How the pandemic affects inflation measurement

- Swiss Economy

- KOF Bulletin

The coronavirus crisis substantially changed consumer behaviour during the lockdown. This can lead to a situation where the prices of consumed goods over time differ significantly from those in Switzerland’s national consumer price index (LIK). In order to estimate these differences, KOF has linked the official LIK data with card transaction data and constructed an alternative COVID price index. This suggests that inflation has been underestimated since the beginning of the coronavirus crisis.

"Consumer prices remained stable in August," reported the Swiss Federal Statistical Office (FSO) this week. According to the official data, inflation in August came to -0.9%. This number shows that the average price of goods and services consumed by Swiss citizens fell by 0.9% in August compared with the same month of the previous year.

Because of COVID-19, however, official inflation statistics are subject to an unusually high degree of uncertainty. The pandemic affects the informative value of these statistics because the crisis has fundamentally changed consumer behaviour.

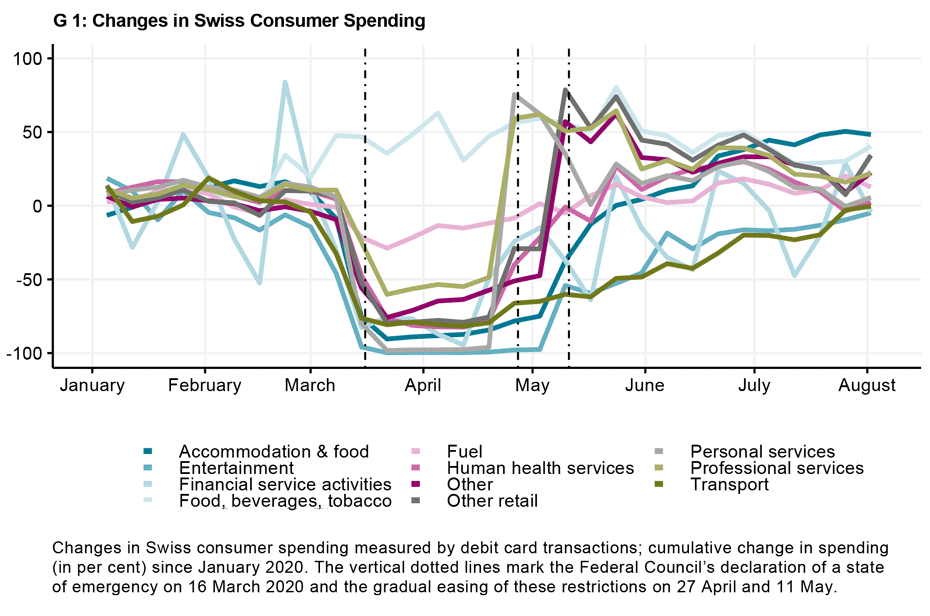

The extent to which purchasing behaviour has changed during the crisis is clearly reflected1 in card payment data. Chart G 1 shows the change in Swiss consumer behaviour since January 2020 measured by debit card transactions.

The transaction volumes clearly reflect the measures taken by the Federal Council to contain the pandemic. Much of private consumption was severely restricted during the almost two-month lockdown from mid-March to mid-May.2 At the same time, the gradual easing of the restrictions on 27 April and 11 May is visible in the payment data. For example, spending on 'personal services' skyrocketed at the end of April when hairdressing salons, massage parlours and beauty salons were allowed to reopen.

Is the shopping basket still representative?

In general, the individual categories of consumer spending have performed very differently since the crisis. For example, while spending on food has risen considerably since the lockdown, spending on entertainment has fallen significantly and is still below pre-crisis levels.

Such abrupt and profound changes in consumption can significantly affect the informative value of the national consumer price index (LIK) used to measure inflation. This is because inflation is calculated based on how much the cost of a representative basket of goods changes over time. To this end, the LIK is constructed using expenditure weightings that are kept constant over the course of a year. The most recent adjustment of the basket weightings took place in December 2019 and was based on the Household Budget Survey from 2017 and 2018.

However, this means that the weighting scheme is not representative of what was consumed or was able to be consumed during the lockdown. Consequently, the inflation of the goods actually consumed may differ from the inflation officially reported.

Debit card data are linked with the shopping basket

In a recently published study a KOF researcher examines the influence of such changes in spending behaviour on the measurement of inflation in Switzerland during the coronavirus crisis. To this end, the official LIK data are combined with consumer spending estimates based on debit card transactions. Specifically, the card transactions are linked with the individual index items of the LIK shopping basket, the weightings of which are updated with transaction-based changes in spending, and an alternative price index is calculated on the basis of such 'COVID weightings'. Instead of using constant weightings, the resultant COVID price index reflects the changes in prices of 'COVID consumption' at any one time, as it can be estimated from the card payment data.

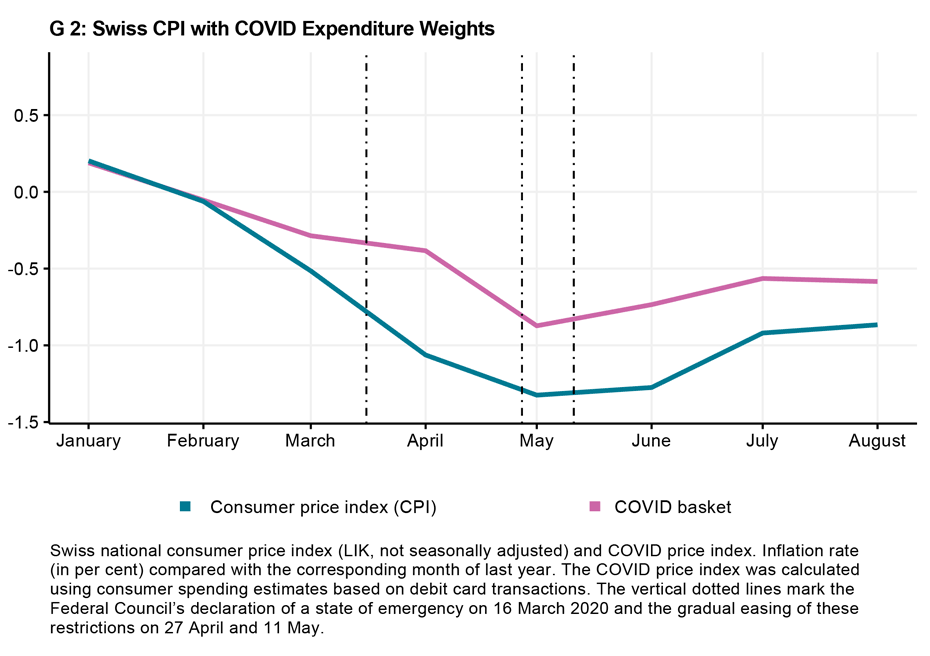

Chart G 2 compares the inflation rates of this COVID price index with those of the Swiss national consumer price index.

Inflation in the LIK index was already low at the beginning of the year before it turned negative with the outbreak of the pandemic and then fell sharply during the lockdown. It fell to -1.3 per cent in May 2020 compared with the corresponding month of last year. By contrast, COVID inflation was consistently higher. The corresponding inflation rate in May 2020 was -0.9 per cent. The difference between the two series peaked in April 2020 and amounted to about 0.7 percentage points. The different underlying baskets of goods thus cause the LIK to show a lower inflation rate during the lockdown than the alternative COVID price index, which takes into account the shift in consumer spending.

High-frequency, alternative data could become more important

This finding is consistent with various contributions to the current debate on inflation and its possible distortions during the crisis.3 It is a consequence of the relative weighting shifts and, in particular, is caused by the relative increase in the consumption of food and non-alcoholic beverages. These goods were more inflationary than other categories of expenditure during the lockdown.

As consumer behaviour gradually returns to normal (see Chart G 2), the weighting difference in the measurement of inflation is also diminishing. In August 2020, CPI inflation was -0.9% and COVID inflation was -0.6%. The difference between the two measures decreased accordingly to 0.3 percentage points.

On the whole, these findings help to assess inflation in economically turbulent times and raise conceptual questions about the appropriate measurement of prices once the crisis is over. When the representative basket of goods and services is updated, in particular, one question that will arise in the near future will be to what extent the year 2020 and COVID consumption should influence the basket’s weighting system. Given this challenge, the use of high-frequency and alternative sources of data on consumer spending could play an essential role in developing more robust and meaningful price measurement tools.

A full version of the study can be found external page here.

-------------------------------------------------------------------

1) These data are based on the weekly transaction volume of debit cards in Switzerland and include payments at points of sale such as grocery stores and service providers (e.g. hairdressers, restaurants and petrol stations). They are publicly available as part of the Consumption Monitoring Switzerland project, which is made possible by the University of St Gallen (Professor Martin Brown, Professor Matthias Fengler) and Novalytica together with Dr Robert Rohrkemper (Distinguished Expert, Senior Data Scientist at Worldline) and Professor Rafael Lalive (University of Lausanne). See external page http://monitoringconsumption.org/switzerland.

2) When the state of emergency was declared on 16 March, non-essential retail outlets and many service businesses such as restaurants, bars and entertainment & leisure facilities were temporarily closed and public transport was reduced. Only grocery stores, pharmacies, banks and post offices remained open.

3) These results are consistent with the analytical argument put forward by Diewert & Fox (2020) that current calculation methods distort consumer prices downwards. Jaravel & O'Connell (2020) empirically document an increase in inflation in the first month of the lockdown using scanner data of short-lived consumer goods in the United Kingdom. Using official price indices and updating basket weightings in a similar way to this study, Cavallo (2020) finds comparable results for the United States, but mixed international evidence overall.

Literature

Cavallo, A. (2020): Inflation with Covid consumption baskets. NBER Working Paper 27352.

Diewert, E. E., & K. J. Fox (2020): Measuring real consumption and CPI bias under lockdown conditions. NBER Working Paper 27144.

Jaravel, X., & M- O'Connell (2020): Inflation spike and falling product variety during the Great Lockdown. CEPR Discussion Paper DP14880.

Seiler, P. (2020): Weighting bias and inflation in the time of Covid-19: Evidence from Swiss transaction data. Swiss Journal of Economics and Statistics. Forthcoming.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland