KOF Business Tendency Surveys: companies feeling stronger headwinds again at the start of the year

- Swiss Economy

- Business Tendency Surveys

- KOF Bulletin

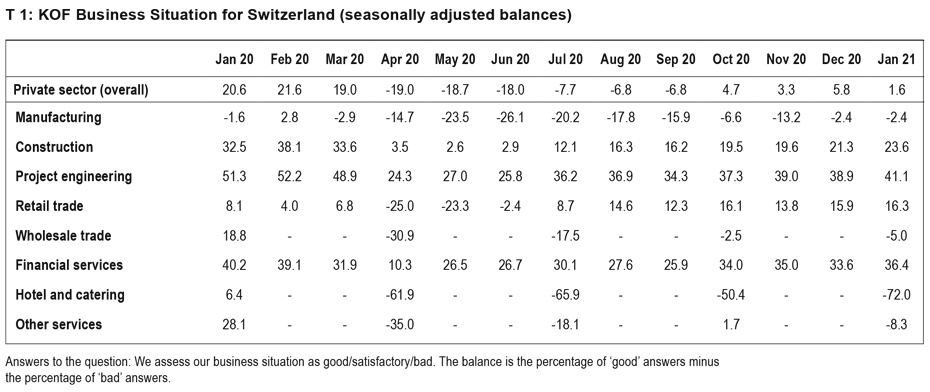

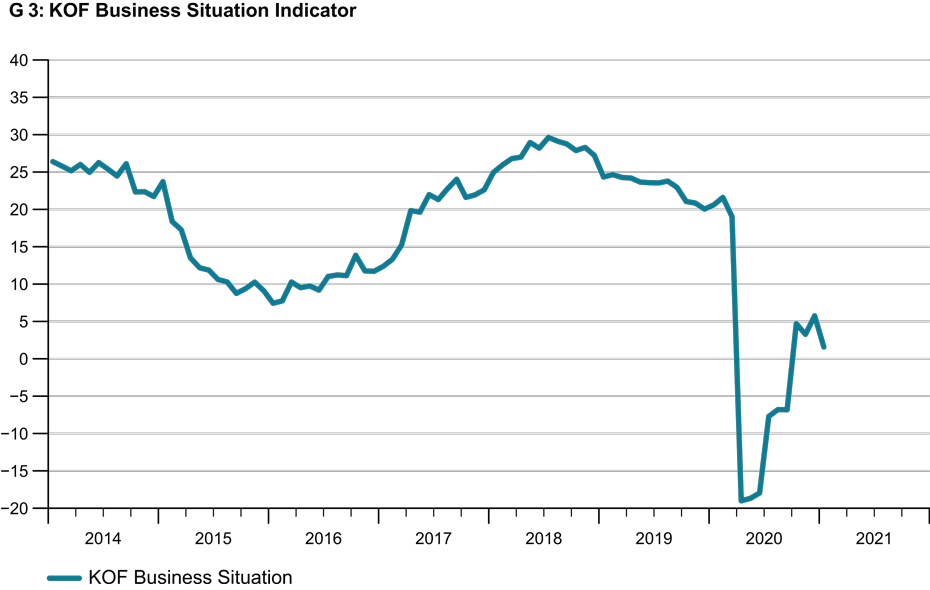

The KOF Business Situation Indicator fell in January after having risen slightly at the end of 2020 (see G 3). While the business situation in the goods-producing sectors is stable to positive, some service industries in particular are struggling. The pandemic is thus driving a wedge between the trends in different sectors of the economy.

Business in various service sectors is again being hit by the pandemic. The hospitality industry, wholesale and other services report a deterioration. In contrast, the business situation in the manufacturing sector is unchanged. Even the most recent tightening of restrictions by the Federal Council on 13 January has hardly affected this stable assessment of the situation. A comparison of the responses given before and after this decision shows no change of opinion in the manufacturing sector.

The situation in construction, project engineering and financial and insurance services actually continued to improve in January. The results also show an improvement in the retail sector. However, shop closures are probably still included in the data to a very limited extent here. (See T 1)

The manufacturing sector is still on the road to recovery

Business in the manufacturing sector remains virtually unchanged despite the adverse environment. The situation is actually improving for strongly domestically focused companies. Demand is picking up overall, and dissatisfaction with order books is declining slightly among survey respondents. After capacity utilisation was raised in the fourth quarter, the latest growth in orders has increasingly been met by inventories. Production reserves would be available, and technical capacities have been utilised at below-average levels. However, production has been increased less frequently than in the autumn.

The recovery in the construction-related segments continues

Business continues to improve in the construction and project engineering sectors associated with building activity. However, the situation is still significantly less encouraging than it was in January 2020. Capacity utilisation is returning to normal in the construction industry. Dissatisfaction with existing order books is decreasing again, and earnings are under less pressure than before. Beyond this normalisation, however, momentum in the construction sector is low.

Closures hit the retail sector

Retailers are reporting that business remains buoyant at the beginning of the year, while large companies are even describing it as excellent. Small and medium-sized firms rate their situation as average. However, most of these responses were received before the renewed closure of large parts of the retail sector. It is possible that many retailers did not expect to face such severe restrictions again. Although they were already cautious prior to the shutdown and planned to wait before ordering new goods, overall they still expected sales figures to remain stable in the near future.

The situation among financial and insurance service providers is encouragin

Financial and insurance service providers’ business is buoyant overall and improved further in January as their earnings grew slightly. Against the background of a further increase in demand, financial institutions expect earnings to continue to rise moderately over the coming months. The subgroup of banks, however, has recently had a few problems increasing their earnings. This is despite the fact that assets under management have grown. However, their interest-earning business has come under pressure while their trading operations are doing fairly well.

The situation in the hospitality sector is gloomy across all tourism areas

The second wave of coronavirus is hitting the hospitality industry hard. In the mountain and lake regions, where business recovered slightly in the second half of 2020, the situation indicator fell sharply in January. Moreover, there has been no noticeable improvement in the major towns and cities since the beginning of the pandemic. Overall, the business situation in the hospitality industry is therefore very weak. In this respect there is no difference between hotels and restaurants. The outlook for the next three months is also gloomy.

The second wave of the pandemic is hitting other service providers again

The pandemic is causing the situation to deteriorate further in the other services sector. Having recovered slightly in the second half of 2020, the business situation here was reckoned to be less encouraging in January. However, it is currently nowhere near as bad as it was in the spring of last year. Moreover, market participants are optimistic about the outlook for the next six months.

The detailed results of the KOF Business Tendency Surveys (including tables and charts) can be found on our website.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland