Coronavirus crisis: many firms short of money for investment

- Innovation

- KOF Bulletin

Investment activity by Swiss companies slumped in 2020 as a result of the economic crisis caused by the coronavirus pandemic. The findings of the semi-annual KOF Investment Survey show that companies plan to catch up on some of their postponed investment projects in the second year of the pandemic. However, one in five firms lacks the financial resources to do so, which is slowing down their investment drives.

The coronavirus crisis has meant that economies around the globe – including Switzerland – are experiencing the sharpest declines in their economic performance in decades. In response to the outbreak of the pandemic and the measures taken to contain it, Swiss companies have massively revised their investment plans downwards. This was already evident in earlier waves of the KOF Investment Survey.

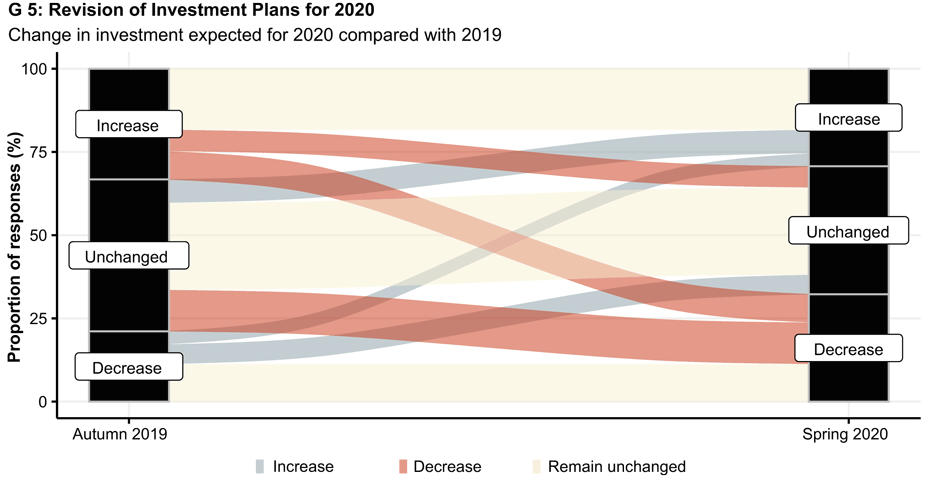

In both autumn 2019 and spring 2020, firms were asked how their investment plans for 2020 would change compared with 2019. Companies could indicate on a three-point scale whether they intended to increase or reduce their investment or leave it unchanged. As the survey was conducted in autumn 2019 up to six months before the pandemic, its results are unaffected by the coronavirus crisis. Conversely, the spring 2020 survey took place in the midst of the lockdown.

Companies have postponed or abandoned investment projects

The flow chart presented in Chart 5 shows how much investment plans have changed over this time. The three response options on both sides of the chart are represented as vertical bars whose height conveys the proportion of firms that chose each response. The flows between them are represented by bands whose width is proportional to the number of firms that changed their investment plans accordingly.

It is clear that the pandemic has caused many companies to revise their investment plans. In autumn 2019 (see bar on the left), one-third intended to increase their investment in 2020, 46 per cent wanted to leave it unchanged and 21 per cent planned to reduce it. During the pandemic, 27 per cent of firms revised their investment plans downwards. Only 17 per cent increased them. Overall, 32 per cent of companies intended to reduce their investment in 2020 compared with 2019, just under two-fifths wanted to leave it unchanged and only 29 per cent planned to increase it.

In fact, over a third of respondents said that postponing investment projects was of medium to high importance in combating the economic impact of the COVID-19 pandemic. Over a quarter have completely foregone investment during the crisis. Only 15 per cent launched new investment projects in response to the crisis.

Tentative upswing in the second pandemic year

The results of the latest KOF Investment Survey from autumn 2020 now give a deeper insight into these revisions and provide an initial assessment of investment plans for 2021. Based on the survey findings, a reduction in fixed asset investment of 9.2 per cent in nominal terms was calculated for the past year. The survey respondents expect to see growth of 7.3 per cent for 2021.

The investment growth expected for 2021 is evenly distributed between industry (up 6 per cent) and the service sector (up 7 per cent). Companies in the construction industry, on the other hand, plan to further reduce their investment (by 2 per cent). But even within services there are major differences between the individual sectors. While wholesalers and retailers expect to see a strong boost to investment (up 12 per cent and 18 per cent respectively), the hospitality industry has been hit particularly hard by the crisis. Having already cut their investment activity by 28 per cent in the pandemic year, hotels and restaurants expect to see a further decline of 18 per cent in 2021.

One in five companies lacks financial resources

The fact that the decline in investment last year is greater than the growth in investment this year suggests that investment will recover only slowly and sluggishly from the coronavirus crisis. A major reason for this is companies’ financial situation. Firms were asked in the survey what impact their available financial resources and their expected earnings situation would have on their investment activity in 2021. They could rank their responses on a five-point scale.

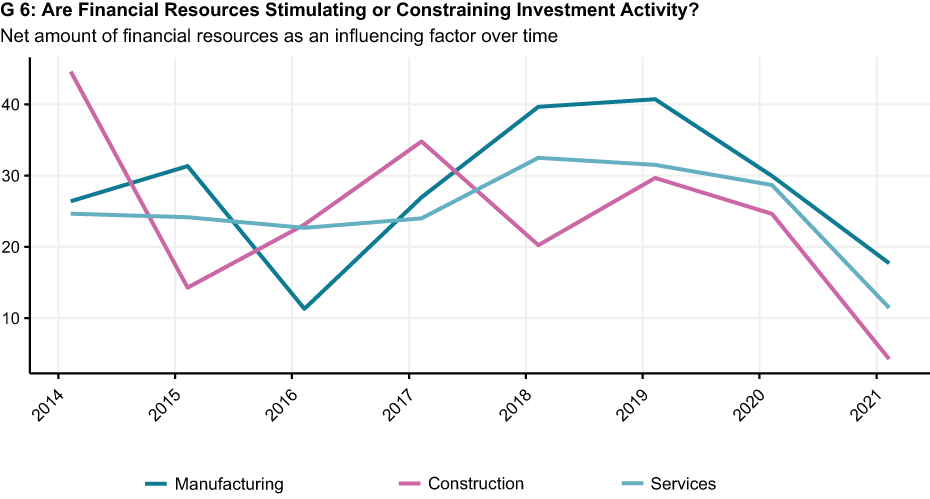

Companies are increasingly claiming that the current financial situation is having a negative impact on investment plans this year. On balance, the influencing factor has fallen by around 20 points in all sectors since the survey was conducted in autumn 2019 (see G 6). It has thus hit a new low in both the construction and services sectors. The last time a similarly challenging situation prevailed in the manufacturing sector was in autumn 2015 after the minimum exchange rate of 1.20 Swiss francs to the euro was lifted. Taken together, 22 per cent of all companies surveyed say that their investment in 2021 will be impacted either slightly or very negatively by their financial resources.

Subdued investment drive may slow recovery

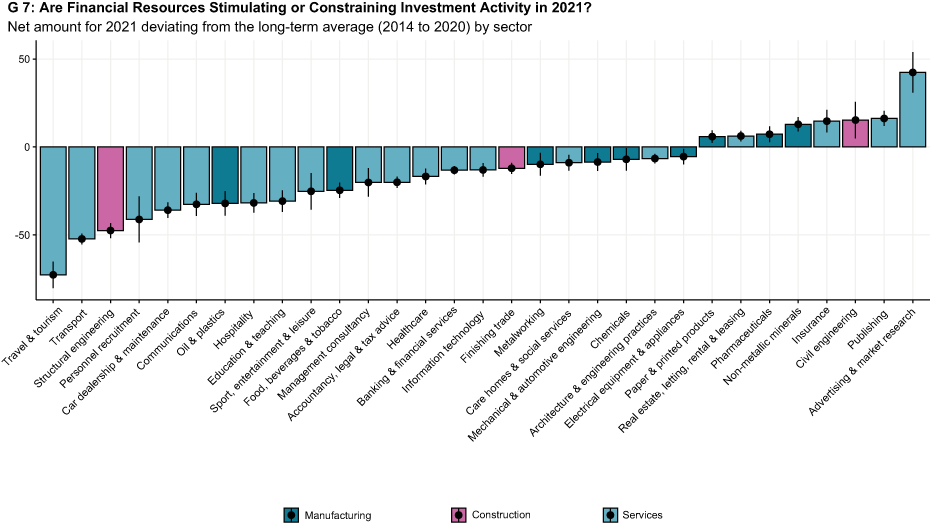

This trend is particularly pronounced in the services sector and is unprecedented since the beginning of the survey. This is revealed in Chart 7, which breaks down the impact that financial resources have on investment activity by sector, showing how the net amount for 2021 deviates from its long-term average (2014 to 2020).1

This trend is particularly pronounced in the services sector and is unprecedented since the beginning of the survey. This is revealed in Chart 7, which breaks down the impact that financial resources have on investment activity by sector, showing how the net amount for 2021 deviates from its long-term average (2014 to 2020).

The most negative change is in the travel industry (General Classification of Economic Activities (NOGA) code 79: travel agencies, tour operators and other reservation services). Two out of three travel agencies complain that their investment has been slightly or significantly constrained by the financial resources available. However, the earnings situation has also had a negative impact on investment in transport (NOGA 49: land transport and transport via pipelines, NOGA 50: water transport, NOGA 51: aeronautics) and in building construction (NOGA 41), where one in three companies is affected.

At the other end of the spectrum, the earnings situation in a few industries has improved and has even stimulated investment growth during the pandemic. These sectors include advertising and market research (NOGA 73), publishing (NOGA 58), civil engineering (NOGA 42) and pharmaceuticals (NOGA 21: manufacture of pharmaceutical products). Although there are major differences across industries, the number of those whose financial situation has deteriorated since the pandemic predominates. It is well known from research that the financial position of companies is a key determinant of investment spending. The findings from the latest KOF Investment Survey suggest that the financial situation in numerous sectors is already having a negative impact on investment activity by Swiss companies. This can further exacerbate adverse trends in vulnerable sectors of the economy or significantly delay the recovery that follows the crisis.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland