KOF Business Tendency Surveys of January 2020: Swiss Companies Start the Year With a Deep Breath

- Business Tendency Surveys

- KOF Bulletin

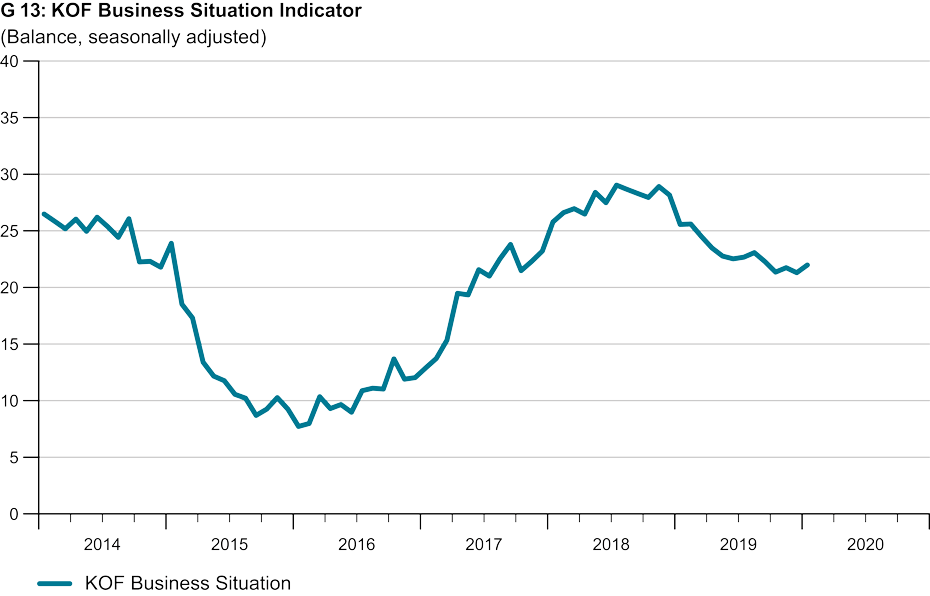

The business situation of Swiss companies improved slightly in January. At the moment it is much less challenging than it was in January of last year. Following a very weak first half of 2019, the situation has been stable since the autumn. The Swiss economy has been able to pull out of its downward spiral.

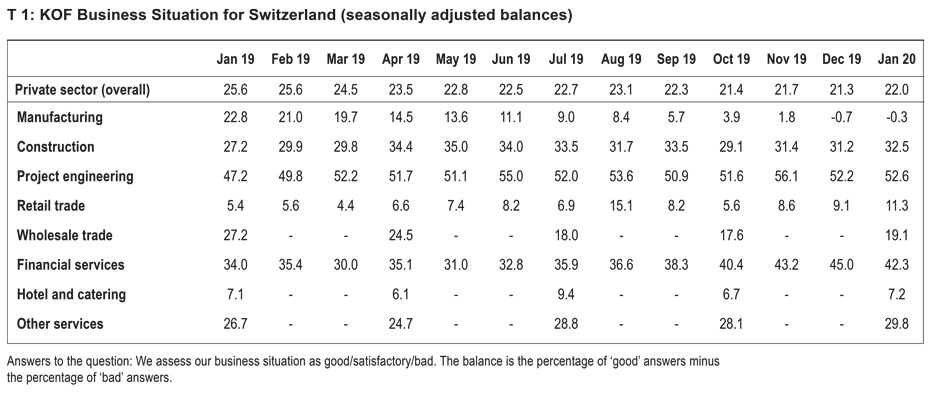

Business situation according to economic sectors

An improvement in the business situation is at least slightly apparent in almost all sectors of the economy. The only exception is the financial and insurance services sector. Here the situation is no longer as positive as it was in December, although it remains very good. In all other sectors of the economy, the Business Situation Indicator has improved marginally (manufacturing and project engineering sectors) or is even strongly up (construction, retail trade, wholesale trade and other services). Thus, whilst the business situation considered overall has only improved slightly, the improvement is on the other hand apparent across the board throughout the economy.

Focus on individual sectors

The situation has stabilised in the manufacturing sector, and companies are also hoping to have slightly fuller order books in the near future. The Business Situation Indicator in the manufacturing sector did not fall any further in January. As a result, the start of 2020 has seen a departure from last year’s trend: in 2019 the Business Situation Indicator fell during all twelve months for manufacturers. Capacity utilisation rates are no longer being reduced and dissatisfaction with order levels is not on the rise. However, the stabilisation has come at the expense of the revenue position, which is performing less favourably than previously. Although competitiveness on EU markets has suffered slightly over the last few weeks, companies’ expectations vis-a-vis export growth have barely changed. Firms are slightly more optimistic about future order book levels than they previously were and are no longer planning to slash prices. However, employee numbers are set to fall. That said, staff planning is no longer as subdued as it was last autumn.

The business situation for retail and wholesale traders is more positive than previously, whilst revenues are taking less of a hit. Traders are cautiously optimistic about future trends. The retail trade sector made a positive start to the new year, with the business situation improving for the third month in a row. Customer footfall has recently been higher than it was last year. Sales volumes have remained stable, as have revenues. Retailers are not expecting much to change in the near future: revenues are anticipated to remain at around their recent levels. Since pressure to cut prices is easing slightly, companies are overall cautiously optimistic about future business trends. The business situation for wholesalers is better than it was in the previous quarter. The downturn apparent since the autumn of 2018 has not continued further in particular for in the wholesale distributors or production goods. The situation in this segment is more favourable than it previously was. On the other hand, the Business Situation Indicator for wholesale distributors of consumer goods was unable to remain in positive territory following the previous quarter's figure. Overall, sales figures for wholesalers have not been as unfavourable as in previous quarters. Wholesalers are also more optimistic than previously as regards future demand trends.

The situation is good in the construction sector, with developers and builders expanding their activities. They are also expecting a moderate uptick in demand for their services over the coming months. The business situation in the project engineering and construction sectors, which closely track construction activity, is good having improved further since the start of the year. Demand for the services of project engineering firms has increased strongly and developers have been providing more services. However, since staffing resources remain low, order books have increased despite the expansion of services. Construction costs are increasing for new contracts in particular in the commercial property and public sector construction segments. Over the next few months, developers are expecting a less robust increase in demand than previously. Capacity utilisation in the construction sector has increased whilst revenues have not suffered as much as in previous months. Order levels are still classified as satisfactory to good. Since firms are moreover still forecasting slightly increasingly demand, they are also planning to increase construction activity with caution.

Business is currently solid in the hotel and catering sector, and firms are also expecting slight increases in revenues in the near future. The business situation in the hotel and catering sector in January remained satisfactory, practically unchanged. Although demand has no longer been increasing over the last few months, revenues remain higher than they were during the same period last year. The business situation for hotel businesses is good, although no longer as markedly as during the previous quarter. In particular figures for overnight stays by national visitors have been rising strongly, whilst increases for foreign guests have not been as marked. Businesses are forecasting figures for overnight stays to grow slightly during the current quarter. This is also suggested by booking numbers, which are lower than they were during the same period from last year. The business situation in the catering sector barely changed in January. However, demand has recently dropped more sharply. Sales of both food and drink have been broadly lower than one year ago. However, caterers are not expecting any further falls in sales. Since revenues have been under pressure over the last few months, they would like to increase prices in more cases.

The very good situation for providers of financial and insurance services has worsened. Demand is only set to increase slightly over the coming months. The business situation for companies in the financial and insurance services sector worsened slightly in January, although remains good. It was possible to make up for a weak first half of 2019 during the second half of the year, and the recent worsening of the position has not changed this. Revenues are increasingly improving, although demand for providers’ services has not been rising as strongly recently. Since, in the view of survey participants, demand is set to rise less strongly than previously, they are not currently planning to increase staffing levels. The sub-group of banks did not report any worsening of the business situation in January. Revenues improved strongly in this segment. They are not set to change much in the near future. Banks are forecasting that they will be able to grow profits from trading, commission and fixed-income business less strongly than previously. Banks are hoping to gain more traction from national lending to private customers and SMEs. This business is attractive for banks because in their view the creditworthiness of this customer group has improved.

The situation for other service providers has improved, with projected demand even more positive. The business situation in the other services segment improved further in January. Demand has been picking up and revenues have risen significantly. Companies are increasingly regarding employee figures as being too low. In particular companies in the economic services segment are increasingly looking to hire more staff. Projected demand is particularly positive in this segment. Overall, other service providers are more optimistic about business performance over the coming year.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland