The recovery of the global economy is in full swing

- KOF Bulletin

- World Economy

Now that the pandemic is largely under control in most advanced economies, economic momentum is also picking up again worldwide. The United States in particular is living up to its reputation as the locomotive of the global economy thanks to massive government stimulus. However, there is a growing danger that the US economy will overheat in the medium term.

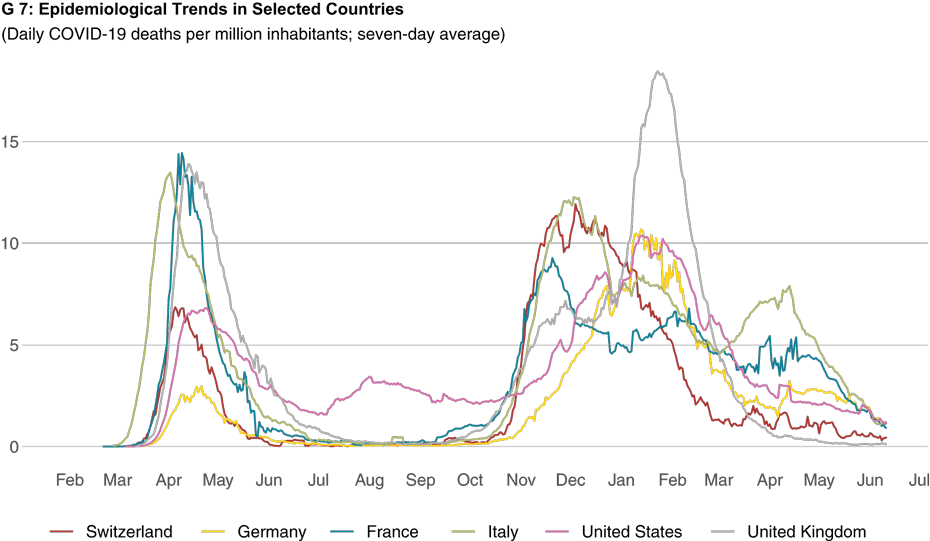

Infection rates in Europe and the United States rebounded in the autumn of 2020 (see G 7). While the United States imposed only mild restrictions, many European countries were forced to re-impose stricter measures in the winter of 2020/21. However, these proved to be far less restrictive on economic activity than during the first wave. These measures were mainly limited to the closure or restriction of personal-contact services and the introduction of curfews, international travel restrictions and stricter social-distancing requirements. This hit private consumption in particular. The transport, hospitality, retail, and arts, entertainment and recreation sectors were severely affected. The manufacturing and construction industries, on the other hand, remained largely unscathed. The pandemic was brought back under control in Europe and the United States during the spring. Whereas public life quickly returned to normal in the US, many of the restrictions in Europe continued throughout the spring. From a Swiss perspective, the global economy expanded by only 1.7 per cent overall in the first quarter of 2021 after having grown by 3.2 per cent in the fourth quarter of 2020, with the individual regions of the world performing very differently. Total economic output in the euro area, for example, declined in the first quarter by 1.3 per cent owing to the restrictions imposed to contain the pandemic. The United Kingdom was also affected by the impact of Brexit after the end of the transition period, causing value added to slump by almost 6 per cent. In the United States, on the other hand, output grew by a very impressive 6.4 per cent. In addition to the early easing of restrictions, massive fiscal stimulus packages had an effect here. The recovery in China weakened considerably, yielding growth of just 2.4 per cent. The expiry of catch-up effects may have played a role here, while renewed restrictions on freedom of movement following an increase in new infections may also have had an impact.

Strong recovery in the summer half-year of 2021

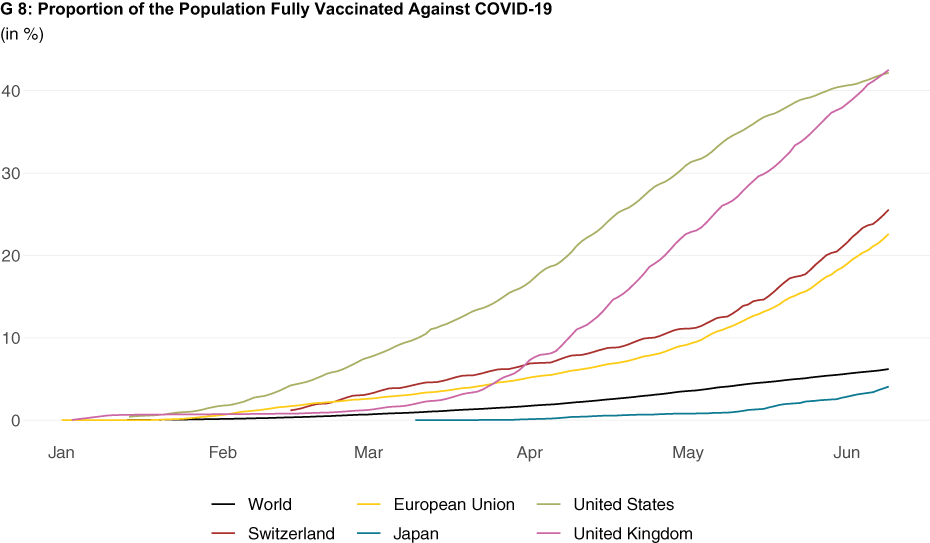

The approval of various vaccines towards the end of last year enabled great progress to be made on vaccination, especially in advanced economies. Both the United States and the United Kingdom, for example, have already been able to vaccinate large sections of their populations (see G 8), especially those at risk, thereby easing restrictions early on. The vaccination campaigns in the European Union have also gained momentum in recent months, so a large proportion of the risk groups there have also been fully vaccinated and restrictions have been relaxed. In many Asian countries, on the other hand, only relatively few people have been vaccinated so far, although the epidemiological situation there is less challenging. No great progress has yet been made in emerging and developing countries owing to the low availability of vaccines.

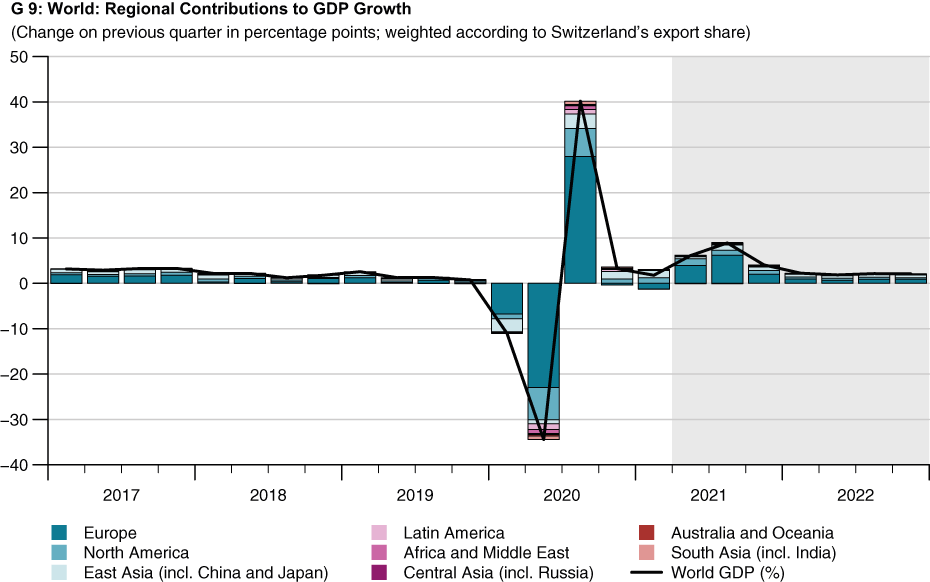

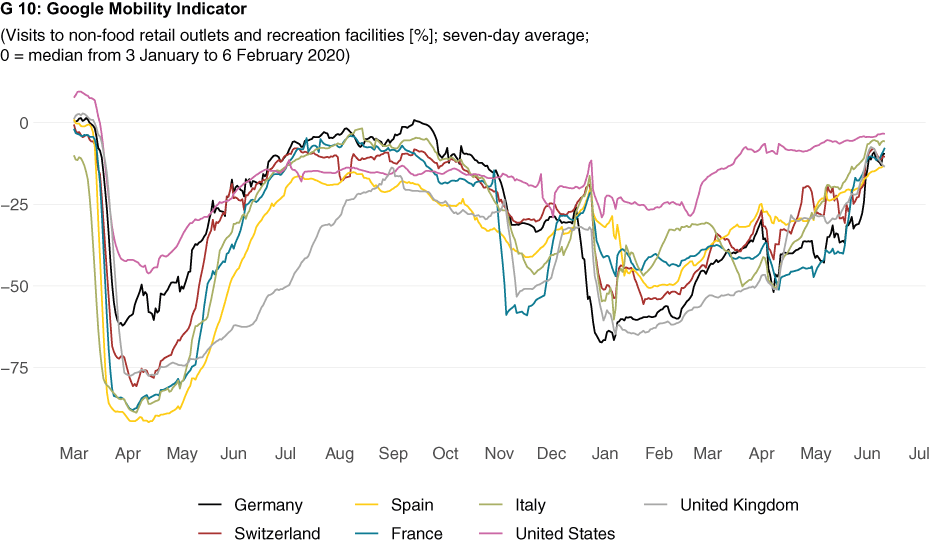

The agreed easing of containment measures and the swift removal of most remaining restrictions should enable the global economy to stage a strong recovery in the second and third quarters of 2021 (see G 9). This is indicated by factors such as high-frequency mobility data (see G 10), which have recovered since the beginning of the year and reveal a significant increase in mobility – especially recently. In addition, various sentiment indicators are close to or above historical highs or at least point to very strong momentum. Likewise, real indicators such as retail sales, industrial output and new orders suggest that a recovery is under way in many countries. As the restrictions in place in the United States and the United Kingdom could be eased fairly soon owing to their progress on vaccination, a large part of the recovery there will already be felt in the second quarter. The hesitant start to the vaccination campaign in the euro area means that the recovery there is likely to be somewhat slower and only peak in the third quarter. Given their strong export industries and generous government support measures, countries such as Germany should recover faster than, for example, Italy or Spain, where tourism plays a bigger role. These two countries – and, to a lesser extent, France – are benefiting from disbursements from the ‘Next Generation EU’ fund. This should provide significant economic stimulus over the coming period. The export-driven upswing in China is likely to continue, while economic growth is also expected to accelerate throughout the rest of Asia over the coming quarters. Fiscal and monetary stimuli are supporting the recovery, and external demand is picking up again. However, the resurgence of the pandemic in countries such as India, Malaysia and Taiwan has recently fuelled new uncertainties.

Growing price pressures

Inflation rates have risen significantly worldwide since the beginning of the year. The main reason for this is the sharp increase in energy and commodity prices since the end of last year, although supply difficulties and material shortages have also fuelled higher goods prices. However, the base effects of past VAT changes as well as one-off effects such as changes in the basket of goods at the beginning of the year and the introduction of a carbon tax in Germany are also factors here. These effects are likely to be transitory for the most part. The main impact of energy prices is likely to have already expired in April, the base effects of basket adjustments and VAT changes will disappear after one year, and the supply issues and material shortages are also likely to gradually disappear as a result of additional investment. Second-round effects of these past price increases are likely to ¬remain modest owing to the current underutilisation of capacity and higher unemployment in many countries. Although unemployment has fallen compared with last year, it is therefore still above pre-crisis levels with just a few exceptions. In addition, the labour market participation rate in many countries is low compared with pre-crisis levels, which suggests that there is untapped labour force potential. Given the transitory nature of these price increases, central banks worldwide are likely to maintain their current expansionary stance for the time being.

Risk of overheating in the United States

However, there is a danger that the current price increases will take on a life of their own and inflation expectations will become anchored at levels above central banks’ inflation targets, which in turn could lead to permanently higher inflation. Monetary policymakers would then be forced to rein in their expansionary stance and raise interest rates, which could abruptly slow down the current recovery. This risk exists above all in the United States.

Further risks exist from both an epidemiological and an economic perspective. The spread of new variants of coronavirus could cause the easing of restrictions to be delayed or even further restrictions to be imposed. Prematurely discontinuing either government support measures or the disbursement of ‘Next Generation EU’ funds could bring about a much slower recovery. In contrast, faster vaccination campaigns worldwide and a swifter reduction in consumer saving could ensure that restrictions are lifted sooner and consumer spending grows more sharply.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland