How has COVID inflation performed since the summer?

- Swiss Economy

- KOF Bulletin

Following a sharp rise in the number of infections in the autumn, the Swiss government and the cantons have taken further measures to combat the pandemic. Both factors are likely to have contributed to the fact that Swiss people have again adjusted their consumption. This also affects the measurement of inflation, albeit not as much as during the lockdown in spring. This is illustrated by an updated comparison of the national consumer price index (LIK) with an alternative COVID price index.

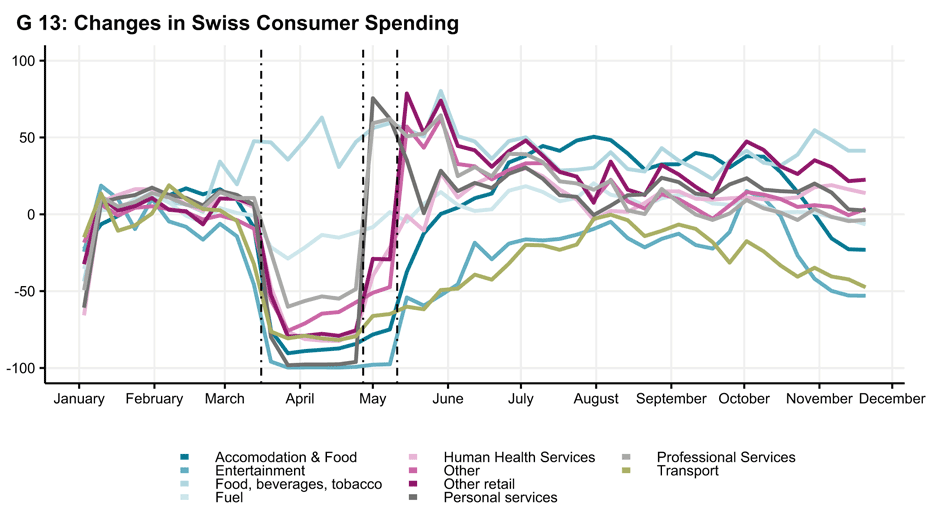

The coronavirus crisis is still affecting consumption. After returning to normal over the summer, the rising number of infections in the autumn and the tighter restrictions may have contributed to the fact that the Swiss have again adjusted their consumption behaviour. This is illustrated by the latest data on debit card transactions.1 Chart 13 shows the changes in Swiss consumer behaviour since January 2020 measured by these transaction data.

In November, consumers again spent less money on entertainment as well as on accommodation and catering. Spending was around 53 per cent and 23 per cent below pre-crisis level and thus comparable to the level of mid-May. By contrast, spending on food, drink and tobacco has remained at a consistently high level since the end of the lockdown in spring and has recently risen slightly again. Since the beginning of the crisis, Swiss citizens have spent on average 30 per cent more for groceries than before the pandemic. Other categories of expenditure such as spending on personal and professional services recovered rapidly after the spring slump. Since then, consumption spending are comparable the level before the crisis.

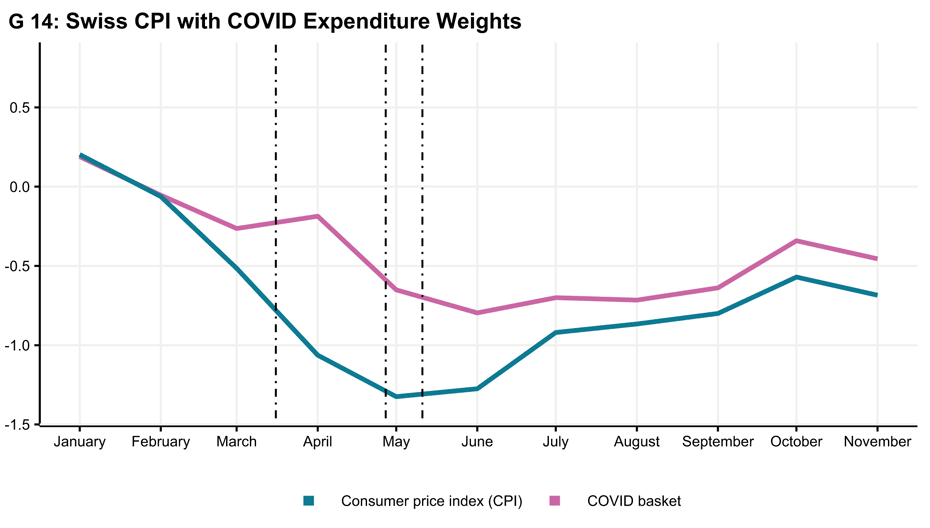

Such adjustments in consumption affect the measurement of inflation in Switzerland, as a KOF researcher showed in July. Inflation is calculated based on how much the cost of a representative basket of goods changes over time. This results in the national consumer price index (LIK). However, the weighting of the LIK basket is only updated annually, and this was last done in December 2019. As consumer behaviour has changed dramatically this year, this poses the question of how representative this basket is of consumption during the pandemic. A price measurement that captures short-term changes in consumer behaviour is therefore an interesting addition to the LIK which, with its fixed weighting, is important for many analyses and statistics.

COVID inflation is still higher than LIK inflation

The KOF researcher has therefore constructed an alternative COVID price index by linking the LIK data with the latest card transactions. Specifically, he has updated the shopping basket weighting of the LIK with the changes in consumer spending resulting from these card transactions. The index thus reflects the price trends of the latest 'COVID consumption'.

A comparison with the LIK shows that the COVID price index has consistently estimated higher inflation since the onset of the crisis (see G 14). The difference between the two indices was greatest in April during the lockdown: COVID inflation was -0.2 per cent at that time, whereas official LIK inflation was -1.1 per cent. COVID inflation was therefore 0.9 percentage points higher. Two effects contributed to this difference. Firstly, the prices of groceries and non-alcoholic beverages rose in April, but at the same time these goods accounted for a larger proportion of Swiss consumer spending, which is why they were heavily overweighted in the COVID price index relative to the LIK. And, secondly, the prices of goods and services in the areas of transport, recreation and culture fell, although these goods and services were hardly able to be consumed in April and were therefore heavily underweighted.

As consumer behaviour has returned to normal since the end of the lockdown, the difference between the two measurements has shrunk. In November, LIK inflation was -0.7 per cent and COVID inflation was -0.5 per cent, so the difference was still 0.2 percentage points.

-------------------------------------------------------------------

1) These data are based on the weekly transaction volumes of debit cards in Switzerland and include payments at points of sale such as grocery shops and service providers (e.g. hairdressers, restaurants and petrol stations). They are made publicly available as part of the Consumption Monitoring Switzerland project, which is facilitated by the University of St Gallen (Professor Martin Brown, Professor Matthias Fengler) and Novalytica together with Dr Robert Rohrkemper (Distinguished Expert and Senior Data Scientist at Worldline) and Professor Rafael Lalive (University of Lausanne). See external page https://monitoringconsumption.com/.

The full study from July can be found external page here.

The latest update from September can be found here.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland