KOF Business Tendency Surveys for October 2020: business situation improving; effect of new measures uncertain

- Swiss Economy

- Business Tendency Surveys

- KOF Bulletin

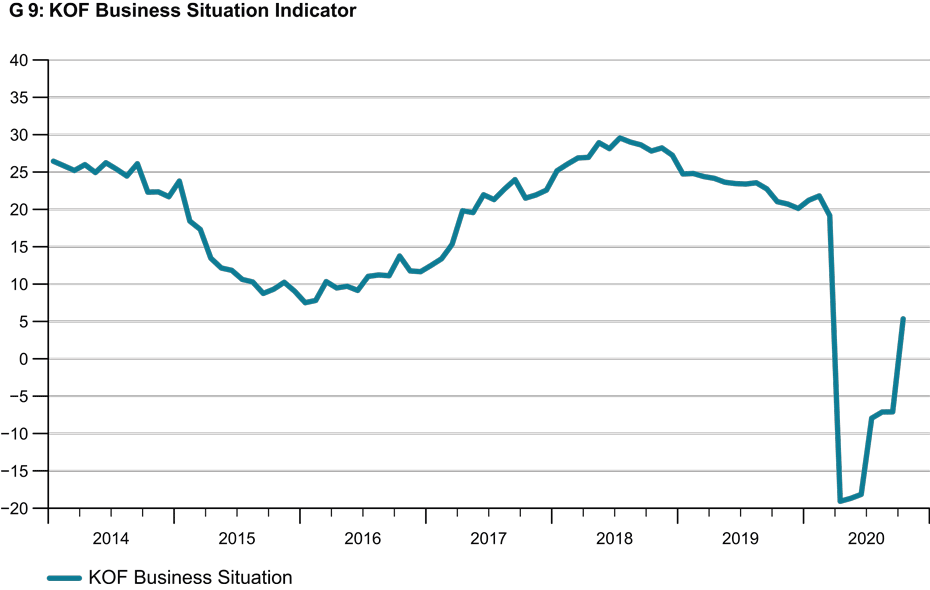

Companies’ business has recently improved noticeably. While the situation in the retail sector is now more encouraging than it has been since 2014, it has not yet returned to pre-crisis levels in many other areas. When asked about their plans for the future, however, companies in some sectors of the economy became more cautious over the course of October.

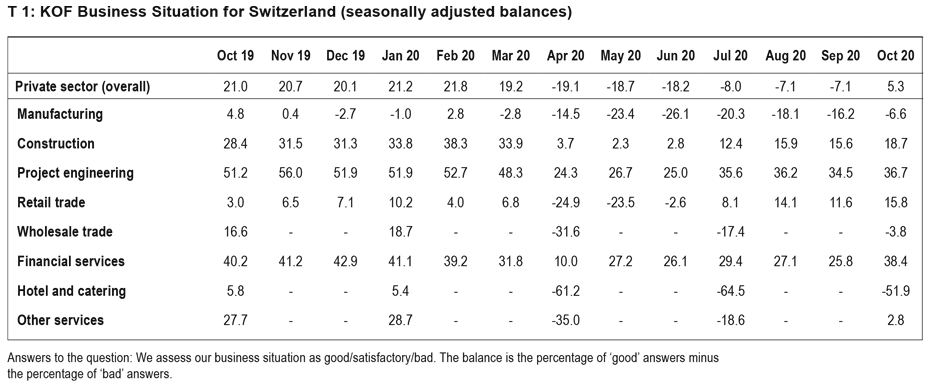

All sectors surveyed are gradually emerging from the crisis at the beginning of autumn (see Table T 1). The Business Situation Indicator for the retail sector was already exceeding its pre-crisis levels back in the summer. It is the only sector whose situation is now more encouraging than it was both at the beginning of this year and in October of last year. The Business Situation Indicator for financial and insurance services is close to its pre-crisis levels. In the other sectors surveyed – manufacturing, construction, project engineering, wholesale, and other services – the situation also improved in October but is still much less encouraging than it was either at the beginning of this year or in October of last year. In addition, the hospitality industry is still in the process of emerging from the doldrums. However, the shortfall compared with last year's business situation remains particularly large.

The pandemic increasingly returned to Switzerland as well during the course of October. This prompted the Federal Council to tighten the relevant restrictions. The question is whether the companies surveyed became more pessimistic about their business situation in the course of the month. But this kind of trend is only slightly evident in the construction industry. Since these restrictions were tightened further on 28 October, however, only isolated responses to the surveys have been received. The very latest developments are therefore not captured in the results.

Some downward revisions of expectations in the second half of the month

It is possible that the worsening of the situation will influence companies' forecasts of future trends – especially their demand expectations. In hospitality – a sector that is once again likely to be severely affected by the pandemic – the outlook for demand throughout the month was already being seen as less encouraging than it had been in the previous quarter. In the manufacturing, other services, project engineering, wholesale, and financial and insurance services sectors, late reporters have a certain tendency to revise their demand expectations downwards on the previous month in comparison with early reporters. On the whole, the responses by some sectors are therefore more cautious in the second half of the month. So far, however, these responses do not point to the sort of slump that we saw back in the spring (see chart G 9).

Situation in manufacturing improving but remains tough

Although the business situation in the manufacturing sector continues to recover, it remains predominantly challenging. Dissatisfaction with the volume of orders received remains high but has abated somewhat. Production activity and, therefore, capacity utilisation are increasing slightly. Capacity utilisation rates remain well below normal. However, companies expect the upward trend to continue: they believe that their export opportunities and order intake should continue to improve, and they intend to increase production. As a result, job cuts are no longer expected to be as frequent as in previous months.

Retail sector: large companies benefiting

Business in the retail sector improved in October. It is seen as being more encouraging than at any time since 2014, with large companies in particular reporting a buoyant situation. Business at small and medium-sized firms is not yet as strong as it was before the crisis. The wholesale sector is still in the process of recovering from the coronavirus shock. Overall, wholesalers’ revenues are no longer down as sharply year on year as they were in the previous quarter. The demand outlook for the coming months has also continued to improve slightly.

Construction-related sectors still waiting for recovery

Business in the construction and project engineering sectors associated with building activity has not yet fully recovered from the coronavirus slump in the spring. In the construction industry, on the other hand, dissatisfaction with existing order books is diminishing and capacity utilisation has increased. However, demand is unlikely to really pick up in the coming months. Moreover, project engineering firms do not expect to see any major change in demand in the near future.

Hospitality industry facing an uncertain future

The business situation in the hospitality sector remains bleak. At least it was not quite as unsatisfactory in October as it had been in the previous two quarters – mainly as a result of the marked improvement in alpine areas. On the other hand, there were no signs of any improvement in the major towns and cities. This discrepancy between mountain regions and urban locations is evident in both the food-service and accommodation segments. Overall, businesses in the mountain regions are currently reporting booking figures similar to last year’s, while those in towns and cities are falling far short of these levels. Businesses are sceptical about their prospects going forward. Both food-service and accommodation providers see the outlook for demand more pessimistically than they did back in the summer.

Banks expect earnings to rise

Business in financial and insurance services is improving again. It is now almost as buoyant as it was back in February before the financial market turmoil triggered by the pandemic. The banking sector reports a stronger increase in demand from domestic retail and corporate customers. As business with foreign clients is slowing, however, they expect overall demand to grow less sharply in the near future.

Challenging situation in the transport, information and communications segment

The business situation in other services also continues to improve. However, it is still far from being as buoyant as it was before the pandemic. In particular, many companies in the transport, information and communications segment continue to complain of a challenging situation. However, both they and providers of personal and business services unanimously expect demand to continue to rise. These companies are no longer looking to reduce their staffing levels.

The findings of the latest KOF Business Tendency Surveys from October 2020 include the responses of more than 4,500 private-sector firms from industry, construction and the major service sectors. This equates to a response rate of around 59 per cent.

The detailed findings of the KOF Business Tendency Surveys (including tables and charts) are available on our website.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland