Wave of bankruptcies: postponed or cancelled?

- Swiss Economy

- KOF Bulletin

Far fewer companies went bankrupt last year than would have been expected in normal times. This is due to the legal and economic support measures introduced. A sudden wave of bankruptcies is still not expected.

Last year’s economic slump led to a threatening situation. The revenues of many companies that had been successful in normal times were directly affected by the restrictions and the general reluctance to consume. The authorities reacted quickly, firstly by taking legal measures. The legal standstill ordered by the Swiss Federal Council (19 March to 4 April 2020) and the subsequent debt collection holidays (until 19 April) gave companies breathing space. In addition, the obligation on companies to report over-indebtedness was suspended until the end of October. However, economic support measures were also implemented quickly and without complications. To secure liquidity, companies could apply for COVID-19 bridging loans guaranteed by the federal government until the end of July. The expansion and simplification of short-time working also allowed affected companies to cover fixed personnel costs.

Far fewer company bankruptcies thanks to support measures

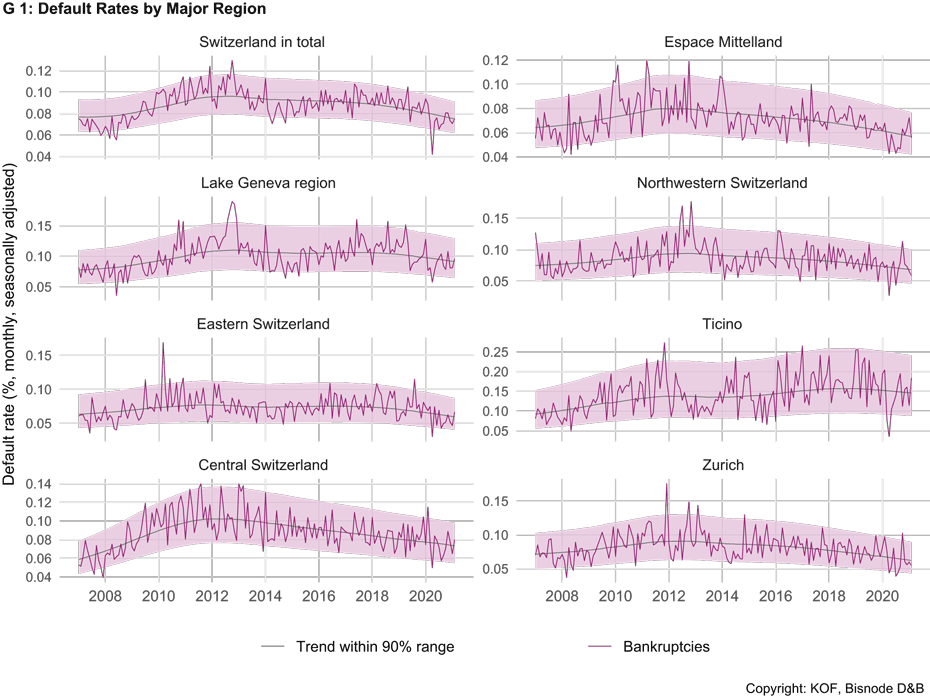

Consequently, Switzerland as a whole experienced an unprecedented sharp decline in bankruptcies. Between March and July 2020, bankruptcies (incl. liquidations1 by the bankruptcy authorities) were on average 21 per cent lower than in the same period of the previous year. This is illustrated in Chart 1, which shows the monthly default rates for Switzerland as a whole and for the major regions.

Even after many support measures had expired, above-average numbers of bankruptcies occurred only in isolated cases2. Although bankruptcies in Zurich and Northwestern Switzerland flared up briefly in the autumn, a wave of bankruptcies failed to materialise.

Bankruptcies in indirectly affected industries

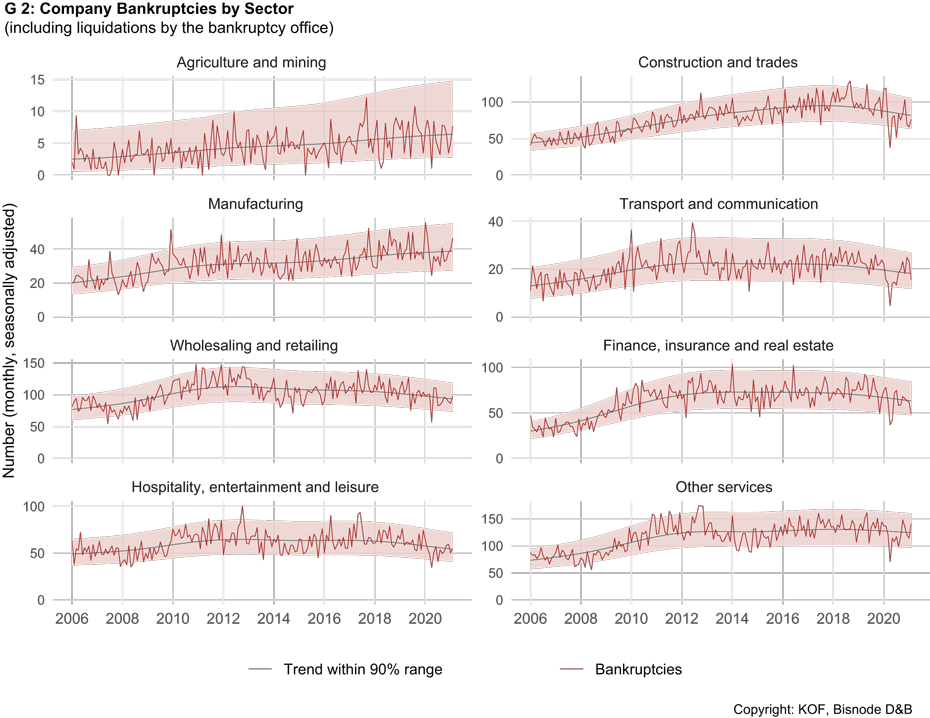

In a sectoral analysis, it is noticeable that those industries that were seriously affected by the official restrictions did not reveal above-average bankruptcy rates. Chart 2 shows that, for example, the retail, hospitality and entertainment sectors did not see any noticeable increases. Instead, companies that are downstream of the affected industries in the value chain or are directly impacted by behavioural changes suffered more. This affected, for example, passenger transport companies, building cleaning and maintenance firms, laundries, and hairdressing and beauty salons.

Comparison with previous crises

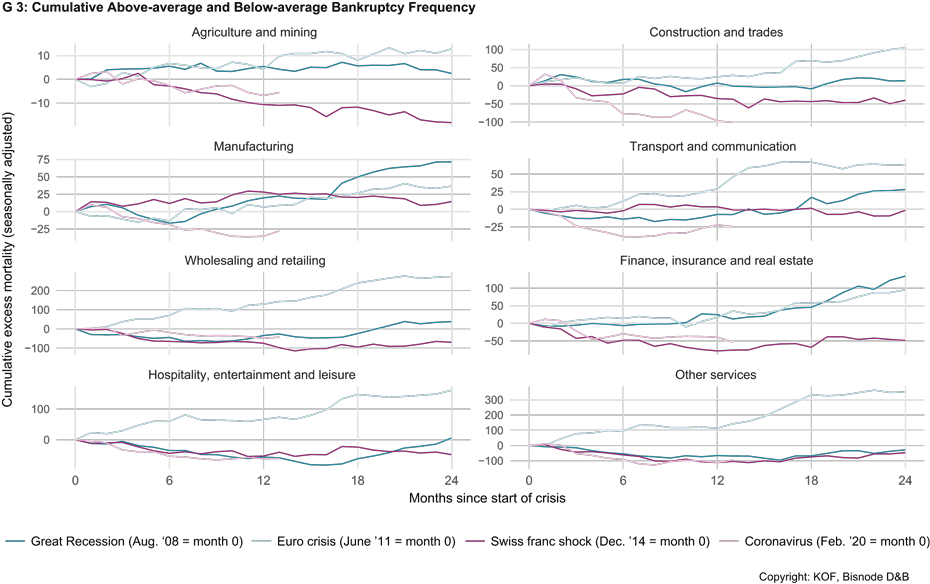

The coronavirus crisis is unique in comparison with past crises. Chart 3 shows the cumulative deviation from the cyclically adjusted trend. Accordingly, it shows how much more or less companies have had to file for bankruptcy than during normal times. For example, the euro crisis affected most sectors, and the Swiss franc shock was followed by a period during which more companies in the manufacturing sector had to file for bankruptcy than usual. Since the beginning of the coronavirus crisis, however, all sectors have seen far fewer bankruptcies than during normal times. Comparisons with previous crises are difficult, mainly because of the massive government support measures introduced.

High level of business start-ups recently despite economic uncertainty

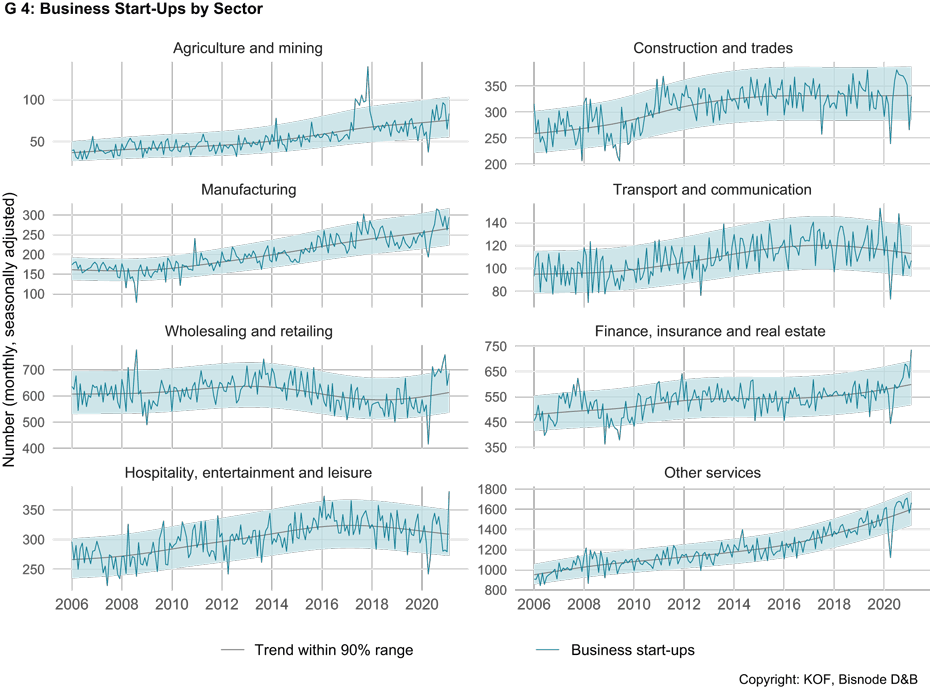

Chart 4 shows that – despite the economic uncertainty – an above-average number of new firms have been registered in the commercial register since the beginning of the crisis. This can also be seen in sectors that have been directly affected by the crisis – such as the retail sector or, most recently, the hospitality industry. This is basically a positive sign. Much of this trend is being driven by catch-up effects following the slump in start-ups in the spring. Furthermore, some sectors are likely to benefit from the pandemic-related changes, such as online retailers, IT service providers, delivery services and the chemical and pharmaceutical sectors. Company reorganisation processes could also play a role.

More bankruptcies expected

The question remains whether and, if so, when an increase in bankruptcies can be expected. The cantonal hardship programmes, under which companies severely affected receive non-repayable contributions, have been running since the beginning of the year. Other support programmes, such as the COVID-acquisition replacement and short-time working, also continue to be used. This should cushion the negative impact of the second and third waves of the pandemic. As the pandemic subsides, the economic recovery is likely to get back on track, benefiting the hospitality and retail sectors. Nevertheless, there is great uncertainty about the future trajectory of the economy, and debt has risen in many places – in some cases probably to unsustainable levels. In addition, structural change has begun in some sectors. The exit of businesses that are no longer viable under the changed circumstances forms part of Schumpeter's ‘creative destruction’. Although some increase in bankruptcies over the coming period will therefore probably be unavoidable, the official measures taken to support the economy have prevented a dramatic rise.

----------------------------------

1) Liquidation by the bankruptcy court shall take place if there is a deficiency in the organisation and this is not remedied in time. This is the case if the organisation of a company does not comply with the legal provisions with regard to its administration, representation or auditing. This is not infrequently an indication that a company is also in an economic emergency.

2) Cf. Press Release of November 2020.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland