Hospitality sector: half of businesses fear for their survival

- Swiss Economy

- Business Tendency Surveys

- KOF Bulletin

About 60 per cent of the businesses surveyed in January claimed that the pandemic had reduced their revenue last year. The hospitality industry has been hit particularly hard: annual revenues here are likely to have fallen by about 37 per cent in 2020, with almost one in three businesses seeing a drop of more than 50 per cent. Fear of bankruptcy increased again in all sectors in January.

The pandemic and the accompanying voluntary and government-imposed restrictions have had a noticeable impact on Swiss companies. In order to assess this effect, KOF has supplemented its regularly conducted Business Tendency Surveys with specific questions on the coronavirus crisis for the ninth time in January. Approximately 3,000 firms from the six sectors of manufacturing, construction, retail1, project engineering, financial and insurance services, and other services take part in this monthly survey. Quarterly surveys of the hospitality and wholesale sectors are also conducted.

Forecasts for annual revenue in 2020 revised upwards

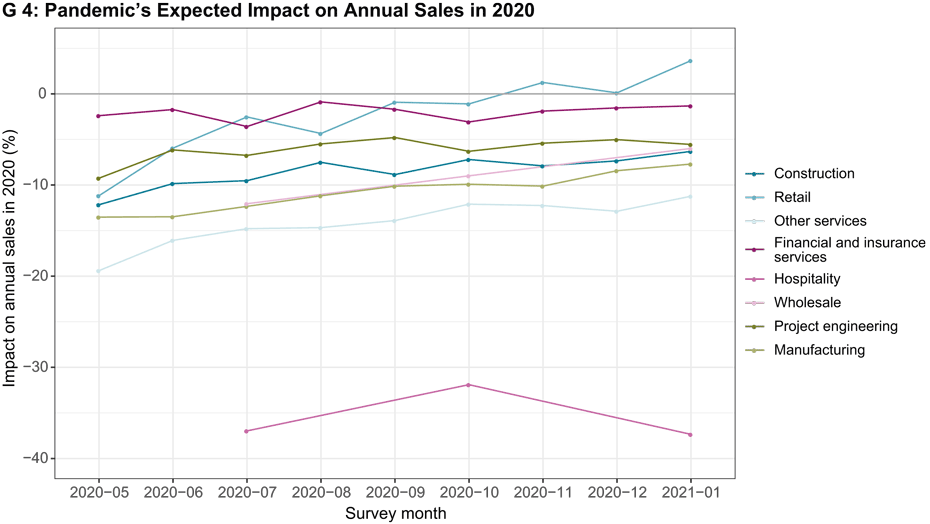

Chart G 4 shows the pandemic’s expected impact on total revenues for 2020 by survey month and business sector, with firms' responses weighted by company size. In most sectors the strongest negative impact on total annual revenue was expected in May, after which forecasts improved relatively steadily. The second wave of infections has therefore hardly led to any downward corrections. One reason for this is likely to be the less severe restrictions. In addition, many companies have adapted to the circumstances and found ways to sustain their economic activities as far as possible.

One exception is the hospitality industry. Quarterly observations show that the businesses in this sector were in October still expecting a much less negative impact on annual revenue for 2020 than they were retrospectively in January 2021. Weighted annual revenues in this industry are likely to have fallen by 37 per cent, with almost one in three businesses reporting a drop of more than 50 per cent. This means that the hospitality industry is by far the most severely affected by the pandemic. Within the hospitality industry, hotels are the most seriously affected, with revenue plunging by 46 per cent, while restaurants report a decline of 33 per cent. In addition, businesses in large towns and cities have seen a greater decline in revenues than those in the mountain and lake regions.

Industry: both export-led and domestically focused firms affected

The crisis has also severely affected manufacturing companies, whose revenues declined by 8 per cent. However, this fall in revenue was smaller than expected in May, when a decline of 14 per cent had been expected. With the exception of November, when companies became somewhat more pessimistic, the outlook improved every month.

Industrial sectors are affected to varying degrees. Companies in the coking and oil-processing sectors as well as the production of chemical and pharmaceutical products have not been affected much (decrease of 1 per cent; General Classification of Economic Activities (NOGA) code: 19-21). Within the manufacturing sector, producers of textiles, clothing, leather, leather goods and footwear have suffered the sharpest declines (decrease of 18 per cent; NOGA code: 13-15). Broken down by main industrial group, manufacturers of capital equipment and durable goods have performed less well than manufacturers of consumer goods and intermediate products. Differences are also evident between export categories, although the correlation between export share and revenue decline is not linear. Export-led companies (export share of 67-100 per cent) experienced the sharpest slump (decrease of 12 per cent). Also significantly affected were domestically focused firms (export share of 0-33 per cent), which suffered a decrease of 8 per cent. Companies with an export share of between 34 per cent and 66 per cent reported a slightly less significant decrease of 6 per cent.

31 per cent of companies report no significant impact on revenue

Overall, around 60 per cent of the firms surveyed claimed that the crisis had negatively affected their annual revenue for 2020. At the same time, however, around 9 per cent of companies reported a positive impact. The latter category includes financial and insurance service providers in particular as well as some retailers. The remaining 31 per cent of businesses stated that their revenues would not be affected. In addition to many financial and insurance service providers this group also includes most firms in the project engineering sector.

The data were also analysed using regressions. The results show that small companies and firms in Ticino and the Lake Geneva region expect to suffer a larger drop in revenue.

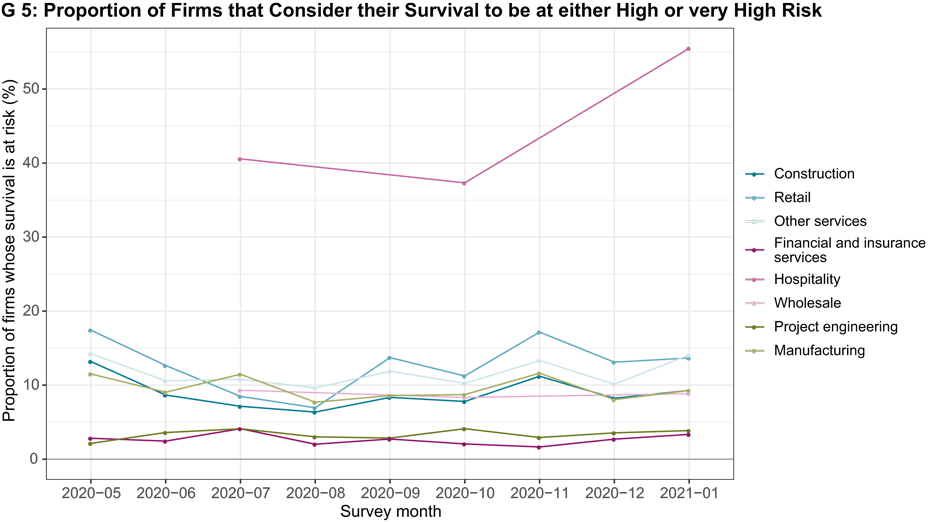

Greater threat to survival of firms in all sectors in January

Survey respondents indicate in another supplementary question how much their company's survival is threatened by the pandemic. Chart G 5 shows how the relevant percentages have changed since May 2020, broken down by sector. Once again the hospitality industry stands out, with 56 per cent of businesses seeing their survival as being either seriously or very seriously threatened. The relevant proportion across all sectors in January is 14 per cent, which is the highest quarterly value. In contrast to the changes in revenue forecasts for 2020, the second wave of infections has left its mark here. The threat to firms’ survival rose slightly in most sectors in November. After this threat declined marginally in December, companies in all sectors were increasingly fearful of bankruptcy in January.

Analysis of the data using logistic regressions shows that the survival of smaller firms located in Ticino and the Lake Geneva region is more at risk. In addition, companies struggling with their debt levels or liquidity situation are more likely to be concerned about their continued survival.

Margins at 17 per cent of firms are too low

Companies were also asked about the factors that are having the greatest impact during the pandemic. The percentage of firms that are not currently impaired is 14 per cent. As before, the decline in demand is the most important factor for companies, with 59 per cent of respondents affected. As the COVID-19 restrictions were tightened in December and January, limited access to customers was increasingly mentioned as a constraining factor. The level of fixed costs and excessively low margins are also a more frequent constraint than in the previous month.

While demand is the most important constraint in all sectors, other relevant factors vary from sector to sector. The debt situation plays a significant role in the hospitality industry. Construction companies, on the other hand, are relatively often affected by low margins. The fact that customers are having payment difficulties is reported by financial service providers. Firms in the wholesale and retail sectors, by contrast, are being constrained by the availability of goods.

-------------------------------------------------------------------

1) Only a small sample of retail firms is surveyed by KOF. These results are therefore of limited significance for the sector as a whole.

The detailed results of the KOF Business Tendency Surveys (including tables and charts) can be found on our website.

The findings of the latest KOF Business Tendency Surveys from January 2021 include the responses of more than 4,500 private firms from industry, construction and the most important service sectors. This equates to a response rate of about 60 per cent.

Contacts

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland