KOF Business Tendency Surveys for October: companies emerging from the worst of the pandemic

- Business Tendency Surveys

- KOF Bulletin

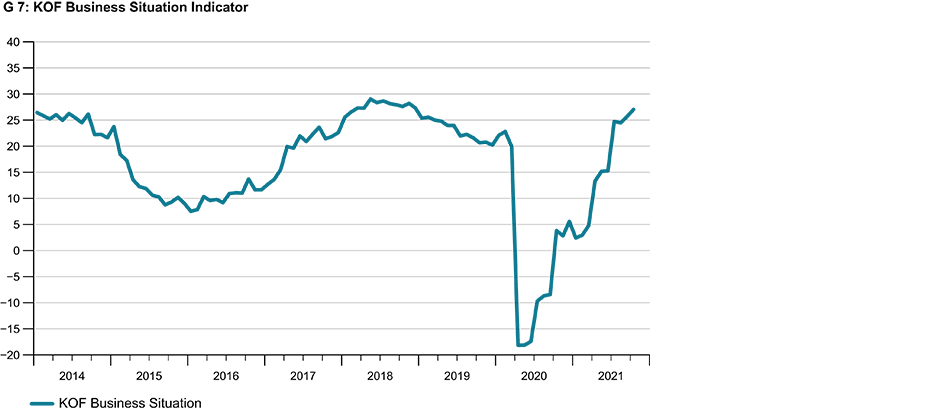

Swiss companies’ business situation continued to improve in October and is now almost as encouraging as it was in spring 2018 (see Chart G 7). The worst of the COVID-19 crisis has been overcome. Companies’ expectations about future developments remain optimistic and uncertainty continues to decrease.

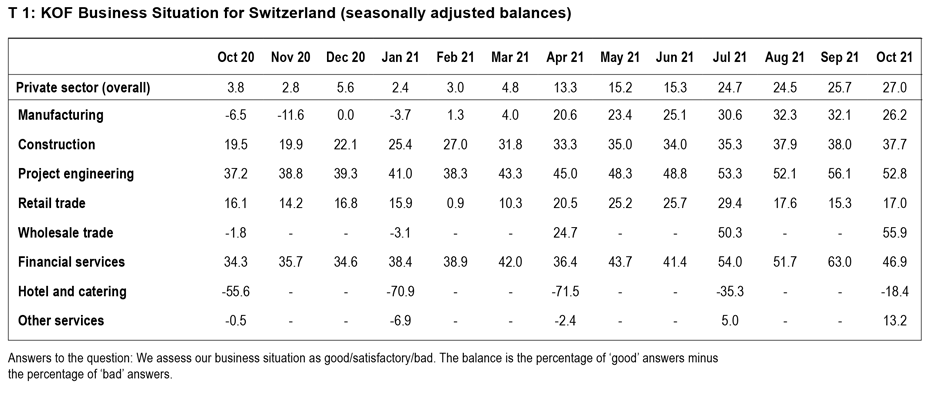

The performance of firms’ business varies from sector to sector. In addition, there are signs of a fundamental shift in patterns. The situation in the previously buoyant manufacturing and financial services & insurance sectors is tending to calm down. On the other hand, the previously particularly disappointing sectors of hospitality and other services are catching up. The gap that had opened up between sectors as a result of the pandemic is therefore closing to some extent (see table T 1).

Many companies complaining about a shortage of skilled workers

The fact that there are still considerable problems with the supply of intermediate products in the goods-producing and goods-distributing sectors – manufacturing, construction, retailing and wholesaling – is also likely to contribute to the convergence of these sectors. These difficulties have recently become even more acute in some industries. Moreover, another problem is now becoming apparent not only among goods producers but also in many service sectors: the availability of further skilled workers. Many companies are looking for additional staff but are increasingly complaining that it is difficult to find them.

In this environment the pressure to raise prices remains high across much of the economy. At least this upward pressure has ceased in some areas, such as construction and other service providers, and has even decreased in other areas, such as the wholesale and hospitality sectors. Nevertheless, price projections are still clearly pointing upwards almost everywhere.

The manufacturing sector is cooling slightly

Business activity in the manufacturing sector is calming down somewhat. However, the Business Situation Indicator remains high. The increased and above-average level of capacity utilisation indicates that the situation remains encouraging overall. In addition, order books are fairly full. However, companies continue to be hampered by difficult access to intermediate products. This is also reflected in the fact that they consider their inventories of intermediate products to be too low, even though they have already replenished them. Now, a shortage of labour is increasingly being felt as a second obstacle to production. Continuing strong demand on the one hand and the shortage of input products and workers on the other are placing constant pressure on companies to raise their buying and selling prices.

Good level of orders in the construction industry.

Business in the sectors associated with building activity – project engineering and construction – changed little over the summer. Despite the rising cost of materials, companies’ earnings are stable, businesses are working at more or less full capacity and construction prices are rising significantly. The order situation is predominantly good, and the range of order backlogs in the construction industry continues to increase. However, companies are finding it difficult to recruit suitable additional staff.

Business in the wholesale sector is booming

Although business in the retail sector improved slightly in October, it has slowed considerably overall compared with the summer. The situation in online retail – including mail order – is returning to normal after having achieved an extraordinary high since the outbreak of the pandemic. Although retailers as a whole have been planning price increases for several months, their earnings have suffered recently. Inventories are rather low by longer-term standards, but companies are becoming more cautious about ordering goods. Their sales outlook is stable to slightly positive. The already good business situation in wholesale continues to improve. The wholesale trade in food and in machinery and equipment has again performed particularly well.

Despite suffering a setback, financial and insurance service providers are in an excellent situation

Although business among financial and insurance service providers slowed somewhat in October, it remained excellent. As far as their expectations for business in the near future are concerned, the relevant institutions’ optimism remains virtually unchanged. Their earnings again performed well and their confident outlook has not changed significantly in this respect. Banking institutions expect to receive an additional boost in particular from the demand from their corporate customers, whose creditworthiness they see as having improved noticeably.

The hospitality industry can breathe a sigh of relief, and foreign guests are also returning

The challenging business situation in the hospitality industry is easing significantly. The situation in the mountain and lake regions continues to improve. However, the trend is also encouraging in the major towns and cities, which have managed to significantly close the gap between themselves and other areas. Nonetheless, uncertainty about business going forward remains high, particularly among restaurateurs. Despite having improved, occupancy rates in the accommodation sector remain well below their pre-crisis levels. However, at least business with foreign customers has now picked up slightly. Businesses expect to see an increase in overnight stays by domestic and foreign guests over the coming months.

The remaining service providers are still in the process of catching up

The Business Situation Indicator for other services is continuing to emerge from the COVID-19 crisis. However, it has still not reached its pre-crisis level. Despite having increased, capacity utilisation therefore remains lower than it was before the crisis. The transport sector is still suffering especially. Information & communication and business services have fallen only just short of their pre-crisis levels in terms of capacity utilisation. Service companies’ earnings situation has improved again overall. Since the survey respondents are optimistic about the future, they are looking to recruit additional staff to meet the expected increase in demand. However, like many other industries, they are increasingly encountering problems finding suitable workers.

Please find the detailed findings of the KOF Business Tendency Surveys (including tables and graphs) on our Website.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland