Most sectors are facing a difficult year ahead

- Swiss Economy

- KOF Bulletin

Although large sections of the Swiss economy have got off to a good start in 2020, the coronavirus pandemic is stifling any optimism. The manufacturing, hospitality and retail sectors have come under particularly intense pressure.

The indicators for the Swiss economy were still performing well at the beginning of the year. The KOF Economic Barometer and the KOF Business Situation Indicator were pointing upwards. Most sectors of the economy were experiencing an improvement in their business situation. The coronavirus pandemic has now put an abrupt end to this encouraging trend.

Owing to its high level of international integration the manufacturing sector is strongly influenced by developments abroad. 2019 was a particularly difficult year because of international trade conflicts and other economic policy uncertainties. This was also felt by Swiss companies. The production statistics of the Federal Statistical Office (FSO) reveal that the output of manufacturing firms fell in the second half of 2019.

At the start of 2020 the manufacturing sector was still managing to decouple itself from this downward trend. The information provided by companies in the KOF Business Tendency Surveys suggested that dissatisfaction with existing order books was no longer increasing any further. Moreover, the utilisation of technical capacities was no longer being reduced by the end of 2019.

Expectations on a downward trajectory since mid-March

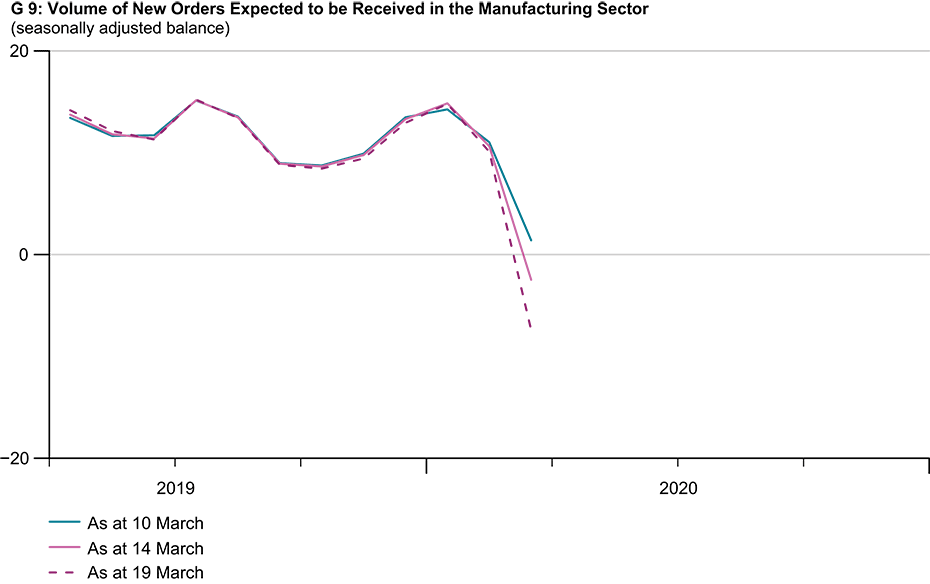

Since mid-January, however, this growing confidence has been increasingly dented by news of the coronavirus outbreak. Although the impact on the performance of the manufacturing sector in Switzerland is likely to have remained limited at first, as KOF’s survey findings for February show, scepticism about incoming orders over the next three months grew steadily throughout March. Chart 1 shows the time series of antici-pated incoming orders for three data statuses in March. These expectations have been on a downward trajectory since mid-March.

The hospitality industry is also highly concerned about the coronavirus pandemic. Business here was solid at the beginning of the year and remained virtually un-changed throughout January. At the beginning of this year firms were still expecting a small overall increase in overnight stays during the first quarter of 2020. These expec-tations have become obsolete owing to the outbreak of the coronavirus pandemic. All tourist travel both to and within the Schengen area has now ground to a halt.

Retail sector under immense pressure

The retail sector was showing signs of weakness around the turn of the year. Accord-ing to the FSO, sales fell in real terms in both December and January. Food and bev-erage retailers and other retailers sold fewer goods in both months. However, the business situation in the retail and wholesale sectors improved slightly at the beginning of the year, as shown by the KOF Business Tendency Surveys.

Lately, however, a new situation has emerged. Many retail outlets have had to close. By the end of March only shops covering basic needs, such as grocery stores and pharmacies, remained open. These are likely to do good business. The same applies to mail order companies, which are experiencing a surge in demand. Despite these developments in certain lines, the retail sector as a whole is under immense pressure.

The construction industry is also affected

In the construction industry, capacity utilisation has gradually increased since mid-2019. In addition, according to the KOF Business Tendency Surveys, the order books available at the beginning of 2020 were still rated as satisfactory to good. Construction output this winter benefited from unusually favourable weather conditions. Building activity was therefore not reduced to the usual seasonal extent at the turn of the year. However, the construction industry will also be affected by the pandemic. Construction activity in Ticino has already been suspended owing to supply bottlenecks.

The business situation of companies in the financial and insurance services sector re-mained very good at the beginning of the year. These institutions expected demand in the first few months of 2020 to grow less sharply than it had previously. The recent turbulence in financial markets has rendered earnings prospects even less favourable.

The business situation of other service providers improved at the beginning of the year. Their earnings also grew significantly. The pandemic is now posing various chal-lenges for these service providers. The transport and logistics sector is likely to face considerable problems overall. By contrast, healthcare services are booming.

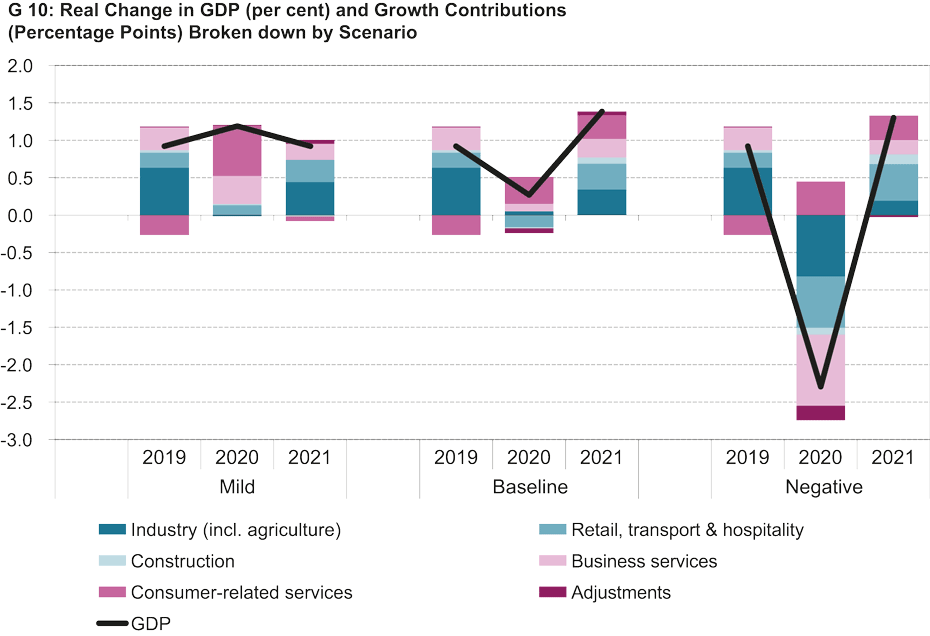

It is currently highly uncertain how the pandemic is likely to continue going forward. KOF has therefore developed various scenarios. The assumptions underlying these scenarios and the resultant consequences for the Swiss economy are explained in detail in the latest economic forecast.

Almost all sectors will suffer in the negative scenario

KOF’s baseline scenario assumes that the pandemic will significantly disrupt economic life over the next twelve months. However, the countermeasures taken should mitigate the economic impact in summer 2020. Over the course of this year the imposed pro-duction restrictions will spread along value chains and develop into supply bottlenecks, which will reduce output across sectors. The containment of the virus will enable some of the output lost to be compensated for at the end of this year and next year.

This year the growth contribution made by the retail, transport and hospitality sectors in particular will be negative. Consumer-related services, on the other hand, are clearly in positive territory thanks to the healthcare sector.

The negative scenario assumes that all sectors – with the exception of consumer-related services – will be seriously adversely affected this year (including on average). Real GDP could fall by 2.3 per cent. Next year will see the situation in this scenario improve, with growth of 1.3 per cent. Given the sharp slump this year, this is a weak recovery. By way of comparison: during the great recession, GDP initially fell by 2.2 per cent in 2009 and then rose by 3.0 per cent the following year.

A longer version of this article can be found here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland