The power of central bank communication

A recent study by KOF analyses the impact that central bank communication has on financial markets, which are a key transmission channel for monetary policy. The findings show that monetary policy speeches are an important source of information for the formation of expectations in financial markets. The findings also suggest that volatility in financial markets increases when a central bank communicates too complexly.

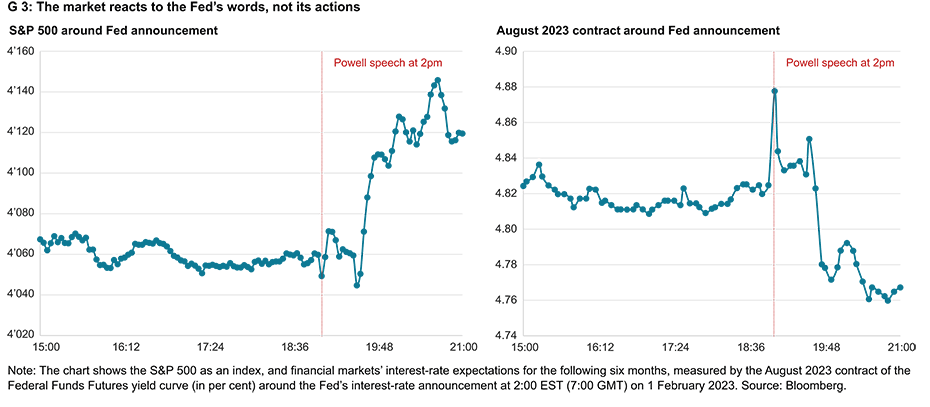

The US Federal Reserve raised its key interest rate by 25 basis points in February 2023. The US equity market (chart G3, left) rose after the relevant interest-rate announcement and interest-rate expectations fell (chart G3, right), although this interest-rate decision was in line with financial market participants’ expectations.

At first glance this seems contradictory. Financial markets are generally efficient, and available information on expected future interest-rate trends is ‘priced in’. If new information becomes available, markets adjust their expectations accordingly. Financial market movements such as those shown in chart G3 should therefore not have happened, as the interest-rate hike was expected.

However, the decisive factor for this adjustment is often not what the central bank does but what it says. It was, for example, Fed Chairman Jerome Powell’s communication in February 2023 that was interpreted as unexpectedly supportive.

Central bank speeches are an important source of information for forming expectations in financial markets

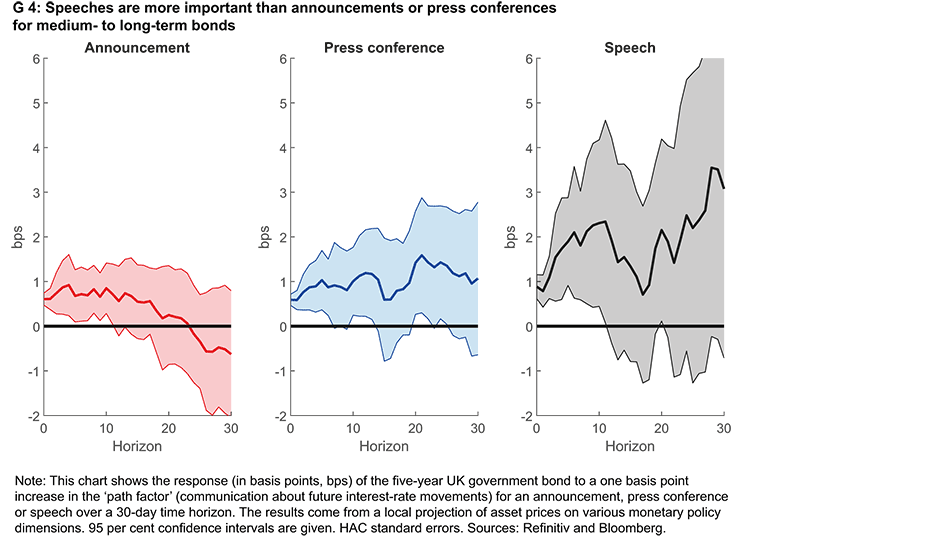

KOF economist Roxane Spitznagel and her co-authors analyse in a recent study how asset prices and bond yields change around a central bank event (interest-rate announcement, press conference or speech) using the Bank of England as an example. Their analysis is based on high-frequency data from the last 25 years and focuses on a narrow, 30-minute time window around each central bank event. This is important in order to isolate the impact that monetary policy has on asset prices from other economic trends.

The findings show that, on average, speeches have a stronger effect on medium- to long-term bonds than announcements or press conferences (chart G4). A speech about a future rate hike of one percentage point would result in an increase in yields of around one percentage point as well (chart G4, right). These effects persist for around ten days after the speech. This is not the case for all speeches, however, and this uncertainty is represented by the area around the estimated effect.

This key role of monetary policy speeches is even more pronounced in the US in terms of scale. The Fed chairman’s speeches are also more important for both bonds and the US stock market than announcements are (Swanson and Jayawickrema, 2021).

After central banks around the world raised interest rates to their highest levels in decades, inflationary pressures have eased and there is now much debate about the timing of the first interest-rate cut (the latest assessment of global interest rates by KOF monetary policy expert Alexis Perakis is available here). Central banks are expected to keep interest rates on hold for the time being. Nevertheless, their influence on markets could be significant as they use a number of channels to communicate their future plans. Our findings suggest that speeches contain certain additional information about monetary policy that is not included in announcements or press conferences. Speeches should be given special attention in the current uncertain environment.

‘Central bank language’ is still not easy to understand

Analysis by the former chief economist at the Bank of England shows that only 10 per cent of central bank publications are comprehensible to the adult population. By way of comparison, for example, campaign speeches by former US President Donald Trump are comprehensible to 70 per cent of the adult population. Data from US literacy surveys and OECD studies can be used to estimate the comprehension of publications (Haldane, 2017).

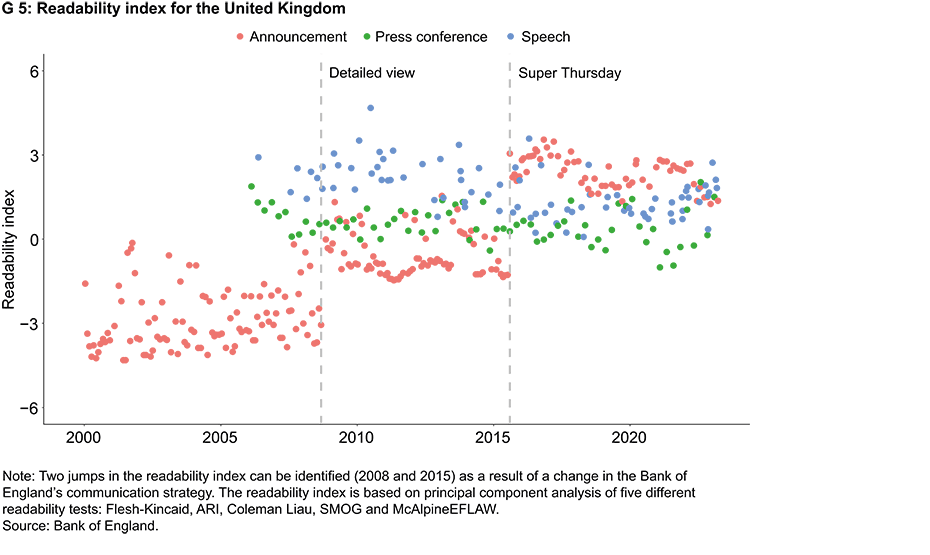

In the second part of this analysis the study presents a new indicator of the linguistic complexity of central bank communication, which was calculated for each central bank event in our dataset. This ‘readability index’ is based on textual analysis of the Bank of England’s scraped communication. It is based on various linguistic features such as average word and sentence length, the proportion of complex words and the proportion of so-called ‘mini-word clusters’, which are particularly relevant for non-English speakers. A readability index of zero means that the communication is largely comprehensible for the average adult. Higher values indicate more complex communication.

Chart G5 shows that despite increasing efforts to improve communication, it still does not appear to be easy to understand.

Clear and simple monetary policy communication can reduce volatility in markets

A good dose of luck and good central bank policy were identified as key factors during the Great Moderation from the 1980s to the financial crisis – a period characterised by economic stability and low market volatility, in contrast to previous decades. Following the COVID-19 pandemic, the war in Ukraine and ongoing geopolitical tensions around the world, there are now fears that we are entering a period of high volatility.

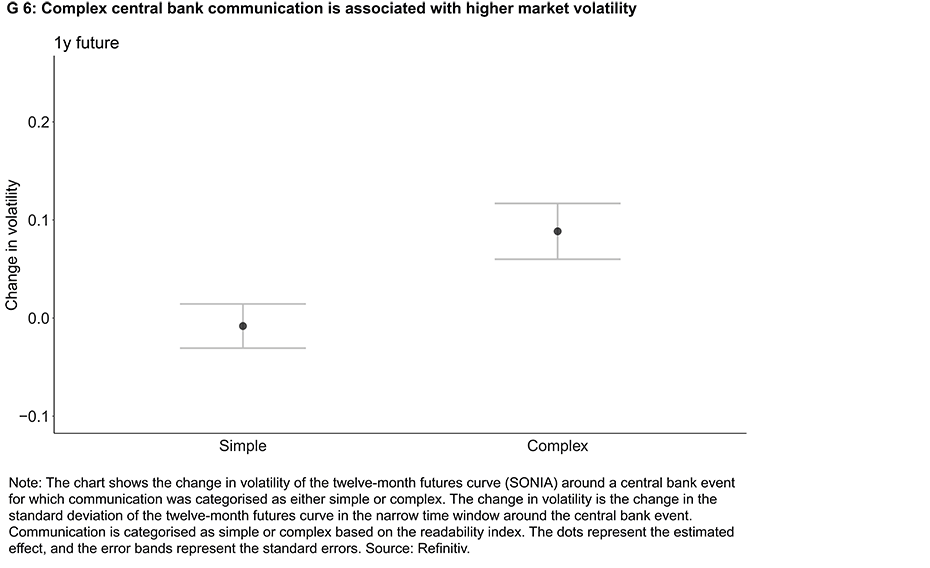

Good communication by central banks that is clear and easy to understand can help to minimise volatility. The final part of this analysis shows that complex communication – as measured by the readability index – is associated with higher volatility in markets.

This is illustrated in chart G6. It shows how the volatility of one-year interest-rate expectations changes after a central bank event. Volatility increases when communication is characterised as complex as opposed to simple communication.

These findings suggest that central bank communication should be clear and simple, as this reduces volatility in markets. This is relevant because asset prices and financial conditions in general are a key transmission channel of monetary policy. In addition to a good dose of luck and good central bank policy, good communication is required. Central banks should therefore focus on the part that they can influence, as good monetary policy includes good monetary policy communication in particular.

The study entitled "Keep it Simple: Central Bank Communication and Asset Prices" by Haroon Mumtaz (Queen Mary, University of London), Jumana Saleheen (Vanguard Asset Management Ltd) and Roxane Spitznagel (KOF), on which this article is based, is available here: external page http://dx.doi.org/10.2139/ssrn.4518806

References

Haldane, Andy (2017): «A little more conversation, a little less action», Bank of England Rede an der Federal Reserve Bank of San Francisco, Macroeconomics and Monetary Policy Conference. external page https://www.bankofengland.co.uk/speech/2017/a-little-more-conversation-a-little-less-action

Swanson, Eric und Vishuddhi Jayawickrema (2021): «Speeches by the fed chair are more important than FOMC announcements: An improved high-frequency measure of us monetary policy shocks», Working Paper. external page https://sites.socsci.uci.edu/~swanson2/papers/hfdat.pdf

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland