KOF Business Situation Indicator: companies’ business situation slightly less encouraging

- KOF Business Situation Indicator

- Swiss Economy

- KOF Bulletin

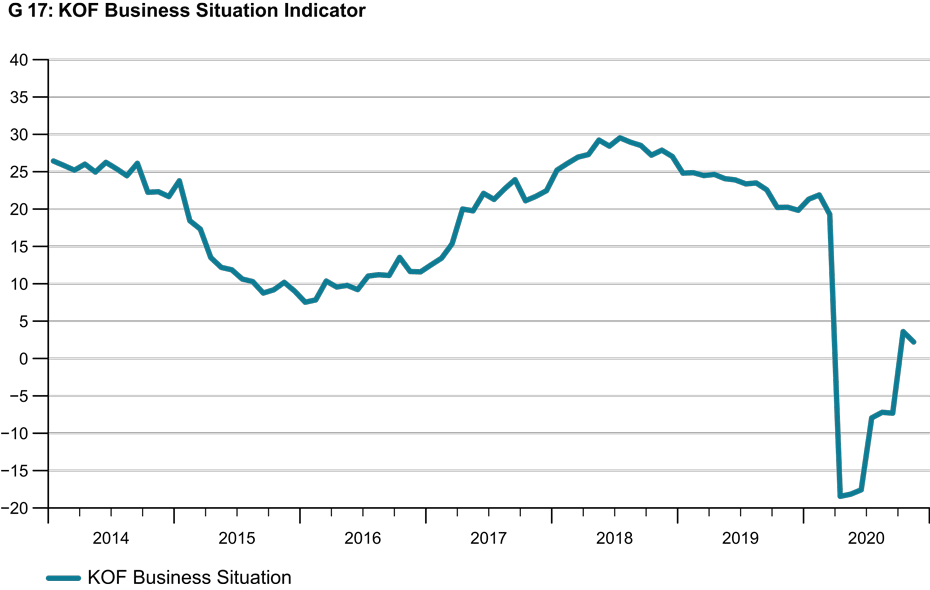

The KOF Business Situation Indicator reported a minor setback in November. After rising in October, it has recently fallen slightly (see G 17). Although coronavirus restrictions have been tightened in recent weeks, companies are currently in a better situation than they were during the summer months.

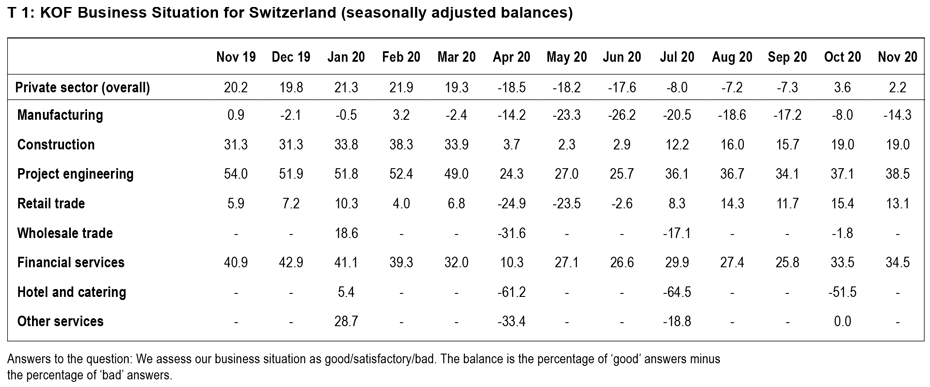

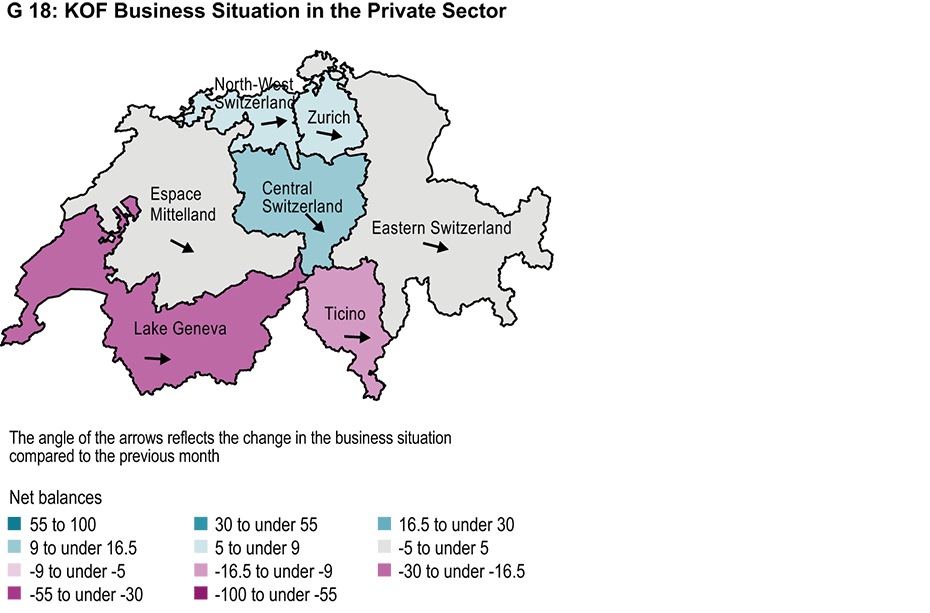

November’s decline arises from two sectors: the situation in the manufacturing and retail sectors was assessed more cautiously than in the previous month (see T 1). In both sectors, however, the recent decline is smaller than the overall increase, so the situation is still better than it was in September. In the other sectors surveyed in November – construction, project engineering, and financial and insurance services – the situation is currently stable or even slightly better than it was in October (see T 1).

The worst-performing area is the middle of Switzerland, where Espace Mittelland, Central Switzerland and Eastern Switzerland are experiencing a slowdown (see G 18). By contrast, the situation in the Lake Geneva region and in Ticino has changed only slightly. The Business Situation Indicator for the Zurich region is trending slightly downwards, while in Northwestern Switzerland it is moving slightly higher (see G 18).

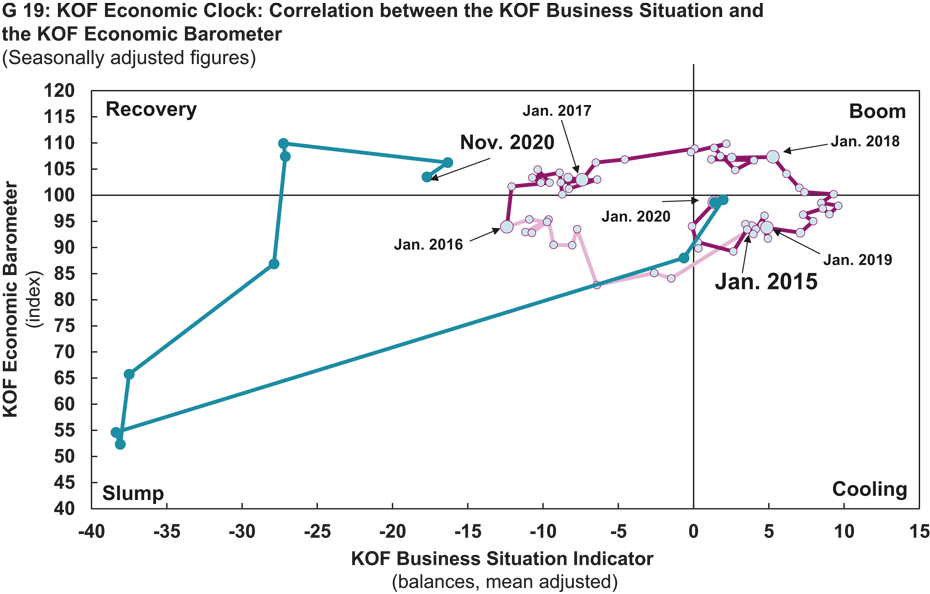

The KOF Business Situation Indicator illustrates companies’ current business situation. The KOF Economic Barometer, on the other hand, is an indicator of economic prospects. The Economic Clock shows that the economy was under pressure in 2019 (see G 19). The KOF Economic Barometer remained below its long-term average throughout the year, and business activity gradually weakened. At the beginning of 2020 the outlook for the Swiss economy was more upbeat. However, the COVID-19 pandemic caused a sharp slowdown in economic activity in spring. Having staged a strong recovery during the summer months, this improving trend is now weakening.

Explanation:

Chart G 17 shows the KOF Business Situation Indicator across all sectors included in the survey. The business situation of sectors that are only surveyed quarterly is kept constant in the interim months.

Chart G 18 shows the business situation in the main regions as defined by the Swiss Federal Statistical Office. The regions are coloured differently to reflect their business situation. The arrows within the regions indicate the change in the situation compared with the previous month. An upward-pointing arrow means, for example, that the situation has improved compared with the previous month.

The Business Situation Indicator in the KOF Economic Clock (Chart G 19) is plotted against the KOF Economic Barometer. The indicator reflects the current business situation, while the barometer is a leading indicator of changes in activity. The clock can be divided into quadrants. During the recovery phase the business situation is below average but growth prospects are above average. At the peak of the economic cycle the situation and prospects are both above average. During the slowdown phase the situation is above average and the prospects are below average. At the bottom of the economic cycle the situation and prospects are both below average. Ideally the chart runs through the quadrants in a clockwise direction.

The KOF Business Situation Indicator is based on more than 4,500 reports from firms in Switzerland. Companies in industry, the retail sector, construction, project engineering, and financial and insurance services are surveyed monthly. Businesses in the hospitality, wholesale and other services sectors are surveyed during the first month of each quarter. These firms are asked, among other things, to assess their current business situation. They can rate their situation as either 'good', 'satisfactory' or 'poor'. The net balance of their current business situation is the difference between the percentages of ‘good’ and ‘poor’ responses.

Further information on the KOF Business Tendency Surveys can be found here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland