Companies Plan to Invest More in Environmental Protection

- Swiss Economy

- KOF Bulletin

According to the results of the semi-annual KOF Investment Survey, investment activities in Switzerland are set to slow down further this year. The uncertain international environment has put a brake on expenditure growth. Nevertheless, investment in environmental protection and compliance with commercial law requirements has clearly acquired greater importance.

In the past year, the Swiss economic performance was on the moderate side. While the price-adjusted economic output still rose by 2.8% in 2018, GDP growth of 0.9% resulted for the year 2019.

Dominated by major political and economic uncertainty, a recession in global trade and an economic downturn in the euro area, the international environment slowed down the Swiss economy in general and Swiss companies’ investment activities in specific.

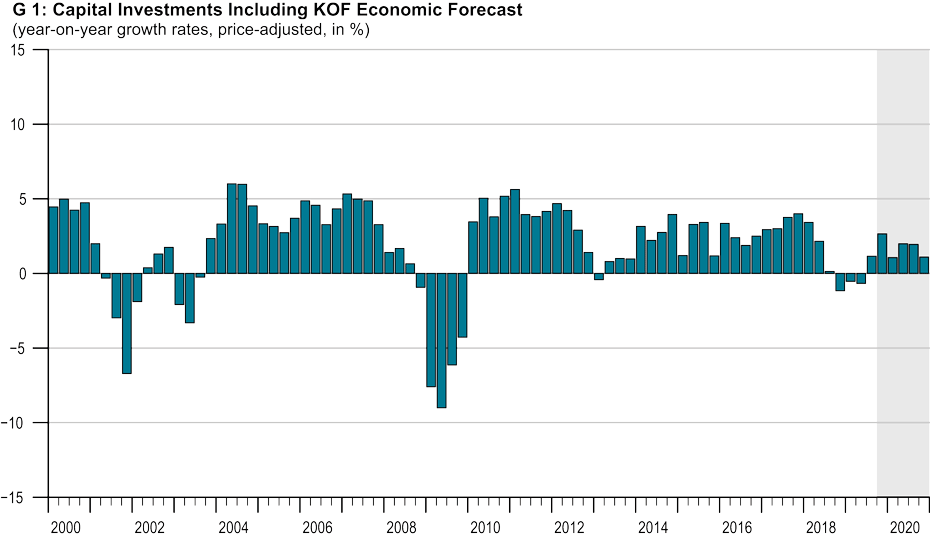

In 2018, price-adjusted growth in capital investment slowed down to 1.1% (see chart 1), and in 2019 investment is also likely to be moderate in historical comparison. Although political and economic uncertainty and the international downside risks diminished slightly towards the end of the year, neither foreign trade nor the domestic economy provided the momentum for a fundamental economic upturn. In this ambivalent environment, real investment activities increased by 0.8% in 2019.

Since corporate investment activities have a decisive impact on the economic trend, business cycle analyses and forecasts crucially depend on early access to reliable information about corporate investment projects. KOF therefore conducts a respective survey among Swiss companies every spring and autumn.

Certainty of implementation has declined

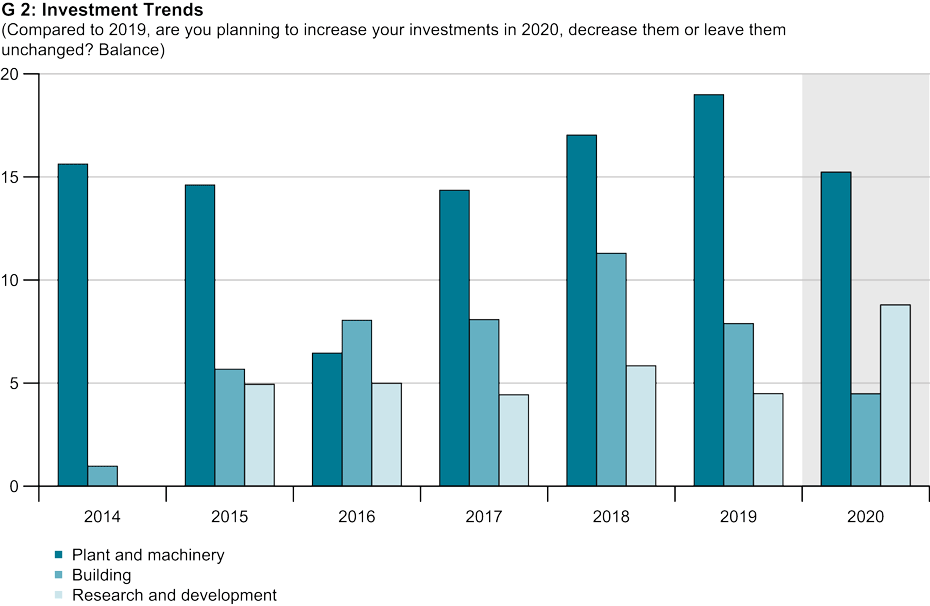

The results of the current KOF Investment Survey of autumn 2019 now allow for an initial assessment of the investment activities in 2020. According to the survey results, companies’ investment plans generally indicate further restraint. The capital investment growth rate will slow down from a nominal 6.1% in the past year to 5.6% in 2020. This hesitant approach is also reflected in the qualitative statements made by the respondents, with the majority indicating that they are not planning to increase investments in 2020 compared to 2019. This is specifically true for investments in plant and machinery and building investments (see chart 2). 66.5% of the respondents plan either no change or a reduction of their investments in plant and machinery (compared to 62.4% in the autumn 2018 survey). In terms of building investments, the same is even true for 74.6% of the respondents (compared to 69.7% in the autumn 2018 survey). By contrast, companies plan to invest more in research and development, as stated by 13.1% of the respondents (compared to 10.5% in autumn 2018).

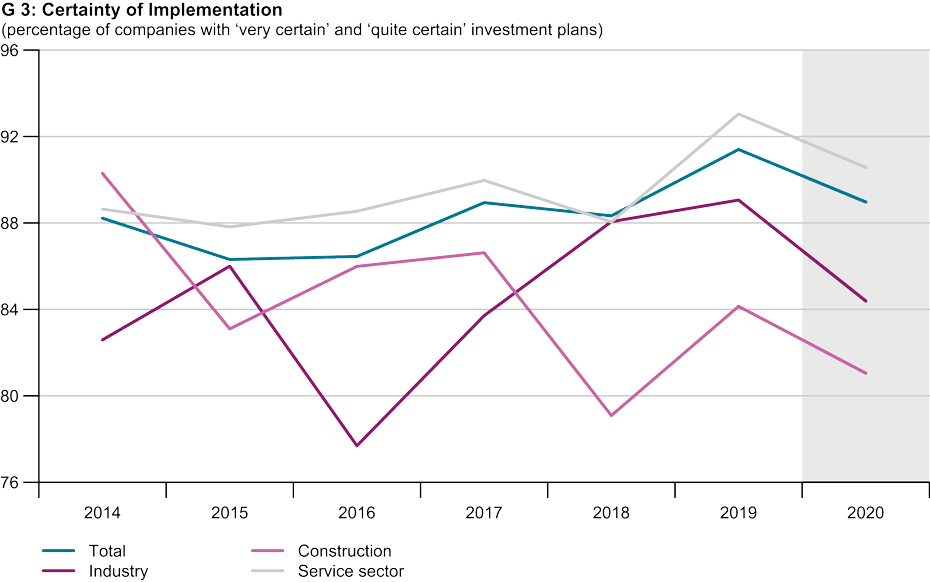

The investment figures compiled for the years 2019 and 2020 represent plans whose actual implementation is not guaranteed. To determine the accuracy of the rate of change resulting from the plans, the companies were asked to assess the subjective certainty with which the planned investments will be carried out. In autumn 2018, 91.4% of the companies considered their investment plans for the coming year to be “very certain” or “quite certain”, with the respective percentage falling to 88.9% in the current survey (see chart 3). On balance, the certainty of implementation is a full 5.4 percentage points lower than a year ago. In general, this reflects an environment dominated by greater uncertainty. The most significant decline in the certainty of implementation has occurred in the manufacturing industry.

Investments driven by technological developments

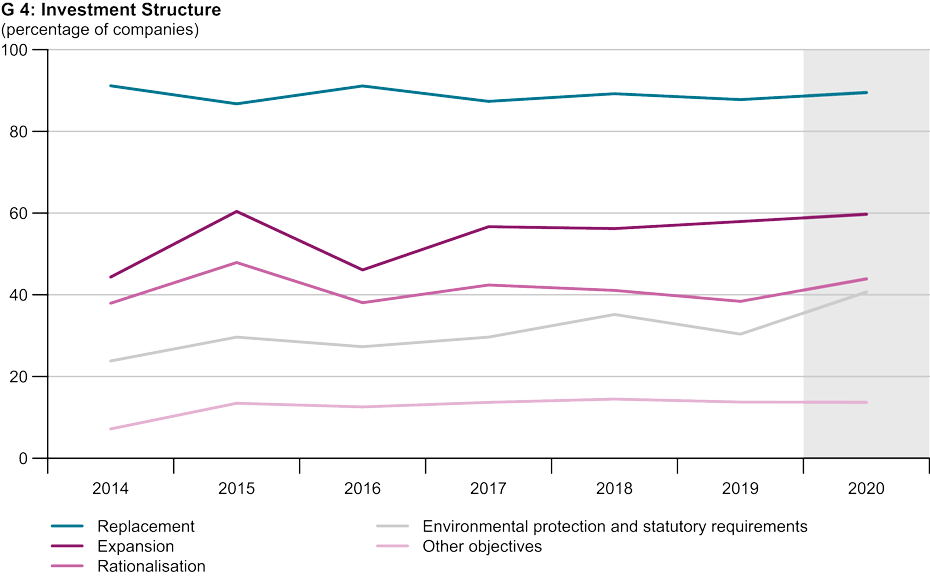

The main types of planned investments are replacement investments, followed by expansion investments and rationalisation (see Chart 4). From an economic perspective, these categories all play different roles. In contrast to replacement investments, which replace existing worn-out equipment and do not affect production capacities, expansion investments do raise both the capital stock and the production capacities and can thus be interpreted as an indicator of companies’ growth expectations. Rationalisation investments, in turn, are made to reduce costs with companies aiming to raise their competitiveness by replacing existing production facilities with more efficient machinery.

While replacement and expansion investments have hardly changed compared to the autumn 2018 survey, rationalisation has increased slightly. This coincides with the statement of the majority of the respondents that they plan to expand production facilities to a lesser degree in 2020 than in 2019. At the same time, a further investment objective – investments in environmental protection and compliance with commercial law requirements – has become significantly more important, especially in the manufacturing industry and the service sector. 43% of the respondents stated that they planned to invest in environmental protection measures this year. In autumn 2018, no more than 32% had stated this intention. Thus, the share of companies pursuing this investment objective has almost doubled within the last six years.

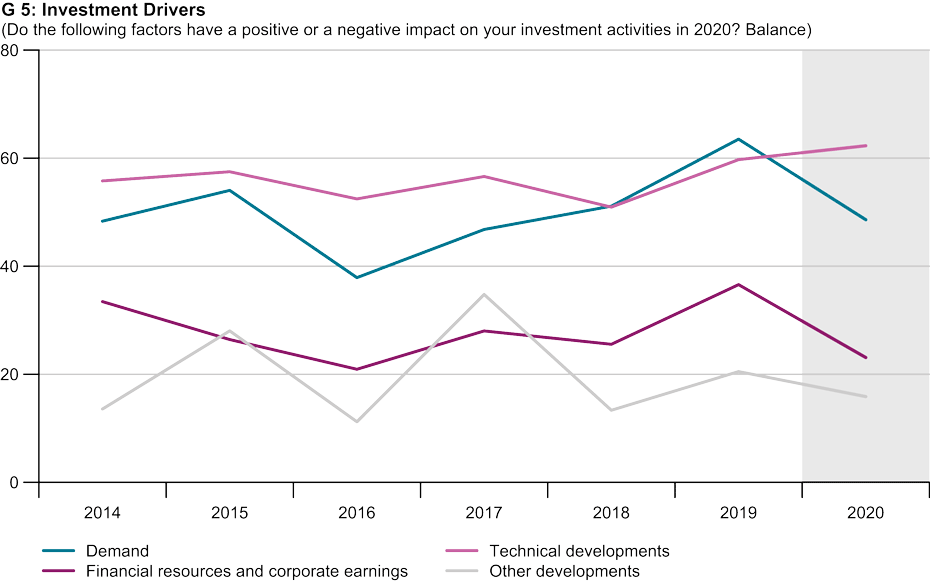

Investment activities are also primarily driven by technological developments. In this year’s survey, this factor has once again become more important in comparison to the previous year (on balance, it has risen from 59.7 points to 62.3 points) and was the main driver of the peak demand development (see chart 5). Both demand and financial resources have lost much of their significance as drivers and are increasingly mentioned as factors that are negatively affecting or slowing down future investment activities.

The survey

Corporate investment activities have a substantial impact on economic development. KOF therefore conducts a survey among domestic companies every spring and autumn. The current KOF Investment Survey of autumn 2019 is based on a panel of over 14,000 companies chosen to reflect the structure of the Swiss economy. The public sector, semi-public enterprises and private households are not included in the calculation of the investment figures. Over 3,400 companies took part in the current survey.

Further information about the Investment Survey is available on the KOF website.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland