Coronavirus crisis: more and more sectors report shortage of goods and intermediate products

- Swiss Economy

- KOF Bulletin

While the decline in demand is constraining fewer and fewer companies, the availability of goods, inputs and supplies is now one of the most important restrictions. Among wholesalers, for example, about half of all businesses are affected.

The pandemic and the accompanying voluntary or government-imposed restrictions have had a noticeable impact on Swiss firms. In order to assess this effect, KOF supplemented its regularly conducted Business Tendency Surveys with specific questions on the coronavirus crisis for the eleventh time in April. Approximately 3,000 firms from the six sectors of manufacturing, construction, retail , project engineering, financial services and insurance, and other services take part in this monthly survey. In addition, about 800 responses are received from firms in the hospitality and wholesale industries on a quarterly basis.

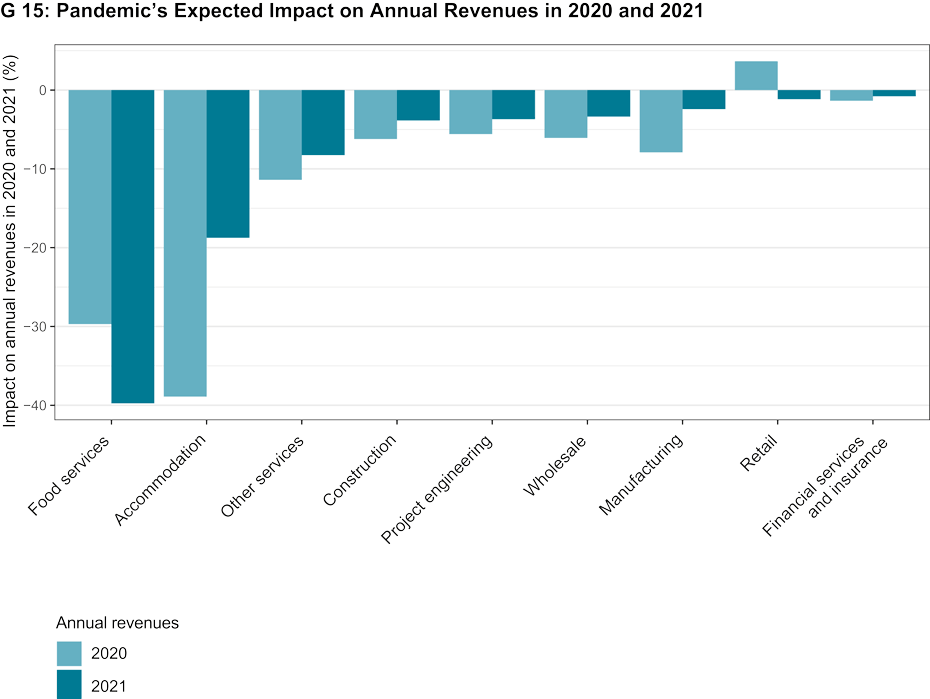

Food service businesses expect revenue in 2021 to be weaker than it was in 2020

Chart G 1 shows, broken down by sector, the adverse impact that the pandemic is expected to have on total revenues for 2020, as reported in January 2021, and for 2021, as anticipated by firms in April 2021. The businesses’ responses were weighted by company size. According to the April 2021 survey, it is feared that the pandemic will have a negative impact on annual revenues across all sectors in 2021. Revenues in the hospitality industry are expected to drop by almost a third in both years owing to the pandemic. The distinction between accommodation and food service businesses is interesting: while accommodation providers expect to see a less severe downturn in 2021 than in 2020 (2020: down 39 per cent, 2021: down 19 per cent), food service businesses see the current year as being worse (2020: down 30 per cent, 2021: down 40 per cent). Also highly negatively affected is the other services sector (down 8 per cent), with businesses operating in transport and warehousing as well as the arts, entertainment and leisure likely to face the sharpest declines. In the manufacturing sector the current year is expected to be nowhere near as bad as last year. The decrease in 2020 was 8 per cent and is currently expected to be 2 per cent this year.

The sectors surveyed monthly reported their revenue expectations for the current year back in February and March. Forecasts in all sectors were revised upwards compared with February. In the construction sector they were revised from minus 6 per cent to minus 4 per cent, while in manufacturing they were revised from minus 4 per cent to minus 2 per cent.

The quantitative revenue expectations obtained from the April 2021 survey were also analysed using regressions, controlling for company size, region and sector. The results show that very small businesses with fewer than nine employees expect a five-percentage-point lower decline in revenue than large companies with more than 250 employees. The difference between small businesses with between ten and 50 employees and large companies is five percentage points. A breakdown by major region reveals that firms in Ticino and the Lake Geneva region have suffered a considerable slump in revenues.

Decreasing risk to survival

Survey respondents indicate in another coronavirus-specific question how much their company's survival is at risk as a result of the pandemic. The proportion of businesses across all sectors whose survival is either highly or very highly at risk was 11 per cent in April, which is three percentage points lower than in January 2021. The situation is most challenging in the hospitality industry: 47 per cent of businesses here see their survival as being either highly or very highly at risk. Data analysis using logistic regressions shows that companies struggling with their debt or liquidity situation are more likely to fear for their survival.

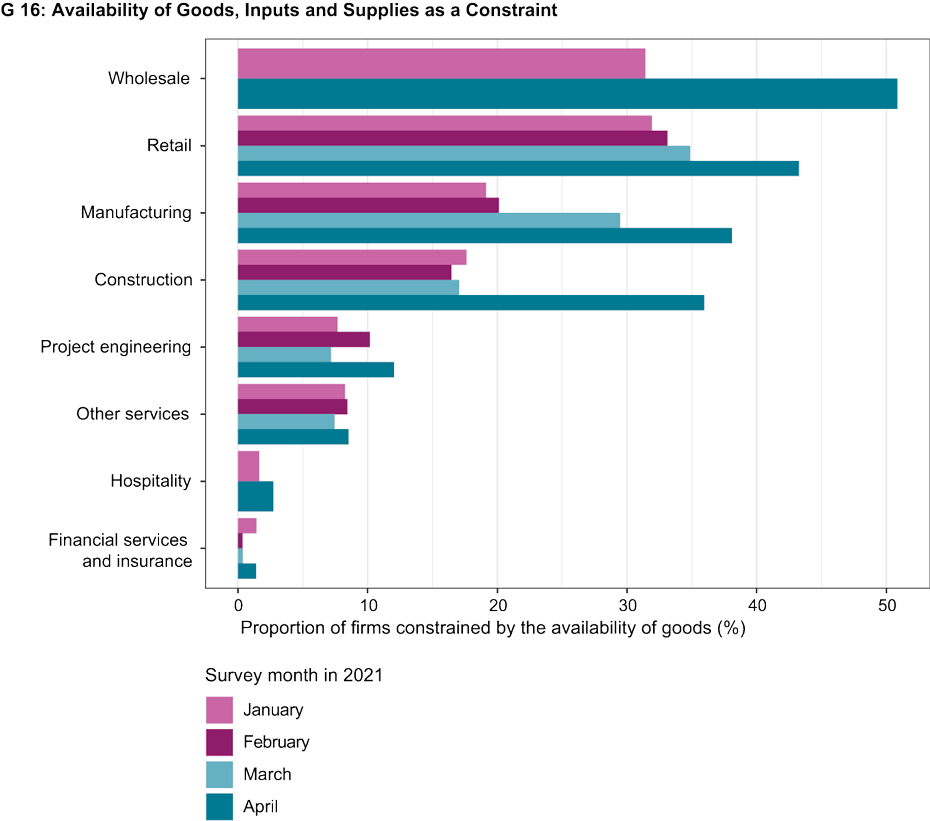

Availability of goods is increasingly becoming a problem

Companies were also asked about the factors that had the greatest adverse impact during the pandemic. 18 per cent of firms said they were not affected. The biggest restriction is the decline in demand. However, the proportion of businesses giving this answer fell steadily from 67 per cent in May 2020 to 48 per cent in April 2021. Across all firms, the availability of goods, inputs and supplies is currently the second-biggest constraint, with the relevant proportion jumping by 10 percentage points to 24 per cent compared with January 2021. Chart G 2 shows the proportion of businesses that reported being constrained by the availability of goods for each sector and for the period of January to April 2021. This restriction was cited particularly often in the wholesale (51 per cent), retail (43 per cent) and manufacturing (38 per cent) sectors. Construction companies are also increasingly being restricted by the availability of goods; the proportion of such firms has more than doubled compared with the previous month and amounts to 36 per cent, according to the latest data.

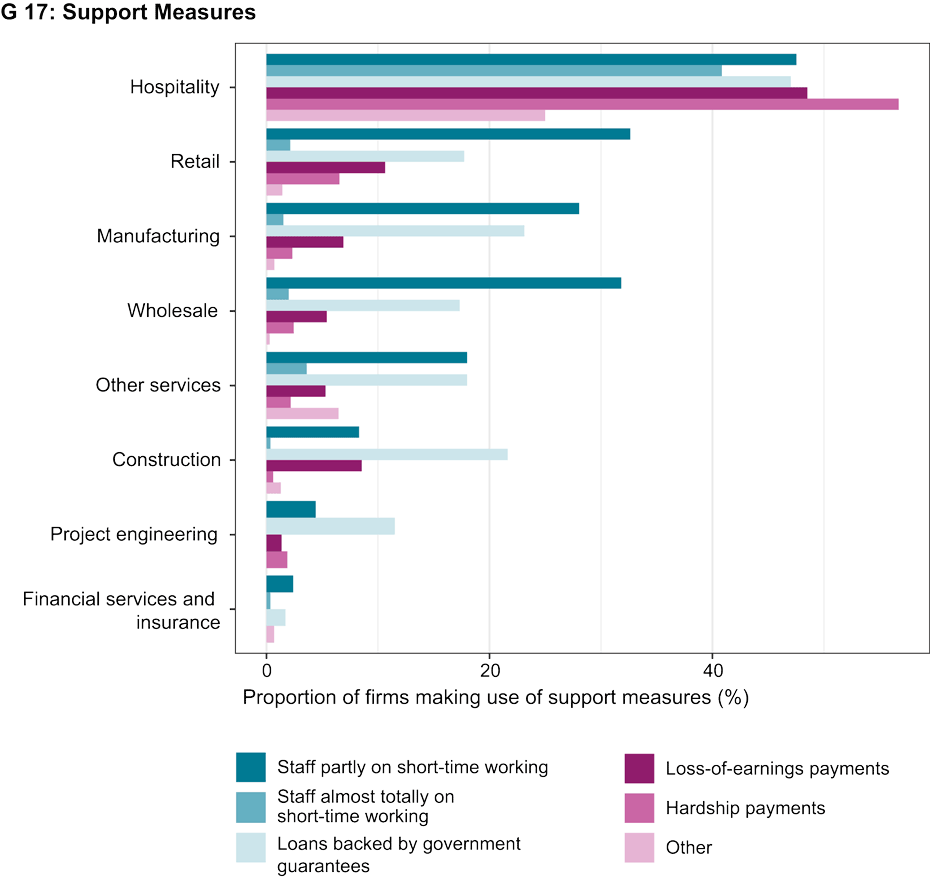

38 per cent of businesses making use of support measures

Chart G 3 shows the proportion of firms that made use of specific support measures in April 2021, broken down by sector. Of the companies surveyed, 62 per cent are currently not claiming any support measures. Around one in four businesses are receiving short-time working compensation, with 20 per cent claiming short-time working for only part of their workforce (up to 85 per cent of working hours) and 5 per cent for almost their entire workforce (over 85 per cent of working hours). In addition to the hospitality (88 per cent) and retail (35 per cent) industries, short-time working is also being used by many companies in the wholesale (34 per cent) and manufacturing (30 per cent) sectors. Loans backed by government guarantees have been taken out by 20 per cent of survey respondents, especially those in the hospitality (47 per cent), manufacturing (23 per cent) and construction (22 per cent) sectors. Hardship and loss-of-earnings payments are also mainly being utilised by businesses in the hospitality industry (56 per cent and 49 per cent respectively).

KOF Business Tendency Surveys

The findings of the latest KOF Business Tendency Surveys from April 2021 include responses from more than 4,500 firms from industry, construction and the major service sectors. This equates to a response rate of around 65 per cent. Since the beginning of the COVID pandemic these regular surveys have been supplemented with specific questions on the coronavirus crisis.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland