Coronavirus crisis is slowing wage growth

- Labour Market

- Swiss Economy

- KOF Bulletin

After the labour market had deteriorated sharply in the spring, it recovered over the summer - thanks in particular to short-time working. However, the outlook for the winter suggests that a second wave of unemployment is to be expected. The increase in nominal wages next year is likely to be the lowest in 80 years.

Although the restrictions started to be gradually eased in May, the full force of the COVID-19 pandemic hit the Swiss labour market in the second quarter. This trend is now also shown by data from the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office. According to this survey, the number of people in work decreased by 2 per cent in the second quarter in seasonally adjusted terms compared with the previous quarter. This represents a change of historic proportions: never before has there been such a large quarterly decline in seasonally adjusted employment in the labour-market data series, which on a quarterly basis goes back to the early 1990s.

As employment declined, capacity utilisation among the remaining labour force – measured in terms of average weekly working hours – also fell. This is because short-time working was introduced for a record 1.275 million employees in April. In the second quarter of 2020 the actual weekly working hours per person fell by 9.5 per cent to 28.4 hours compared with the same quarter of last year.

Women more affected in the first half of the year

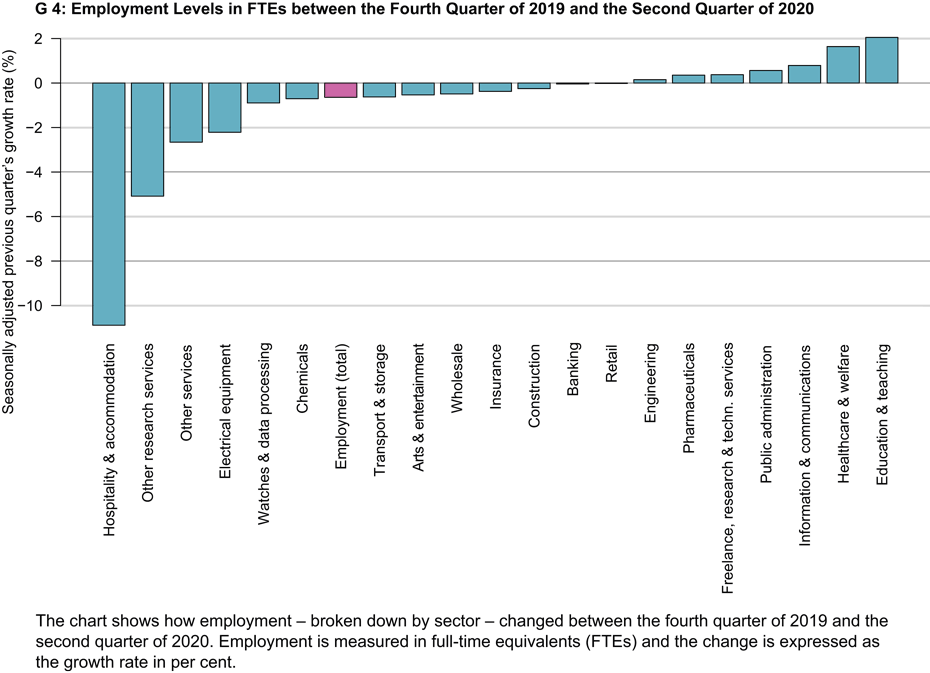

The employment statistics data show how different the impact of the crisis was on the various sectors (see chart G 4). The hospitality industry was hit hardest, with as many as 12.1 per cent or 32,331 of those employed in hospitality at the end of 2019 losing their jobs by the end of the second quarter of 2020. Employees working in 'other business activities', which include trade fair, exhibition and congress organisers (down 7.3 per cent) as well as those working in the arts and entertainment (down 5.0 per cent) were also seriously affected. By contrast, employment in the healthcare sector increased by 12,381 (up 1.7 per cent) between the fourth quarter of 2019 and the second quarter of 2020.

Women tend to be more affected by any decline in employment than men. While male employment has fallen by 1.0 per cent (27,835 individuals) since the end of 2019, the corresponding decrease for women has been 1.5 per cent (34,452 people). Consequently, the current crisis differs from recent economic crises, which on average affected men slightly more severely. This is due in particular to the disproportionate representation of women in some sectors of the economy that have been badly affected. At the end of 2019, for example, significantly more women were employed in the catering sector than men, which means that in the first two quarters of 2020, more women lost their jobs in absolute terms.

We are not out of the woods yet

The figures available so far suggest that the labour market stabilised during the summer months. According to KOF, the seasonally adjusted number of those officially registered as unemployed1 fell from 161,100 in May – which represents an unemployment rate of just under 3.5 per cent – to 155,700 in September (just under 3.4 per cent). There was also some fairly good news with regard to short-time working. Compared with the peak of the crisis in April, when short-time working accounted for almost 103 million working hours, the number of hours of short-time working officially reported fell by 69 per cent in June and by more than 80 per cent in July.

The fall in unemployment over the summer came as a pleasant surprise. However, we are not out of the woods yet. Some businesses benefited from one-off effects during the summer, such as the tourism industry in certain regions thanks to exceptionally strong demand from Swiss tourists, or the retail sector owing to catch-up effects in consumption following the lockdown. Above all, however, short-time working helped to avoid excessive redundancies.

Nonetheless, short-time working was still being introduced for around 350,000 people in July of the current year. Although this was considerably fewer than in April, there were still more than 3.5 times as many short-time workers as at the height of the financial and economic crisis. The next few months will reveal how many of the jobs affected can be secured in the long term. The instrument of short-time working is particularly effective in the event of a temporary economic downturn. For some of the companies affected, however, the slump in demand is likely to prove permanent.

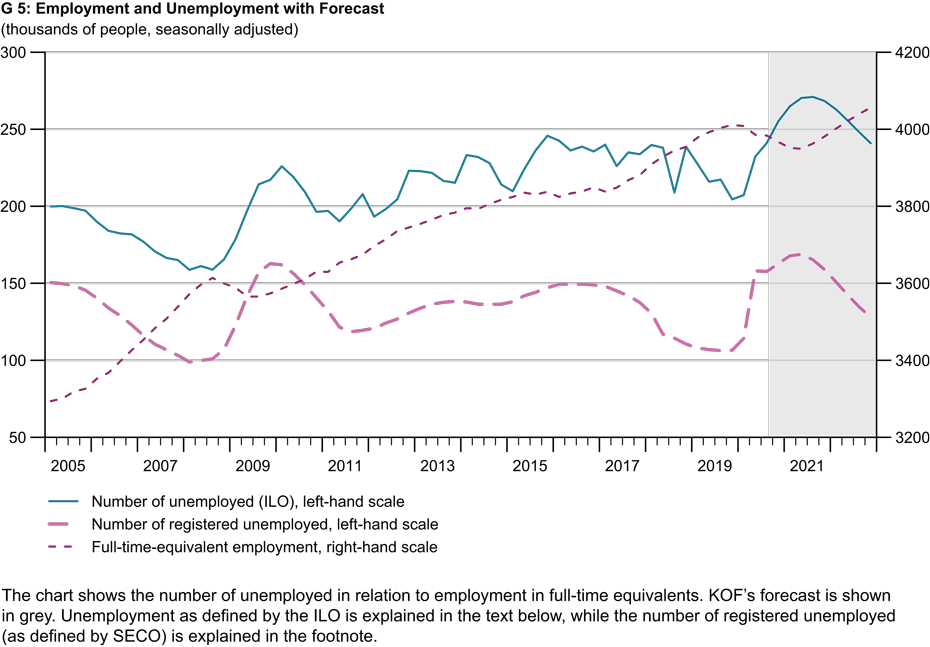

Slight increase in unemployment expected in winter

KOF’s latest forecast predicts a second wave of redundancies during the winter half of the year owing to the expiry of the above-mentioned one-off effects and as a result of lay-offs of workers for whom short-time working is currently being introduced. Although these redundancies will be much lower than previously assumed, they will cause a modest second increase in unemployment (see chart G 5). According to the State Secretariat for Economic Affairs (SECO), the rate of registered unemployed will rise from 3.2 per cent this year to 3.6 per cent next year. The peak in seasonally adjusted unemployment will be reached in the second quarter of 2021. The unemployment rate as defined by the International Labour Organization (ILO), which includes unemployed individuals not registered with an employment office, is moving in parallel at a much higher level. The ILO unemployment rate is estimated to average 4.8 per cent this year and 5.5 per cent next year.

Employment is expected to remain sluggish, mirroring the trend in unemployment. KOF is forecasting that full-time-equivalent employment will decline by 0.3 per cent in 2020 as a whole compared with last year. The number of those in employment is likely to fall by 0.4 per cent in 2020. This decline in employment is unlikely to be compensated for in 2021 as the economy slows at the beginning of next year. The forecast therefore anticipates that employment will grow by 0.1 per cent next year. We will not see a recovery until 2022 (rise of 1.4 per cent).

Wage stagnation next year?

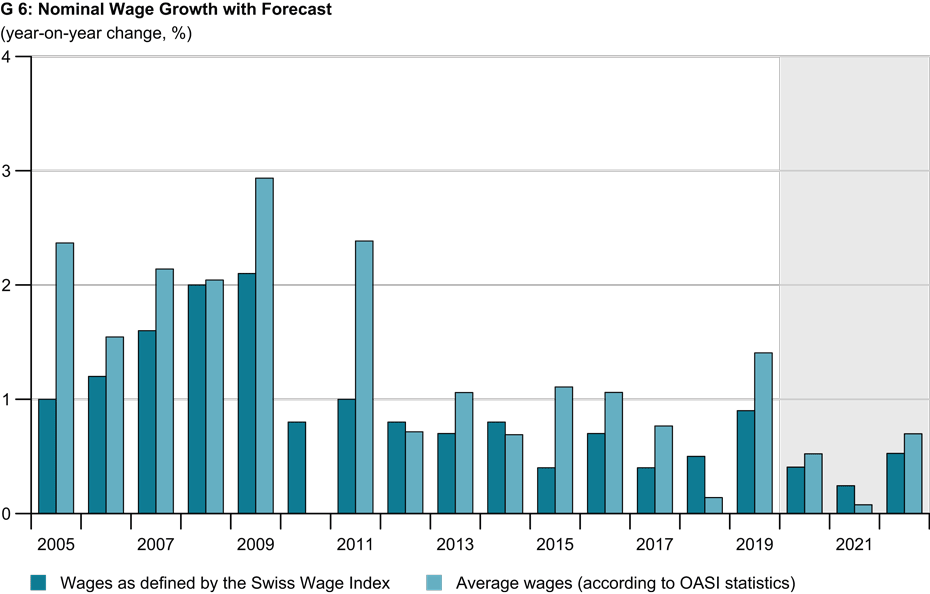

The coronavirus crisis is not expected to have a significantly negative impact on wage growth until next year. In 2020, many wage earners will benefit from the fact that wages paid under existing employment contracts – including those negotiated under collective bargaining agreements – were renegotiated last autumn when the economic outlook was still fairly promising. In 2020 this will give rise to nominal wage increases that only partly reflect the crisis. Wages as defined by the Swiss Wage Index (SLI) are forecast to rise by 0.4 per cent this year. Although this is a small increase in nominal terms, falling consumer prices will result in relatively strong gains in purchasing power for households, which will provide some support for the economy. According to the SLI, real wages will rise by 1.1 per cent in 2020.

The labour market conditions currently prevailing this autumn do not look promising for workers’ pay. Falling prices and the strong pressure to save mean that there are unlikely to be any general wage increases in many sectors this year. Overall, KOF is therefore forecasting that SLI wages will increase by only 0.2 per cent in nominal terms in 2021, which would be the lowest nominal wage growth in the wage data series' 80-year history (see chart G 6). In some sectors we might even see nominal wages fall.

-------------------------------------------------------------------

1) Registered unemployment according to SECO includes only those who are definitively unemployed. Individuals who, for example, participate in the labour market on temporary wages are not included.

The full version of this article can be found in KOF’s analysis from the end of October.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland