How is the retail sector faring as it enters the Christmas period?

- Business Tendency Surveys

- Swiss Economy

- KOF Bulletin

The Christmas trade is of great importance for the retail sector. November and, even more so, December are usually the months that generate the highest sales of the year. KOF has therefore taken the pulse of the retail sector. Following a swift recovery in Switzerland and neighbouring countries after the slump in spring, confidence in November fell only slightly in Switzerland but plummeted in Austria.

Given the rising infection rates, coronavirus restrictions were tightened further in many countries in the autumn. However, the packages of measures taken differ. In Germany, for example, retail outlets have so far remained open during the partial lockdown there. In Austria, by contrast, shops with the exception of grocery stores and pharmacies had to close in mid-November. In Switzerland, the Federal Council has not yet imposed any nationwide restrictions on the retail sector. However, several cantons have been forced to take further steps. The canton of Geneva, for example, declared a state of emergency at the beginning of November and many shops had to close their doors.

Given these circumstances and the importance of the Christmas shopping season, the question that arises now is: how do retailers rate their current situation? An international performance comparison is provided by the so-called Confidence Indicator, which the EU Commission publishes for all member countries.

KOF calculates a comparable indicator for Switzerland, which is computed as the average of three questions from the retail-sector business surveys. The focus here is on the performance of sales in the past three months, an assessment of current inventories, and expected sales over the next three months. However, differences in the performance of confidence indicators cannot be causally attributed to the coronavirus restrictions. Income support measures and changes in consumer behaviour can also play a role here, for example.

Only in Switzerland has there been an increase far above the pre-crisis level

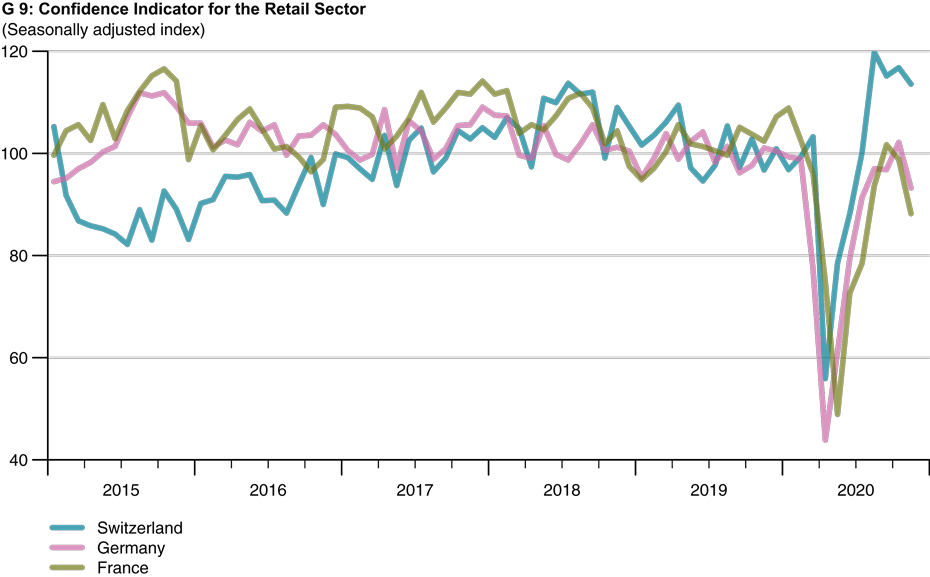

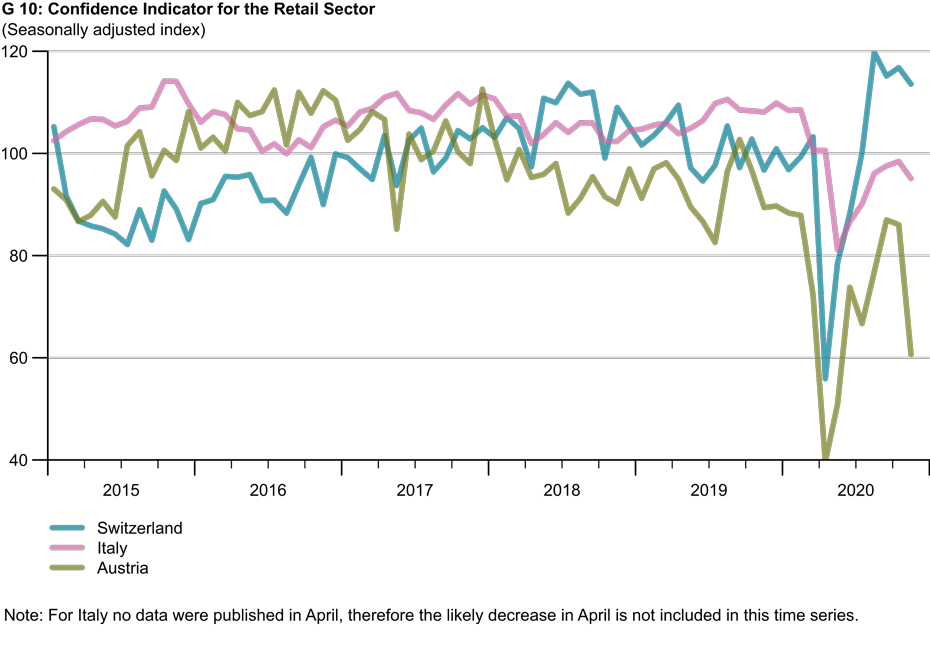

Chart 9 shows the performance of confidence indicators for Switzerland and our neighbours Germany and France. The situation in all three countries improved soon after the slump in spring. A swift recovery in the retail sector is therefore not a purely Swiss phenomenon. However, only in Switzerland has the indicator risen way above its pre-crisis level. Chart 10 shows that the confidence indicator also tended to rise over the summer in the other two neighbouring countries Italy and Austria, although it remained below average in Austria.

The latest figures presented in the charts are based on the November business surveys. These results show a relatively modest decline in the confidence indicators for both Switzerland and Italy. In Germany and France the decline is more pronounced, while in Austria the indicator has plummeted again, albeit not as much as in spring.

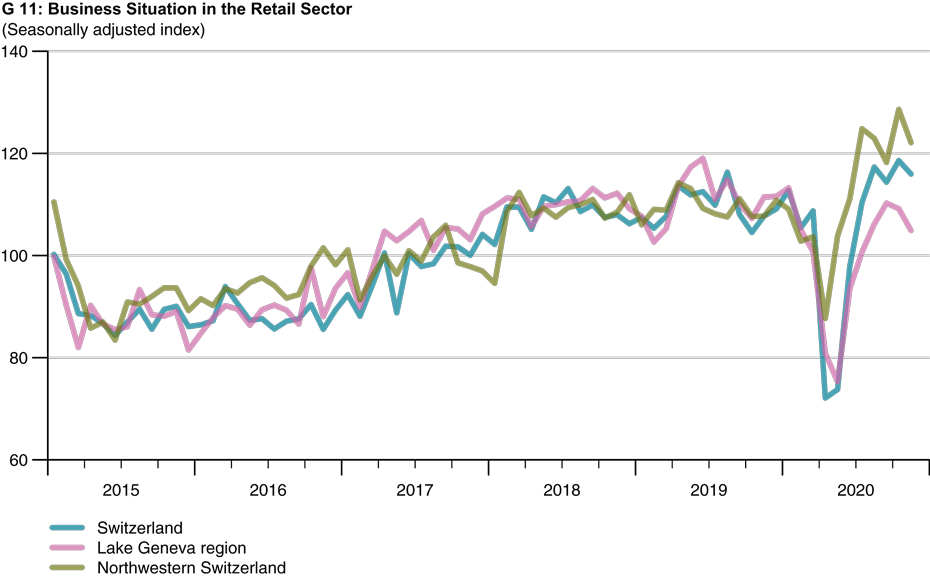

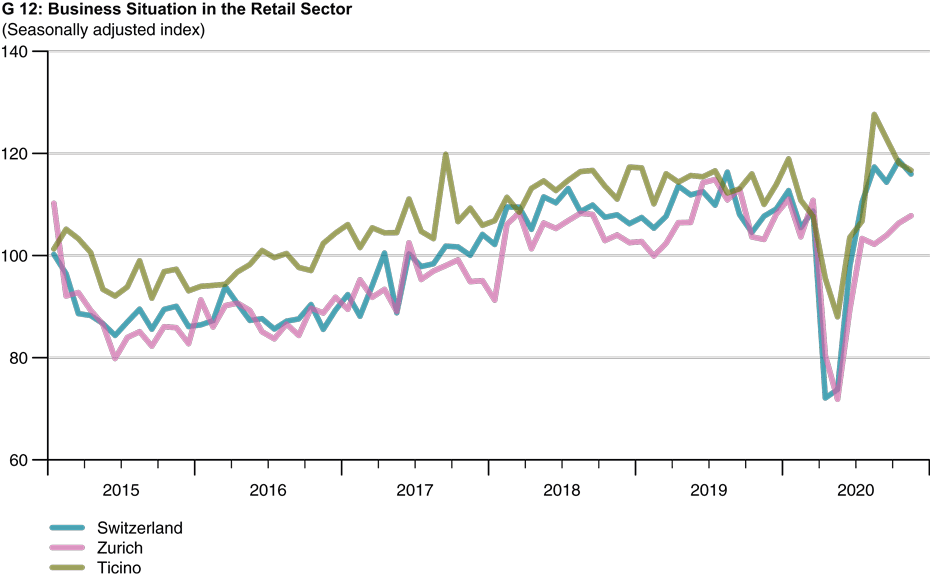

Regional trends within Switzerland are illustrated by the business situation indicator. In order to compile this indicator, firms are asked to assess their current business situation, which can be classified as good, satisfactory or poor. The retail-sector indicator for Switzerland as a whole declined in November. Chart 11 shows that this negative trend is more pronounced in the Lake Geneva region, although the situation here was already slightly below the overall average. By contrast, business in Northwestern Switzerland was above average, although here too the situation has recently deteriorated somewhat. Chart 12 shows a similar picture for Ticino, where the situation was above average – especially in summer. In the Zurich region, on the other hand, the recovery has recently continued, although it had previously been relatively sluggish.

Further information on the KOF Business Tendency Surveys can be found here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland