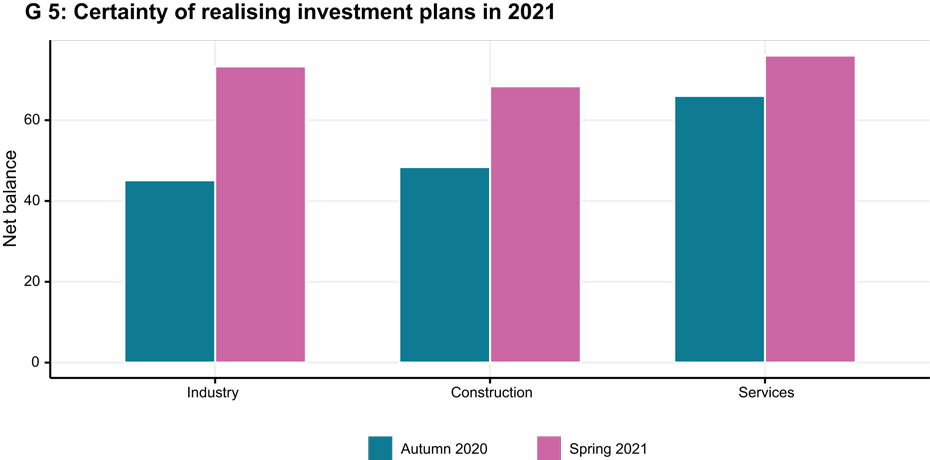

Certainty of realising investment plans has increased

Overall, companies now reckon that their investment plans for the current year are more certain to be realised. Chart G 5 shows that, on balance, the certainty of realising these plans has increased significantly in all sectors, especially in industry. In spring 2021, almost three-quarters of firms rated their investment plans for 2021 as either certain or very certain (compared with 69 per cent in autumn 2020). Conversely, the proportion of companies that consider their investment plans for 2021 to be either uncertain or very uncertain has fallen from 26 per cent in autumn 2020 to 20 per cent in spring 2021. This means that investment-inhibiting uncertainty has been significantly reduced overall.

Expansion investment gaining considerably in importance

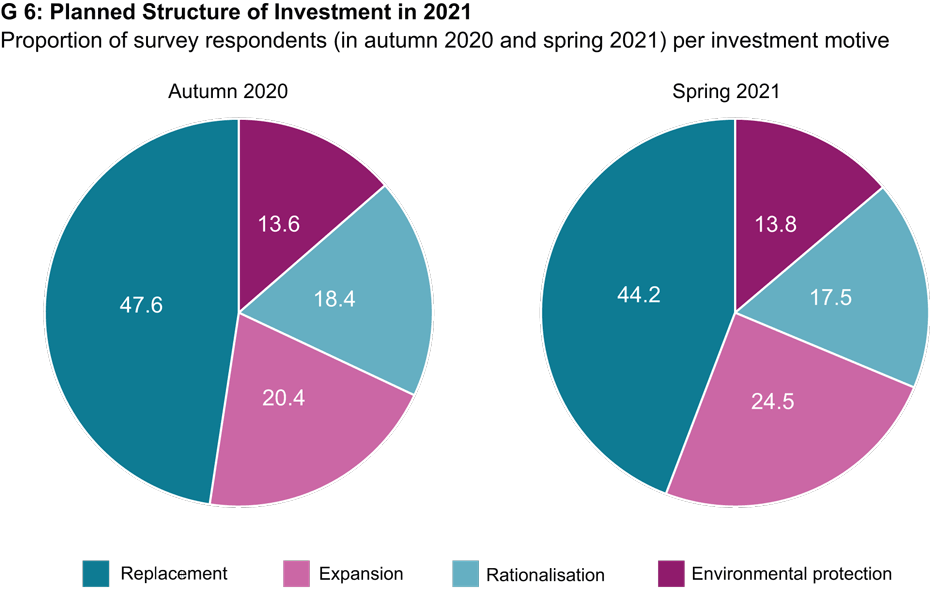

Most companies continue to invest in replacement capacity. Environmental protection is becoming increasingly important in all sectors. At the same time, investing in the expansion of production and service provision has clearly gained in relative importance (see chart G 6).

25 per cent of the companies surveyed say they intend to expand their operational capacity this year. In autumn 2020 this was the case for only 20 per cent of firms. The manufacturing sector and service providers in particular plan to invest in expansion. In construction, on the other hand, the importance of this motive has declined. Expansion investment increases the capital stock and, therefore, production capacity, which is why it can be interpreted as an indicator of companies' expectation of growth. Firms invest to expand their capacity above all when they expect demand to rise. The larger proportion of companies that plan to invest in expansion accordingly indicates positive demand stimulus in industry and the service sector.

The strength of the economy is significantly affected by firms’ investment activity. For this reason the Swiss Economic Institute at ETH Zurich (KOF ETH) conducts a survey of domestic businesses every spring and autumn. The semi-annual survey for spring 2021 was conducted from 22 February to 15 May 2021. 6,306 firms were contacted as part of this survey and 3,041 responded, which corresponds to a response rate of 48 per cent.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland