KOF-NZZ Economists’ Survey: majority of economists fear higher inequality as a result of coronavirus crisis

- KOF Bulletin

- Economists Surveys

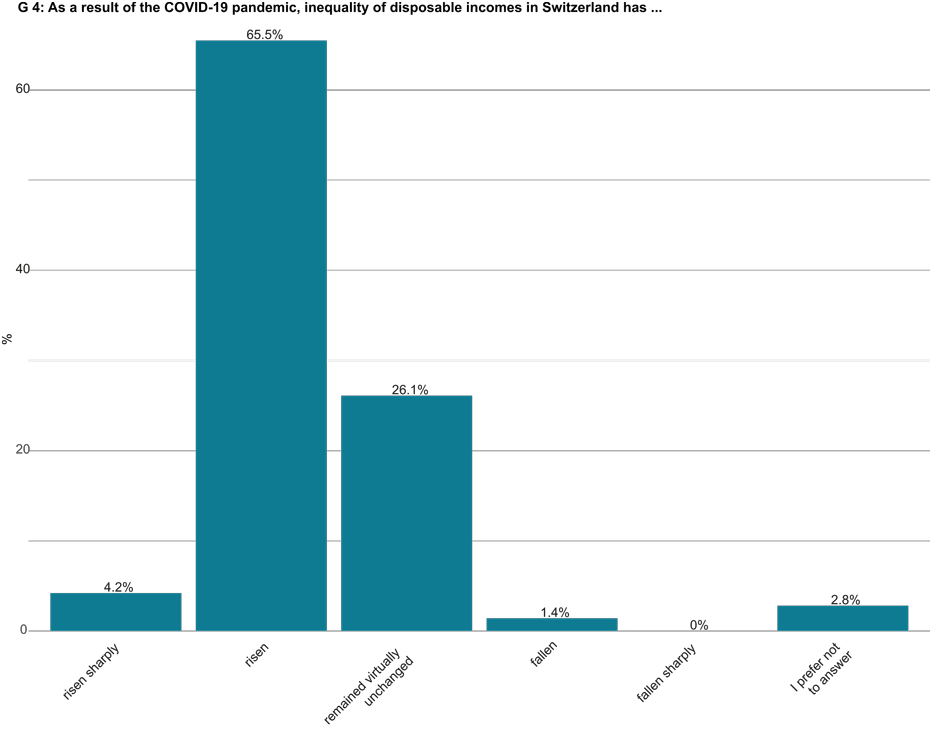

In August, KOF and Switzerland’s Neue Zürcher Zeitung (NZZ) newspaper surveyed economists at Swiss universities on the subject of income and wealth inequalities and the associated ‘99 per cent Initiative’. 70 per cent of the 142 survey respondents were of the view that inequality of disposable incomes in Switzerland has increased as a result of the coronavirus crisis. More than half of them fear that income inequality will become worse in the long term.

The so-called '99 per cent Initiative' and the coronavirus crisis have made economic inequality the subject of increased public attention in recent months. The economists surveyed were fairly unanimous about the short-term impact that the coronavirus crisis would have on the distribution of disposable incomes in Switzerland. Almost 70 per cent of these academics reckoned that inequality would have risen (sharply) by the summer of 2021 (Chart G 4). In contrast, 26 per cent of them believe that there will be no effect, while only 1 per cent think that the gap between rich and poor will close.1 The reason for the widening of inequality as a result of the pandemic is probably that lower earners are more likely to be affected by short-time working and unemployment.2 Many industries with a high proportion of low-paid jobs have been disproportionately affected by the official measures taken to combat the pandemic, as typified by the retail and hospitality sectors. In contrast, other sectors with a large proportion of higher-paid jobs are more likely to have been able to switch to working from home.

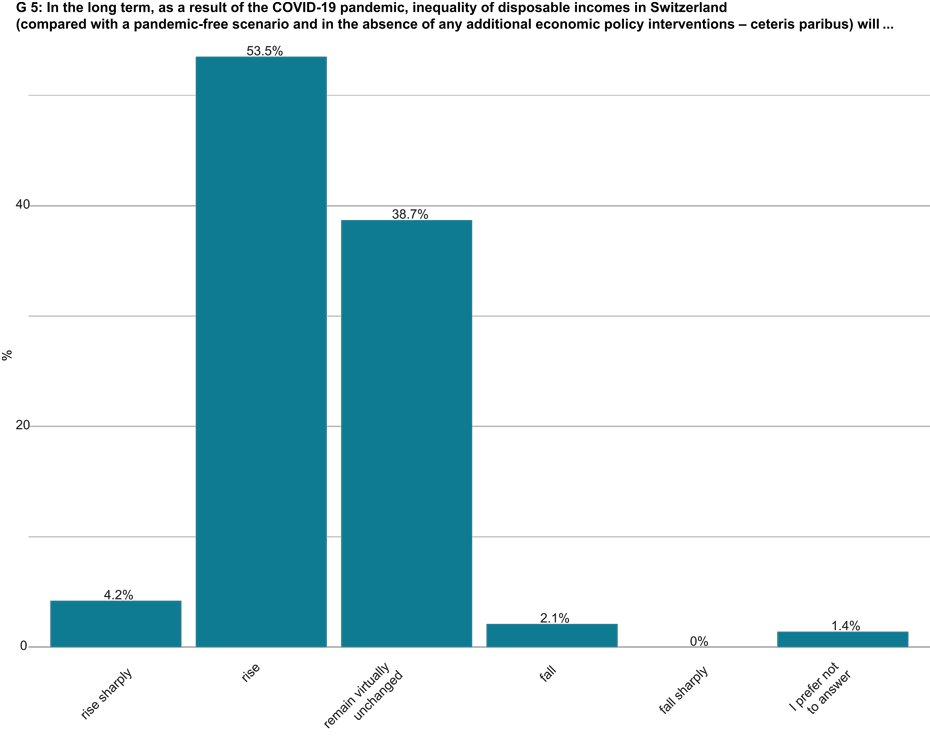

As far as long-term inequality is concerned, most survey respondents expect the income gap to widen. 58 per cent of respondents fear higher inequality in the long term (Chart G 5), 39 per cent of economists firmly believe that the pandemic will have no impact on income distribution in the long term, while 2 per cent expect incomes to converge. Long-term inequality trends are likely to depend on the emerging economic recovery, in which the decline in unemployment as well as structural change will play a role. There is also the question of whether and, if so, how the pandemic has affected the educational attainment – and hence the future earning prospects – of children from households with widely varying levels of income. For example, has home schooling produced worse learning outcomes for children from low-income households?

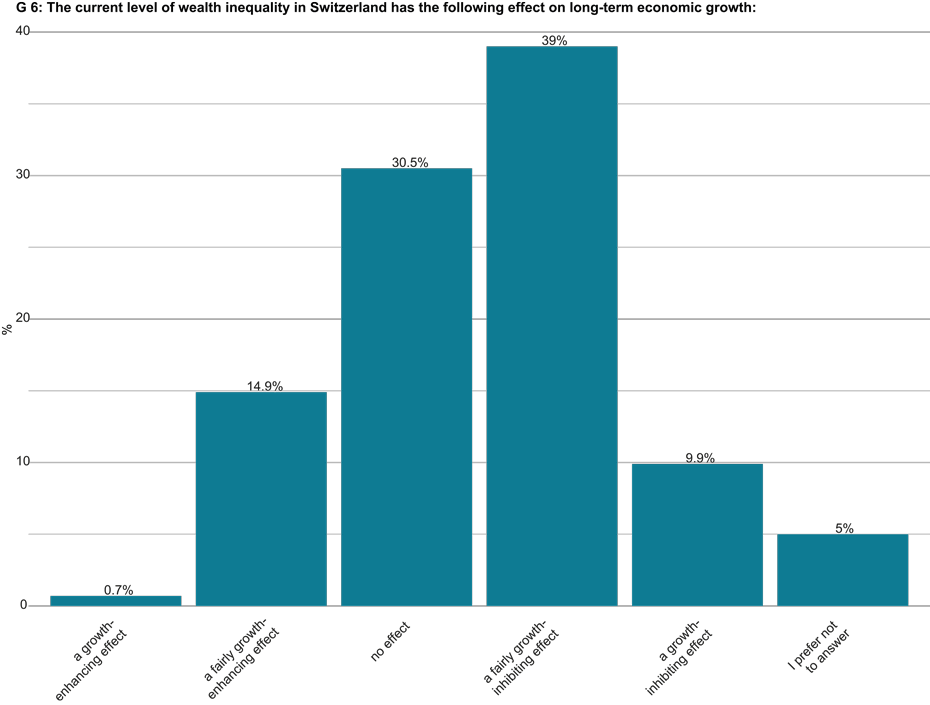

Inequalities of wealth and income are inhibiting economic growth

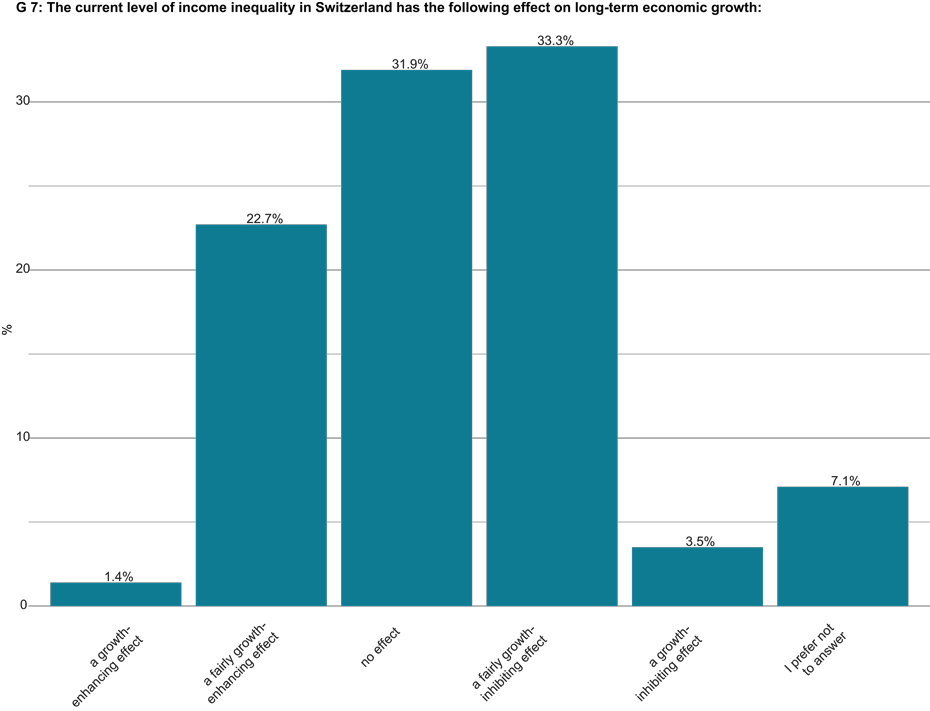

Inequalities of income and wealth in Switzerland are considered to be average by international standards.3 However, the proportion of very wealthy households in Switzerland is relatively high. According to the survey results, almost half of respondents believe that the current level of wealth inequality in Switzerland tends to inhibit long-term economic growth, while 16 per cent reckon that it tends to stimulate growth (Chart G 6). A smaller proportion (37 per cent) see the current level of income inequality as tending to constrain growth (Chart G 7), whereas 24 per cent of economists consider income inequality to be growth-enhancing. The remainder believe that it has no effect.

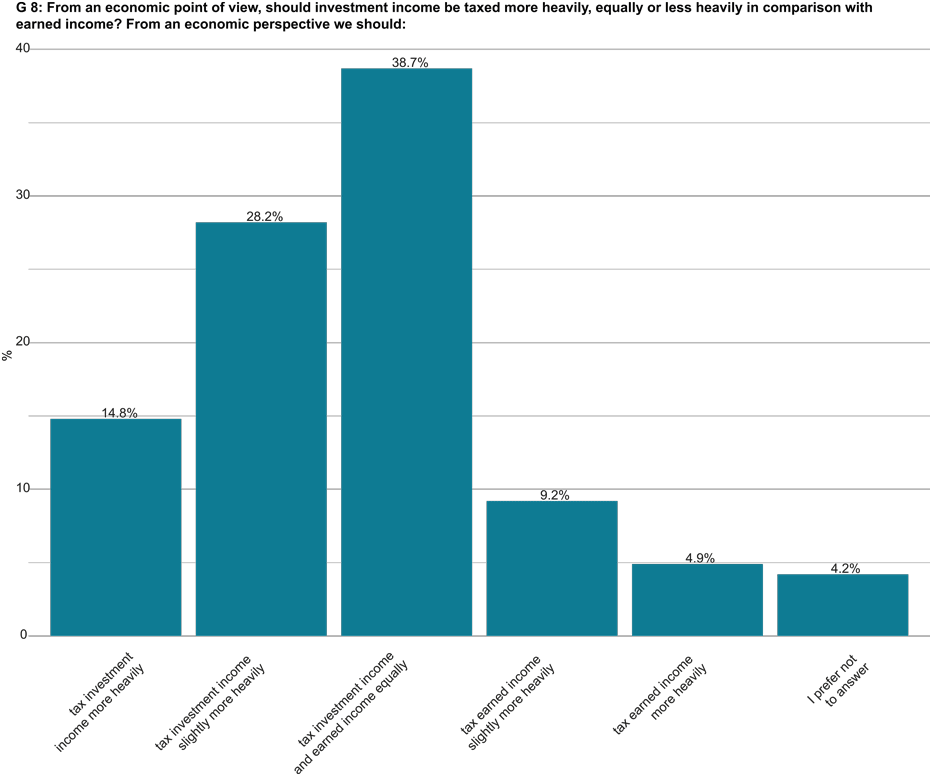

Economists tend to want to tax investment income more heavily than earned income

The August Economists’ Survey also addressed a popular initiative aimed at reducing the tax burden on wages while taxing capital ‘fairly’ (unofficially known as the '99 per cent Initiative'), which was rejected by the Swiss electorate on 26 September. The aim of the 99 per cent Initiative was to promote social justice by taxing investment income (e.g. interest and dividends) above a certain allowance 1.5 times as much as earned income. The resulting additional revenue was to be used to cut income taxes for people on low to average wages and salaries and to fund spending on social welfare, education and health. Several factors may play a role in assessing the appropriate tax burden on unearned income versus earned income. On the one hand, distributional issues can be taken into account in such considerations. Negative aspects of economic inequality are, for example, the threat to social and political cohesion or inefficiently low investment in human capital. Another factor is the efficiency of taxation, which would tend to favour taxing mobile factors (such as capital) less than immobile ones (this tends to include labour). Economists were asked whether, from an economic point of view, earned or unearned income should be taxed more heavily (Chart G 8). 43 per cent are of the opinion that investment income should be taxed (slightly) more heavily. 39 per cent, on the other hand, are in favour of taxing both equally, while 14 per cent are in favour of a (slightly) higher tax on wages.

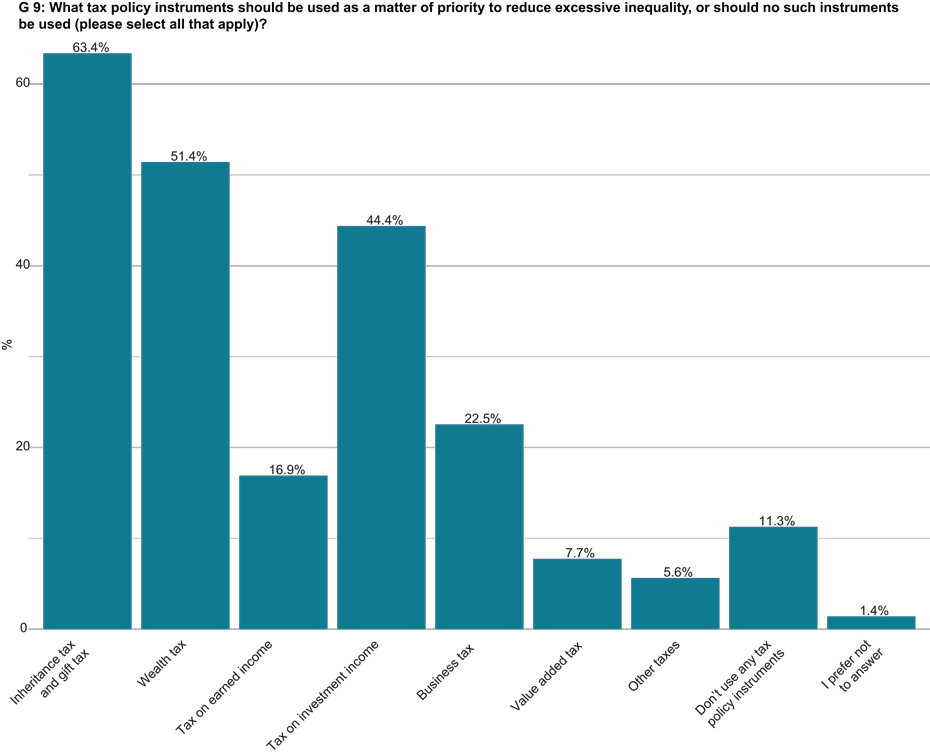

Inheritance tax, gift tax and education are best suited to reducing inequality

But is the taxation of investment income an appropriate means of reducing excessive inequality, or are other tax policy instruments better suited? The economists surveyed see inheritance tax and gift tax as the most effective tax policy instruments (Chart G 9). Unlike other instruments, taxing inheritances and gifts is beneficial because it does not make a productive service unattractive. The second and third most frequently mentioned options were wealth taxes and investment income taxes. In contrast, business taxes, taxes on earned income, and value added taxes are less popular.

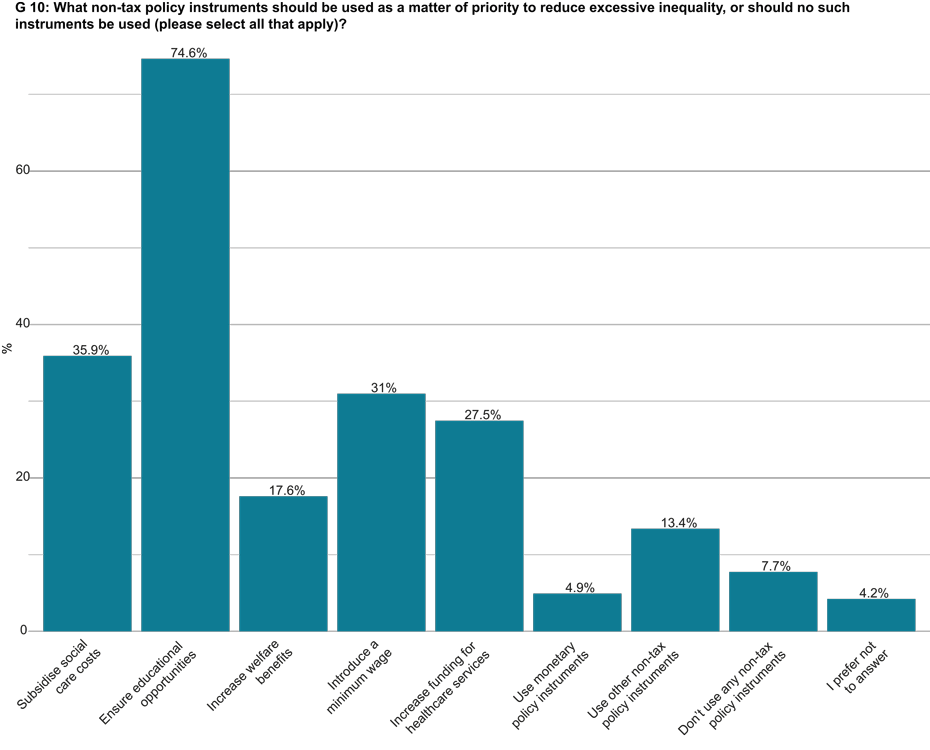

As far as non-tax policy instruments are concerned, economists are relatively unanimous: ensuring educational opportunities is seen as the primary way to reduce inequality (Chart G 10). The subsidisation of social care costs, the introduction of a minimum wage and additional funding for healthcare services are also suitable non-tax policy instruments. On the other hand, the economists surveyed consider the expansion of welfare benefits and monetary policy instruments to be less important.

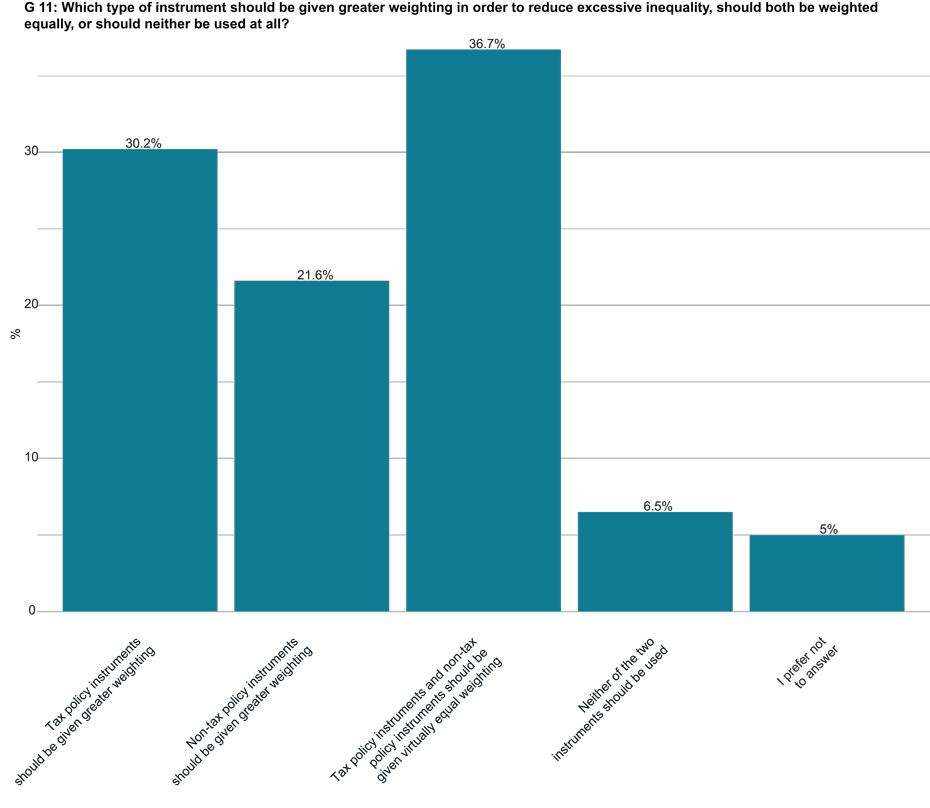

The survey respondents also indicated what type of instrument should be given greater weighting in order to reduce excessive inequality. 37 per cent of economists are in favour of giving equal weighting to these two policy options (Chart G 11). When choosing between the two types of instrument, they prefer to give greater weighting to tax policy options (30 per cent) than to non-tax policy ones (22 per cent). The remainder would use neither instrument.

--------------------------------------------

1) The rest preferred not to answer.

2) https://doi.org/10.3929/ethz-b-000472065

3) For example external page hier.

Further information on the KOF-NZZ Economists’ Survey is available here.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland

Director of KOF Swiss Economic Institute

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland