The economy in the clutches of coronavirus

- Swiss Economy

- KOF Bulletin

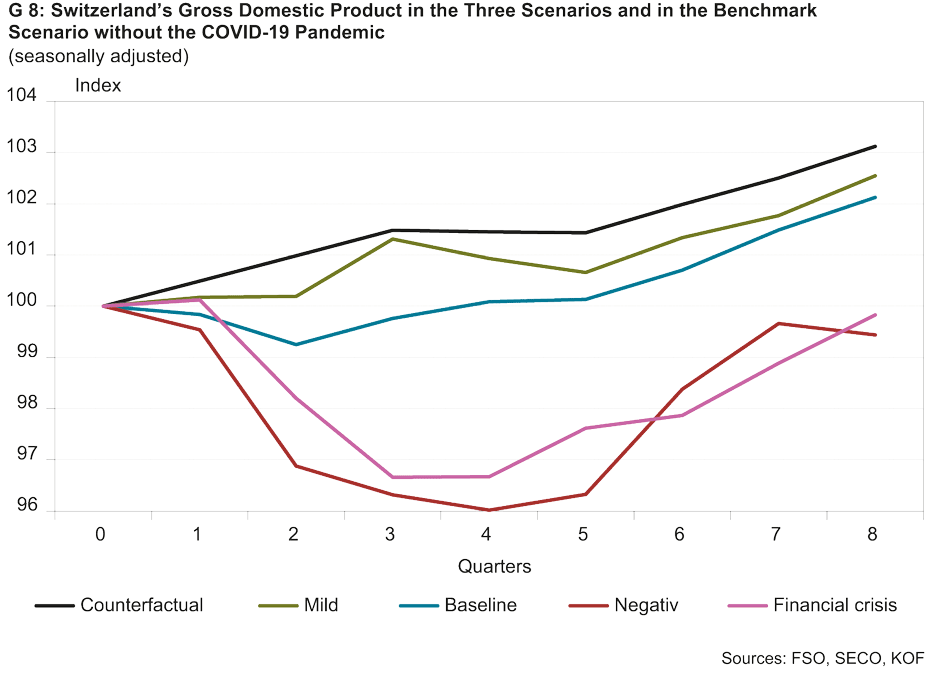

Instead of presenting a forecast, this spring KOF has published three scenarios that show how the economy might potentially perform going forward. The baseline scenario assumes a recession in the first half of the year, while the negative scenario predicts a longer-lasting slump. The mild scenario is becoming increasingly unlikely.

The economy has been caught in the clutches of the coronavirus pandemic since at least March. The effects will most likely be felt over the entire forecast horizon. At present it is virtually impossible to predict when things will return to normal.

On 16 March the Swiss Federal Council declared the situation in Switzerland to be ‘exceptional’ under the Epidemics Act. The economic forecast published by KOF on 17 March is therefore subject to an unusually high degree of uncertainty. New measures to combat the pandemic have been and continue to be announced practically every day. There is therefore uncertainty not only about the current and future spread of the virus but also about the countermeasures taken and how these will affect the economy.

GDP performance based on three scenarios

For these reasons, KOF decided to forecast three alternative GDP trajectories rather than just the economic trajectory that was considered most likely, as is usually the case. As far as KOF is concerned, the most likely trajectory up to 17 March is the baseline scenario. KOF called the more optimistic outcome with a faster recovery the ‘mild’ scenario. The negative scenario assumes longer-lasting and more serious consequences.

These scenarios differ in terms of their assumptions and outcomes according to factors such as how long and how profoundly the pandemic will affect the economy and what transmission channels will play a role (further information). Supply-side effects arise primarily from output lost owing to government-imposed protective measures. One of the potential demand-side effects of the crisis is that people are cutting back on their consumption of goods and services as a precautionary measure.

Chart 8 shows how Switzerland's GDP performs in the three scenarios. The chart also shows how the Swiss economy would have performed if coronavirus had not appeared worldwide. This counterfactual scenario makes it possible to illustrate the pandemic’s impact on economic performance in the three scenarios.

Recession in the first half of 2020

In the baseline scenario, economic life is significantly disrupted over the next twelve months. However, the countermeasures taken will mitigate the economic impact of the pandemic. In addition, Switzerland and other industrialised countries are putting together comprehensive packages of measures to support the economy.

However, the next two quarters in particular will see a sharp decline in private consumption and widespread reluctance to invest on the part of companies. Forthcoming events have been cancelled or postponed. At the same time, closures of schools and borders are hampering production. Over the course of 2020 the imposed production restrictions will spread along value chains and develop into supply bottlenecks, which will reduce output across the industries initially affected. The containment of the virus will enable some of the output lost to be compensated for at the end of this year and next year.

The baseline scenario sees Switzerland sliding into recession in the first half of 2020 owing to the output lost and a widespread reluctance to consume and invest. Overall, although this recession will be sharp, the decline will be limited to just a few quarters and it will be ‘mild’ because businesess and households will be able to compensate for some of the slump. Nevertheless, the effects of the pandemic on the economy will be long-lasting: since it will not be possible to fully compensate for the output lost, gross domestic product (GDP) in the medium term will be lower than it would be in the counterfactual scenario in which the pandemic did not break out in the first place. In addition, it will take until 2021 before the Swiss economy returns to its pre-crisis level of growth.

Negative scenario expects GDP to fall by 2.3 per cent in 2020

In contrast to the baseline scenario, the negative scenario assumes that a substantial part of the population will fall ill with COVID-19 in the course of this year and be quarantined for several days at a time. Consequently, other workers will have to self-isolate as a precautionary measure and will only partly be able to work from home. In addition, some employees with children will be absent from work during the year because schools will be closed not only for a few weeks but for several months. Many cross-border commuters will also be unable to get to work for some time in 2020.

The resultant gaps in the production process can only be partially compensated for. In addition, key trading partners of Switzerland such as Germany, the United States and France are experiencing deep recessions. Consequently, firms both in Switzerland and abroad are suffering liquidity bottlenecks, which are causing bankruptcies and redundancies. Banks will also be affected by the liquidity crisis, and the threat of a financial crisis breaking out will exacerbate the economic impact.

Overall, the negative scenario sees Swiss GDP this year falling by 2.3 per cent compared with last year despite a comprehensive package of government measures. A similarly sharp decline in GDP was last seen in 2009 in the wake of the financial and economic crisis. The beginning of 2021 will witness pent-up demand in this scenario too despite the persistence of systemic risks. The increase in demand from abroad and rising domestic demand will support the Swiss economy, which is why GDP will start to grow again, particularly from the second quarter of 2021. However, this countervailing trend will not be sufficient to offset the significant slump in value added in 2020.

Mild scenario increasingly unlikely

In the mild scenario, the economic disruption caused by the pandemic rapidly diminishes. The impact on the Swiss domestic economy is effectively limited to the second quarter of 2020. However, it seems increasingly unlikely that the assumptions underlying the mild scenario will turn out to be correct. Among other things, this scenario assumed that the European Football Championships and the summer Olympics could be held this year. Both events have since been postponed.

A longer version of this article can be found Downloadherevertical_align_bottom.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland