The COVID-19 pandemic is widening the gap between rich and poor

KOF Bulletin

The coronavirus crisis has exacerbated existing inequalities in Switzerland. Low-income households are being hit particularly hard by the pandemic – not just financially but also in terms of mental health. This is because most high-income earners have been able to switch to working from home and have suffered only a minor loss of income, whereas many low-income earners have been affected by short-time working and unemployment. And that, in turn, has had a serious impact on their mood.

“To him that hath shall be given”, as the saying goes. The fall-out from the economic crisis triggered by the COVID-19 pandemic is not quite as one-sided as this proverb implies. Many high-income earners have also suffered a significant loss of income as a result of the crisis. But households at the lower end of the income distribution have been more severely affected by the pandemic than richer households in most of the dimensions studied – be it the impact of the coronavirus crisis on income, spending, saving or personal well-being. A new KOF study investigates the distributional effects of the crisis.

Substantial loss of earnings for low-income earners and the self-employed

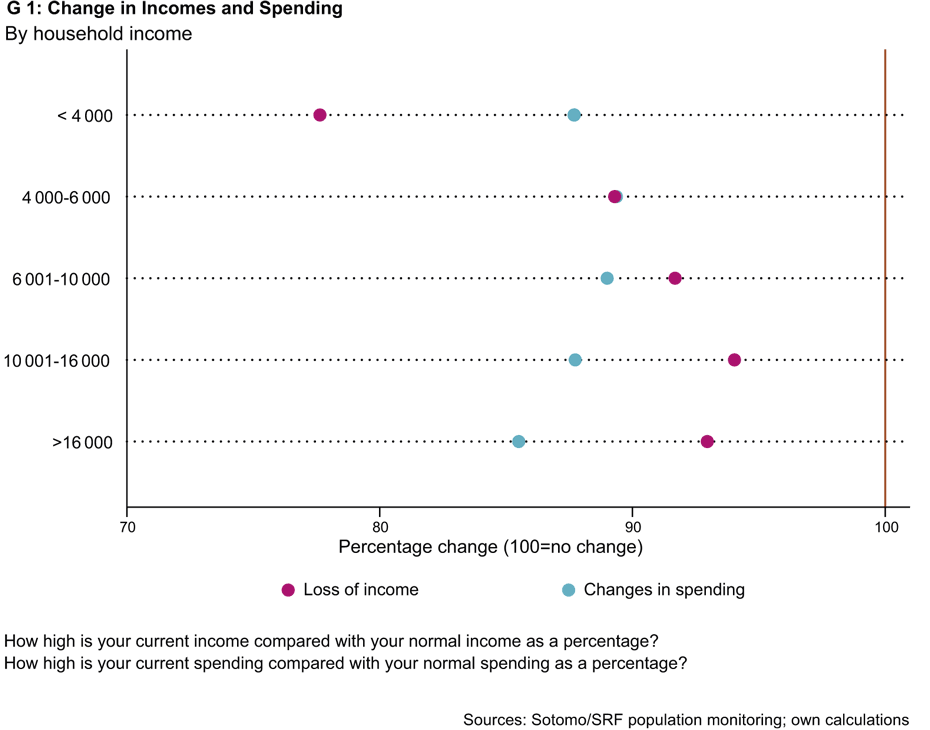

People on low household incomes of less than 4,000 Swiss francs report that their incomes have dropped by a substantial 20 per cent on average (see G 1). Those in households on monthly incomes of more than 16,000 francs have seen their incomes fall by 8 per cent. Moreover, the situation of respondents on household incomes of less than 4,000 francs has hardly improved even since the end of the lockdown in summer 2020. In contrast, the loss of income suffered by the other income categories in the two subsequent surveys (October 2020 and January 2021) is smaller than it was in the two previous surveys, which took place in the middle and at the end of the first lockdown. Changes in income as a result of the pandemic are strongly related to changes in employment situation. The household incomes of survey respondents who continued to work decreased little or not at all on average. There were substantial losses of income among households in which the respondent became unemployed. Significant declines in income were also experienced by many self-employed individuals.

Low-income households more often affected by short-time working and unemployment

Although the decline in incomes among respondents affected by short-time working was somewhat smaller than it was among the newly unemployed, it was still significant, averaging around 20 per cent. If we look at the relevant trends in terms of the income distribution, we firstly see that people from poorer households more frequently experienced a deterioration in their employment situation. About one-third of respondents from households on incomes of less than 4,000 Swiss francs who were in gainful employment before the crisis either became unemployed during the crisis or had to claim short-time working benefits. The corresponding proportion in the highest income category (household incomes above 16,000 francs) was one-sixth of respondents. Secondly, we can see that the loss of income across all employment situations was greatest for people from households at the lowest end of the income distribution. There was a particularly sharp drop of 50 per cent in the incomes of respondents from the poorest households who became unemployed.

Fewer options for consumption

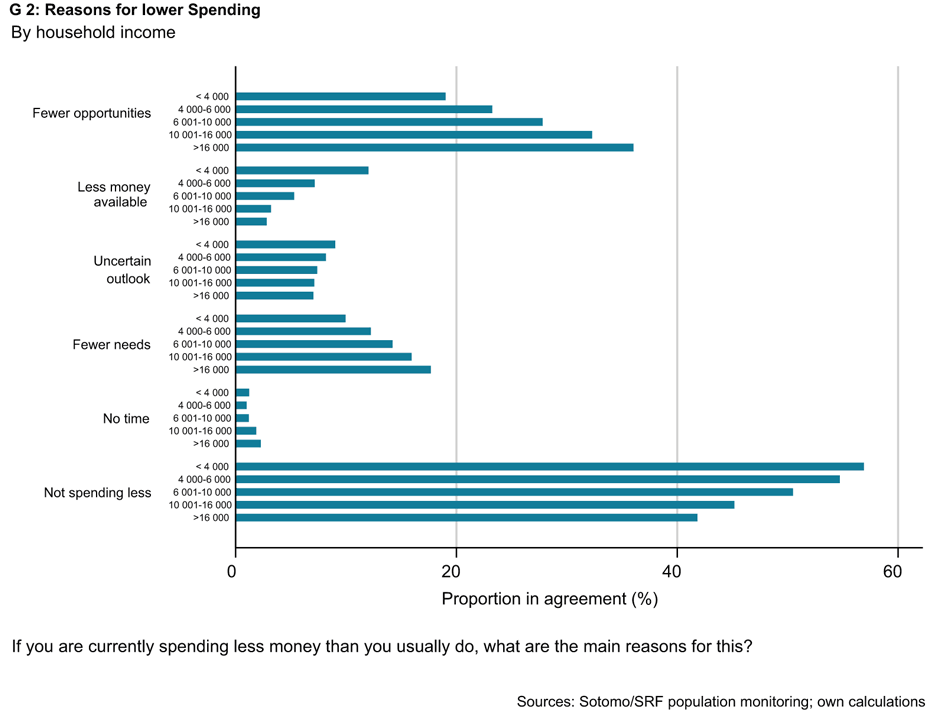

When it comes to expenditure – household consumption – the picture is different. Respondents from households on high or very high incomes reduced their spending the most (by around 16 per cent). People from low-income households cut their spending slightly less (by 12 per cent). The reasons for this reduction in expenditure differ in part between poorer and richer households. Wealthier households cut their spending primarily because they had fewer needs and fewer opportunities to spend money. Although these motives are also important among low-income households, 11 per cent of households on incomes of less than 4,000 Swiss francs say they reduced their spending because they had less money available (see G 2).

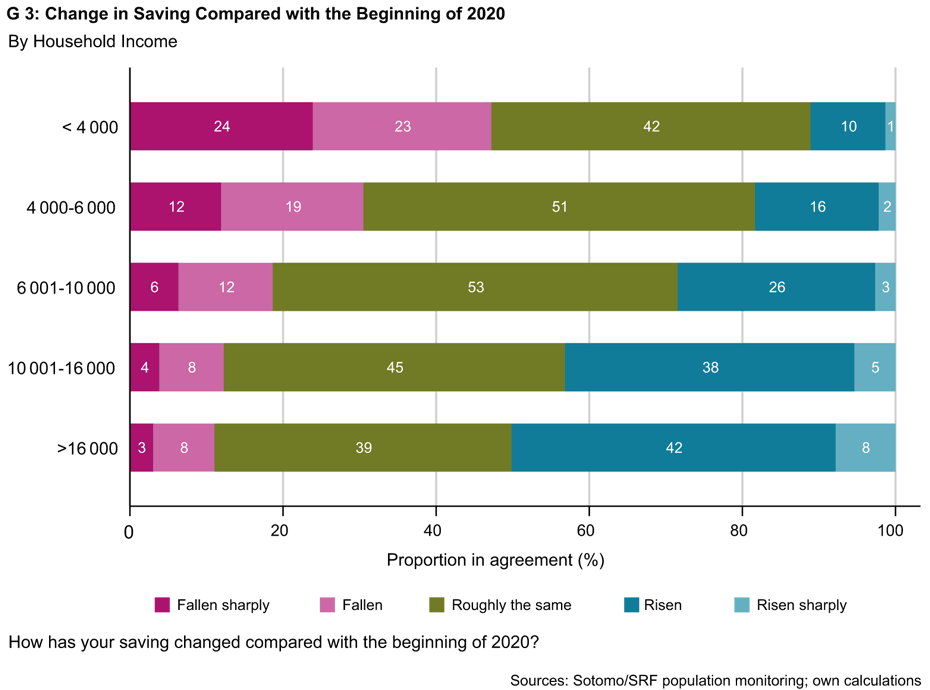

The differing changes in spending and income behaviour at the upper and lower ends of the income distribution are reflected in the levels of household saving one year after the outbreak of the pandemic. Whereas saving among low-income households has fallen significantly, it has risen for half of households on the highest incomes (see G 3).

Around 39 per cent of people on monthly household incomes of less than 4,000 Swiss francs even stated that they had drawn on their savings to cover current expenses. According to their own statements, one in nine individuals in this income category has gone into debt. Although no information is available on the level of wealth, it is therefore to be expected that wealth inequality has increased.

Unemployment has affected mental health

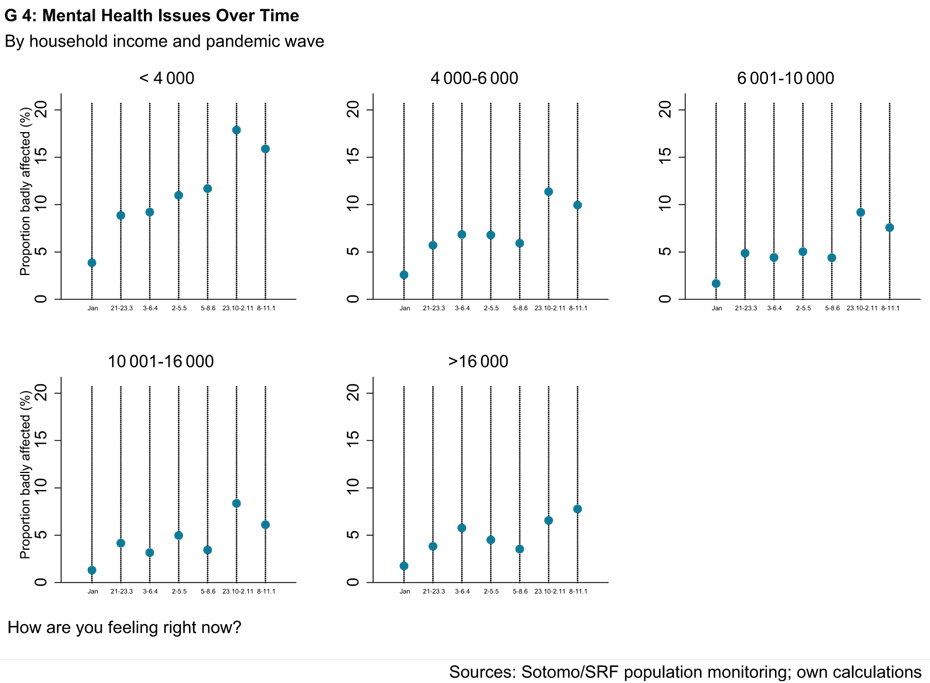

People on low incomes have been more seriously affected by the pandemic than wealthier households – not only financially but also in terms of their health. Since the outbreak of the pandemic last spring, the mental health of those on low incomes has steadily worsened, despite having temporarily improved (see G 4). Individuals from high-income households, on the other hand, fared somewhat better during the summer months. People affected by unemployment in particular have often reported being in poor health.

Part of the difference between rich and poor may be due to the fact that far fewer respondents from low-income households have had the opportunity to work from home. This form of working has been beneficial during the coronavirus crisis as it has reduced the risk of contagion, is more likely to enable people to keep their previous jobs and is also more likely to reduce spending.

Trust in politics is declining

The data also show that the initially high levels of trust in the Swiss Federal Council to manage the coronavirus crisis have declined over time. While at the beginning of the crisis just under 20 per cent of respondents said they had little or very little trust in the Federal Council, this proportion had risen to 40 per cent by October 2020 and January 2021. Respondents from low-income households have slightly lower levels of trust in political leaders than respondents on high household incomes.

Finally, the January 2021 data reveal clear differences in the levels of willingness to be vaccinated according to household income. Only 36 per cent of respondents in the lowest income bracket would like to be vaccinated immediately, while 59 per cent of those in the highest income bracket would agree to do so.

This analysis is based on surveys conducted by sotomo/SRF population monitoring, which has been systematically describing the situation of households in Switzerland since the beginning of the pandemic. Six surveys covering a total of 202.516 people have been conducted since March 2020. This study has received financial support from the Swiss Federal Office of Public Health (FOPH) and Enterprise for Society (E4S).

You can find the full-length study (in German) here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland

Quartier UNIL-Chamberonne

Bâtiment Internef

1015

Lausanne

Schweiz