The ECB's communication as a monetary policy instrument

- KOF Monetary Policy Communicator

- Monetary Policy

- KOF Bulletin

The European Central Bank’s main communication channel is the press conferences it holds following its Council meetings. In addition to its decisions on monetary policy measures, the Council also outlines its view of the economic situation in the euro area. Although the subtle differences between the introductory remarks made are often barely perceptible to laypersons, investors and economists react to them and revise their expectations accordingly.

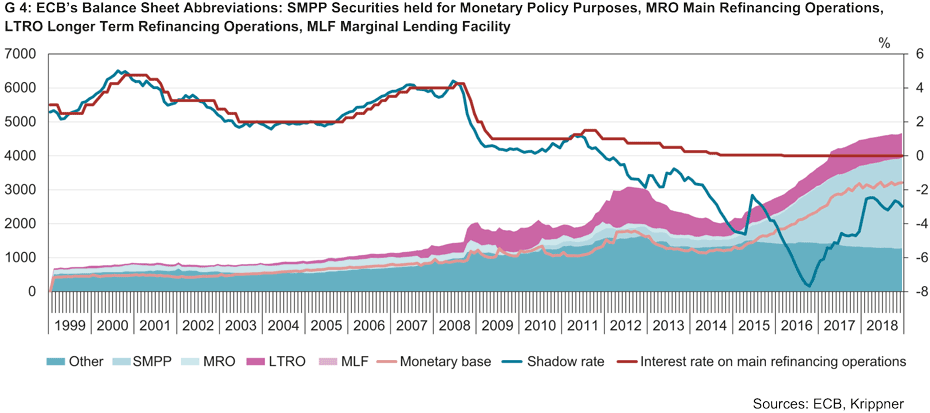

Until the financial crisis of 2008/2009, the key interest rate was considered to be the primary monetary policy instrument used by the European Central Bank (ECB). The subsequent sovereign debt crisis in the euro zone prompted the ECB to lower the interest rate on its main refinancing operations to such an extent that further cuts became increasingly difficult. Instead, the ECB began to resort to unconventional methods to combat the risks of persistently low inflation. These included asset purchase programmes (APPs), which were designed to increase the volume of bank lending to businesses and households.

At the same time, the ECB relied on ‘forward guidance’: by communicating its future monetary policy stance based on price stability forecasts, it was seeking to influence market expectations. The ECB had to adapt its monetary policy communication strategy accordingly. One question that now arises is how the ECB's stance should be measured in times of increasingly unconventional monetary policy instruments. And another question is how its communication can be quantified.

A measure of unconventional monetary policy

In conventional times the ECB’s monetary policy stance is usually reflected in the interest rate on its main refinancing operations. In unconventional times, once the key interest rate has reached its effective floor, assessing monetary policy poses a challenge. To circumvent this problem, ‘shadow rates’ are used. These are derived from yield curves and, unlike the key interest rate, do not have an effective floor.

The shadow rate represents the key interest rate in a hypothetical world where there is no cash. This is because in such a world there is no alternative to bank deposits; no one would have the option of escaping negative interest rates and hoarding money under the mattress instead. Banks could therefore set negative interest rates at any level without scruples. The shadow rate corresponds to the key interest rate in conventional times, whereas it can become negative in low-interest periods and thus also reflect changes in long-term interest rates (see chart 4). It is precisely these long-term interest rates that are of central importance in assessing monetary policy, since these unconventional methods are intended to influence them.

Communication indicators of price stability, the real economy and the money supply

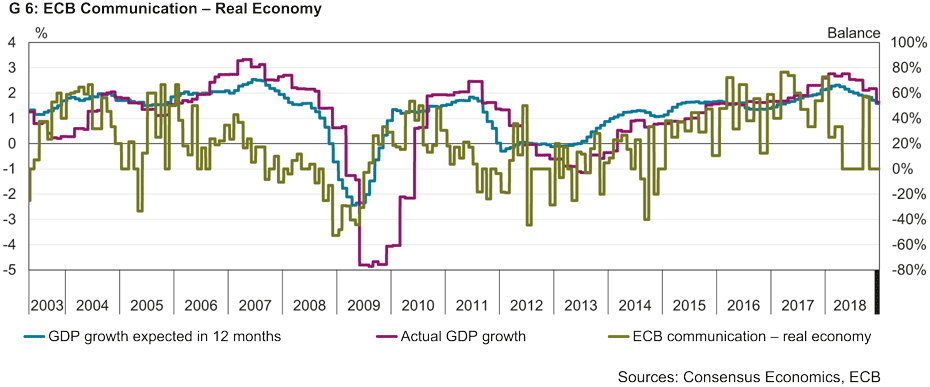

The introductory remarks made following Governing Council meetings can be used to quantify the ECB’s communication. Each statement can be classified in terms of its subject matter, timing and qualitative assessment. For example, Mario Draghi said on 7 March 2019: "Compared with the December 2018 Eurosystem staff macroeconomic projections, the outlook for real GDP growth has been revised down substantially in 2019 and slightly in 2020". This statement can be assigned to the subject area of the real economy; it relates to the future and contains a negative assessment.

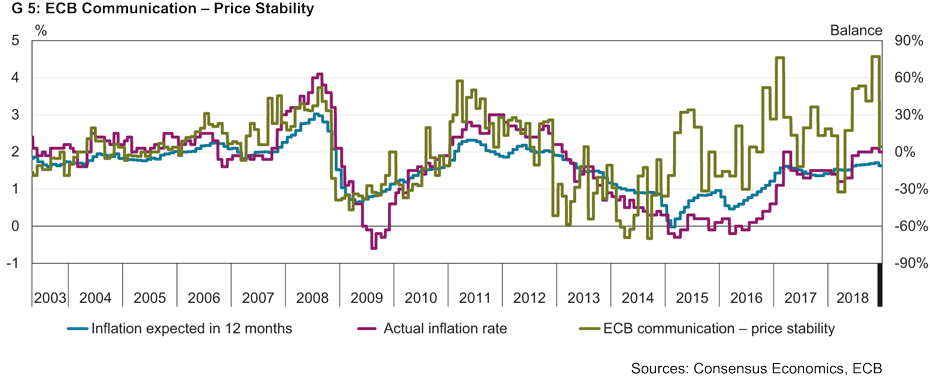

This categorisation can be used to derive communication indicators on the topics of price stability, the real economy and the money supply. The constructed indicators give the standardised balance of positive statements on the respective subject area. Chart 5 shows the indicator of price stability, also known as the KOF Monetary Policy Communicator (MPC), which shows clear movements in parallel with the expected and actual inflation rates.

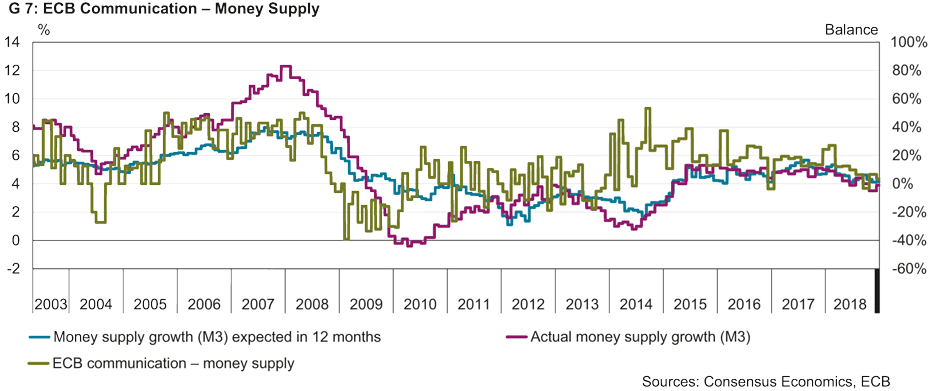

The indicator of the real economy (chart 6) is a leading one compared with expected and actual GDP growth. The correlation between the money supply indicator and expected and actual money supply growth is also clearly visible (chart 7). Actual rates are shown in real time, while the expected rates are based on consensus forecasts by the survey institute Consensus Economics.

How do the financial markets react to the ECB's communication?

Throughout the period under review (2003 to 2018) it is possible to observe market participants' reactions to ECB representatives’ statements on the real economy. For example, the shadow rate decreased in response to pessimistic statements and increased in response to encouraging ones. This correlation remains valid even across different monetary policy phases. Statements on price stability also have a strong and lasting impact on the shadow rate. Market participants’ inflation expectations, which have been measured with the help of interest-rate swaps, are also influenced by the ECB's statements on money supply.

Exchange rates, on the other hand, do not seem to react to the quasi-monthly decisions and comments of the Governing Council, and none of the three communication indicators shows any correlation with the exchange rate. This is consistent with the ECB’s monetary policy objectives, which do not include exchange-rate stabilisation.

Economists revise their forecasts

In addition to financial market participants, professional forecasters are also influenced by the ECB's press releases. Messages relating to the real economy and price stability affect changes in both growth and inflation forecasts. However, communication relating to the money supply only influences forecasts of money supply growth.

One notable exception was the time of the financial and eurozone crisis. During this period, announcements pointing to an expansionary monetary policy stance coincided with downward projections of money supply growth. During this crisis period in particular, therefore, the relationship between ECB statements and the reactions of forecasters was partially distorted. As far as price stability is concerned, the ECB’s communication and decisions appear to have become more important during the global financial and European sovereign debt crisis.

A longer version of this article can be found here.

Contact